Multichain or Modular? Where the Future of Infrastructure Is Headed Post-Celestia & Mitosis

Introduction

Imagine two sprawling cities.

One is stitched together by dozens of bridges each crafted by a different architect, each designed to handle traffic slightly differently. The other is a high-speed modular city, with sleek underground rails connecting every neighborhood with precision and purpose.

This is the metaphorical crossroads where the blockchain world finds itself in 2025.

On one side stands the multichain thesis a once-revolutionary idea that blockchains, like sovereign nations, could interact through bridges, protocols like IBC, and shared standards. Cosmos, Polkadot, and Avalanche were its architects, promising diversity through sovereignty.

On the other side, a quieter but powerful vision has emerged: modular blockchain architecture. Spearheaded by Celestia and most recently accelerated by Mitosis, this movement proposes a disassembled blockchain stack where each layer data availability, execution, consensus can be built and scaled independently.

What started as a technical debate has now become a strategic choice.

For founders, investors, and developers alike, the infrastructure decisions made today will determine scalability, composability, and perhaps most importantly user experience in the decade to come.

As Celestia matures into a serious data availability backbone and Mitosis introduces new frameworks for cross-rollup liquidity and composable yield, one question is beginning to dominate developer forums and investor calls:

Multichain or Modular?

In this article, we’ll dissect what’s truly at stake. We’ll look at how these two models evolved, where they’re thriving (or struggling), and what recent innovations like Matrix Vaults and Zootosis signal about the future of onchain infrastructure.

The Rise and Plateau of Multichain Ecosystems

The multichain thesis wasn’t just a technical framework it was a cultural manifesto.

By 2021, Ethereum congestion had priced out the average user, making way for a Cambrian explosion of Layer 1 blockchains. Solana promised speed. Avalanche delivered scalability through subnets. Cosmos advocated sovereignty through interoperability. Each had its own chain, culture, and loyalists a sort of “crypto Game of Thrones.”

But under the hood, the vision was elegant: different chains, specialized in their use cases, could interoperate seamlessly through bridges and protocols. Builders could choose their tooling, users could migrate to cheaper environments, and liquidity could flow between them with minimal friction.

It worked for a while.

Billions were bridged across L1s. TVL surged. Tokens pumped. And then reality hit.

The Security Woes

Bridges became the Achilles’ heel of the multichain thesis. In 2022 and 2023, hacks on cross-chain bridges (like Wormhole, Nomad, and Ronin) resulted in over $2 billion in losses. The very mechanism that connected sovereign chains became their biggest vulnerability.

Trust-minimized bridging was harder than anticipated. Light clients were expensive. Validators could be corrupted. And users no matter how much they cared about decentralization began to care more about safety and UX.

UX Fragmentation

Beyond security, the user experience was fragmented.

- You needed different wallets for different chains.

- Assets had wrapped versions with varying liquidity.

- DeFi protocols were often chain-specific, leading to siloed liquidity and duplicated effort.

For developers, this meant building on one chain and being isolated from another’s user base. For users, it meant higher learning curves and more friction. Even with tools like LayerZero, Axelar, and THORChain improving composability, the multichain dream began to feel like a patchwork held together by duct tape and vibes.

A Movement in Pause

As of mid-2025, multichain is not dead but it’s plateaued. Projects like Cosmos Hub continue to iterate, Avalanche is pivoting with a renewed focus on “elastic subnets,” and Polkadot is undergoing a transformation with JAM (Join-Accumulate Machine). But something has shifted.

Developers especially those launching new rollups or dApps are starting to look elsewhere.

The Modular Alternative; Celestia’s Vision and Mitosis’ Execution

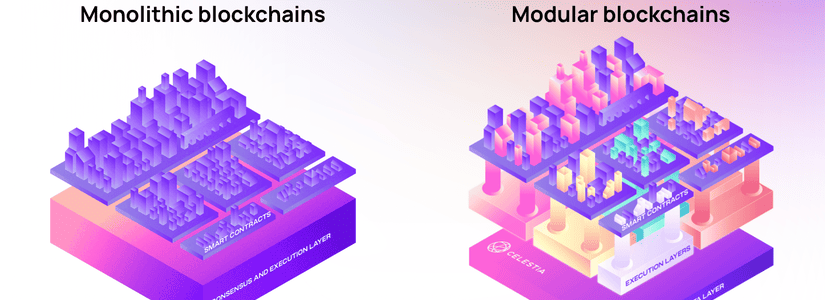

While multichain networks aimed to scale horizontally through sovereign chains, modular architecture proposed something radical: instead of building one monolithic chain to do everything, break the blockchain stack into optimized layers.

