🧠 Oracle Wars: How Pyth Network, Chainlink, and Mitosis Are Redefining Real-Time Data in Web3

Oracles are the invisible backbone of decentralized finance (DeFi), gaming, and many Web3 applications. Without them, smart contracts would be isolated — unable to react to the real world.

In this article, we’ll explore:

- What oracles are (and why they matter)

- How Chainlink pioneered decentralized oracles

- How Pyth Network is pushing boundaries with real-time, ultra-low latency data

- How Mitosis enhances cross-chain liquidity security using Chainlink CCIP and price feeds

- Why the oracle landscape is more important than ever for the future of DeFi

Let’s dive in! 🌊

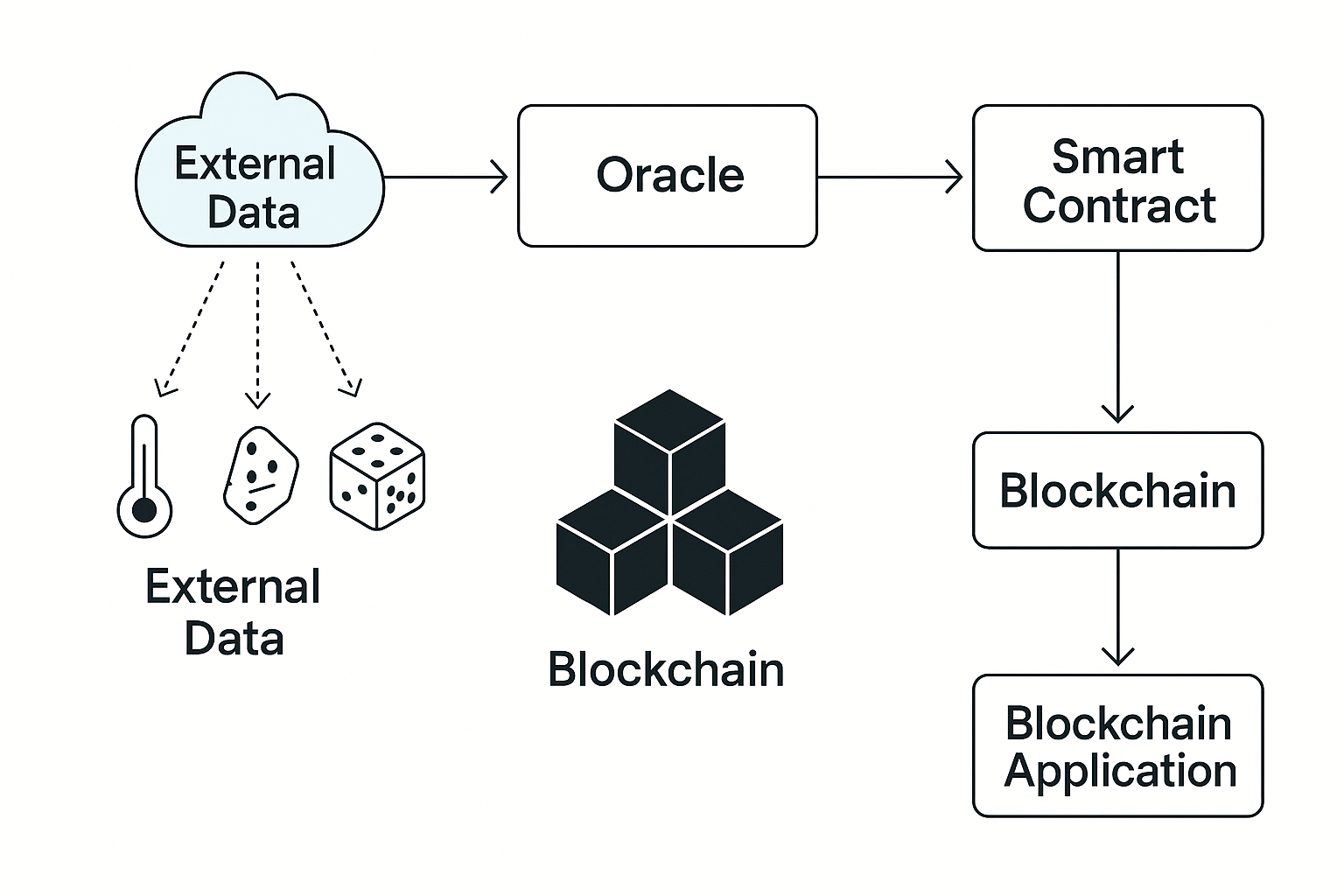

🏛️ What Are Oracles, Anyway?

A blockchain oracle connects on-chain smart contracts to off-chain information like asset prices, weather, sports results, or IoT sensor data.

