Network Effect: The Invisible Driving Force of the Digital World

We are living in an era where digitalization increasingly dominates our daily lives. The value of a technology is no longer determined solely by its innovation but also by how many people use it. This is where the concept of the "network effect" comes into play. But what exactly is the network effect, and why does it play such a critical role?

What Is the Network Effect?

The network effect describes a situation in which the value of a product or service increases as the number of users grows. In other words, when one more person joins the system, the experience improves not only for them but for all existing users. Over time, this creates a self-reinforcing cycle of growth.

To better understand this, we can take a brief look at the history of technology. For example, in the late 1990s, MSN Messenger became widely popular. Although it wasn't revolutionary from a technical standpoint, the fact that everyone was using it made it essential. The same applies today to platforms like WhatsApp or Telegram. As the user base expands, the value of the platform increases. If your friends are already on those apps, there's little reason for you to choose another one.

The Power of Network Effects in Crypto

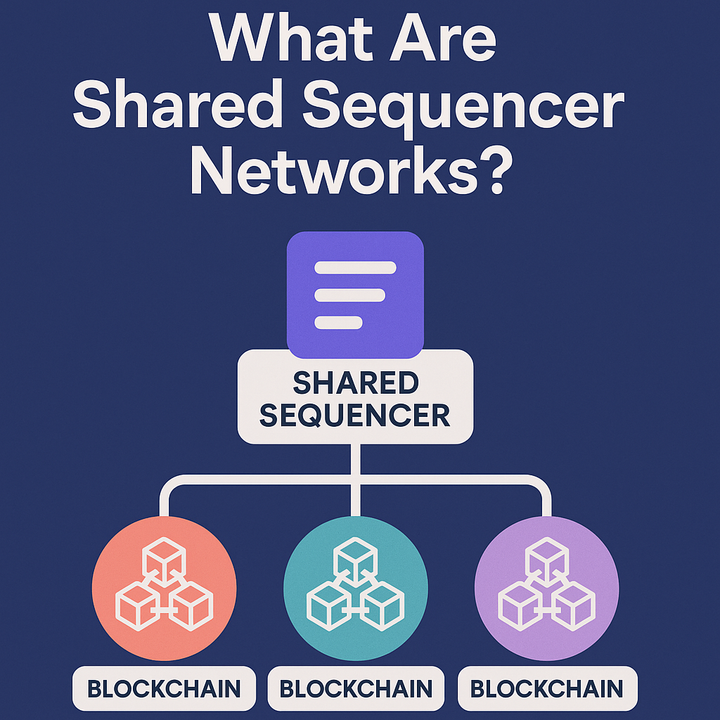

In the crypto space, network effects are not just measured by user numbers, but also by the number of developers, miners, validators, and dApp builders within the ecosystem. The more users a blockchain has, the more developers it attracts. The more developers there are, the faster the platform evolves, becomes more secure, and spawns new products. This triggers a positive feedback loop.

Many attribute Bitcoin's success to its technical features. Of course, elements like Proof of Work, fixed supply, and decentralization are crucial. However, Bitcoin’s real success lies in its ability to establish a massive network effect by gaining early trust from a wide audience. Today, even though there are hundreds of faster, cheaper, and more advanced alternatives, replacing Bitcoin is not easybecause it has a massive "network" behind it.

Direct and Indirect Network Effects

To understand network effects better, it's helpful to divide them into two types: direct and indirect.

Direct network effects occur when each new user directly adds value for all other users. For instance, the more people you can email using a service, the more useful that service becomes. Or, if you want to play games with your friends on a platform, they need to be using the same system. As participation grows, so does the platform’s appeal.

Indirect network effects are a bit more subtle. When a platform gains many users, it attracts complementary products and services. For example, if a crypto network grows, wallets, bridges, NFT marketplaces, and staking platforms are also developed for it. These may not directly affect the network but add indirect value by enhancing the user experience.

Examples of Network Effects Today

Social media platforms are prime examples of network effects. Facebook, Twitter, and TikTok started as ordinary apps. But as they gained users, their value grew exponentially—because people knew their friends, influencers, or content creators were active there.

The same applies to the business world. Tools like Slack or Zoom gained massive traction during the pandemic. As people became familiar with them, companies started building integrated tools and extensions. Today, Zoom isn't just used for video calls but also for scheduling meetings, file sharing, and live polling.

In crypto, Ethereum is a standout example. Thanks to its first-mover advantage, it attracted a huge number of developers. With the ERC-20 standard, thousands of tokens were launched on Ethereum. DeFi and NFT ecosystems also emerged from this network. Although many newer blockchains offer lower fees, Ethereum continues to enjoy the highest level of trust and ecosystem support—because network effects are built with communities, not just technology.

Negative Network Effects

Too much of anything can be harmful, and the same applies to network effects. When new users start harming rather than benefiting the system, this is called a negative network effect. For instance, when a blockchain becomes too popular and user traffic spikes, it can lead to congestion and higher transaction fees.

Ethereum’s experience in 2021 is a good example. As NFT mania and DeFi projects surged, gas fees skyrocketed. Even basic transactions became costly, pricing out smaller investors. As more people tried to use the network, it became bloated, generating friction instead of value.

In such cases, it’s essential to ask: “Does every new user truly add value?” If a system can scale not just in volume but also in efficiency, it can preserve a positive network effect.

Key Factors That Strengthen the Network Effect

For a crypto project to achieve a strong network effect, it needs more than just a large user base. Several other elements are critical:

- Community Management: An active, engaged, and loyal community ensures long-term success.

- Open-Source Development: Developer contributions enhance flexibility and innovation.

- Liquidity and Accessibility: Projects that are easy to access and integrate with various platforms grow faster.

- Education and Awareness: Users need to be informed and involved to contribute effectively to the system.

Conclusion: Network Effect = Invisible Competitive Power

The network effect is one of the most powerful yet invisible competitive forces behind a platform or project. Even systems that are technically inferior can maintain market leadership if they have strong network effects. This phenomenon is visible not just in business but also in crypto, social media, e-commerce, and even open-source initiatives.

In short: More users = More value. But only if each user truly adds value

Comments ()