NFT Market Reset: Strategies for Reigniting Trading Volume After a 12 % Slump

Introduction

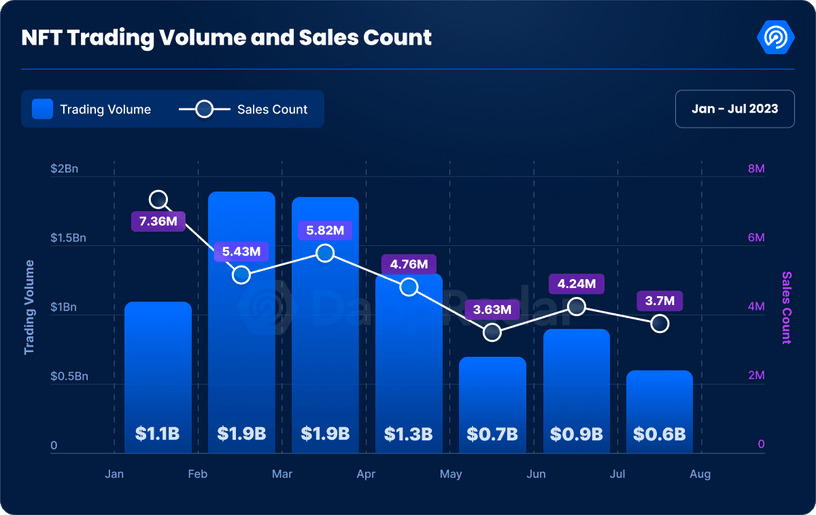

It’s no secret that NFTs have hit a rough patch. According to recent market data, Ethereum-based NFT sales have dropped by a staggering 59%, contributing to a broader 12% slump in overall trading volume. Floor prices are sliding, Twitter buzz is quieting, and once-hyped projects are fading into digital oblivion.

But not all hope is lost.

While the general NFT market is cooling off, some niches—like Panini’s licensed sports collectibles—are bucking the trend. These focused ecosystems, built around recognizable brands and real-world value, continue to pull in new users and generate steady trading activity.

In this article, we’ll unpack:

- Why Ethereum NFTs are stalling—from oversupply to lack of real use.

- What’s working in niche spaces like sports, music, and fandom.

- How creators and platforms can reignite engagement through better design, partnerships, and utility-driven ecosystems.

1. What Caused the NFT Market Slump?

At a glance, it might seem like interest in NFTs just vanished overnight. But the slowdown is more complex—and frankly, expected.

Oversaturation of collections is one major culprit. Thousands of derivative projects flooded marketplaces in 2023 and early 2024, chasing short-term gains without delivering long-term value. With similar-looking avatars and recycled metadata, buyers began asking: Why should I care about any of this?

Then there’s speculation fatigue. Early in the NFT wave, flipping JPEGs for profit was the norm. But as the hype cooled and profits dried up, traders exited en masse—leaving collections with low liquidity and few organic users.

Finally, limited in-app utility dragged things down. Most NFTs still don’t do anything beyond sit in your wallet or act as social flex. There’s little incentive to engage post-purchase. This has caused many to reevaluate whether NFT ownership actually means anything.

As a result, Ethereum’s once-dominant NFT ecosystem is feeling the weight of disillusioned collectors, slower launches, and less creator innovation.

2. What’s Still Working—and Why?

Despite the slump, some NFT projects are thriving. So what are they doing differently?

Let’s take Panini as a case study. Their digital collectibles—centered around real-world sports IP like FIFA, UFC, and the NFL—are seeing consistent activity and healthy engagement. They’ve mastered a few core strategies:

A. Real Brand Connection

Panini ties NFTs to licensed assets that fans already care about. You’re not just buying a random card—you’re owning a digital version of something tied to your favorite athlete or team. That emotional link goes a long way.

B. Scarcity With Purpose

Rather than pumping out unlimited drops, Panini keeps collection sizes lean and meaningful. Each release has a clear theme, structured rarity, and ongoing relevance to events (like tournaments or playoffs).

