Navigating the Cross-Chain Jungle: How Mitosis Stands Out Among Competitors

1. Introduction

The Multichain Era: Opportunities and Challenges

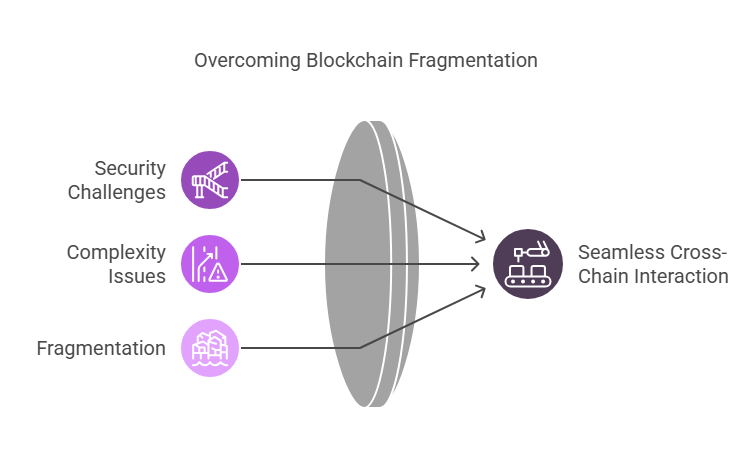

We live in an exciting multichain era. Dozens, if not hundreds, of blockchains – from giants like Ethereum to specialized Layer2 and Cosmos networks – form an ever-expanding Web3 universe. This opens up incredible opportunities for innovation, competition, and choice. But with opportunities come challenges.

The main one is fragmentation. Liquidity, users, and applications are scattered across these numerous networks like islands in an ocean. To take advantage of different ecosystems, users and developers must constantly cross borders – "swim" between the islands. And this is where the difficulties begin:

- Security: Cross-chain bridges have historically been some of the most vulnerable targets for hackers.

- Complexity: Using different bridges with different interfaces, fees, and speeds is inconvenient.

- Efficiency: Liquidity often gets "stuck" on bridges or requires complex steps to move.

Many Solutions, One Question: Which to Choose?

Demand creates supply. Understanding the critical importance of interoperability, the industry has spawned numerous protocols and solutions seeking to connect disparate blockchains. We hear about projects like LayerZero, Wormhole, Chainlink CCIP, Connext, and many others. Each offers its unique approach to transferring data and assets between networks, with its own strengths and weaknesses.

Against this backdrop emerges Mitosis – a protocol that doesn't just build another bridge, but offers a comprehensive approach to managing cross-chain liquidity, based on the Ecosystem-Owned Liquidity (EOL) model and advanced security mechanisms like EigenLayer AVS.

But how can an ordinary user or developer navigate this diversity? How can one understand how Mitosis truly differs from alternatives and what advantages it offers?

The Goal of This Article: A Comparative Analysis

These are precisely the questions we will try to answer in this article. We will conduct a comparative analysis of Mitosis and some key competitors in the cross-chain solutions market. Our goal is not just to list features, but to understand the fundamental differences in their approaches based on key criteria:

- Architecture and Transfer Mechanism: How exactly are messages and assets transferred?

- Security Model: What is the protocol's security based on? What risks exist?

- Approach to Liquidity: How does the protocol manage liquidity (if at all)? Are there EOL equivalents?

- Decentralization and Trust: How decentralized is the protocol, and what trust assumptions does it require?

We will not declare a single "winner," as different solutions may be suitable for different tasks. However, we aim to provide you with the information needed to understand Mitosis's unique place in this complex ecosystem and to make an informed choice of the right tool for your cross-chain needs.

2. Comparing Approaches: Mitosis and Competitors

To understand the uniqueness of Mitosis, it's important to see how it compares to other players in the interoperability field. We won't cover absolutely every existing protocol, but we will focus on a few well-known examples, such as LayerZero and Wormhole, to illustrate the key differences in approaches.

