Navigating Chaos: Game of Mito Lessons About Crypto Volatility and Slippage

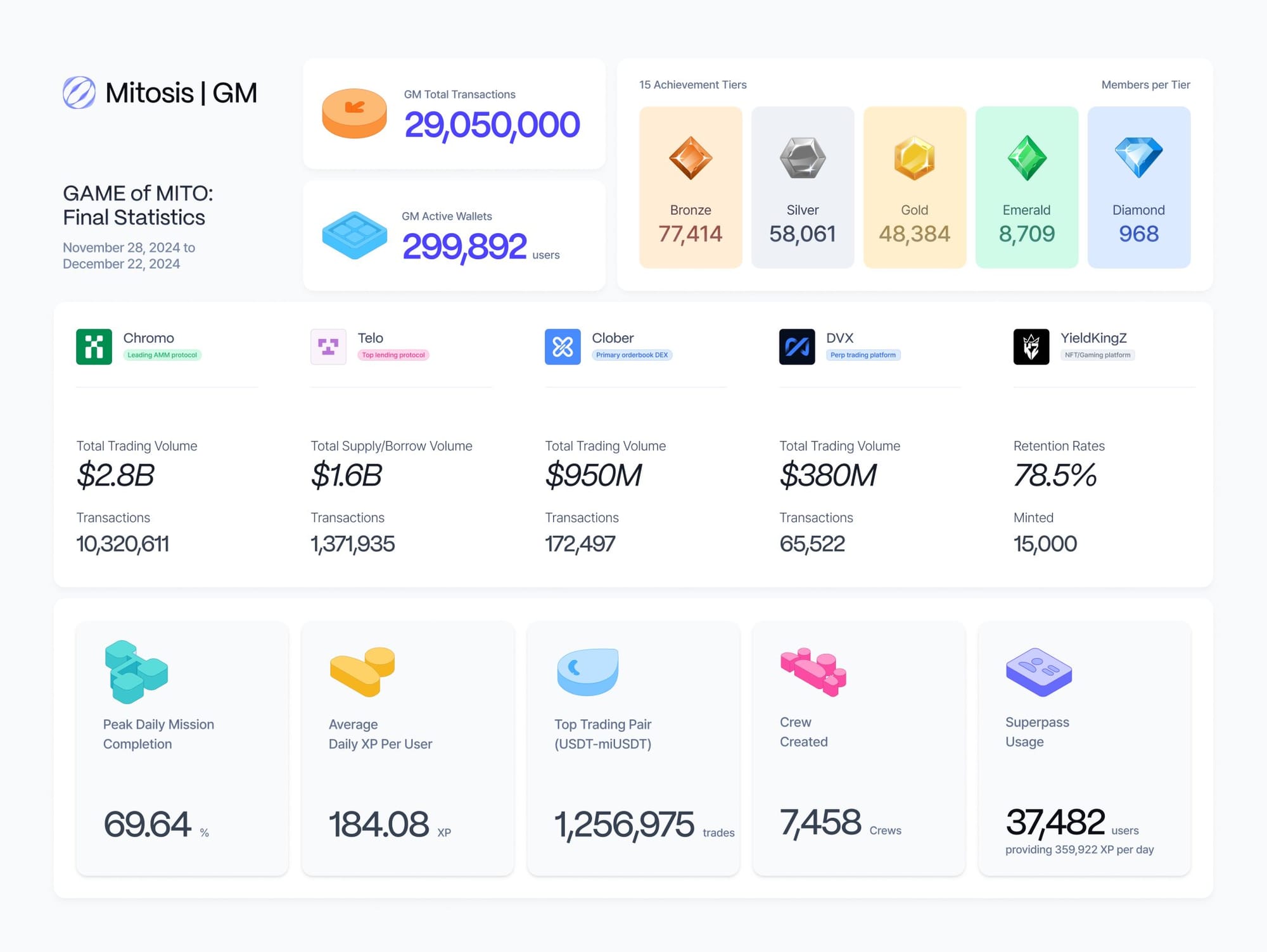

Introduction The Game of Mito campaign wasn’t just another crypto casual testnet, it was a lesson disguised as a challenge. Built around the Chromo Exchange dApp, it put testers in a live-fire environment where the core mechanics of decentralized swaps were no longer theoretical. They were real and often frustrating for testors hunting for XP's. The biggest obstacle? Volatility. When dozens or hundreds of users attempted to swap at the same moment, transactions started to crumble. Swaps failed and Prices slipped. In the world of decentralized finance, volatility and slippage aren’t bugs they’re know as features for DeFI folks. But understanding how they work, and more importantly, how to navigate them, is what separates casual users from serious players. Let’s break down what happened in the Chromo Exchange, and how volatility and slippage are shaping the future of on-chain trading.

Great let’s move into the next section. Based on your earlier input, I’ll keep it focused, informative, and narrative-driven, similar to how a top Medium writer would bridge storytelling with clarity.

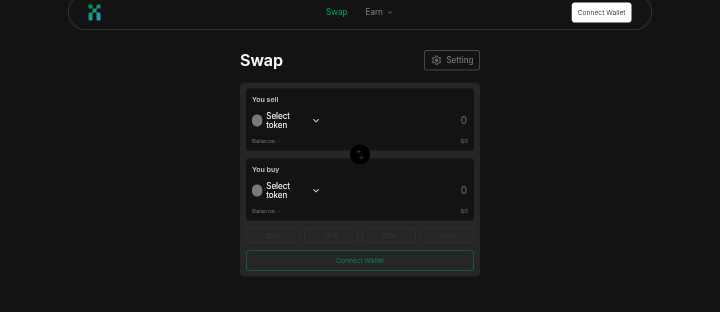

Chromo Exchange DEX – The $MITO Asset Swap

Chromo Exchange isn’t your average Decentralized Exchange. It’s part of a broader vision by mitosis to create fluid, permissionless asset swaps without relying on centralized intermediaries. That sounds simple enough theoretically. But in practice, it means putting users face-to-face with the raw mechanics of decentralization of the Mito blockchain.

During the Game of Mito, testers were dropped into a volatile environment, tasks to perform swaps. It was a huge challenge considering the number of users trying to perform swaps at once which constantly changes the token prices.

What made Chromo unique was also what made it chaotic: everyone was playing at the same time. Unlike centralized exchanges where the backend adjusts quietly to high-volume trading, decentralized protocols like Chromo expose the friction. That friction? It’s what makes Decentralized finance real.

When everyone tried to swap at once, slippage took over. Transactions failed or went through at less than ideal rates. It wasn’t a bug,it was a feature of decentralized liquidity which was really engaging for testers.

This wasn’t just a stress test for the platform. It was a stress test for every participant’s understanding of how decentralized markets work before public mainnet.