Celestia was the first to crystallize this vision.

Rather than hosting smart contracts or execution environments itself, Celestia only focused on data availability. It provided a scalable, secure foundation upon which developers could build their own execution layers (rollups), without having to bootstrap validator sets or worry about consensus.

This decoupling of the blockchain stack unlocked a whole new design space one where teams could launch highly customized rollups (execution layers), while relying on Celestia for shared security and data availability.

But modularity was only part of the story. What was still missing? Liquidity and coordination.

Enter Mitosis: Modular Interoperability in Action

Mitosis emerged not as a competitor to Celestia, but as its logical complement solving the critical problem of how these modular chains interact. It focused on:

- Shared Sequencing: Letting multiple rollups plug into the same sequencing layer, ensuring fair ordering and reducing MEV.

- Restaked Security: By integrating with EigenLayer, Mitosis enabled rollups to inherit Ethereum-grade economic security without setting up their own validators.

- Modular Interoperability: Its Matrix Vault system and miAssets allowed developers and users to deposit assets once, and earn utility across multiple chains and protocols a DeFi abstraction layer for modular chains.

Where Celestia optimized the base, Mitosis optimized the flow.

Builders’ Dream Stack

For developers in 2025, the stack now looks something like:

- Data Layer: Celestia

- Execution Layer: Custom rollup (using OP Stack, Arbitrum Orbit, or zkVMs)

- Sequencing & Interop: Mitosis

- Security Layer: Ethereum via EigenLayer

This is no longer speculative it's being built now. And what’s more: users don’t need to know they’re interacting with five separate layers. All they see is faster execution, safer bridging, and better incentives.

Comparing User Experience: Modular vs. Multichain

For years, the average crypto user has been expected to know far too much.

If you’ve ever had to manually bridge tokens, wrap ETH three times, or pay $40 just to swap stablecoins you’ve seen the dark side of multichain UX. It wasn’t broken by design, but it was inherently fragmented.

Each chain felt like its own island:

- Separate wallets and RPCs.

- Distinct assets with wrapped or bridged versions.

- Multiple sources of truth for liquidity and state.

The promise of modular architecture isn’t just a backend upgrade it’s a UX revolution.

Modular UX: One Portal, Many Chains

With projects like Mitosis acting as the connective tissue, the modular experience simplifies dramatically:

- Users deposit assets once into shared vaults.

- Smart routing handles execution across rollups.

- Restaked security means less need to verify obscure chains or bridge risks.

For example, with Matrix Vaults on Mitosis, you can:

- Stake ETH or stablecoins once,

- Gain exposure to multiple rollups or appchains,

- Earn points or rewards from partner ecosystems (like EigenLayer, Scroll, etc.),

- And never leave your interface.

Compare that to the days of bridging from Ethereum to Arbitrum, then to Optimism, then staking in some app-specific protocol all while paying gas and hoping no bridge gets exploited in the process.

Modular design collapses complexity.

From Multichain Pain to Modular Abstraction

Multichain made DeFi accessible to niche groups. Modular architecture aims to make it invisible.

Just like no one today thinks about whether Gmail is hosted on Google Cloud or AWS, the next generation of Web3 users won't care if their transaction settled on Celestia, was sequenced by Mitosis, and secured by Ethereum restakers.

The Economic Layer: Incentives, Yields, and Liquidity Flows

At the heart of Web3 lies one truth: liquidity is loyalty.

Users don’t just follow hype—they follow incentives. The rise of multichain ecosystems proved this. Liquidity migrates to wherever the yields are highest, the rewards are most attractive, or the airdrop potential is too good to ignore.

But with modular systems, the economics change fundamentally. Let’s explore how.