Without oracles, a DeFi app like Aave wouldn't know ETH’s current price, a prediction market like Polymarket couldn't settle bets, and an insurance contract couldn’t pay out after a storm.

In simple terms:

Oracles = Real-world data → Blockchain world

✅ But it's not enough to just feed in data — it must be:

- Trust-minimized (no single point of failure)

- Real-time (especially for volatile markets)

- Reliable (no missed updates)

The quest for better, faster, and more secure oracles is shaping the future of Web3 infrastructure.

🔗 Chainlink: The First King of Decentralized Oracles

Chainlink’s decentralized node network securing Web3 data.

Launched in 2017, Chainlink was the first project to decentralize the oracle problem.

Before Chainlink, DeFi protocols often depended on single data sources — exposing them to hacks and manipulation. Chainlink’s design introduced:

- A network of independent node operators

- Aggregation of multiple data points

- Cryptoeconomic incentives for honesty

- Staking and slashing for misbehavior

Over time, Chainlink expanded with:

- Proof of Reserve: Verifying that asset-backed tokens are truly collateralized

- CCIP (Cross-Chain Interoperability Protocol): Secure cross-chain messaging

- Automation (Keepers): Decentralized transaction execution

Chainlink Today:

- Integrated with 1,700+ projects

- Supports 15+ chains

- Secures billions of dollars daily

👉 Learn more at Chainlink Official Site.

⚡ Pyth Network: Real-Time Oracle for High-Frequency DeFi

Pyth Network: direct publisher-to-consumer data flow.

Unlike Chainlink’s generalized model, Pyth Network targets low-latency, high-fidelity financial data.

Pyth’s unique model:

| Chainlink | Pyth |

|---|---|

| Fetches data from public APIs | Gets data directly from first-party sources (exchanges, trading firms) |

| Aggregated before publishing | Pushed directly to chain |

| Best for general DeFi | Best for trading, derivatives |

Pyth is ideal for:

- DEXs (like Drift Protocol on Solana)

- Perpetuals and options markets

- High-frequency financial applications

Because Pyth works directly with exchanges like Binance, Bybit, and Jane Street, it delivers:

- Millisecond-level price updates

- More granular data for better risk management

- Minimal latency critical for fast-moving markets

👉 Explore Pyth at Pyth Network Official Site.

