Programmable Money Legos: Building Custom DeFi Flows

Introduction

The rise of decentralized finance (DeFi) has transformed the financial landscape, enabling users to engage in a wide array of financial activities without the need for traditional intermediaries. At the heart of this revolution lies the concept of Programmable Money Legos—modular components that can be combined to create custom financial applications. This article delves into the intricacies of these building blocks, showcasing how developers can compose swaps, lending, leverage, and insurance into seamless user flows using tools like DeFi SDKs.

1. Understanding Programmable Money Legos

1.1 What are Money Legos?

Money Legos refer to the modular nature of DeFi protocols that allow developers to build complex financial applications by stacking and combining various components. Each protocol serves as a building block, providing specific functionalities that can be integrated with others to create new services. This composability is a defining feature of DeFi, enabling rapid innovation and the development of sophisticated financial products.

1.2 The Importance of Composability

Composability in DeFi is akin to the concept of APIs in traditional software development. It allows developers to leverage existing protocols without reinventing the wheel. The benefits of composability include:

- Efficiency: Developers can save time and resources by using pre-built components.

- Innovation: New financial products can be created by combining existing protocols in novel ways.

- Interoperability: Different protocols can work together seamlessly, enhancing user experience.

1.3 Key Characteristics of Money Legos

- Modularity: Each protocol can function independently while also being part of a larger system.

- Interoperability: Protocols can communicate and interact with one another, allowing for complex workflows.

- Open Source: Most DeFi protocols are open-source, enabling developers to inspect, modify, and build upon existing code.

2. Composing Financial Flows

2.1 Swaps

Swaps are one of the most fundamental operations in DeFi, allowing users to exchange one cryptocurrency for another. Protocols like Uniswap and SushiSwap have popularized automated market-making (AMM) models, enabling users to swap tokens without relying on order books.

Example: Token Swapping with Uniswap

- User Interface: A user accesses a decentralized application (dApp) that integrates Uniswap.

- Token Selection: The user selects the tokens they wish to swap (e.g., ETH for DAI).

- Price Calculation: The dApp queries Uniswap’s liquidity pools to determine the best exchange rate.

- Transaction Execution: The user confirms the transaction, and the dApp interacts with the Uniswap smart contract to execute the swap.

2.1.1 Enhancing Swaps with Aggregators

To optimize the swapping process, developers can integrate aggregators like 1inch or Paraswap. These platforms analyze multiple liquidity sources to find the best rates for users.

2.2 Lending

Lending protocols like Compound and Aave allow users to lend their assets to others in exchange for interest. Users can also borrow assets by providing collateral, creating a dynamic lending environment.

Example: Lending with Compound

- User Deposit: A user deposits DAI into the Compound protocol.

- Interest Accrual: The user earns interest on their deposit, which is calculated in real-time.

- Borrowing: The user can borrow against their DAI deposit, receiving a loan in ETH while maintaining a collateralized position.

2.2.1 Creating Custom Lending Flows

Developers can create custom lending flows by integrating multiple protocols. For instance, a user could deposit assets into Compound, borrow against them, and then use the borrowed assets to participate in yield farming on another platform.

2.3 Leverage

Leverage allows users to amplify their exposure to an asset by borrowing funds. This can lead to higher returns but also increases risk.

Example: Leveraged Trading with Aave

- Initial Deposit: A user deposits USDC into Aave.

- Borrowing: The user borrows ETH against their USDC collateral.

- Trading: The user uses the borrowed ETH to trade on a decentralized exchange, aiming to profit from price movements.

2.3.1 Risk Management

Developers can implement risk management strategies by integrating insurance protocols like Nexus Mutual. This allows users to protect their leveraged positions against smart contract failures or market volatility.

2.4 Insurance

Insurance protocols in DeFi provide coverage against various risks, including smart contract failures and hacks. Nexus Mutual is a prominent example, allowing users to purchase coverage for their DeFi investments.

Example: Insuring DeFi Investments

- Coverage Purchase: A user purchases coverage for their assets deposited in a lending protocol.

- Claim Process: In the event of a smart contract failure, the user can file a claim with Nexus Mutual.

- Payout: If the claim is validated, the user receives compensation for their losses.

2.4.1 Integrating Insurance into Custom Flows

Developers can create custom flows that automatically purchase insurance when users engage in high-risk activities, such as leveraging assets or participating in yield farming.

3. Building Custom DeFi Flows with DeFi SDKs

3.1 What are DeFi SDKs?

DeFi SDKs (Software Development Kits) are tools that simplify the process of building decentralized applications. They provide pre-built functions and libraries that developers can use to interact with various DeFi protocols.

3.2 Benefits of Using DeFi SDKs

- Speed: Developers can quickly build and deploy applications without extensive coding.

- Ease of Use: SDKs often come with user-friendly documentation and examples, making it easier for developers to get started.

- Interoperability: SDKs facilitate seamless integration with multiple DeFi protocols.

