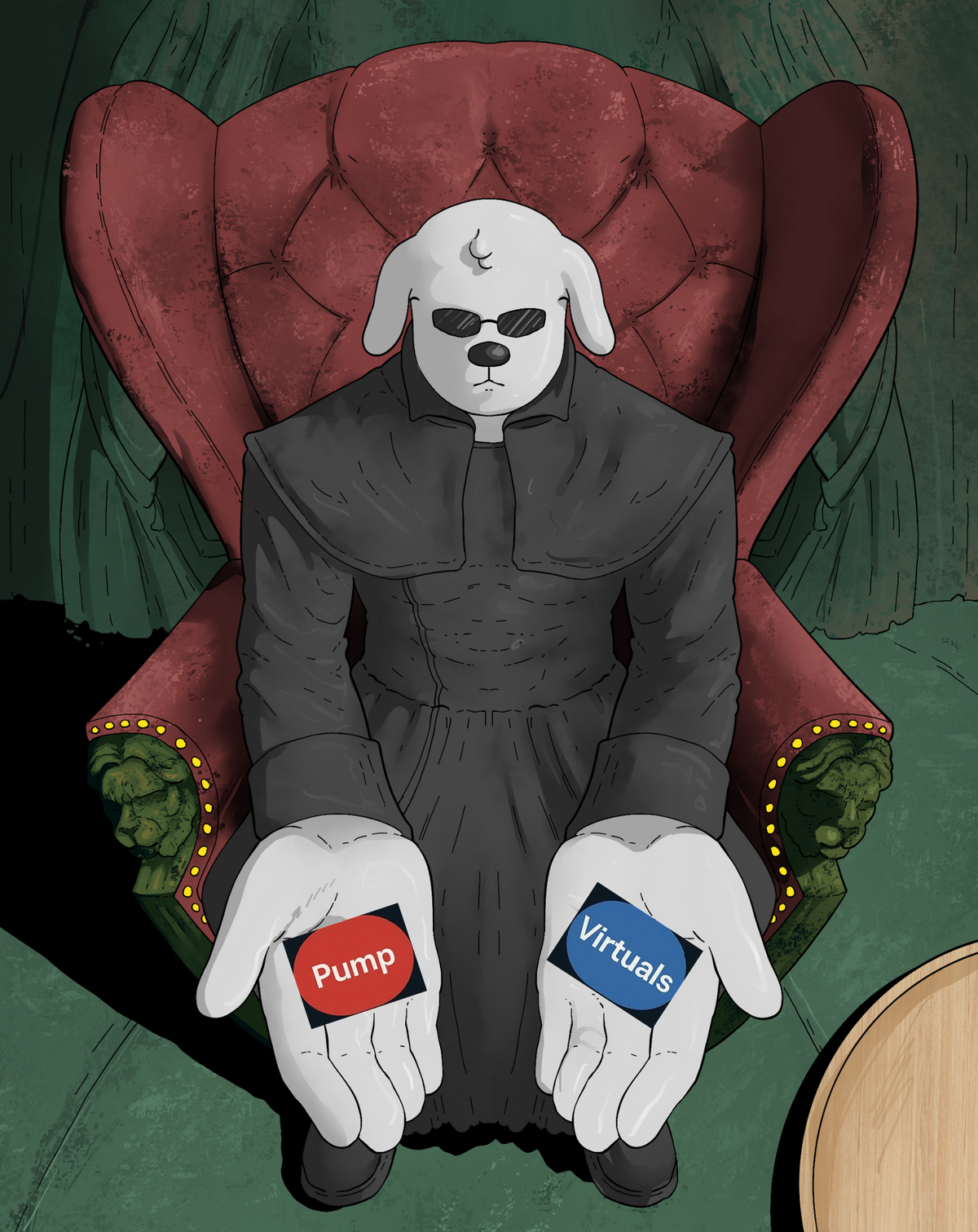

Pumpfun vs. Virtuals Protocol: Casino Chaos or Community Vision?

In the ever-evolving landscape of decentralized finance (DeFi), two Solana-based platforms, Pump.fun and Virtuals Protocol, have emerged as opposites in the token creation and trading arena. Pump.fun, often criticized as a speculative “Ponzi casino,” thrives on rapid memecoin launches but faces accusations of exploiting users for profit. Virtuals Protocol, by contrast, is celebrated as a “decentralized VC community,” prioritizing creator rewards and sustainable projects. This article dives into three core differences, like fee structures, incentive mechanisms, and token sale strategies, to uncover what sets these platforms apart and what they reveal about the future of DeFi.