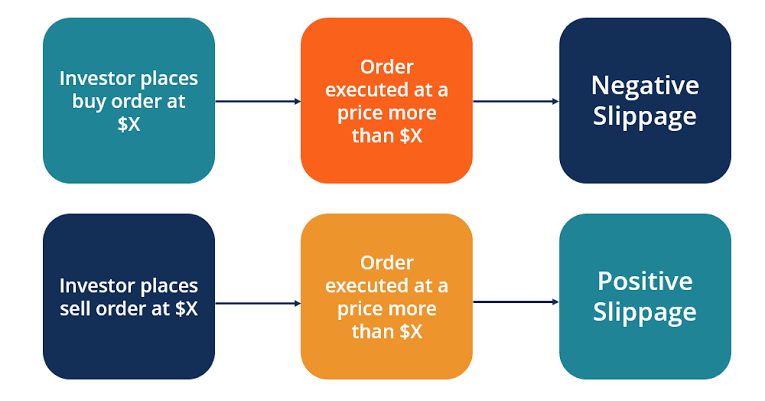

Volatility and Slippage — The Challenges of Decentralized Swaps Volatility refers to the degree of price fluctuation, indicating how much an asset's value changes over a period. It essentially measures the speed and extent of price swings, both up and down.In traditional markets, volatility measures how quickly and drastically prices move. In crypto, that speed is magnified. A token’s value can spike or crash within seconds driven by hype, news or mass user activity. In the Game of Mito, volatility became more than a market term it became a real DEX challenge to GOM testooors. Picture this: hundreds of testnet participants rushing to execute swaps on Chromo Exchange at the same time. Prices jumping erratically. Token values fluctuating with every new block. In that chaos, even a well-timed trade could be sabotaged by the time it was confirmed. That’s where slippage enters the picture. Slippage happens when the price at the time you initiate a swap is different from the price when your transaction actually goes through. In centralized exchanges, slippage is often minimized by deep liquidity and high-frequency trade engines. But in decentralized exchanges like Chromo, where liquidity is sourced from pools and everything runs on-chain, slippage is more exposed and more punishing. And when volatility increases, slippage becomes more aggressive. During the campaign, many users watched their swaps fail or complete at significantly worse prices than expected. That’s because in volatile conditions, by the time a transaction is mined, the price may have moved just enough to breach the user’s slippage tolerance. If it moves too far, the swap fails. If it just barely clears the threshold, the user still takes a hit. This is where the lesson hits hardest: volatility and slippage are not separate issues. They’re a chain reaction. High volatility causes faster price swings. Faster swings lead to mismatches between expected and executed prices. And that’s the exact moment where slippage either chips away at your trade—or kills it entirely.

Adapting Under Pressure – How Players Learnt to utilize slippage for Swap When theory meets reality, things break. And that’s exactly what happened for many first-time users of Chromo Exchange during the Game of Mito. But what was more interesting than the failures was how quickly people started adapting,this really got me frustrated at some point but you don't let your weakness defeat you. As the campaign progressed, educational YT videos/X Threads was made by experts. People began timing their swaps more carefully and adjusting their slippage tolerance settings more strategically. Some users even started analyzing blockchain data in real-time to gauge the optimal moment to execute a trade. Others moved away from highly volatile tokens and gravitated toward assets with more stable price movement anything to minimize the risk of failed swaps but even stables later became too volatile (Usdt,USDC,MiUSDT,MiUSDC). It wasn’t about chasing perfect trades anymore. It was about preserving precision in chaos. The most successful participants weren’t necessarily the fastest. They were the most aware. They understood that in a decentralized fast-moving environment, every transaction is a mini-game of timing, patience, and risk tolerance. And that’s what the Game of Mito ultimately revealed: real decentralization doesn’t just demand technical knowledge, it demands behavioral change. It teaches you not just how to use a protocol specifically how to perform swaps on MITO mainnet, and how to think like a DeFi native.

Personal Bias and encounters

Game of Mito didn’t just test Mitosis blockchain,it tested people. And I’ll admit my own experience wasn’t smooth at first. There were moments of frustration,constant refreshing, adjusting slippage back and forth, watching token values jump just after hitting approve. It felt chaotic. But that chaos taught me. Every failed swap was feedback. Every refresh was a recalibration.

Eventually, that persistence paid off and I landed at Emerald 1 on the testnet tier. Not because I had insider knowledge, but because I adapted. And that’s the deeper truth behind this whole experience.

Conclusion: The Game Was Real, and So Were the Lessons

The Game of Mito didn’t just test a protocol it tested people. It exposed the fragility of assumptions in DeFi. It revealed how little most users understand about slippage, about volatility, about what it truly means to interact with a decentralized system that doesn’t make room for mistakes.

But in that pressure, something powerful happened. People learned. Not from a guide. Not from a YouTube tutorial. But from failure, experimentation, and adaptation which was the main purpose of the gamified testnet.

That’s the future of Web3 education: experiential by design. Platforms like Chromo Exchange don’t need to teach with words they teach experimentally. And the users who walk away from that fire a little more cautious, a little more strategic are the ones who’ll thrive in the next evolution of decentralized markets.

Because in crypto, knowledge isn’t power. Applied knowledge is.

Useful links

Read about the Conclusion of GOM campaign

Comments ()