NFT Market Resurgence as Ethereum Nears $4K: Whale Trades, $6.37B Cap, and Web3 Implications

Introduction

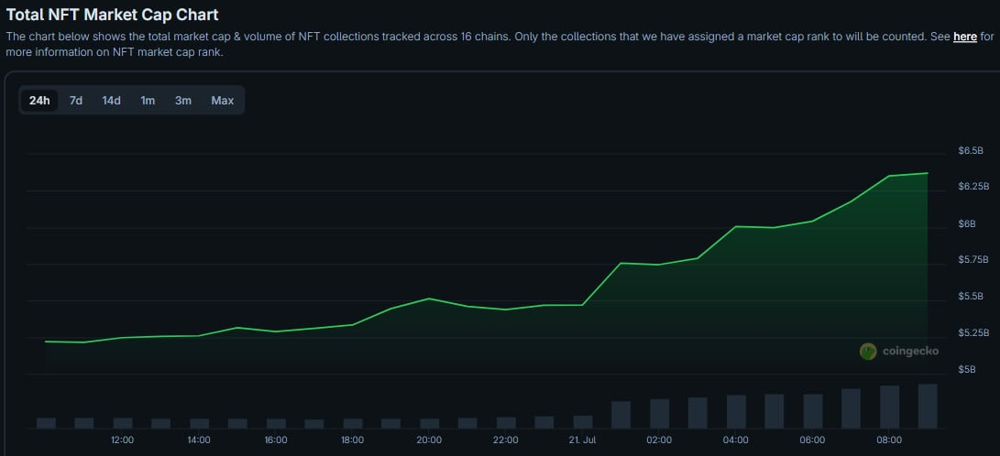

The non-fungible token (NFT) market is showing signs of a dramatic comeback in mid-2025. After a prolonged cooldown, NFT market capitalization surged ~22.5% in a single day to $6.37 billion – the highest level since February 202. This rapid rebound, accompanied by daily NFT trading volumes topping $41.6 million, has re-energized collectors and builders across Web3. What’s driving this NFT revival? A key catalyst is Ethereum’s powerful price rally toward the $4,000 mark, which is injecting fresh liquidity and confidence into digital collectibles. One headline-grabbing example: a whale trader swept up 76 CryptoPunks for $13.5 million, instantly lifting that collection’s floor price ~15% and sending volume skyrocketing by thousands of percent. This article will dissect the factors behind Ethereum’s surge, explore how rising ETH prices correlate with booming NFT activity, and analyze whether the renewed NFT fervor of 2025 is sustainable or just a flash in the pan. We’ll also consider the broader implications for the Web3 ecosystem and projects like Mitosis – from DeFi integrations to cross-chain infrastructure – as they navigate this new wave of digital asset enthusiasm.

NFT Market Rebound: Whale Power and Soaring Blue-Chip Collections

With Ethereum’s resurgence, dormant NFT markets have roared back to life. In July 2025, NFT metrics across the board hit highs not seen in over a year. Total NFT market capitalization jumped to roughly $6.3–6.4 billion (up from ~$5.1B the day before), a level last observed in early Feb 2024. This one-day >20% leap signals a sharp rebound in investor appetite for digital collectibles. Equally telling, daily NFT trading volume hit ~$42 million (a 344% increase to a six-month peak) as thousands of buyers and sellers re-engaged with the market.

At the forefront of this revival are Ethereum-based “blue-chip” NFT collections – many of which saw sudden price and volume spikes. The most eye-popping event was a CryptoPunks buying spree by a single aggressive wallet. The whale spent 2,082 ETH (≈$5.9 M) in minutes to buy 45 CryptoPunks on the open market, and reportedly continued to accumulate more. In total, 76 CryptoPunks were snapped up within 5 hours for about $13.5 M, marking “the most spectacular CryptoPunks sweep since 2021,” according to one observer. The impact on the CryptoPunks market was immediate: the floor price surged ~15–16% to ~47.5 ETH (roughly $175,000 per punk) overnight. Trading volume for CryptoPunks exploded by an order of magnitude, jumping over 8,000% compared to the previous day – a testament to how one whale’s bet can ignite a frenzy of follow-on activity.

The whale’s confidence seemed to spark a broader re-rating of top-tier NFT collections. “CryptoPunks Lead Charge,” noted one report as traders rushed back into established NFTs. Pudgy Penguins – another beloved collection – saw its floor price climb ~15% (to ~16.8 ETH, ~$63.5K) in the same rall. The Bored Ape Yacht Club rose about 7% in floor value, while newer blue-chips like Moonbirds jumped over 30. Even secondary spin-offs (e.g. “Lil Pudgys”) notched double-digit percentage gain. These synchronized jumps suggest a wave of speculative capital flowing back into what many consider “blue-chip NFTs” – assets that had established cultural or collector value during the 2021 boom.