Criterion 1: Architecture and Transfer Mechanism

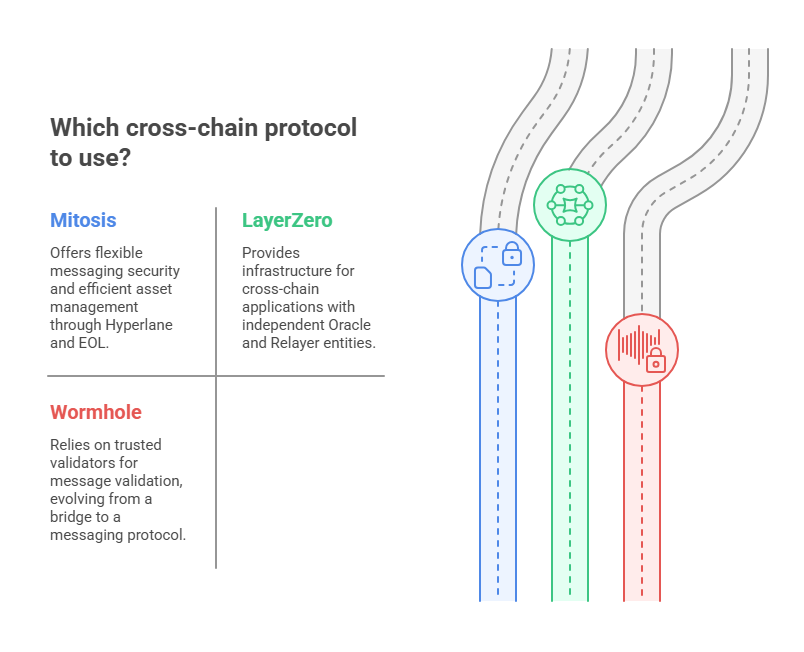

- Mitosis: Utilizes a combination of a messaging protocol (e.g., Hyperlane) and its own liquidity management layer (EOL). Hyperlane is responsible for the secure transfer of information between networks, while Mitosis manages liquidity based on this information. This separation allows for flexibility in messaging security and efficient asset management.

- LayerZero: Positions itself as an "omnichain" messaging protocol. Its architecture relies on the interaction of two independent entities: the Oracle (transmits the block header) and the Relayer (transmits the transaction proof). A message is considered delivered only if the information from the Oracle and the Relayer matches on the destination chain. It doesn't manage liquidity directly but provides the infrastructure for building cross-chain applications (like Stargate Finance).

- Wormhole: Initially a bridge, it evolved into a messaging protocol. Its security relies on a network of 19 (currently) trusted validators called Guardians. Guardians observe events on connected chains and sign messages (attestations) confirming their validity. A 2/3+ signature majority from the Guardians is required to relay a message.

Key Difference: Mitosis separates message passing and liquidity management, LayerZero relies on the independence of the Oracle and Relayer, and Wormhole uses a dedicated network of trusted Guardians.

Criterion 2: Security Model

- Mitosis: Security is multi-layered. Message passing security via Hyperlane is ensured by Interchain Security Modules (ISMs), which can be configured – even up to using EigenLayer AVS. This allows Mitosis to "borrow" the cryptoeconomic security of Ethereum, relying on the vast economic stake of AVS validators. Security is based on verifiable economic incentives and a high threshold for the cost of attack.

- LayerZero: Security depends on the assumption of independence between the Oracle and the Relayer. If an attacker can compromise both (e.g., if the same provider is used for both roles or they collude), the protocol's security could be breached. Security here is more operational and reputational.

- Wormhole: Security depends on the honesty of 2/3+ of the Guardians. If an attacker manages to compromise or collude with 13 out of 19 Guardians, they could sign malicious messages and potentially steal funds from bridges built on Wormhole (which unfortunately has happened in the past). Security is based on trust in a limited set of validators.

Key Difference: Mitosis aims for maximum cryptoeconomic security via AVS, LayerZero relies on the separation of roles, and Wormhole relies on a trusted federation.

Criterion 3: Approach to Liquidity

- Mitosis: Unique Ecosystem-Owned Liquidity (EOL) model. The protocol itself owns a significant portion of the liquidity, strategically deploying it to ensure stability, low slippage, and capital efficiency. This reduces dependence on external liquidity providers (LPs) and associated risks (like sudden LP withdrawal).

- LayerZero: The protocol itself does not manage liquidity. It provides the messaging infrastructure upon which other applications (like the Stargate bridge) are built. These applications then use traditional models: liquidity pools provided by LPs, or lock-and-mint/burn-and-redeem mechanisms.

- Wormhole: Similar to LayerZero, the protocol focuses on message passing. Bridges and applications built on Wormhole (like Portal Bridge) typically use a lock-and-mint model (tokens are locked on one chain, and "wrapped" versions are issued on another) or liquidity pools.

Key Difference: Mitosis actively manages its own liquidity via EOL, whereas LayerZero and Wormhole provide the base infrastructure, and liquidity management is implemented at the application layer, often using traditional models.

Criterion 4: Decentralization and Trust

- Mitosis: Aims for high decentralization. Using AVS allows reliance on a broad set of operators with economic stakes. Hyperlane's modular architecture also allows for flexible security configurations. Plans for a DAO suggest further decentralization of governance. Requires minimal trust due to economic guarantees.

- LayerZero: The level of decentralization depends on the specific application's choice of Oracle and Relayer. If an application chooses centralized providers, the level of decentralization decreases. Requires trust in the independence of the Oracle and Relayer.

- Wormhole: Decentralization is limited by the fixed number of Guardians (19). Although they are well-known and reputable validators, the model itself requires significant trust in this group.

Key Difference: Mitosis minimizes trust through economic incentives and a broad base of AVS validators. LayerZero requires trust in the independence of two entities. Wormhole requires trust in a fixed group of Guardians.

