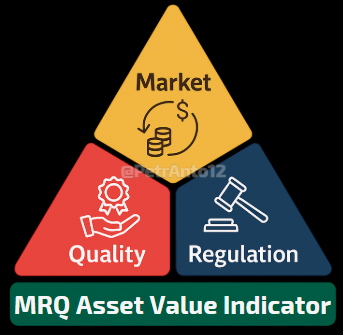

MRQ Asset Value Indicator: A Multidimensional Framework for Asset Valuation

Abstract

Traditional valuation methods often struggle to keep pace with the complexity of today’s financial markets, particularly for emerging assets like cryptocurrencies. The MRQ Asset Value Indicator offers a robust and innovative solution, assessing assets through three key dimensions: Quality of the Asset, Quality of Regulation, and Quality of the Market.

Developed and refined through years of investment expertise and stock-picking experience, this framework blends intrinsic asset value with regulatory and market dynamics to provide a holistic perspective.

It serves as an adaptable, actionable tool for investors across all asset classes—from traditional finance (TradFi) to decentralized ecosystems (Crypto) and Real-World Assets (RWA).

Initially published in Mitosis University, the MRQ Indicator empowers DAO members to make informed investment decisions, guiding the community through an ever-evolving financial landscape with confidence.

Introduction

Valuing assets in modern markets requires more than a single-factor approach. The MRQ Asset Value Indicator addresses this by assessing:

Quality of the Asset: The inherent worth or fundamental strength of the asset.

Quality of Regulation: The impact of regulatory frameworks on the asset’s utility and efficiency.

Quality of the Market: The external economic and trading conditions affecting performance.

This multidimensional framework balances internal attributes with external forces, providing a holistic perspective for investors navigating stocks, cryptocurrencies, commodities, and beyond.

1. Theoretical Foundations

The MRQ framework adopts a systems-based approach, recognizing that asset value emerges from interconnected factors:

Intrinsic Quality: Fundamental metrics like earnings or technology.

Regulatory Influence: Rules that constrain or enhance efficiency.

Market Dynamics: Liquidity, volatility, and economic trends.

Many investors tend to concentrate their efforts on uncovering the next standout opportunity within a specific area of interest—whether it’s the top fintech stock because they frequently use a particular app, the prime real estate in a quaint village, or the leading DeFi cryptocurrency after hours of research.

However, focusing solely on an asset’s quality is insufficient.

Even a high-quality asset can falter if its market lacks dynamism or if regulatory conditions are unfavorable. Annual reports from major institutions, such as those by the International Monetary Fund, consistently emphasize the significant role that market conditions, particularly liquidity, play in shaping asset pricing across diverse classes, while also underscoring the critical importance of regulation in fostering market stability and investor confidence, which can either amplify or diminish an asset’s growth potential.

This framework seeks to provide a structured approach to building and managing an investment portfolio, offering clarity and insight while allowing for continuous adaptation within a flexible and versatile asset valuation system.

2. The Three Dimensions of the Indicator

Quality of the Asset

Measures the intrinsic value or fundamental strength of the asset, based on factors like utility, scarcity, demand, or reliability.

This dimension evaluates the asset’s core attributes:

Stocks: Earnings, growth potential, competitive position.

Cryptocurrencies: Blockchain utility, adoption rates, security.

Commodities: Scarcity, industrial demand.

Real Estate: Location, condition, income potential.

Scoring: 0% (weak) to 100% (excellent), based on asset-specific metrics and qualitative judgment.

Quality of Regulation

Evaluates the regulatory environment—how clear, supportive, or restrictive the rules are that govern the asset’s production, trade, or use.

Regulation’s impact varies by asset and context:

Supportive: Clear rules that foster stability and growth.

Restrictive: Rules that limit flexibility and efficiency.

Unclear: Ambiguous policies that create uncertainty.

Scoring: Higher for balanced, innovation-friendly frameworks (e.g., 70%), lower for restrictive or vague rules (e.g., 30%).

Quality of the Market

Assesses the economic and market conditions affecting the asset, including demand trends, liquidity, and external risks

This dimension captures the trading environment:

Liquidity: Ease of buying and selling.

Volatility: Price stability.

Market Depth: Ability to handle large transactions.

Economic Trends: Inflation, interest rates, GDP growth.

