More Than the Sum of Its Parts: Mitosis, Network Effects, and the Exponential Value of Unified Liquidity

1. Introduction: The Magic of Network Effects

In the world of technology and economics, there exists a powerful, almost magical force capable of transforming simple products and services into indispensable ecosystems – network effects. Simply put, a network effect occurs when the value of a product or service for each individual user increases as the total number of users grows.

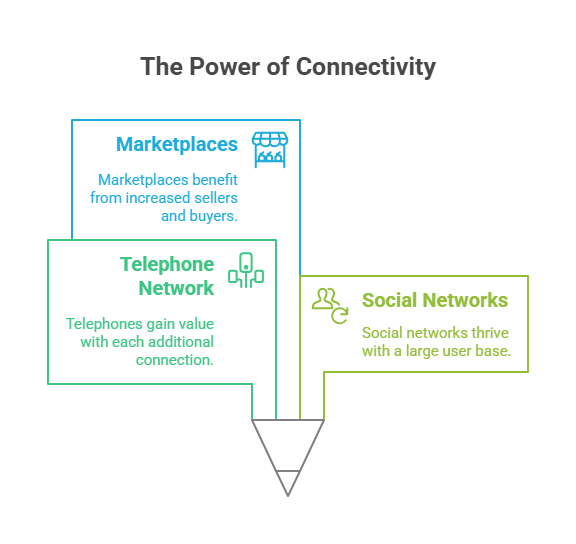

Classic examples are obvious:

- The Telephone Network: One telephone is useless. Two telephones allow communication. Millions of telephones create a global communication network, the value of which is immense for each subscriber.

- Social Networks: Facebook or Twitter would be uninteresting with a dozen users. But with billions of users, they become powerful platforms for communication, information, and influence.

- Marketplaces: The more sellers on Amazon, the more attractive it is to buyers (more choice). The more buyers, the more profitable it is for sellers to be there (more demand).

This principle of "the more, the better (for everyone)" underlies the success of many dominant technology platforms. Network effects create a positive feedback loop: an increase in users increases value, which attracts even more users, and so on, often leading to exponential growth.

Network Effects in Web3 and DeFi: Missed Opportunities?

The world of Web3 and decentralized finance (DeFi) is, by its nature, ideally suited for the manifestation of powerful network effects. Openness, composability, and global access should have fostered the creation of vast, interconnected networks of value.

However, in practice, we often see the opposite, especially in the context of liquidity:

- Liquidity Fragmentation: As we've discussed multiple times, liquidity in DeFi is fragmented across numerous blockchains, Layer 2 solutions, and individual protocols. Each such "island" of liquidity has a limited number of users and assets compared to the potentially unified market.

- Barriers to Interaction: The complexity and risks of cross-chain transfers prevent users and capital from moving freely between these "islands." This hinders the formation of a single, large network.

- Reduced Composability: Protocols on different networks cannot easily interact with each other, limiting the possibilities for creating innovative products that could leverage liquidity from various sources.

As a result, instead of one powerful "ocean" of liquidity with pronounced network effects, we have many "ponds" and "lakes" whose aggregate value is significantly lower than it could be. The potential of network effects for DeFi liquidity remains largely unrealized.

Mitosis: A Catalyst for Network Effects in DeFi Liquidity

This is precisely where Mitosis enters the scene. Its mission is not just to move assets, but to unify disparate pools of liquidity into a single, more powerful, and valuable whole. Mitosis aims to become the infrastructure that will allow true network effects for liquidity to manifest in Web3.

How can Mitosis achieve this?

- By lowering barriers: Simplifying and reducing the cost of secure cross-chain transfers.

- By creating a "common network": Allowing assets and users from different blockchains to interact as if they were in a single space.

- By stimulating composability: Giving developers the ability to create dApps that can leverage liquidity from any connected network.

What Will You Learn From This Article?

In this article, we will explore in detail:

- How exactly liquidity fragmentation suppresses network effects in DeFi.

- How Mitosis's key features (EOL, secure transfers, focus on UX) contribute to creating conditions for the emergence and strengthening of network effects.

- Why unified liquidity, thanks to Mitosis, is not just the arithmetic sum of its parts, but potentially an exponential increase in value for the entire Web3 ecosystem.

We will show that Mitosis is not just a technological solution, but a strategic project capable of unlocking a new level of value in decentralized finance by leveraging one of the most fundamental economic principles – the power of the network.

2. Mitosis as a Value Multiplier: Creating a Positive Feedback Loop

We've established that liquidity fragmentation hinders the manifestation of network effects in DeFi. Now let's examine how Mitosis's specific mechanisms and approaches not only solve this problem but actively contribute to creating and strengthening these effects, turning the protocol into a true value multiplier for the entire ecosystem.

