Modular Blockchains: Why Monolithic Chains Are Losing the Spotlight

Introduction

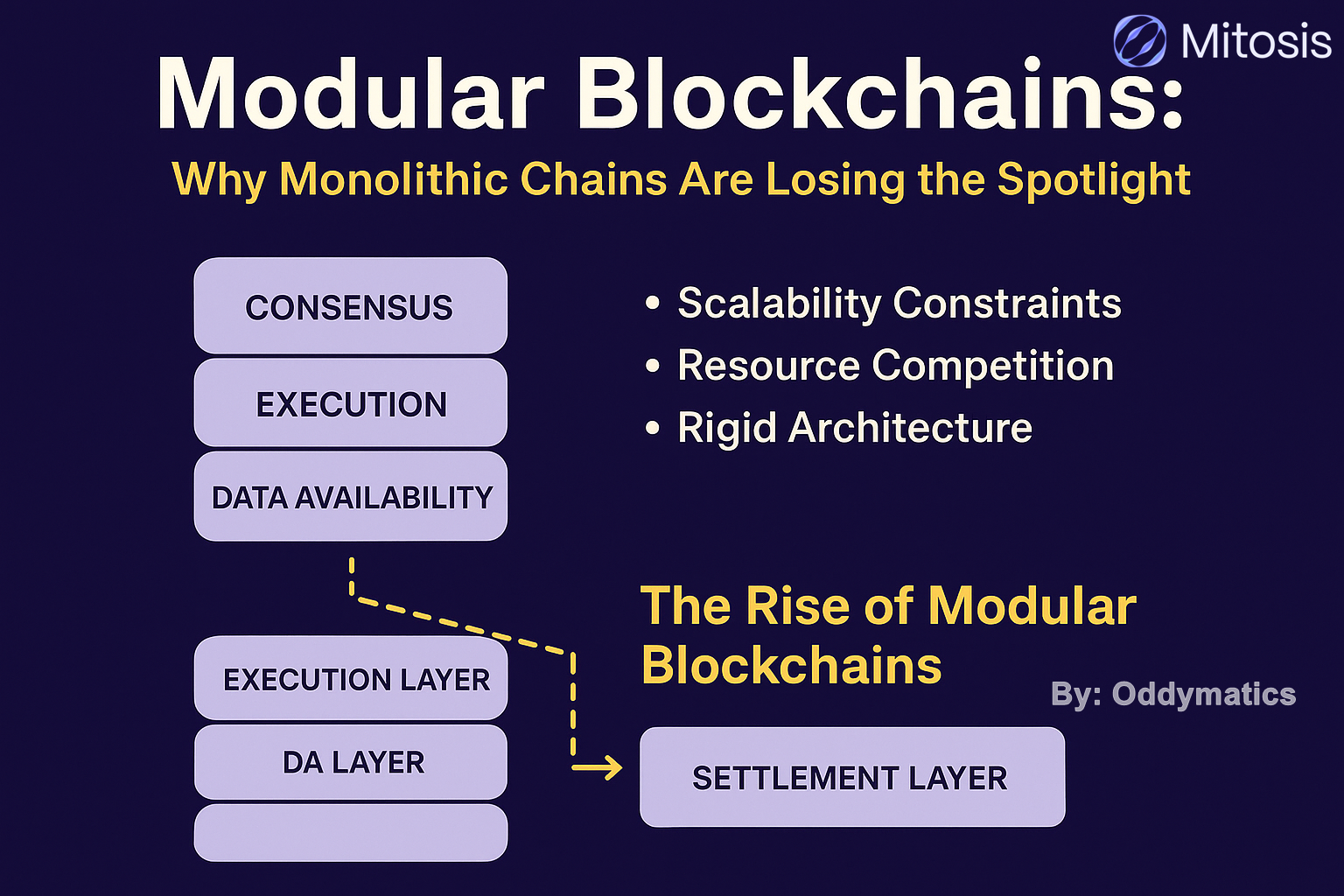

In the early days of blockchain, the formula seemed simple: one chain to handle everything. Networks like Bitcoin and Ethereum were designed as monolithic blockchains, meaning they performed all core functions, execution, consensus, settlement, and data availability, under one roof. This architecture made sense at the time, offering security and simplicity. But as the crypto industry matured, demand for scalability, lower fees, and faster innovation began to expose the cracks in this model.

Enter modular blockchains, a new paradigm that promises to unbundle the responsibilities of a blockchain into specialized layers. Instead of one chain doing everything, modular systems let different chains focus on what they do best, and then stitch those functions together. The result? A flexible, scalable, and potentially more resilient ecosystem.

This shift has sparked one of the most important debates in crypto: Will modular blockchains outshine monolithic giants, or will both models coexist in the future?

1. What Are Monolithic Blockchains?

A monolithic blockchain is like a traditional “all-in-one” company that handles production, marketing, sales, and customer service in-house. Ethereum, Solana, and Bitcoin are prime examples of this design.

- Execution: Transactions are processed directly on-chain.

- Consensus: Nodes agree on the state of the blockchain.

- Settlement: Finality of transactions is locked in.

- Data availability: Transaction data is stored and made accessible to all nodes.

This one-stop-shop approach offers major advantages:

- Simplicity: Developers only need to build within one environment.

- Security: A single, unified network secures all activities.

- Network effects: All apps and users concentrate liquidity on one chain.

But as crypto adoption grew, the weaknesses of monolithic chains became harder to ignore:

- Scalability limits: Transaction throughput struggles to keep up with demand.

- High fees: Ethereum gas wars in 2021–22 became legendary examples.

- Bottlenecks: One chain trying to do everything slows innovation and limits flexibility.

2. The Rise of Modular Blockchains

If monolithic blockchains are “all-in-one” companies, modular blockchains are like specialized startups, each handling one core function of the blockchain stack, but doing it extremely well. Instead of one chain juggling everything, modular systems separate responsibilities into distinct layers that can interoperate.

Here’s the unbundled model:

- Execution Layer: Handles smart contracts and transaction logic (e.g., Fuel, Eclipse).

- Settlement Layer: Provides finality and dispute resolution (e.g., Ethereum, Cosmos Hub).

- Consensus Layer: Ensures nodes agree on the state of the chain.

- Data Availability Layer (DA): Stores and distributes transaction data for validation (e.g., Celestia, EigenDA, Avail).

This separation allows developers to mix and match components, tailoring blockchains to specific needs. Want a gaming chain with lightning-fast execution but low costs? Pair a high-performance execution layer with a cheap DA layer. Building a DeFi protocol that needs security above all else? Anchor to Ethereum’s settlement while outsourcing scalability.

Key players in the modular movement include:

- Celestia → the pioneer of modular DA and consensus.

- Mitosis → pushing the boundaries of cross-chain liquidity and modular design.

- Fuel → execution layer built for scalable rollups.

- Dymension → a modular “rollup hub” connecting different app-chains.

The benefits of this model are becoming clearer:

- Scalability: Each layer focuses on its task, boosting overall performance.

- Flexibility: Developers can innovate without being trapped in one monolithic chain.

- Composability: Different modular layers can be plugged together like Lego blocks.

In short, modular blockchains transform the blockchain world from a “fenced garden” into a composable ecosystem of specialized parts.

Comments ()