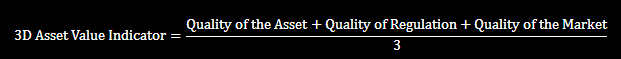

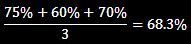

The overall score is computed as:

This straightforward formula ensures the indicator can evaluate anything from tangible goods to illicit substances.

Scoring: 0% (unfavorable) to 100% (optimal), reflecting real-time market data:

50%: Indicates growth potential; investment may be warranted.

< 50%: Suggests caution due to risks or inefficiencies.

= 50%: Neutral stance.

3. Understanding How to Apply the Indicator to Diverse Assets

Let’s explore how the indicator applies to five distinct assets: gold, U.S. Treasury bonds, a patented drug, orange juice sold by kids, and illegal drugs such as cocaine.

Commodities: Gold

Gold is a globally recognized commodity with a well-established market.

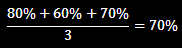

Quality of the Asset: Gold’s scarcity, historical significance as a store of value, and industrial uses make it fundamentally strong, though its value can fluctuate with speculation. Score: 80%

Quality of Regulation: Gold trading operates under stable regulations worldwide, with occasional restrictions (e.g., export limits) introducing minor uncertainty. Score: 60%

Quality of the Market: Current economic conditions, such as inflation and geopolitical tensions, boost demand for gold as a safe-haven asset. Score: 70%

Overall Score: 70%

A 70% score reflects gold’s reliability as an investment under present conditions.

Bonds: U.S. Treasury Bonds

U.S. Treasury bonds represent a cornerstone of financial security.

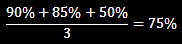

Quality of the Asset: Backed by the U.S. government, these bonds offer negligible default risk and steady returns, making them exceptionally robust. Score: 90%

Quality of Regulation: The U.S. provides a clear and stable regulatory framework for bonds, with well-defined rules for trading and taxation. Score: 85%

Quality of the Market: Rising interest rates currently reduce bond prices, creating a less favorable market despite their safety. Score: 50%

Overall Score: 75%

A 75% score highlights the bonds’ strength, tempered by market challenges.

Pharmaceuticals: A Patented Drug

A patented drug introduces a physical asset with regulatory and market intricacies.

Quality of the Asset: A drug with proven efficacy and strong demand has solid fundamentals, though its value hinges on patent life and competition. Score: 75%

Quality of Regulation: Strict health regulations (e.g., FDA approvals) ensure safety but can delay market entry or raise costs. Score: 60%

Quality of the Market: High healthcare demand and aging populations create a favorable market, though pricing pressures may pose risks. Score: 70%

Overall Score: 68.3%

A 68.3% score indicates a valuable asset with regulatory hurdles.

Orange Juice Sold by Kids

This informal venture tests the indicator’s applicability to small-scale, everyday assets.

Quality of the Asset: Freshness and taste matter, but this product lacks uniqueness or scalability compared to commercial goods. Score: 30%

Quality of Regulation: Minimal rules apply—perhaps basic health codes or a simple permit—making the regulatory environment easy to navigate. Score: 70%

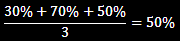

Quality of the Market: Local demand varies with weather, foot traffic, and competition (e.g., other stands), suggesting neutral conditions. Score: 50%

Overall Score: 50%

A 50% score fits a modest, low-stakes opportunity.

Illegal Asset: Cocaine

Cocaine, as an illegal drug, showcases the indicator’s ability to assess illicit markets.

Quality of the Asset: Cocaine’s high demand and revenue potential are driven by its addictive nature, but its illegal status introduces risks like inconsistent quality and legal consequences. Score: 60%

Quality of Regulation: Harsh laws, severe penalties, and active enforcement create an extremely restrictive environment. Score: 10%

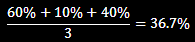

Quality of the Market: Persistent demand ensures a robust market, but volatility from legal crackdowns and competition adds significant risk. Score: 40%

Overall Score: 36.7%

A 36.7% score reflects cocaine’s potential returns overshadowed by substantial regulatory and market risks.

(by the way, don't do any drugs, they just make things worse)

Why It Works Across Assets

The indicator’s flexibility allows it to adapt to each asset’s unique traits:

Gold thrives on scarcity and market stability.

Treasury bonds excel due to government backing and regulatory clarity.

A patented drug balances strong fundamentals with regulatory complexity.

Orange juice sold by kids reflects a simple product in a low-regulation, local market.

Cocaine demonstrates high demand clashing with legal and operational risks.