1. Reducing Transaction Costs and Barriers – The First Step Towards a Network

Network effect theory states that to kickstart the flywheel of positive feedback, interaction costs within the network must be minimized as much as possible.

- The Fragmentation Problem: High fees for using different bridges, time delays, and the complexity of learning each new interface are all "transaction costs" that prevent users and capital from moving freely and forming a unified network.

- The Mitosis Solution:

- Efficient and (Potentially) Cheap Transfers: Mitosis aims to optimize the speed and cost of cross-chain operations. The cheaper and faster an asset can be moved, the more users will do so, and the more actively a unified liquidity space will form.

- Simplified UX: Mitosis's unified interface or easily integrable solutions reduce "cognitive costs" for users, making cross-chain interaction more accessible.

The Effect: By lowering barriers, Mitosis makes participation in the "global liquidity network" more attractive, which is the first necessary condition for triggering network effects.

2. Ecosystem-Owned Liquidity (EOL) – Guaranteed Network Value

For a network to be valuable, it must contain something of value. In the context of DeFi, this is primarily liquidity.

- The Fragmentation Problem: If each "island" has only a small amount of liquidity, its attractiveness to users (traders, borrowers, liquidity providers) and developers (building dApps) is low.

- The Mitosis Solution (EOL):

- Ensuring Baseline Liquidity: The EOL model, where Mitosis owns and strategically deploys its liquidity, guarantees a certain level of liquidity on connected networks. This makes Mitosis and its associated networks more attractive from the outset. Users know they will be able to make a swap or find capital.

- Attracting Additional Liquidity: The presence of stable EOL liquidity can also attract external liquidity providers who see that the protocol already has a "core" and is actively developing.

The Effect: EOL creates an initial "gravitational mass" of liquidity that begins to attract more users and more capital, starting a growth cycle. The value of the Mitosis network for each participant increases as they gain access to deeper and more stable liquidity.

3. Stimulating Composability – Network Effects for Developers

Network effects manifest not only at the user level but also at the developer and application level.

- The Fragmentation Problem: It's difficult for developers to create dApps that can seamlessly work with assets and data from different networks. This limits innovation.

- The Mitosis Solution:

- Infrastructure for Cross-Chain dApps: By providing a reliable and (prospectively) easy-to-use toolkit (SDK, API) for cross-chain transfers and messaging, Mitosis enables developers to easily integrate multichain functionality into their applications.

- Access to Unified Liquidity: Developers can create protocols that leverage liquidity aggregated by Mitosis from many networks. This opens the way for more efficient DEX aggregators, lending protocols with cross-chain collateral, etc.

The Effect: The more developers build on Mitosis, the more useful cross-chain applications emerge. This, in turn, attracts more users to the Mitosis ecosystem. A network effect at the developer level arises: the value of Mitosis as a platform grows with each new integrated dApp, stimulating further integrations.

4. Positive Feedback and Exponential Growth

When all these elements work together, a powerful positive feedback loop is created:

- Mitosis lowers barriers for cross-chain interactions.

- More users and capital begin to move between networks via Mitosis.

- EOL provides and attracts liquidity, making the Mitosis network more valuable.

- Developers create more cross-chain dApps on top of Mitosis, utilizing this unified liquidity.

- The emergence of new useful dApps attracts even more users to the ecosystem.

- The value of the Mitosis network for each participant (user, developer, liquidity provider) grows exponentially.

This is a classic scenario of network effects manifesting, leading to the formation of a dominant standard or platform.

Conclusion: Mitosis – Not Just a Bridge, but a Builder of a Value Network

Mitosis is much more than just a technology for transferring tokens. It is a strategic project aimed at solving the fundamental problem of fragmentation that holds back the development of all of Web3. By unifying liquidity and simplifying interaction between blockchains, Mitosis creates the conditions for powerful network effects to emerge.

Instead of simply summing up disparate parts, Mitosis strives to create synergy, where the unified ecosystem becomes orders of magnitude more valuable than the sum of its individual components. This is the path from simple asset movement to the creation of a single, global, and highly liquid decentralized finance space, whose value will grow exponentially with each new connected user, each new integrated protocol, and each new dollar of liquidity freely circulating thanks to Mitosis.

Understanding the role of network effects allows us to see Mitosis not just as an infrastructure project, but as a potential catalyst for the next wave of growth and innovation in the entire Web3 industry.

Learn more about Mitosis:

- Explore details on the official website: https://www.mitosis.org/

- Follow announcements on Twitter: https://twitter.com/MitosisOrg

- Participate in discussions on Discord: https://discord.com/invite/mitosis

- Read articles and updates on Medium: https://medium.com/mitosisorg

- Blog: https://blog.mitosis.org/

Comments ()