On-Chain Order Books vs. AMMs – What’s the Difference?

If you're into crypto or DeFi, you've heard of trading on DEXs like Uniswap or dYdX.

But do you know the difference between how they actually work?

Let’s break it down :

In crypto, there are two main ways you can swap tokens :

Both help you trade, but they work very differently.

What Is an Order Book?

An order book is like a digital list of all the people who want to buy or sell a token. It shows:

- Who wants to buy, at what price, and how much

- Who wants to sell, at what price, and how much

These offers are called "orders."

When a buy and sell order match, a trade happens.

You’re not just clicking “swap” — you're choosing your price and waiting for someone to meet you there.

Real-world comparison:

It’s like a stock market — you place a buy or sell offer and wait for someone to agree with your price.

On-chain examples: dYdX, Injective, Serum

Order books are better for active traders who care about small price differences, fast trades, and limit orders. But they need more users to stay active and liquid.

What Is an AMM (Automated Market Maker)?

An AMM is like a smart robot that lets you trade instantly by using a liquidity pool.

A liquidity pool is a pot of two tokens — say, ETH and USDC — provided by users.

When you trade:

- You’re swapping directly with the pool

- The price changes based on how much you take out or put in

- There’s no need to wait for a matching buyer or seller

Real-world comparison:

It’s like a vending machine. You choose what you want, the price is shown, and you get your item instantly. No negotiation.

Popular examples: Uniswap, PancakeSwap, Balancer

AMMs are super beginner-friendly — just connect your wallet and swap. But you may face slippage, where your actual price is slightly different, especially in big trades or small pools.

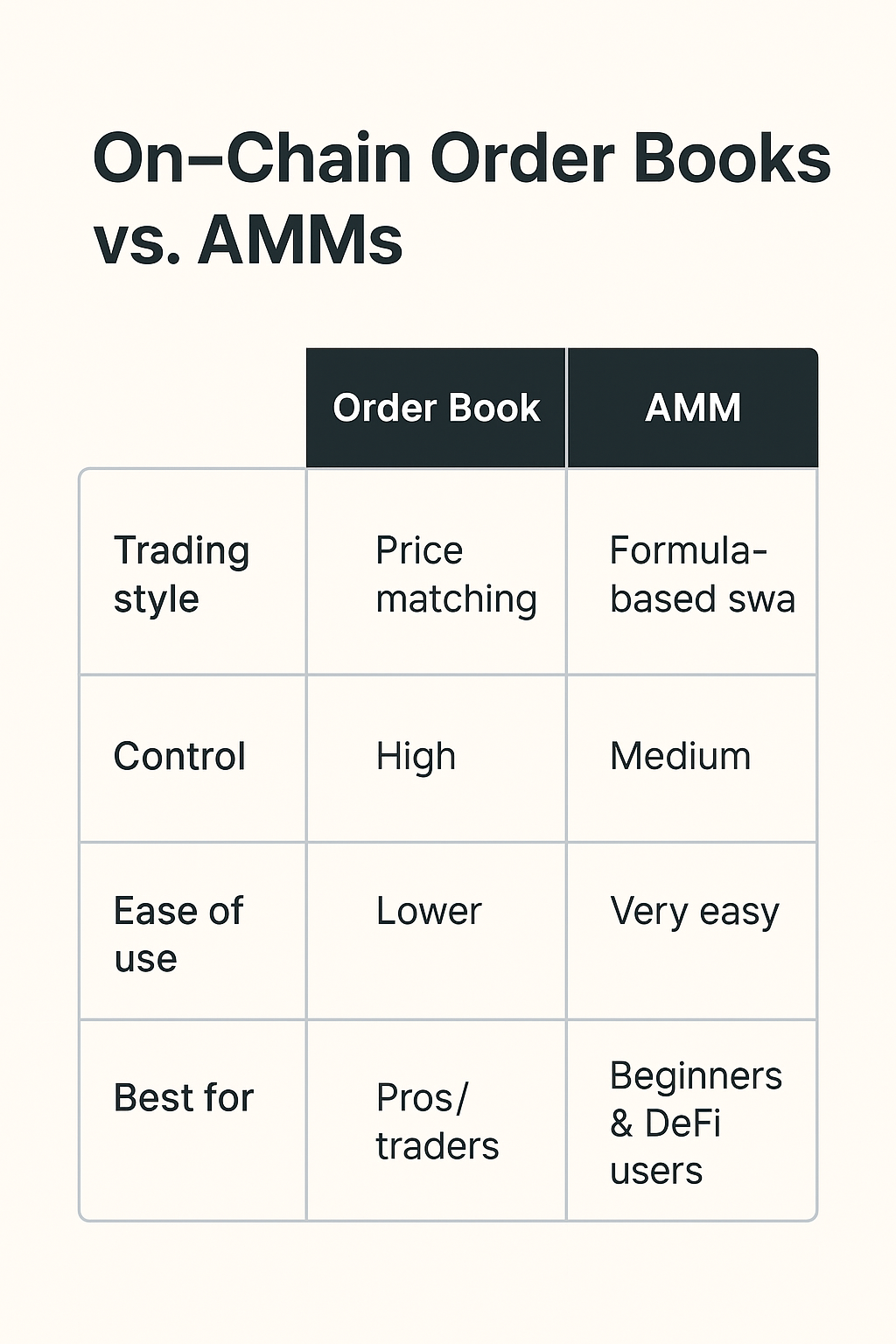

Order Books – Pros & Cons

✅ More control — You set your price

✅ Better for pro traders

❌ Needs lots of active users to work

❌ Harder to use for beginners

AMMs – Pros & Cons

✅ Easy to use — Just swap and go

✅ Always available liquidity (if the pool has funds)

❌ Slippage — Price can shift during big trades

❌ Impermanent loss for liquidity providers

Comparison

Conclusion

Both Order Books and AMMs are powerful tools in the world of crypto trading, but they serve different purposes.

- AMMs are great for beginners and casual users. They’re simple, always available, and don’t need you to worry about setting prices. Just connect your wallet and swap.

- Order Books are made for traders who want more control — placing exact orders, watching the market, and making strategic moves.

Each one has its own strengths and weaknesses. It’s not about which one is “better” — it’s about which one is better for your needs.

Comments ()