By tailoring the dimensions to the asset’s context—whether legal, informal, or illicit—the indicator provides a consistent yet nuanced evaluation.

4. Quality of the Asset: The Foundation of Valuation

The Quality of the Asset dimension evaluates the intrinsic worth of an asset, serving as the cornerstone of the MRQ framework. It focuses on the asset’s core attributes that endure market fluctuations.

Why It Matters

Core Strength: Captures the asset’s fundamental value, independent of external noise.

Foundation for Other Dimensions: A strong asset can withstand regulatory or market challenges, while a weak one may struggle even in favorable conditions.

How It’s Assessed

Assessment varies by asset type:

Stocks: Financial health (e.g., revenue growth, profit margins), competitive edge, management quality.

Cryptocurrencies: Technological innovation, network adoption, security protocols.

Commodities: Physical scarcity, industrial or economic utility.

Real Estate: Location desirability, property condition, rental yield potential.

Measuring Quality

Quantitative Metrics: Earnings, adoption rates, rental income.

Qualitative Factors: Brand reputation, innovation, community support.

Interaction with Other Dimensions

A high-quality asset may be constrained by restrictive regulation (e.g., a prime property with zoning limits).

Conversely, favorable market conditions can amplify an asset’s potential (e.g., Bitcoin during liquidity surges).

Practical Insights

Investment Strategy: Prioritize assets with strong intrinsic quality to identify undervalued opportunities.

Risk Management: Assess whether external challenges (e.g., regulation) are temporary or structural.

5. Regulation’s Role: A Nuanced View

Regulation’s impact on asset value is multifaceted and context-dependent. While traditional views often cast it as a barrier to efficiency, recent research reveals a more complex picture, particularly in emerging markets like cryptocurrencies.

Traditional Perspective

Efficiency Reduction: Regulations like zoning laws or licensing requirements limit an asset’s flexibility, reducing its utility and value.

For example, rental restrictions on Long Island homes lower their score to 30%, reflecting lost income potential.

Emerging Evidence

Short-Term Costs: New regulations can increase compliance burdens and uncertainty, temporarily reducing efficiency.

Long-Term Benefits: Clear, supportive regulation can enhance market efficiency by reducing volatility and building trust.

e.g. Every relevant study on cryptocurrencies found that regulatory clarity in certain jurisdictions improved pricing efficiency and reduced speculative bubbles.

Examples Across Asset Classes

Cryptocurrencies:

This market being very new and without much regulation. Investors must be very cautious here about change of policy.

The EU’s Markets in Crypto-Assets (MiCA) framework, for instance, fully implemented in 2024, while it may affect some projects not able to adapt rapidly, is overall boosting Crypto’s regulation score by providing clarity and reducing legal risks.

Real Estate:

Real estate is heavily influenced by regulatory frameworks, particularly zoning laws, which can limit property utility and value.

For instance, Long Island homes would score just 30% in regulatory terms due to restrictive zoning that curbs multifunctionality—such as renting or redeveloping properties. These constraints reduce income potential and diminish market value, making regulatory considerations critical for investors. The impact of such laws underscores how local policies can significantly shape real estate’s investment appeal.

Commodities (Gold):

Gold typically enjoys a stable regulatory framework, reinforcing its status as a safe-haven asset during economic or geopolitical unrest. This stability supports its profitability in turbulent times. However, it is not immune to disruption. Regulatory changes—like stricter anti-money laundering rules or shifts in import/export policies—can affect market operations, liquidity, and costs, ultimately influencing investor returns.

Even in environments where gold traditionally thrives, these adjustments introduce risks, highlighting the need for investors to stay attentive to regulatory developments.

Equities:

In the U.S., equities generally benefit from a structured regulatory environment overseen by the Securities and Exchange Commission (SEC), typically earning a regulatory score of around 70%. This framework fosters market integrity and investor trust through clear rules on trading and disclosure.

However, the complexity of some regulations can occasionally create inefficiencies, such as higher compliance burdens or slower market responses.

Additionally, specific asset classes, like cannabis-related stocks, face unique regulatory hurdles that add further complexity, impact their regulatory score and demand greater diligence from investors.

When assessing the regulatory landscape of equities, investors must balance the stability provided by SEC oversight with the potential drawbacks of intricate rules, adopting a more nuanced approach for assets with specialized regulatory considerations.

Scoring the Quality of Regulation

Supportive Regulation: Clear, balanced rules that protect investors without stifling innovation (e.g., 70%).

