MORSE NFT: It’s a Liquid Loyalty Layer for DeFi in Mitosis

Wait, why did Mitosis go with DN404, and how does it turn “just another NFT” into something alive in DeFi?

real talk:

MORSE is not your typical NFT drop. It’s a composable, yield-ready, loyalty-linked DeFi primitive…disguised as a cute doggo.

First up: DN404, The Hybrid Standard DN404 is the real unlock here. It’s a new Ethereum token standard that blends ERC-721 (NFT) and ERC-20 (fungible tokens) into one contract.

How Does It Works?

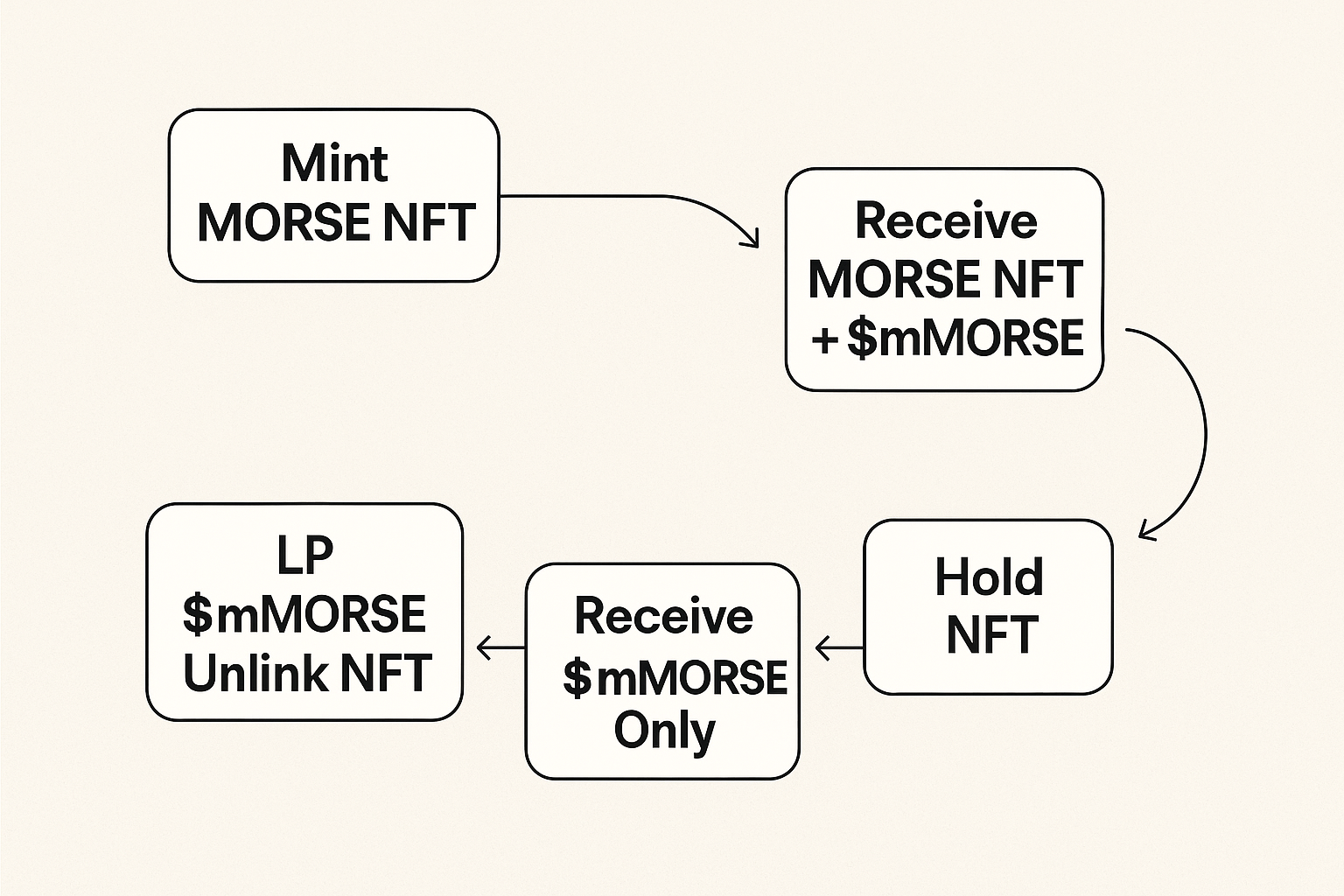

When you mint a MORSE NFT, you automatically get a corresponding ERC-20 token → $mMORSE.

