[MTSS 201 Class] - Chapter 3: Cross-Chain Liquidity and Mitosis’s Blockchain Connections—Bridges to Freedom

![[MTSS 201 Class] - Chapter 3: Cross-Chain Liquidity and Mitosis’s Blockchain Connections—Bridges to Freedom](/content/images/size/w1200/2025/03/whisk_storyboard55e09abeb09c43f0b562f81342342e3557e1--1--02.jpg)

Welcome back to Mitosis University. In Chapter 2, we learned how Ecosystem-Owned Liquidity (EOL) makes Liquidity fair, like neighbors pooling resources for a community project.

Now, let’s explore Cross-Chain Liquidity (CCL). Think of blockchains as separate islands, each holding crypto assets like weETH on Ethereum or uniBTC on Solana. Without connections, those assets stay trapped. Mitosis builds bridges to let them move freely across DeFi. It’s crucial for DeFi’s growth, but not simple. Let’s break it down together as Gakuseis and Senseis. By the end, you’ll know what Cross-Chain Liquidity is, why it matters, the challenges, and how Mitosis uses Mitosis Vaults.

What Is Cross-Chain Liquidity?

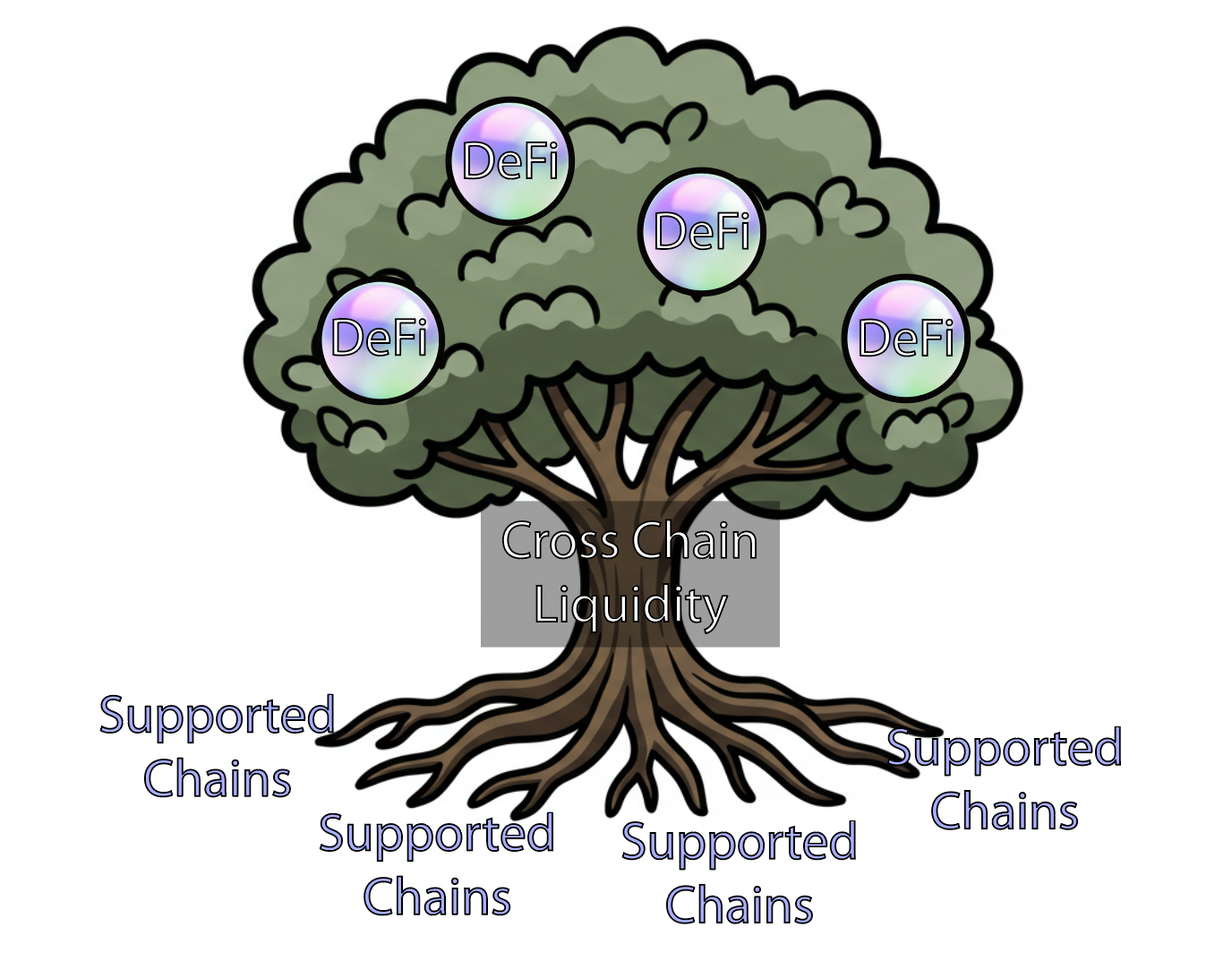

Blockchains are like isolated islands, each holding valuable assets like weETH or uniBTC. Normally, these assets remain on their home island due to different blockchain rules. Cross-Chain Liquidity is like a tree, connecting scattered chains like deep roots, strengthening the ecosystem’s foundation, and making assets usable anywhere in DeFi. For example, if you have weETH on Ethereum but want to lend on Solana, Cross-Chain Liquidity enables a smooth transfer. It provides flexibility but requires the right tools to function efficiently.