C. Built-In Use and Rewards

Many Panini drops tie into fantasy-style leaderboards or limited-time trading challenges. Completing a set might win you IRL merchandise or early access to the next drop—giving holders something to do after minting.

D. No Speculation Dependency

Success isn’t based on floor price speculation. Value is driven by fan enjoyment and collection goals—not quick flips. That stabilizes demand and reduces volatility.

Other niches like music NFTs, loyalty tokens, and digital ticketing are seeing similar strength, as they prioritize community, real-world perks, and brand consistency over hype.

3. Strategies for Reigniting NFT Engagement

So how can the broader NFT space—especially Ethereum-based projects—reclaim momentum? Here are five proven strategies to spark new life into the ecosystem:

1. Partner With Culture, Not Just Crypto

People don’t need another NFT “project.” They need stories, experiences, and connection. Collaborating with artists, musicians, athletes, or creators that people already follow can breathe emotional depth into drops.

Example: An animated film studio releasing NFTs that unlock behind-the-scenes content or allow holders to vote on story arcs. That’s immersive, not just speculative.

2. Focus on Post-Mint Utility

An NFT that does nothing is just a receipt. Builders should design NFTs with clear utility baked in:

- Access to exclusive events or spaces

- In-game roles or upgrades

- Merch discounts or digital merch

- DAO voting or storyline impact

NFTs should do something, not just exist.

3. Reward Ongoing Participation

Too often, NFT holders are forgotten post-sale. Projects can flip this by creating quests, loyalty ladders, or collect-to-earn incentives that keep people coming back. Even small interactions (commenting, trading, attending AMAs) could count toward special rewards or roles.

Gamification is underused—and it doesn’t have to mean “play-to-earn.” It can simply mean fun.

4. Simplify the UX

For mainstream users, NFTs are still way too complicated. Between gas fees, wallet setups, and marketplace confusion, it’s a mess.

Success lies in abstraction: credit card payments, mobile-first interfaces, and custodial onboarding for newbies. Look at Reddit’s Collectible Avatars—they’re NFTs, but most users don’t even realize it. That’s the level of simplicity we need.

5. Build With Community, Not Just for Them

Projects that treat their holders like investors tend to lose engagement fast. On the flip side, creators who co-build with their communities—letting them vote on themes, pick artists, or shape the roadmap—foster loyalty that no marketing budget can buy.

Tools like Snapshot, Charmverse, or even Discord-based feedback loops can go a long way in making holders feel heard.

Conclusion

The NFT space is not dead—it’s just evolving. The drop in Ethereum NFT sales is a sign that speculation can’t be the sole fuel for this industry anymore. What’s needed now is substance: better storytelling, stronger utility, and ecosystems that reward users for showing up and sticking around.

The good news? We’ve already seen what works.

Niche success stories like Panini prove that with the right mix of brand connection, thoughtful design, and consistent engagement, NFTs still have the power to inspire collectors, communities, and creators.

The next wave of NFT growth won’t come from wild speculation or high mint prices. It’ll come from projects that treat their audience as fans, not exit liquidity. Those who deliver real value—before and after the mint—will win.

Want to Go Deeper?

- Explore NFT Utility terms in the Mitosis Glossary

- Check out our guide to Brand Collaborations in Web3 under the Ecosystem Connections section

- Read our take on Gaming NFTs That Actually Work in Market Insights

Let’s build the next chapter of NFTs—not as financial tricks, but as tools for creativity, culture, and community.

Internal Mitosis Links & Glossary References

- Bitcoin

- Blockchain

- Cryptocurrency

- Mitosis Core: https://university.mitosis.org/mitosis-core

- Governance: https://university.mitosis.org/governance

- Glossary: https://university.mitosis.org/glossary/

- Ecosystem Connections: https://university.mitosis.org/ecosystem-connections

Comments ()