🏛️ Nike Sued for Pulling the Plug on RTFKT NFTs: A Web3 Wake-up Call

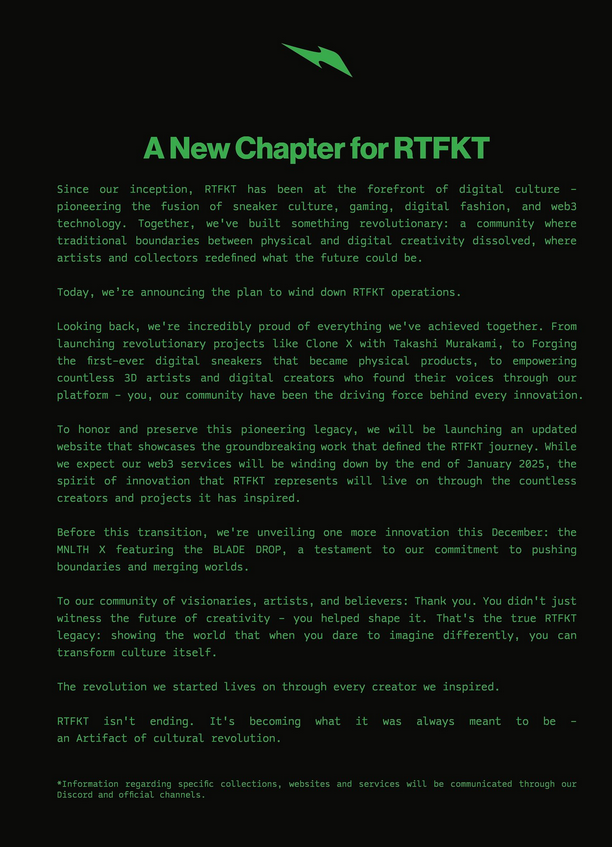

In late 2021, Nike made a bold move that captured the attention of both traditional and crypto audiences: it acquired RTFKT Studios, a rising star in the NFT and digital fashion space.

Projects like CloneX avatars and CryptoKicks sneakers were positioned as the future of branding, a seamless blend of real-world prestige and virtual identity.

But, as with many fast-moving Web3 experiments, not everything was as permanent as it seemed.

🛑 The Shutdown: How Trust Was Broken

In December 2024, Nike abruptly announced it would shut down RTFKT operations, effectively rug-pulling its own community. Holders of once-hyped NFTs watched in disbelief as values collapsed, in some cases dropping to under $16 according to OpenSea data.

The emotional fallout was intense. Many early adopters believed they weren’t just buying digital sneakers, they were staking their loyalty to a future ecosystem.

In Web3 terms, this wasn't just a failed product, it was a violation of an unspoken staking of trust, something harder to measure but infinitely harder to rebuild.

It didn't take long for legal consequences to follow. By April 2025, a $5 million class-action lawsuit had been filed against Nike, accusing it of misleading investors and failing to properly register the NFTs as securities.

Plaintiffs argue that buying an RTFKT NFT wasn't just a purchase; it was an investment contract, one that now sits at the heart of regulatory scrutiny.

⚖️ The Bigger Question

Are NFTs Investments?

The heart of the legal fight revolves around one uncomfortable truth Web3 has danced around:

When does an NFT stop being art or utility, and start being a security token?

Using the Howey Test, a traditional benchmark in U.S. law for identifying securities, plaintiffs claim that RTFKT NFTs fit the mold: purchasers invested money, in a common enterprise, with the expectation of profits based on Nike's efforts.

If courts agree, it won't just be Nike facing consequences. The entire NFT industry, from indie creators to major brands, could see a new wave of regulation.

This connects closely with discussions around concepts like Fair Market Liquidity. When liquidity is artificially propped up by brand hype, without real utility or commitment, the entire market’s foundation weakens and collapses quickly when the music stops.

📉 The Financial Fallout: REKT in Real Time

The numbers tell a brutal story. NFTs once valued in the thousands are now struggling to find buyers at triple-digit valuations.

In an industry where Total Value Locked (TVL) and Annual Percentage Yield (APY) metrics drive much of the attention, Nike’s collapse highlights something even more fragile: emotional investment.

The trust deficit will likely ripple far beyond RTFKT. Major players entering the NFT space will face harder questions, and projects that can’t demonstrate long-term utility, not just clever marketing, may find liquidity evaporating faster than they can pivot.

This environment could accelerate the shift toward models like Actively Validated Services (AVS), where real-world usage and security, rather than hype alone, determine project sustainability.

🔮 Where Does Web3 Go from Here?

Nike’s failure isn't just a footnote. It marks a turning point. If brands want to succeed in Web3, they can’t treat communities like marketing demographics.

They need to offer more than collectibles, they need ecosystems, modular blockchain strategies, and meaningful interoperability across Appchains and ecosystems.

The concept of Digital Identity is central here. NFT projects that align with decentralized, user-owned identity models will have a longer runway than those built solely on speculation or influencer hype.

The age of selling JPEGs with corporate logos is over.

The next era of NFTs belongs to builders who create real value, interoperable, composable, and community-first.

🛑 Important Reminder

About The Reality

No one really talks about this, but it’s happening:

RTFKT used to be the poster child for digital fashion. Nike bought them, everyone called it the future of wearables.

Now? It's basically dead.

Metadata is broken. The art’s just... gone.

All that’s left are black screens and cheap floor prices. And honestly, this can happen to any NFT.

If you don't control the keys, you don't control the files.

You don't control your future either.

Be careful out there.

📝 Quick Takeaways

- Big brands can't rely on name recognition alone in Web3.

- NFT buyers are becoming more sophisticated and demanding real value.

- Legal frameworks like the Howey Test could reshape the NFT landscape.

- Loyalty and true Digital Identity building are more critical than ever.

I hope you guys enjoyed this thread about Mitosis. If you have any feedback feel free to hit me a dm on https://x.com/FarmingLegendX

If you want to check out my latest Mitosis University Articles you can visit them here:

🧠 Deep Dive: Mitosis 6-Month

Read It Now

Bibliography

Official Sources and Industry References

Nike, Inc. (2024, December). Nike Announces Strategic Changes to RTFKT Operations [Press Release]. Retrieved from https://news.nike.com

RTFKT Webiste. (n.d.). RTFKT Website. Retrieved April 2025, from https://rtfkt.com/

U.S. Securities and Exchange Commission. (n.d.). Framework for Investment Contract Analysis of Digital Assets. Retrieved from https://www.sec.gov/corpfin/framework-investment-contract-analysis-digital-assets

Mitosis Team. (2024). Mitosis: Network for Programmable Liquidity [Whitepaper]. Mitosis Documentation. Retrieved from https://docs.mitosis.org

Comments ()