Polynomial Is Cooking: On-Chain Derivatives Done Right

In DeFi, derivatives (perpetuals, options, prediction markets) are still lagging behind centralized exchanges when it comes to speed, liquidity, and user experience. Enter Polynomial, a purpose-built Layer 2 blockchain on the Optimism Superchain, designed to solve those limitations

Polynomial delivers unified liquidity, sub‑3‑second trade settlement, gas‑free UX, and modular infrastructure. Here’s a fresh and fun deep‑dive into why it’s earning its name as The Derivatives Chain.

Unified Liquidity: The Heartbeat of Polynomial

At the core of Polynomial’s design is its unified liquidity layer, which sets it apart from most DeFi platforms that fragment liquidity across separate pools for different instruments like perpetuals, options, or prediction markets.

By combining all these products into a single capital pool, Polynomial maximizes capital efficiency and significantly reduces slippage, even for large trades. This streamlined approach also simplifies the user experience by providing liquidity providers (LPs) with one unified staking interface.

To top it off, LPs receive a generous 60% share of all trading fees generated across the entire chain, creating a compelling incentive to commit capital and sustain deep, vibrant liquidity.

CEX-Speed & Gasless UX: Superchain in Action

Polynomial is built on top of the OP Stack and leverages Optimism’s Bedrock upgrade to deliver lightning-fast transaction speeds and a user experience that rivals centralized exchanges.

Trades settle in under three seconds, significantly faster than the typical 13 to 15 seconds on other Layer 2 solutions. Thanks to account abstraction, users enjoy gas-free transactions, making trading seamless and cost-effective.

The platform also supports cross-margin trading with multiple collateral options like ETH, USDC, sDAI, and sUSDe, alongside advanced order types such as take-profit, stop-loss, and TWAP. This combination allows traders to execute complex strategies fluidly, capturing the best of both centralized exchange speed and decentralized finance flexibility.