Notably, Ethereum’s dominance in the NFT arena has reasserted itself. Over 50% of all NFT trading volume by value is now on Ethereum, and weekly Ethereum NFT volume hit ~$75 M, the strongest in almost two month. Other chains are seeing positive spillover too: marketplaces on Solana, Polygon, and other networks report upticks in activity as traders broaden their search for NFT opportunitie. Order books that were thin and illiquid a few weeks ago are filling up again; market-makers have returned to tighten bid-ask spreads and fuel liquidity. In the wider NFT ecosystem, new mints and NFT-adjacent projects are cautiously reviving: generative art drops are drawing interest, virtual land sales are picking up, and play-to-earn games are integrating NFTs once more. It’s as if the entire NFT space has been jolted awake from a winter slumber – the past week’s total NFT sales (~$140M) was the highest since January, and social media is abuzz with chatter of an “NFT comeback.”

However, this rebound is not uniform or without caveats. The excitement is largely concentrated in well-known collections and high-value purchases. Many of the biggest gains came from whale wallets (“smart money”) re-entering the market, rather than a groundswell of new retail buyers. In fact, on-chain data shows only a modest increase in the number of active traders – unique NFT buyers are still down about 52% from peak bull-market levels, even if volumes are up. In other words, deep-pocketed collectors are leading the charge, snapping up what they perceive as undervalued grails (a trend reinforced by tweets speculating that “digital collectibles remain underpriced” relative to crypto gains). This dynamic has lifted floors for “legacy” NFT projects (CryptoPunks, BAYC, Azuki, etc.) more than new launches, which by comparison remain relatively quiet. The focus on established collections suggests that confidence has returned first to NFTs with proven track records – the assets people consider blue-chip stores of value in the NFT world. Newer and more experimental NFT projects, on the other hand, haven’t yet seen the same level of speculative mania, indicating an uneven recovery. We may not be in full “NFT season” for the entire market just yet, but the top tier of NFTs is undeniably heating up again.

Implications for Web3 and Mitosis Ecosystem

The 2025 NFT resurgence carries significant implications for the wider Web3 landscape and for projects like Mitosis that aim to provide next-generation blockchain infrastructure. First and foremost, a thriving NFT market is a bellwether of renewed investor optimism in Web3. It suggests that the crypto community’s risk tolerance is back and that capital is rotating into innovative digital assets (not just Bitcoin or Layer-1 coins). This rising tide could benefit decentralized finance (DeFi), gaming, and social tokens as well, potentially sparking an “altseason” where multiple sectors see growth. Investor sentiment has clearly improved – if people are willing to spend millions on CryptoPunks again, it indicates confidence that the broader crypto economy is in a bullish phase. This confidence can encourage builders to resume ambitious projects and startups to explore novel Web3 integrations.

For the Mitosis ecosystem, which bridges multi-chain liquidity and applications, the NFT upswing opens up new opportunities. Mitosis isn’t just about DeFi; it has positioned itself as a purpose-driven ecosystem that embraces art, community, and creativity alongside finance. In fact, Mitosis has actively welcomed NFT communities – from launching its own Morse NFTs for community access to collaborating with popular collections on incentive campaign. A resurgence of NFT activity could mean increased network usage on platforms that facilitate NFT trading, minting, or transfer across chains. Here, Mitosis’s technology for cross-chain asset movement could prove invaluable. In a multichain NFT market, collectors might want to seamlessly move their NFTs between Ethereum, Layer-2 networks, and alternative chains to find the best marketplaces or lower fees. “NFTs Without Borders” is no longer just a slogan – it’s an emerging requirement. Mitosis’s cross-chain protocols can enable exactly that: securely transferring NFTs between different blockchains, effectively uniting siloed NFT markets into one fluid ecosystem. If this NFT boom endures, we can expect greater demand for interoperability infrastructure to support it – from cross-chain NFT bridges to unified wallets – and Mitosis is building toward that vision of a frictionless, interconnected Web3 marketplace.

Moreover, the blending of NFTs and DeFi (“NFT-Fi”) may get a second wind. In past cycles we saw experimentation with NFT collateralized loans, fractional ownership, and NFT yield farming. Those concepts could gain traction once more now that NFTs have significant market value again. DeFi integrations that allow users to borrow against blue-chip NFTs or earn yield on their NFT holdings could become more popular. This is directly relevant to Mitosis’s focus on liquidity and yield optimization. Mitosis’s Layer-1, known for Ecosystem-Owned Liquidity (EOL), might expand to support NFTs as part of its omni-sourced yield strategies. For example, a future scenario might involve depositing high-value NFTs into a Mitosis-powered vault to mint liquidity or to participate in cross-chain lending markets. By providing the backbone for such features, Mitosis can help unlock liquidity from NFTs – turning static collectibles into productive assets. The current trend is already hinting at this convergence: NFT traders are flush with gains, and many will look for ways to leverage or reinvest them, which could flow into DeFi. Increased network activity is a likely outcome, as on-chain transactions for NFT trades, collateralizations, and cross-chain transfers all pick up. Mitosis, with its emphasis on scalability and cross-chain connectivity, stands to benefit from this uptick in on-chain actions. In essence, a sustained NFT revival could catalyze growth across the Mitosis ecosystem, from higher transaction volumes on its network to new partnerships with NFT platforms and more users engaging with its multi-chain tools.

