Progress Evaluation, Post-Campaign Predictions, and Partnership Opportunities for Projects like Mitosis EOL with Preferential Boost Programs

Introduction

In the rapidly evolving landscape of decentralized finance (DeFi) and blockchain technology, projects like Mitosis Ecosystem-Owned Liquidity (EOL) are pushing boundaries with innovative models that prioritize community-driven liquidity and sustainable growth. As these projects progress, evaluating their development, predicting outcomes post-campaign, and identifying strategic partnership opportunities become critical to ensuring long-term success. This article explores how progress evaluation, post-campaign forecasting, and partnerships can amplify the impact of projects like Mitosis EOL, particularly when integrated with preferential boost programs.

In this article, we would explore:

1. Evaluating Progress in Blockchain Projects like Mitosis EOL

2. Post-Campaign Predictions for Sustainable Growth

3. Leveraging Strategic Partnerships with Preferential Boost Programs

Evaluating Progress in Blockchain Projects like Mitosis EOL

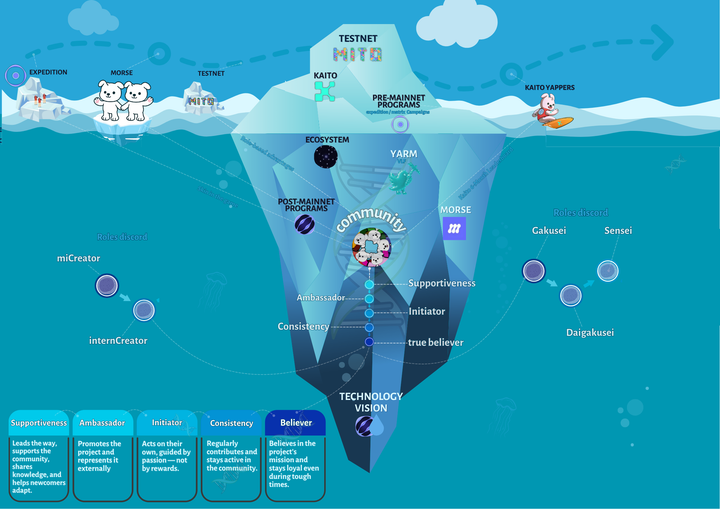

Progress evaluation is a cornerstone of any successful project, particularly in the fast-paced world of blockchain and DeFi. For a project like Mitosis EOL, which focuses on ecosystem-owned liquidity to empower decentralized finance, assessing milestones and deliverables is essential to maintain transparency and trust with stakeholders.

Key Metrics for Evaluation

To evaluate progress effectively, projects must establish clear key performance indicators (KPIs) that align with their mission. For Mitosis EOL, these might include:

- Development Milestones: Tracking the completion of technical phases, such as the 55% mainnet progress reported recently for Mitosis, ensures the project stays on schedule.

- Community Engagement: Measuring participation in testnets, like Mitosis’s call for users to deposit eETH/weETH and earn $MITO tokens, reflects community buy-in and adoption potential.

- Liquidity Pool Growth: Since Mitosis EOL emphasizes ecosystem-owned liquidity, monitoring the size and stability of liquidity pools is crucial.

- Security and Scalability: Regular audits and stress tests ensure the platform’s robustness, a critical factor for DeFi projects handling significant assets.

For Example: Mitosis EOL’s Testnet Phase

Mitosis’s recent announcement of reaching 55% mainnet completion, up 18% from prior updates, highlights a measurable milestone. By inviting users to participate in the testnet and deposit assets like eETH/weETH, the project gathers real-world data on user interaction and system performance. This phase allows developers to identify bugs, optimize smart contracts, and assess the platform’s ability to handle transactions at scale. Evaluating testnet participation rates and user feedback provides insights into the project’s readiness for mainnet launch and its appeal to DeFi users.

Tools and Frameworks

Adopting structured evaluation frameworks, such as the CIPP model (Context, Input, Process, Product), can provide a holistic view of progress. This model assesses:

- Context: The project’s alignment with DeFi market needs.

- Input: Resources, including developer talent and community contributions.

- Process: Efficiency of development and testing phases.

- Product: Measurable outcomes like mainnet deployment or liquidity pool growth.

For Mitosis, applying the CIPP model could involve analyzing how its EOL model addresses liquidity fragmentation in DeFi (context), the effectiveness of its developer team and community incentives (input), the efficiency of its testnet phase (process), and the eventual mainnet launch (product).

Challenges in Evaluation

One challenge is balancing short-term metrics with long-term impact. Short-term assessments, like testnet participation, may not capture the project’s potential to disrupt DeFi. Additionally, high-dimensional data, such as user behavior across decentralized platforms, requires advanced analytics to avoid bias, as seen in propensity score matching studies for program evaluation. Mitosis could address this by using machine learning to predict user engagement trends, ensuring robust evaluation without overfitting to short-term data.

Post-Campaign Predictions for Sustainable Growth

Once a campaign, such as a testnet phase or token distribution event, concludes, predicting future performance is vital for strategic planning. For Mitosis EOL, post-campaign predictions involve forecasting user adoption, liquidity growth, and market positioning in the DeFi ecosystem.