Restrictive Regulation: Heavy-handed or ambiguous policies that increase costs and uncertainty (e.g., 30%).

Context Matters: A commodity like gold might thrive under minimal regulation, while crypto benefits from structured oversight.

Investor Takeaways

Opportunities: Assets in jurisdictions with improving regulatory clarity (e.g., crypto) may see value appreciation.

Risks: Overly restrictive regulations (e.g., zoning laws) can cap an asset’s potential, signaling caution.

Contrast: Traditional assets like equities and commodities often face stable rules, while crypto navigates a rapidly evolving landscape, affecting their respective scores.

6. Market Quality: External Forces Shaping Valuation

Market Quality reflects the external environment in which an asset is traded, encompassing factors like liquidity, volatility, and economic stability. It plays a crucial role in determining how effectively an asset’s intrinsic value is realized.

Key Components

Liquidity: The ease of buying or selling without affecting price. (See Fair market Liquidity)

Volatility: The degree of price fluctuations.

Market Depth: The ability to handle large transactions without price distortion.

Information Efficiency: How well prices reflect available data.

Macroeconomic Factors: Inflation, interest rates, GDP growth.

Impact on Valuation

High Market Quality: Reduces transaction costs, stabilizes prices, and enhances demand, lifting value.

Low Market Quality: Increases risks and costs, potentially undervaluing even strong assets.

Examples Across Asset Classes

Cryptocurrency Markets

Bitcoin's market quality hinges on its high liquidity and significant volatility.

Its global trading volume and growing institutional interest create a highly liquid market, making it easy to buy and sell. However, its price swings can deter risk-averse investors.

Stablecoins, on the other hand, exhibit lower volatility due to their pegged design (e.g., tied to fiat currencies like the USD), which enhances their stability. This design-driven feature makes them reliable in decentralized finance (DeFi), though they’re still influenced by shifts in market sentiment.

Equities

The S&P 500 showcases strong market quality through its deep liquidity and moderate volatility. As a broad index, it benefits from consistent trading activity and the ability to handle large transactions without major price disruptions. During stable economic periods, it might score 80% or higher, reflecting investor confidence and economic trends.

Market quality here is purely a function of how efficiently the market operates and responds to economic conditions.

Commodities (Gold)

Gold’s market quality is driven by demand during uncertainty and liquidity fluctuations. As a safe-haven asset, it sees spikes in demand during economic or geopolitical turmoil, supporting a liquid global market.

However, liquidity can dip in calmer periods. This dynamic might yield a score of 70%, capturing how economic factors and trading conditions shape its market quality.

Real Estate

In a market like Long Island’s housing sector, market quality stems from high demand and stable pricing.

Local economic trends and buyer interest fuel consistent value, potentially earning a score of 80%. This reflects the market’s strength based on economic appeal and trading conditions.

Measuring Market Quality

Tools: Trading volume, bid-ask spreads, volatility indices (e.g., VIX), economic forecasts.

Real-Time Data: Essential for capturing dynamic shifts, such as liquidity surges or economic downturns.

Interaction with Other Dimensions

A high-quality asset in a low-quality market may trade below its potential (e.g., a blue-chip stock during a liquidity crisis).

Strong regulation can improve Market Quality by enhancing transparency and participation (e.g., crypto under clear rules).

Poor market conditions can exacerbate regulatory weaknesses (e.g., unclear crypto rules in a volatile market).

Investor Takeaways

Timing: Enter markets with improving quality (e.g., rising liquidity) to capture value.

Diversification: Balance exposure across markets with varying quality to manage risk.

Practical Example: Bitcoin’s 60% score reflects a trade-off—investors must weigh its liquidity against volatility, while gold’s 70% offers stability.

Conclusion

The MRQ Asset Value Indicator presents a sophisticated approach to asset valuation, weaving together Quality of the Asset, Quality of Regulation, and Quality of the Market into a unified framework.

This method captures both the intrinsic strengths and external influences that shape value, making it well-suited for navigating the intricacies of today’s financial markets.

Detailed explorations of each dimension reveal their critical roles: the asset’s core quality sets the foundation, regulation can either constrain or enhance efficiency depending on its clarity and intent, and market quality determines how effectively an asset’s potential is realized.

Applicable to a broad spectrum of asset classes—from real estate and commodities to cryptocurrencies—this framework equips investors with a structured and adaptable tool for informed decision-making in an ever-evolving economic landscape.

Comments ()