One NFT = One $mMORSE

$mMORSE is tradable, LP-able, and DeFi-native.

The NFT holds metadata, art, and rarity; the social layer.

But you wanna know the kicker?

The ERC-20 and NFT are bound. If you LP or trade even a fraction of your $mMORSE → the NFT disappears.

Not burned, not lost, just unlinked. That’s the DN404 contract logic

So you choose:

Hold it all and keep your rare NFT for vault boosts, governance clout, and digital flex… or break the pair, LP the $mMORSE, and get in the yield game.

Supply Breakdown

There are 10,000 total MORSE NFTs, split across 5 tiers of rarity: Rarity Count

Lil Pup 4,700

Rare Pooch 3,000

Epic Canine 1,600

Legendary Hound 480

Mythical Breed 220

the rarer means more potential “airdrop”

So… What Can You Do With MORSE?

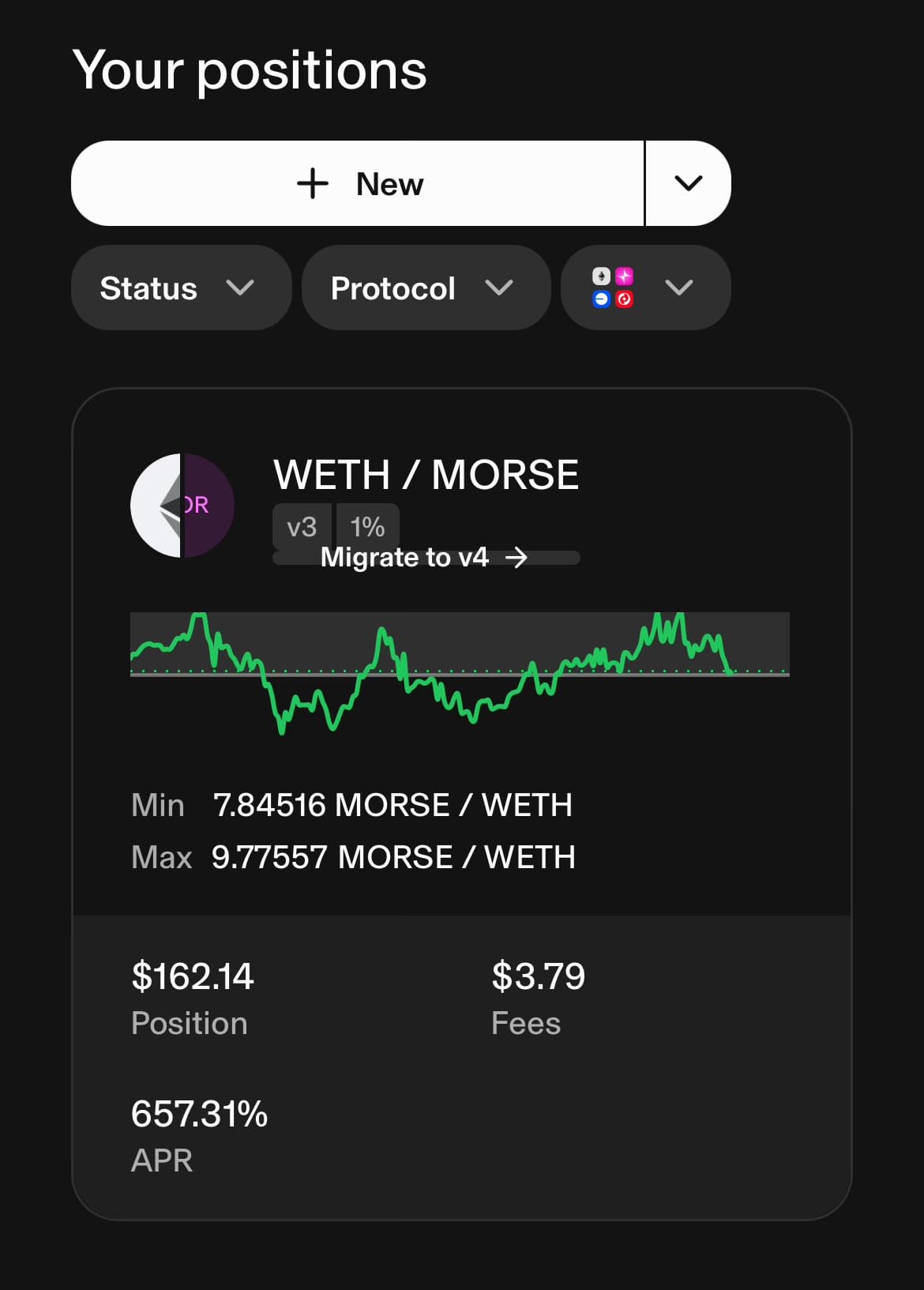

1. LP $mMORSE on Uniswap (e.g., with WETH)

Once you've got your MORSE NFT, you also hold the $mMORSE token. If you’re not planning to hold for rarity flex, you can:

Unlink the $mMORSE from the NFT (by selling or LPing a part of it)

Head to Uniswap and create or join the $mMORSE/WETH pool

Farm trading fees and potential emissions (when incentivized by Mitosis or a partner) Why LP?

Because $mMORSE is composable with Matrix vaults. You can farm Matrix points with your LP tokens, stake in partner campaigns, or use it as an entry point for vault loops.

But again: The moment you LP part of your token, you lose the NFT. No vault boost. No rare metadata. Choose wisely.

2. Hold the NFT for Vault Boosts & Loyalty Perks

Keeping the NFT intact gives you:

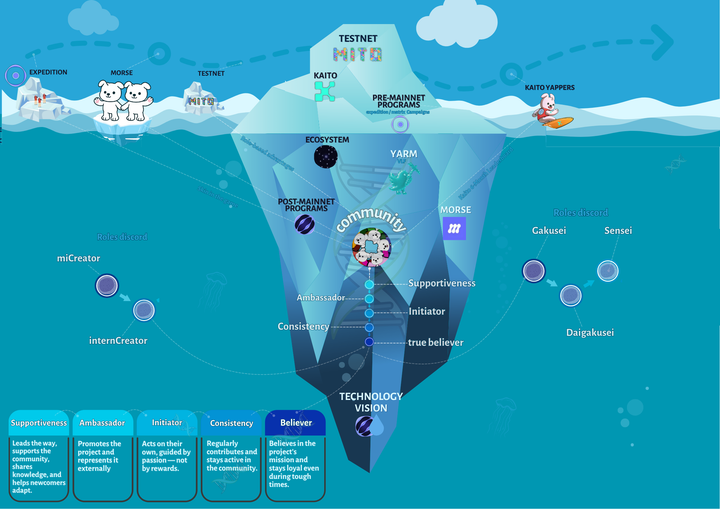

Governance Weight: Older MORSE = more weight in governance (Morse Genesis, 100+ days = bigger voting power)