Finally, there’s an intangible but important effect: cultural and community momentum. NFTs are at the intersection of technology and culture, often bringing in artists, gamers, and communities that might not engage purely with DeFi or infrastructure projects. The excitement around iconic collections like CryptoPunks and Pudgy Penguins radiates outward – drawing fresh eyes into Web3 and reminding the world that crypto is not just about charts, but also about creativity and community ownership. Mitosis’s philosophy aligns with this inclusive vision of Web3. It prides itself on being “more than DeFi – a home for art, community, and NFT collectors”. A thriving NFT scene provides Mitosis University and the broader Mitosis community a prime opportunity to educate and on-board these new or re-energized participants. There could be chances to demonstrate how, for example, an NFT artist might use Mitosis to reach audiences on multiple chains, or how a DAO of collectors could manage their treasury using Mitosis’s yield features. In short, the current trend might not only boost on-chain metrics, but also foster a cross-pollination of ideas and users between the creative NFT world and the technical DeFi/infra world – a synthesis that Mitosis is well positioned to cultivate.

Conclusion: A New Chapter for NFTs and Web3 – Cautious Optimism Ahead

The recent resurgence of NFTs – marked by a double-digit percentage jump in market cap to $6+ billion and eye-popping whale-driven rallies in collections like CryptoPunks – suggests that the digital collectibles market may be turning a corner after a long slump. Combined with Ethereum’s impressive march toward $4,000, it feels as though a new chapter of the 2020s crypto story is unfolding, one where frothy speculation and fundamental innovation co-mingle. There is a palpable sense of optimism in the air: phrases like “NFT season” are again being whispered on crypto Twitter, and on-chain data confirms that activity is the highest it’s been in many months. For builders and investors who weathered the bear market, this is a welcome revival – a chance to refocus on new developments and opportunities across Web3.

Yet, it’s important to temper excitement with clear-eyed analysis. The longevity of this NFT revival is not guaranteed. We should watch for follow-through beyond the initial whale splashes: Will casual collectors return? Will new project mints start selling out again? Can the NFT market expand beyond the same few thousand traders recycling capital among blue-chips? The coming weeks will be telling. If Ethereum continues its steady ascent (or at least remains strong) and macro conditions stay favorable, NFTs could very well sustain an upward trajectory, potentially even approaching the euphoria of early 2021. On the other hand, any sharp correction in ETH or negative external shock could quickly deflate this nascent rally – NFTs, being a relatively illiquid and sentiment-driven asset class, are highly sensitive to shifts in confidence.

For the broader Web3 ecosystem, a cautious optimism is warranted. The NFT resurgence of 2025 underscores the cyclic nature of innovation: quiet periods often sow the seeds for the next boom. During the downturn, infrastructure improved and new use cases emerged; now, with fresh capital and users returning, those improvements will be stress-tested and hopefully widely adopted. Projects like Mitosis have an opportunity to shine by providing the connective tissue for an increasingly multichain, multi-asset world – whether that’s through enabling cross-chain NFT marketplaces, or through melding NFT economies with DeFi liquidity in creative ways. The current trend might also inspire entirely new hybrid applications (think NFT-driven social finance, or metaverse experiences powered by DeFi backends) that blur the lines between different domains of Web3.

In summary, the NFT market’s 22.5% overnight jump and Ethereum’s bullish run toward $4K are more than isolated headlines – they’re a reflection of renewed faith in the promise of Web3. It’s a reminder that in this industry, sentiment can flip swiftly and dramatically. As we move forward, investors and builders should keep a balanced view: celebrate the return of volume and interest, but remain vigilant about risks and focused on delivering real utility. If the excitement of this moment can be channeled into sustainable growth – by broadening participation, advancing cross-chain capabilities, and integrating NFTs into the wider digital economy – then the 2025 NFT resurgence may indeed prove to be a cornerstone of the next Web3 boom rather than just a short-lived echo of the last. The team at Mitosis University will be watching these developments closely, and we encourage our community to stay engaged, informed, and innovative as this dynamic market unfolds. The NFT phoenix is rising again; time will tell how high it soars, and for how long, but one thing is clear: the intersection of Ethereum’s technology and creative digital assets is once more the place to watch in Web3.

Useful links:

Comments ()