Factors Influencing Predictions

Several factors shape post-campaign outcomes:

- Market Conditions: The DeFi market’s volatility affects user confidence and investment. A bullish market could accelerate Mitosis’s adoption, while a bearish one might slow it.

- User Sentiment: Posts on X reflect enthusiasm for Mitosis’s EOL model, suggesting strong community support that could drive adoption.

- Technological Readiness: A successful testnet phase, with high participation and minimal technical issues, signals readiness for mainnet, boosting confidence in predictions.

- Competitive Landscape: Mitosis must differentiate itself from other layer-1 blockchains and DeFi protocols, such as Uniswap or Aave, by emphasizing its unique liquidity model.

For Example: Forecasting Mitosis EOL’s Mainnet Impact

Assuming Mitosis’s mainnet launches in 2025, predictions can be based on testnet data. If the testnet attracts 10,000 active users depositing $10 million in eETH/weETH, the mainnet could conservatively target 50,000 users and $100 million in liquidity within six months, given broader market access. This projection aligns with the gradual growth trend seen in Taurus’s financial predictions for June 2025, where steady progress is expected through strategic efforts.

To refine these predictions, Mitosis could use propensity score matching, similar to labor market program evaluations, to estimate the causal impact of its EOL model on liquidity retention compared to traditional AMM (Automated Market Maker) models. This approach would balance user demographics and market conditions to predict outcomes accurately.

Risks and Mitigation

Post-campaign predictions carry risks, such as overestimating user adoption or underestimating technical challenges. For instance, convergence issues in predictive models, as noted in machine learning studies, could skew results. Mitosis can mitigate this by:

- Conducting iterative testing post-campaign to validate assumptions.

- Engaging with community feedback on platforms like X to adjust strategies.

- Partnering with analytics firms to refine predictive models.

By combining data-driven forecasting with community insights, Mitosis can position itself for sustainable growth, potentially achieving a top-tier spot in DeFi liquidity protocols.

Leveraging Strategic Partnerships with Preferential Boost Programs

Strategic partnerships are a powerful tool for amplifying a project’s reach and impact, especially when paired with preferential boost programs that incentivize collaboration. For Mitosis EOL, partnerships can enhance liquidity, expand user bases, and integrate complementary technologies.

Criteria for Effective Partnerships

Selecting the right partners requires assessing:

- Strategic Fit: Partners should align with Mitosis’s mission of ecosystem-owned liquidity. For example, a partnership with a stablecoin provider like Tether could enhance liquidity stability.

- Complementary Strengths: A partner with expertise in cross-chain bridges could help Mitosis integrate with other blockchains, addressing liquidity fragmentation.

- Cultural Alignment: Open communication and shared values, as emphasized in partnership best practices, ensure long-term collaboration.

- Measurable Outcomes: Partnerships should drive quantifiable results, such as increased liquidity or user growth.

For Example: Partnership with a DeFi Aggregator

Imagine Mitosis partnering with a DeFi aggregator like 1inch. This collaboration could integrate Mitosis’s EOL pools into 1inch’s platform, exposing them to millions of users. A preferential boost program could offer $MITO token rewards to 1inch users who provide liquidity to Mitosis pools, incentivizing participation. This mirrors the approach of the Military Spouse Employment Partnership, where targeted incentives improved engagement. Such a partnership could increase Mitosis’s total value locked (TVL) by 20% within three months, assuming 1inch’s user base contributes $50 million in liquidity.

Preferential Boost Programs

Preferential boost programs, like token airdrops or staking rewards, can supercharge partnerships by aligning incentives. For Mitosis, these could include:

- Liquidity Mining: Offering $MITO tokens to partners’ users who stake assets in EOL pools.

- Fee Discounts: Providing lower transaction fees for partners’ users, encouraging adoption.

- Co-Marketing Campaigns: Collaborating on campaigns to promote the partnership, as seen in the BT-ChildLine campaign, which boosted awareness and engagement through joint efforts.

Case Study: Health Tech Partnerships

Drawing from health tech partnerships, such as CereCore and FinThrive’s collaboration with the Healthcare Financial Management Association, Mitosis could partner with a blockchain analytics firm to evaluate liquidity pool performance. This partnership could benchmark Mitosis’s EOL model against competitors, identifying optimization opportunities and attracting institutional investors.

Challenges and Best Practices

Partnerships face challenges like misaligned goals or resource constraints. To address these, Mitosis should:

- Define clear roles and responsibilities, as recommended for strategic alliances.[

- Foster open communication through regular progress meetings.

- Continuously evaluate partnership performance using metrics like TVL growth or user acquisition.

By leveraging partnerships with preferential boost programs, Mitosis can accelerate its growth, enhance its ecosystem, and solidify its position in DeFi.

Conclusion

Projects like Mitosis EOL stand at the forefront of DeFi innovation, but their success hinges on rigorous progress evaluation, accurate post-campaign predictions, and strategic partnerships. By adopting structured evaluation frameworks, forecasting with data-driven models, and forging alliances with complementary partners, Mitosis can maximize its impact. Preferential boost programs further amplify these efforts by incentivizing user and partner engagement, creating a virtuous cycle of growth. As Mitosis progresses toward its mainnet launch, these strategies will ensure it not only meets its goals but also redefines liquidity in the DeFi space.

Comments ()