Community Status: You’re recognized on Discord. It’s your digital badge. This is perfect for people who don’t want to LP, but still want to accumulate loyalty-based perks across the Mitosis ecosystem.

This Part is my speculation Post Mainnet

3. Use $mMORSE in DeFi Across the Stack

Let’s say you do unlink it and keep the token:

On Telo: Use $mMORSE as collateral for borrowing

On Zygo: Hedge your Matrix vault exposure using $mMORSE

On Chromo Exchange: Swap across chains without bridge risk

In LP Vaults: Pair with WETH or stablecoins and double-dip in rewards

The Design Logic?

Make community loyalty itself liquid.

No more “JPEGs stuck in a wallet.” Your loyalty can earn, move, borrow, trade, and vote.

Culture + Liquidity: Tied at the Contract Level

MORSE is built to make culture liquid and liquidity cultural.

Why DN404 Was the Right Call

Mitosis is a liquidity OS. Not a JPEG farm.

Matrix vaults need vault-native tokens

SpindleAG uses PT/YT for transparent valuation

Zygo requires tradable LP primitives

Telo needs collateral with on-chain price feeds A regular ERC-721 would’ve been deadweight in that system. DN404? It’s composable, traceable, yield-bearing, and tradable.

That’s the level-up.

Final Alpha

MORSE is what happens when:

NFTs meet real DeFi infrastructure

Loyalty becomes an on-chain yield strategy ERC-20s and NFTs stop competing, and start completing each other MORSE isn’t just a meme. It’s a programmable culture asset.

So whether you flex it or farm it… You’re plugged directly into the next wave of on-chain loyalty.

NOTE: I call $mMORSE — the token part of MORSE

Comments ()