Pendle Finance x Mitosis: The Fusion of Tokenized Yields and Programmable Liquidity 🔄💧

TL;DR 🔍

Pendle Finance introduces tokenized yields via Principal Tokens (PT) and Yield Tokens (YT), enabling fixed income and yield speculation. Mitosis provides programmable, cross-chain liquidity with its modular primitives. Together, Pendle and Mitosis unlock a powerful DeFi synergy: imagine tokenized yield streams becoming programmable liquidity that can be routed, bridged, or restaked — autonomously. 🤖🌉

This article is based on official sources:Mitosis DocumentationPendle DocsMitosis University

🧩 Pendle: Where Time Unlocks Value

Pendle Finance lets users split a yield-bearing asset into:

- PT (Principal Token): Redeemable at maturity.

- YT (Yield Token): Earns yield until maturity.

By tokenizing the time value of money, Pendle unlocks:

- Fixed-rate yield 💰

- Yield speculation 📈

- Yield trading on its AMM 🔁

This system creates a composable layer for yield — and that's where Mitosis enters the picture. 🧠

🧠 Mitosis: The Programmable Liquidity Engine

Mitosis abstracts liquidity into programmable modules:

- miAssets/maAssets — tokenized LP and yield positions.

- Matrix Vaults — multi-chain liquidity containers.

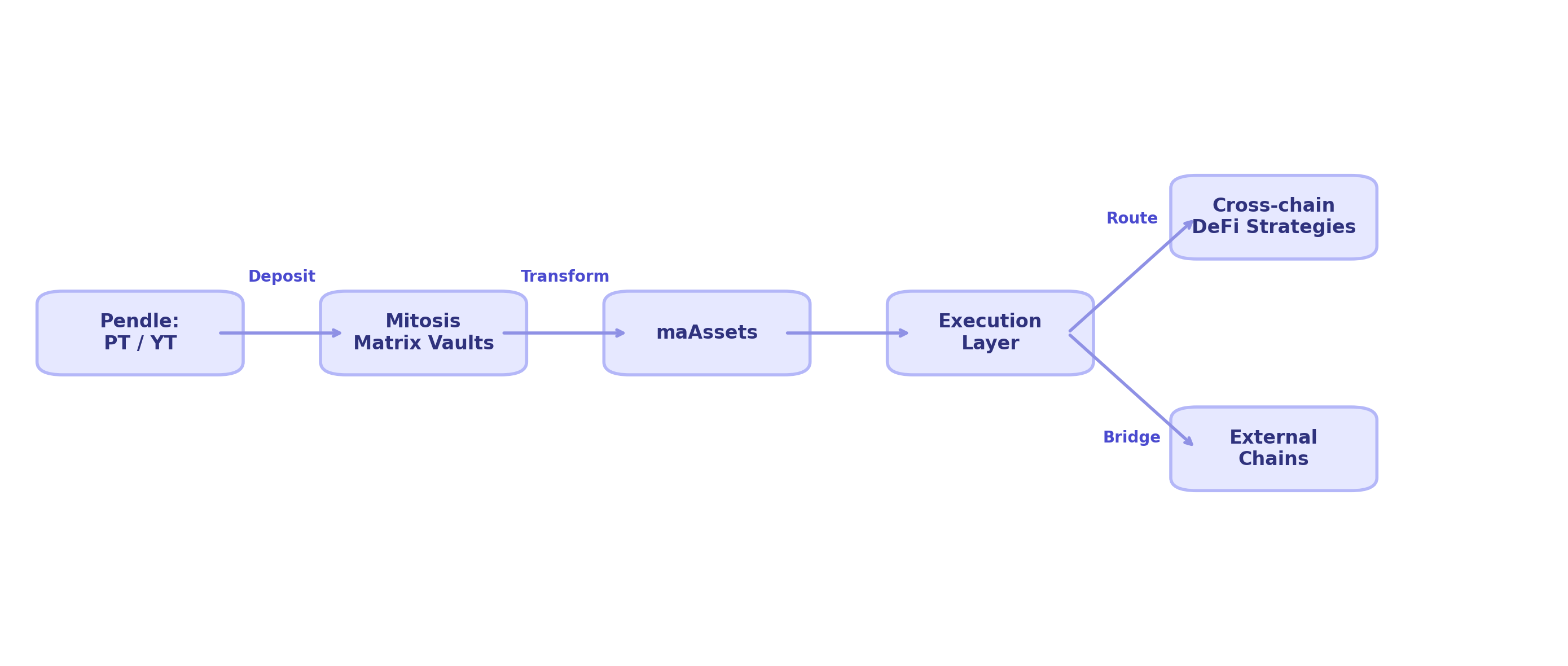

- Execution Layer — executes bridging, routing, and smart liquidity flows.

These components enable:

- Cross-chain yield automation 🌐

- Intelligent asset routing 🛰️

- Yield stacking via dynamic vault strategies 🧮

By integrating Pendle’s tokenized yield primitives, Mitosis can turn fixed yield assets into programmable capital.

🧬 How They Intersect: Yield-Driven Liquidity

Here’s what the synergy looks like:

- 🔗 PT/YT deposits into Matrix Vaults

- Users can bring Pendle tokens into Mitosis, gaining access to cross-chain execution strategies.

- 🔄 Programmable strategies with YT/PT

- Restake YTs across chains

- Route PTs toward fixed income strategies

- Create dynamic portfolio flows

- 🔥 maAssets + Pendle = DeFi Lego++

- Tokenized Pendle positions (PT/YT) can be converted into maAssets, enabling yield-bearing programmable liquidity.

🧠 Use Case Diagram

🌐 Why It Matters

This integration isn’t just cosmetic — it’s core infrastructure:

- 🧱 Composability: Pendle’s primitives become building blocks for Mitosis logic.

- 🚀 Autonomy: Mitosis’ execution layer can route yield tokens dynamically.

- 🌍 Liquidity Efficiency: Capital is used where it’s needed most — across any chain.

Together, they power a smarter, more efficient liquidity mesh — one where time, yield, and programmability are fused. 🧠🔗⏳

🔗 Learn More

Follow @MitosisOrg and @pendle_fi on X to stay updated on the latest integrations.

Comments ()