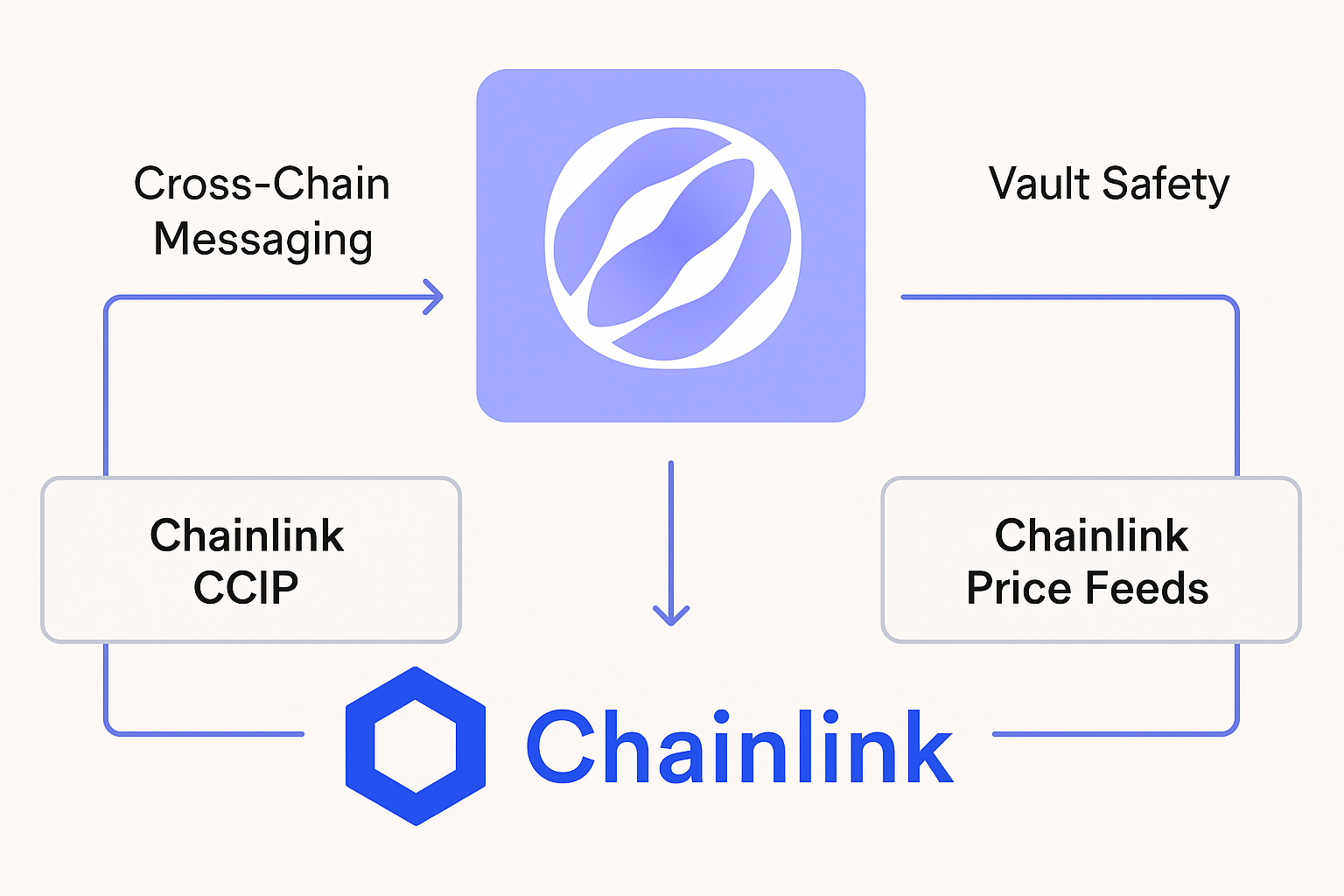

🌐 Mitosis + Chainlink: Building the Future of Cross-Chain Liquidity

Mitosis leverages Chainlink for secure programmable liquidity across chains.

Mitosis is a modular liquidity layer that enables users to move and program liquidity across blockchains without losing composability or facing major trust risks.

To achieve this, Mitosis uses Chainlink’s technologies at two critical levels:

🔵 1. Chainlink CCIP for Cross-Chain Messaging

Mitosis leverages Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to transmit messages safely across chains.

Instead of inventing a new, untested bridge mechanism, Mitosis opts for Chainlink’s decentralized, secure framework for:

- Asset bridging

- Governance execution

- Vault rebalancing

✅ This significantly reduces the attack surface compared to traditional multi-sig or light client-based bridges.

👉 Read more on Mitosis Docs.

🔵 2. Chainlink Price Feeds for Vault Security

Inside Mitosis’s Matrix Vaults, Chainlink’s decentralized price feeds are used to:

- Rebalance liquidity based on real-time prices

- Execute safety checks during cross-chain swaps

- Maintain risk parameters for dynamic liquidity pools

By relying on Chainlink Price Feeds, Mitosis ensures that price manipulations, stale data issues, and slippage risks are minimized.

👉 Full technical overview in Mitosis Docs: Oracles & Data Sources.

✨ Summary: Why Mitosis Chooses Chainlink

| Feature | Purpose |

|---|---|

| CCIP | Secure cross-chain messaging |

| Price Feeds | Accurate and reliable pricing for liquidity management |

| Goal | Secure, programmable, decentralized cross-chain liquidity |

Thanks to Chainlink, Mitosis users can trust that programmable liquidity across chains is not just fast — but also secure at a protocol level.

🧩 Which Oracle Should You Choose?

✅ Chainlink: Best for general-purpose DeFi, proof-of-reserve, automation, and multi-chain integration.

✅ Pyth: Best for high-frequency trading, perps DEXs, and ultra-low-latency DeFi.

✅ Mitosis (via Chainlink): Best for secure cross-chain liquidity, vault management, and multi-chain programmable liquidity.

Different oracles will dominate different sectors of Web3 depending on the application's needs.

🚀 Conclusion: The Future of Oracles Is Modular, Fast, and Secure

Chainlink decentralized trust.

Pyth Network decentralized speed.

Mitosis decentralized cross-chain liquidity.

The Oracle Wars are creating specialized, highly secure systems that will power the next generation of DeFi, gaming, asset tokenization, and autonomous finance.

One thing is certain:

Without reliable oracles, Web3 cannot exist.

With today’s innovations, Web3 will soon be smarter, faster, and more secure than ever. 🚀

Stay tuned — the Oracle Wars are just beginning! 🌍

📸 Quick Visual Recap

🔵 What Are Oracles?

🟣 Chainlink vs Pyth Comparison

| Feature | Chainlink | Pyth Network |

|---|---|---|

| Source | Public APIs | Exchanges and trading firms |

| Speed | Seconds | Milliseconds |

| Ideal Use | Lending, DeFi, Insurance | Trading, Derivatives |

Chainlink = traditional DeFi

Pyth = ultra-fast finance

🌐 How Mitosis Uses Chainlink

Comments ()