3. Comparison Summary and Mitosis Positioning

Summing Up: Key Differences at a Glance

The comparison of Mitosis with protocols like LayerZero and Wormhole reveals fundamental differences in their philosophies and approaches to solving the interoperability problem:

- Architecture: Mitosis separates the tasks of message passing (via Hyperlane) and liquidity management (via EOL). LayerZero focuses on message passing through an Oracle/Relayer. Wormhole also focuses on messages, but via a trusted network of Guardians.

- Security: Mitosis bets on verifiable cryptoeconomic security, borrowing it from Ethereum via EigenLayer AVS. LayerZero relies on operational security and the independence of two external entities. Wormhole relies on trust in a limited group of validators.

- Liquidity: Mitosis is unique with its Ecosystem-Owned Liquidity (EOL) model, actively managing its own pools. LayerZero and Wormhole are base protocols, leaving liquidity management to applications built on top of them (often using traditional LP or lock-and-mint models).

- Decentralization and Trust: Mitosis minimizes the need for trust through the economic incentives of AVS. The level of trust in LayerZero depends on the choice of Oracle/Relayer. Wormhole requires significant trust in its Guardians.

Mitosis's Unique Proposition: Security and Liquidity Efficiency

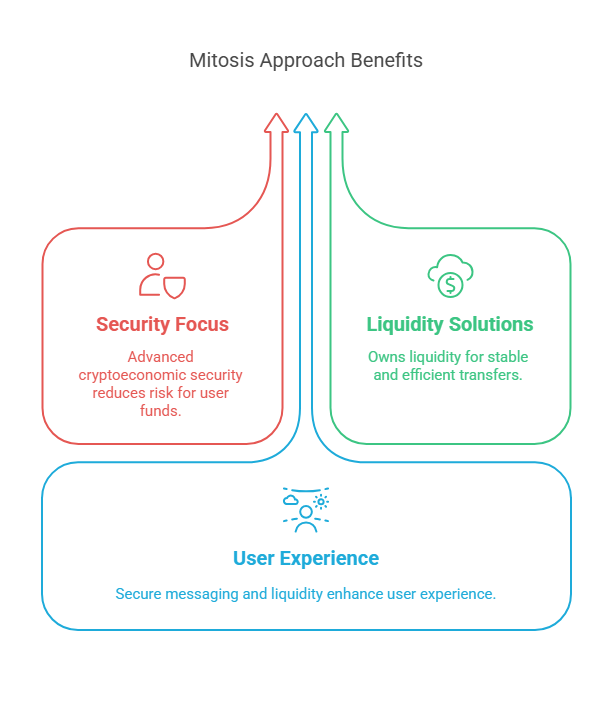

Based on this comparison, Mitosis's unique positioning becomes clear. It doesn't try to be just another universal messaging protocol. Mitosis positions itself as a comprehensive solution for cross-chain liquidity, where security and capital efficiency come first.

Key advantages of the Mitosis approach:

- Focus on Security: Integration with EigenLayer AVS places Mitosis alongside the most advanced developments in cryptoeconomic security. This is not just a theoretical advantage, but a real reduction in risk for user funds compared to models based on trust in small groups.

- Solving the Liquidity Problem: The EOL model directly addresses the issues of fragmentation and impermanent liquidity faced by traditional bridges and protocols dependent on external LPs. By owning liquidity, Mitosis can guarantee more stable and efficient transfers.

- Potential for Better UX: The combination of secure messaging and managed liquidity can lead to a smoother and more predictable user experience for cross-chain operations.

Of course, every approach has its trade-offs. The EOL model might require more initial capital and more complex management from the protocol's side. However, the potential benefits of enhanced security and liquidity efficiency may outweigh these complexities for users and developers seeking the most reliable solution.

Conclusion: Choosing Your Tool in the Multichain World

Navigating the world of cross-chain protocols can seem daunting, but understanding the key differences in their architecture, security, and approach to liquidity is crucial. Mitosis stands out with its focus on creating a secure and efficient liquidity ecosystem, utilizing cutting-edge technologies like EigenLayer AVS and the innovative EOL model.

While other protocols might offer more general-purpose messaging solutions, Mitosis bets on a comprehensive solution to the cross-chain liquidity problem. This makes it an attractive choice for users and projects for whom asset security and capital efficiency are top priorities.

The choice of a specific cross-chain solution always depends on specific needs. However, Mitosis undoubtedly offers a unique and powerful set of tools deserving close attention in the constantly evolving Web3 landscape.

Learn more about Mitosis and its technologies:

- Explore details on the official website: https://www.mitosis.org/

- Follow announcements on Twitter: https://twitter.com/MitosisOrg

- Participate in discussions on Discord: https://discord.com/invite/mitosis

- Read articles and updates on Medium: https://medium.com/mitosisorg

- Blog: https://blog.mitosis.org/

Comments ()