3.3 Example Use Case: Building a Custom DeFi Application

Let’s consider a developer who wants to create a dApp that allows users to swap tokens, lend assets, and purchase insurance in a single interface.

- Choosing an SDK: The developer selects a DeFi SDK that supports Uniswap, Compound, and Nexus Mutual.

- Token Swapping: The SDK provides functions to interact with Uniswap’s smart contracts, allowing users to swap tokens easily.

- Lending Integration: The developer uses the SDK to connect to Compound, enabling users to lend and borrow assets.

- Insurance Purchase: The SDK includes functions to interact with Nexus Mutual, allowing users to purchase coverage for their investments.

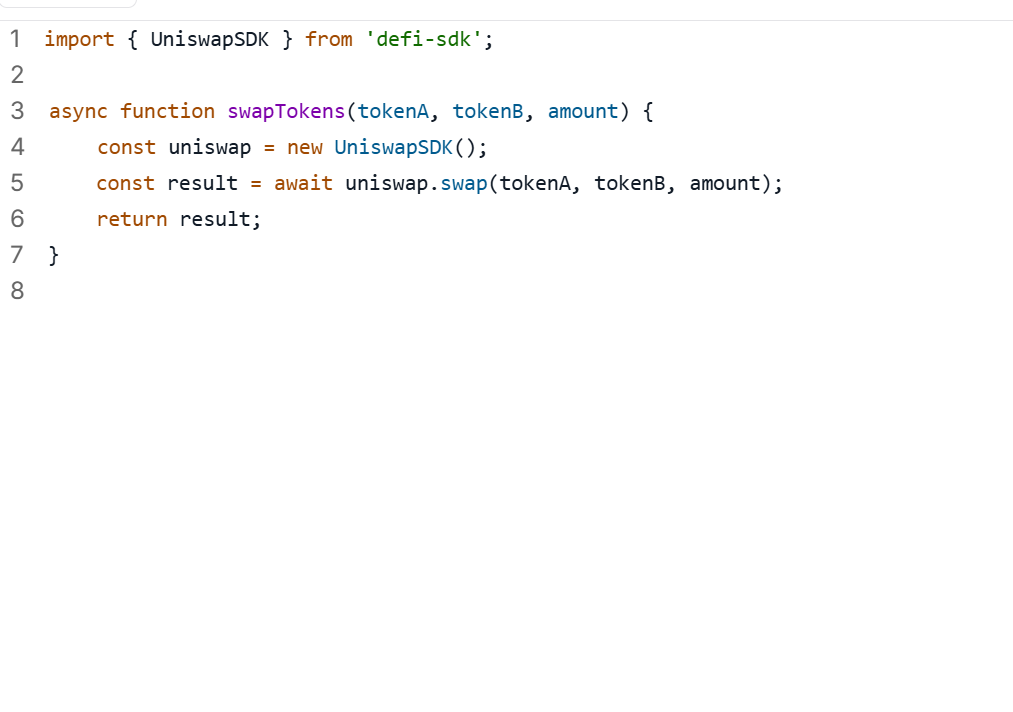

Example Code Snippet

Here’s a simplified example of how a developer might use a DeFi SDK to create a token swap function:

4. Real-World Examples of Custom DeFi Flows

1. Example 1: Yield Farming Strategy

A user wants to maximize their returns by participating in yield farming. They can create a custom flow that includes:

- Swapping: Use Uniswap to swap ETH for a stablecoin (e.g., USDC).

- Lending: Deposit USDC into Compound to earn interest.

- Insurance: Purchase coverage from Nexus Mutual to protect against smart contract risks.

2. Example 2: Leveraged Trading Strategy

A trader wants to leverage their position in a volatile market. They can create a flow that includes:

- Lending: Deposit DAI into Aave to earn interest.

- Borrowing: Borrow ETH against their DAI collateral.

- Trading: Use the borrowed ETH to trade on a decentralized exchange.

- Insurance: Automatically purchase coverage from Nexus Mutual to protect against potential losses.

5. Challenges and Considerations

1. Smart Contract Risks

While DeFi offers numerous advantages, it is not without risks. Smart contracts can be vulnerable to bugs and exploits, leading to potential losses for users. Developers must prioritize security and conduct thorough audits of their code.

2. Regulatory Uncertainty

The regulatory landscape for DeFi is still evolving. Developers should stay informed about potential regulations that could impact their applications and ensure compliance where necessary.

3. User Experience

Creating a seamless user experience is crucial for the adoption of DeFi applications. Developers should focus on intuitive interfaces and clear instructions to guide users through complex financial processes.

Conclusion

Programmable Money Legos are revolutionizing the DeFi landscape by enabling developers to create custom financial solutions through composability. By leveraging existing protocols and DeFi SDKs, developers can build innovative applications that streamline user interactions and enhance the overall efficiency of decentralized finance.

As the DeFi ecosystem continues to evolve, the potential for creating sophisticated financial products will only grow. By embracing the principles of composability and utilizing the tools available, developers can contribute to a more accessible and efficient financial future.

Comments ()