Why Does Cross-Chain Liquidity Matter?

Here’s why Cross-Chain Liquidity is key for DeFi:

- More Opportunities: Access top yields or projects on any blockchain, like lending on Ethereum or staking on Solana. It’s like shopping in every neighborhood.

- Efficient Assets: Move your crypto where it’s most valuable, boosting Capital Efficiency and cutting waste.

- Unified DeFi: Connecting blockchains reduces fragmentation, making DeFi collaborative, like highways linking cities.

But building those bridges isn’t easy. Let’s look at the hurdles.

Challenges of Connecting Blockchains

Linking blockchains is like building roads between distant islands. Here’s what makes it hard:

- Tech Barriers: Each blockchain has unique rules, Consensus Mechanisms, like different laws per island. Special tools are needed to connect them.

- Security Risks: Moving assets risks hackers or errors, like carrying gold over open water needing protection from pirates or storms.

- User Complexity: For most, crossing bridges is confusing—too many steps, fees, and wallets. It’s like getting lost without a map.

These issues make Cross-Chain Liquidity tough, but Mitosis fixes them with Mitosis Vaults.

How Mitosis Uses Mitosis Vaults for Cross-Chain Liquidity

Mitosis is like an expert architect, building secure bridges between blockchain islands—Ethereum, Solana, and Mitosis Chain—using Mitosis Vaults. Here’s how it works:

- Deposit Your Assets: Put assets like weETH or uniBTC into a Mitosis Vault on your island, like Ethereum. The Vault, a smart contract, safely holds them for movement. It’s like locking valuables in a safe.

- Get Vanilla Assets: Mitosis issues Vanilla Assets, a 1:1 token for your assets on the Mitosis Chain. It’s a receipt, but programmable for bridges. An arbitrary message bridge ensures secure communication.

- Cross the Bridge: Mitosis builds a bridge for your Vanilla Assets to reach another island, like Solana, via secure protocols. No tech skills needed, just deposit, and Mitosis does the rest!

- Stay Safe and Balanced: Smart protocols and Consensus Mechanisms protect assets, like reinforced bridges against threats. Mitosis monitors balances to keep Liquidity balanced across islands.

- Earn with miAssets: After depositing, your assets become Vanilla Assets, which can turn into miAssets. These are yield-bearing tokens issued by Mitosis, representing your share of Liquidity in Mitosis Vaults. They reflect potential rewards before moving or community use.

It's too complicated and hard to understand, isn't it?

The role of Mitosis Vault for Cross-Chain Liquidity is simple yet essential.

Mitosis Vault functions as both a branch and an investment division of a bank.

It operates across multiple islands (chains), receiving deposits of various assets from customers and transmitting them to the bank’s headquarters (Mitosis Chain). Based on these collected assets, the headquarters issues Vanilla assets, which are then transferred to an investment account (MLF Vault) to be managed according to customers' investment strategies.

In this process, receipts in the form of miAssets or maAssets, each with distinct functionalities, are issued. Also, since the scale is shared with other customers, you can receive the same treatment as large clients. Finally, once the investment direction is determined, the branch (Mitosis Vault) located on the respective island takes on the role of the investment department and executes the investment.

Move weETH from Ethereum to Solana or pool uniBTC for Karak or Mendi Finance, Mitosis makes it efficient, secure, and rewarding. It boosts Capital Efficiency, reduces Liquidity Fragmentation, and enables Programmable Liquidity.

Real-World Wins with Mitosis

Here’s how Cross-Chain Liquidity helps, as we’d discuss at Mitosis University:

- New Opportunities: If you have weETH on Ethereum but find a lending deal on Solana, deposit it into a Vault, get Vanilla Assets and miAssets, cross the bridge, lend, and earn rewards. Simple!

- Support Projects: A Solana startup needs Ethereum liquidity. Mitosis pools assets via Vaults and bridges, letting you join, help, and earn Cross-Chain Yield. It’s like neighbors funding a community project together!

Mitosis solves DeFi’s fragmentation, making it accessible for all.

Quick Check—Got It?

Before moving on, test yourself with these questions:

- “What’s one benefit of Cross-Chain Liquidity for me in DeFi?”

- “How does Mitosis use Mitosis Vaults to move weETH between blockchains?”

If you know these, great work! If not, no worries, reread or ask a friend. We’re learning together here.

What’s Next?

You’ve nailed cross-chain liquidity and seen how Mitosis builds the bridges. Next up, we’ll dive into Mitosis Vaults and tokens like miAssets and maAssets. You’ll learn how to deposit assets, make your Liquidity flexible, and start experimenting yourself. Catch you in Chapter 4. Let’s keep exploring at Mitosis University!

Comments ()