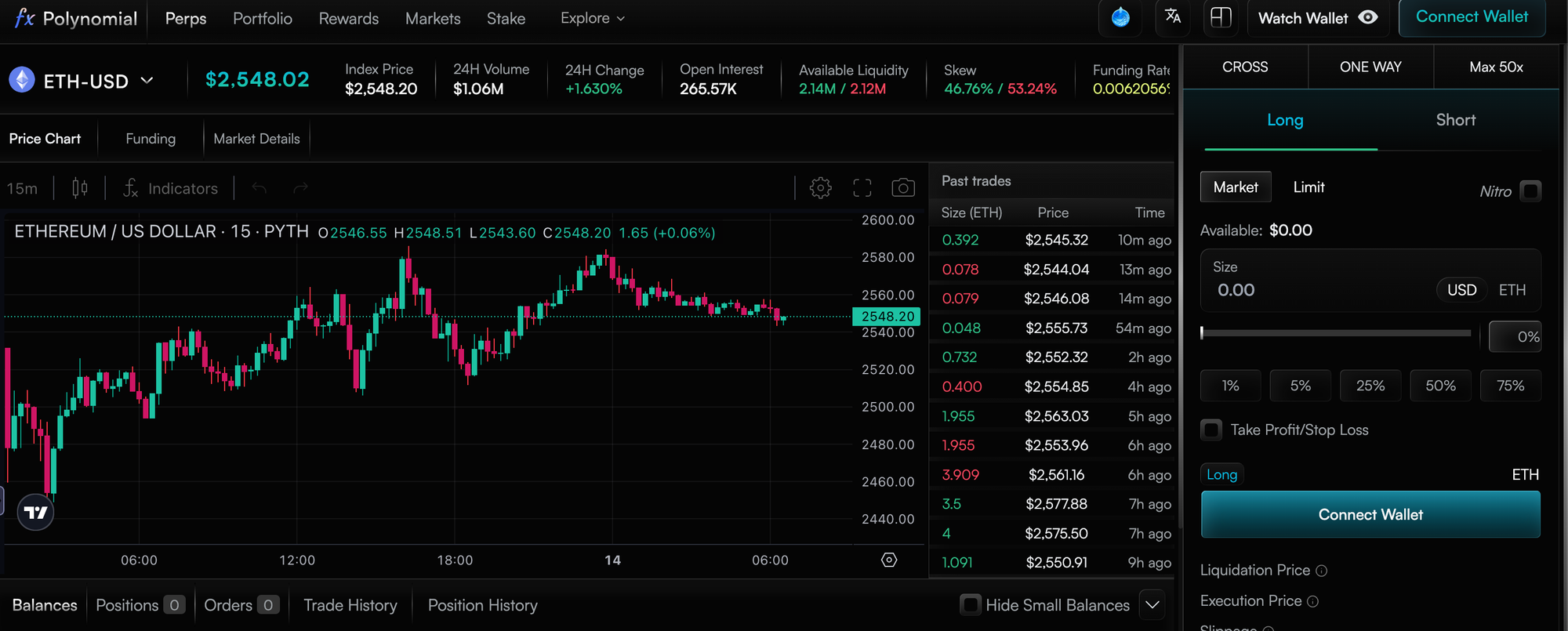

Polynomial Perpetuals Exchange

Polynomial Trade is the platform’s flagship perpetuals exchange, built on the deep liquidity provided by Synthetix. It offers traders a top-tier experience with up to 50× leverage on major trading pairs, supported by a cross-margin system through a shared account for more efficient capital use.

The exchange features real-time trade execution and automated funding rate adjustments, ensuring smooth and responsive market operations. On the liquidity provider side, LPs earn a substantial 60% share of all trading fees, creating strong incentives to support the platform’s markets.

Beyond its current capabilities, Polynomial Trade is actively evolving to meet the needs of sophisticated traders. An anticipated hybrid orderbook release in Q4 will combine automated market maker liquidity with orderbook precision, resulting in tighter spreads and greater price efficiency. This upgrade is especially aimed at attracting institutional traders who demand high liquidity and execution quality, all while maintaining the platform’s hallmark gasless and instant user experience.

Polynomial Token? No Token Yet, But Points Are the Currency

Polynomial doesn’t have a native token yet, but it rewards its community through a dynamic points system that effectively serves as its current currency. Users earn points daily based on their trading volume and liquidity provision, creating a strong incentive to stay active on the platform. These points expire after seven days if unclaimed, encouraging consistent participation. Polynomial has also retroactively distributed points to early adopters—including liquidity providers, vault builders, stakers, and NFT holders—rewarding those who helped build the ecosystem from the ground up.

While points may not have the immediate allure of a tradable token, they lay important groundwork for future governance and tokenomics. They foster genuine user engagement, reduce speculative hype, and prepare the community for upcoming native token launches or governance participation. Early participants who accumulate points now are positioned well to benefit from whatever rewards and influence Polynomial rolls out next, making the points system a meaningful currency of value and loyalty in the meantime.