In Multichain: Fragmented Liquidity, Fragmented Rewards

Multichain ecosystems forced users to:

- Split assets across L1s, L2s, and alt-L1s.

- Rely on third-party bridges (often insecure) to move funds.

- Chase temporary yield farms that were often unsustainable.

This created a fractured experience and protocols constantly had to rebuy user attention with high emissions, mercenary incentives, or aggressive airdrop games.

In Modular: Consolidated Liquidity, Shared Incentives

With systems like Mitosis Matrix Vaults, modular ecosystems can now aggregate capital at the base layer while distributing utility across rollups.

That means:

- One asset deposit = exposure to multiple rollups and ecosystems.

- Yield comes not just from one protocol, but multiple underlying sources.

- Protocols can plug into Mitosis and attract liquidity without reinventing the wheel.

This is liquidity composability a core economic advantage of modular infrastructure.

The Rise of “miAssets” and Composable Points

Take Mitosis’s “miAssets” as a case in point.

When a user deposits ETH, USDC, or other tokens into Matrix Vaults:

- They receive a modular asset (miETH, miUSDC, etc.).

- These assets accumulate multiple incentives simultaneously: Mitosis points, partner ecosystem rewards (e.g., EigenLayer), and protocol-native emissions (e.g., Theo).

It’s no longer a zero-sum game of “where should I stake?” Instead, it's a stacked yield strategy, abstracted for users.

In this new model, protocols don’t compete for liquidity they cooperate across a shared base. And users win.

Developer Mindset: Building in a Modular World

For years, developers in crypto were forced to make a binary choice:

"Which chain are we building on?"

In a multichain world, that decision often came down to:

- Ecosystem grants.

- Liquidity pools.

- Community size.

- L1 vs L2 gas fees.

But in a modular world, that question becomes obsolete. Developers now ask:

“Which execution layer best serves my app — and how can I plug into shared security, liquidity, and data?”

Welcome to the modular builder’s era.

Building Blocks, Not Silos

Modular infrastructure turns monolithic blockchains into composable Lego bricks:

- Celestia offers shared data availability.

- Mitosis provides cross-rollup liquidity, yield, and interoperability.

- Execution layers (Rollups, AppChains) can be tailored to specific use cases.

The result? Developers can now:

- Launch a chain with minimal overhead.

- Use Mitosis vaults to bootstrap liquidity.

- Leverage shared security/data without building it from scratch.

Instead of competing for chain market share, developers collaborate on shared rails.

Faster Experimentation, Safer Iteration

The modular stack encourages faster iteration:

- Rollups are customizable sandboxes.

- Upgrades and forks don’t require hard changes to the base layer.

- Devs can trial novel features (e.g., privacy-preserving ZK tech, new VM environments) without risking the broader network.

This is especially critical for early-stage dApps and experimental DeFi protocols. The modular stack is permissionless innovation at its best.

Plug-and-Play Protocols

With Mitosis and other modular tooling, devs can tap into pre-built infrastructure:

- Vault integrations for instant yield aggregation.

- miAsset support for native liquidity bootstrapping.

- Cross-rollup bridging and composability via the Mitosis router.

It’s not just about building a dApp it’s about joining an economic and technical mesh

Multichain or Modular: The Real Future of Web3 Infrastructure

As crypto matures beyond speculation and meme cycles, the infrastructure it runs on must evolve from fractured, siloed ecosystems to a unified, composable, and permissionless stack.

That’s the promise of the modular future.

While multichain made everything interoperable in theory, modular makes it seamless in practice:

- Liquidity doesn’t have to be fragmented — Mitosis vaults unify it.

- Execution doesn’t have to be one-size-fits-all custom rollups make it flexible.

- Innovation doesn’t have to wait for upstream L1 governance modular stacks let builders iterate fast.

Projects like Celestia have shown that data availability can be decoupled. Mitosis is proving that yield, liquidity, and security can scale across rollups. Together, they represent more than infrastructure they mark a new economic paradigm for Web3.

The question isn’t Multichain or Modular. It’s: How modular can we get while remaining user-first and developer-friendly?

In this next cycle, winning ecosystems won’t just connect chains, they’ll dissolve the very notion of chains into a seamless network of composable parts.

Comments ()