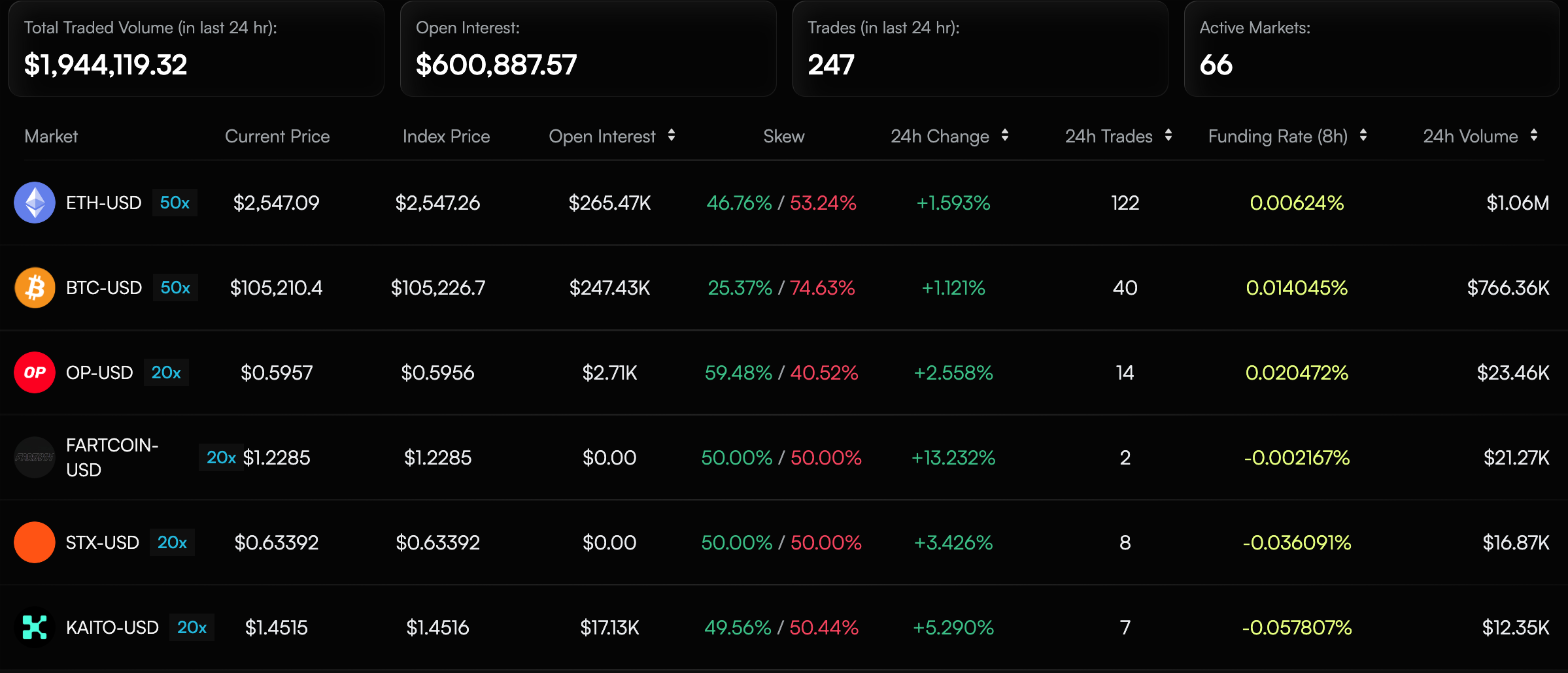

Polynomial In Action: Some Statistics

Polynomial isn't just theory, it’s battle-tested in the wild. With over $7 billion in total trading volume and 13 million gasless transactions executed, the platform has proven its scalability and user appeal. More than 10,000 active stakers are currently earning protocol fees, showcasing strong community buy-in and capital commitment.

Security-wise, Polynomial boasts $8.11 M million in Total Value Secured (TVS), placing it among the top L2s for derivatives on L2Beat. These numbers underline Polynomial’s growing dominance as a reliable, high-performance chain for derivatives trading in the real world.

Conclusion

Polynomial is more than just a trading platform—it's the next evolution of on-chain financial infrastructure. By unifying liquidity across derivative products, delivering lightning-fast and gasless execution, and offering powerful tools for both traders and builders, it redefines what’s possible in DeFi.

With a single stake, users tap into deep, cross-product liquidity and share in 60% of protocol revenue. Meanwhile, builders get a robust playground powered by modular tooling and a thriving ecosystem. Add in a high-impact points system—with retroactive rewards and future governance on the horizon—and you have a chain designed to reward participation at every level.

Backed by the security of the OP Stack and built for the high-speed, high-stakes world of on-chain derivatives, Polynomial truly is the go-to Derivatives Chain—fast, flexible, and future-ready.

References

CoinMonks. (2024, November 12). Polynomial Chain: An optimized L2 for on‑chain derivatives. Medium. Retrieved June 14, 2025, from https://medium.com/coinmonks/polynomial-chain-an-optimized-l2-for-on-chain-derivatives-098e15ee0eda

L2BEAT. (2025). Polynomial – Total Value Secured. In L2BEAT – The state of the layer two ecosystem. Retrieved June 14, 2025, from https://l2beat.com/scaling/projects/polynomial#tvs

Mitosis University. (n.d.). Automated Market Maker (AMM). https://university.mitosis.org/amm/

Mitosis University. (n.d.). Centralized Exchange (CEX). https://university.mitosis.org/centralized-exchange-cex/

Mitosis University. (n.d.). Decentralized Finance (DeFi). https://university.mitosis.org/defi/

Mitosis University. (n.d.). Glossary. https://university.mitosis.org/glossary/

Mitosis University. (n.d.). Layer 2. https://university.mitosis.org/layer-2/

Mitosis University. (n.d.). Liquidity. https://university.mitosis.org/liquidity/

Polynomial. (n.d.). The native liquidity layer. In Polynomial documentation. Retrieved June 14, 2025, from https://docs.polynomial.fi/staking/the-native-liquidity-layer

Polynomial Protocol. (2025). Polynomial [Website]. Retrieved June 14, 2025, from https://polynomial.fi/

Comments ()