Origins and Core Vision

Pump.fun emerged as a cultural phenomenon. Built on the premise of instant memecoin launches, it allowed anyone (literally anyone) to deploy a token with just a few clicks. No technical experience required, or smart contract audits, just pure community vibes. A bonding curve automatically handles the pricing mechanism, and tokens live or die by their hype cycles. This resulted in an explosive, casino-like environment where speculation is the norm and volatility is the product. In contrast, Virtuals Protocol is a deliberate attempt to inject structure and sustainability into the same open-token world. It brands itself as a “decentralized VC protocol,” a place where creators launch AI-powered agents, not memecoins, and are rewarded proportionally for value creation over time. These agents are programmable digital entities designed to be used in areas like Web3 gaming, social applications, or decentralized AI interfaces. The vision isn’t chaos, it’s cooperative growth. Understanding these origins helps explain why their mechanics differ so drastically. Below, we explore three critical pillars of comparison: fee structures, incentive mechanisms, and token sale strategies. Also Read: Mitosis vs Traditional L2s: Who’s Really Modular?

Fee Structures: Extraction vs. Empowerment

Pump.fun

Pump.fun’s fee model has drawn significant scrutiny for its extractive nature. The platform charges a 0.25% trading fee on its decentralized exchange, PumpSwap, but shares none of this revenue with token creators.. For a token generating $10 million in trading volume, a creator earns a flat $5,000, barely a fraction of the platform’s take. Creators have criticized this setup, arguing that it treats them as an afterthought while Pump pockets the lion’s share. In 2024, Pump removed its 0.02 SOL token creation fee, shifting costs to the first buyer, which fueled an explosion of over 600,000 new tokens in January 2025 alone. While this democratizes access, it floods the market with low-quality memecoins, diluting value for serious projects. The lack of revenue sharing reinforces Pump’s reputation as a platform that prioritizes its profits over community growth, with users labeling it a “cash grab” that sees users as “exit liquidity.”

Virtuals Protocol

Virtuals takes a radically different approach, sharing 70% of its trading fees with creators, a model that aligns with its decentralized VC ethos. For the same $10 million in trading volume, a creator could earn $70,000 (a 14x increase over Pump’s payout). This generous split incentivizes creators to build projects with lasting utility, as they directly benefit from their token’s success. Virtuals’ fee structure is designed to foster a collaborative ecosystem where users are treated as partners, not products. However, the platform’s 100-token fee for launching AI-driven agents acts as a gatekeeper, deterring low-effort scams but potentially limiting access for smaller creators. Virtual’s revenue-sharing model has continued to earn praise for empowering creators and fostering sustainable growth.

Also Read: What is Mitosis in Crypto? A Beginner’s Guide

Incentive Mechanisms: Hype vs. Utility

Pump.fun

Pump’s incentive structure is a lightning rod for criticism, a report accusing it of encouraging “rugs, jeeters, and violent livestreams.” The platform’s low barrier to entry has led to a deluge of speculative memecoins, many of which collapse shortly after launch. Pump’s live-streaming feature, introduced in 2024, amplifies this issue, with some creators resorting to dangerous stunts or hype-driven tactics to pump token prices. This environment fosters pump-and-dump schemes, where early buyers profit at the expense of latecomers. A federal class-action lawsuit filed in January 2025 alleges that Pump orchestrated a $500 million pump-and-dump scheme through unregistered securities, citing its discrete bonding curve (DBC) as a tool for price manipulation. The lack of mechanisms to reward utility or penalize scams has cemented Pump’s reputation as a speculative playground, with minimal oversight to protect users.

Virtuals Protocol

Virtuals flips the script by incentivizing utility and punishing bad actors. Its 70% fee-sharing model rewards creators who build projects with real-world applications, such as AI-driven tokens for Web3 gaming. The platform’s 100-token launch fee deters “rug pulls,” ensuring only committed creators participate. Virtuals’ integration with the Ronin blockchain, announced in January 2025, supports AI agents like JAIHOZ, targeting practical use cases in gaming and beyond. By treating users as “VC partners,” Virtuals fosters a community-driven ecosystem where success is tied to collective growth. However, the platform isn’t immune to challenges; tokens like GAME and Prefrontal Cortex dropped over 20% in January 2025, reflecting broader market volatility. Still, Virtuals’ focus on utility and scam deterrence positions it as a beacon for sustainable DeFi innovation.

Token Sale Strategies: Cash-Out vs. Commitment

Pump.fun

Perhaps the most damning critique of Pump is its alleged $1 billion SOL sell-off by founders. Critics argue this massive extraction, with no apparent reinvestment into the platform, signals a lack of long-term commitment. With Pump generating significant revenue from trading fees, users question why founders need “1000x the cash” to improve the platform, accusing them of treating users as exit liquidity. The January 2025 lawsuit further alleges that Pump’s token sales through its bonding curve constitute unregistered securities, raising regulatory red flags. The UK’s December 2024 ban on Pump for operating without permission underscores these concerns, with the platform’s opaque financial practices fueling distrust. This extractive approach contrasts sharply with Pump’s public image as a fun, accessible memecoin hub.

Virtuals Protocol

Virtuals takes a starkly different stance, holding its agent tokens long-term to signal confidence in its ecosystem. Rather than cashing out, Virtuals reinvests 70% of fees into creators and stakers, creating a self-sustaining value loop. Its partnership with Ronin to launch AI-driven tokens like JAIHOZ in January 2025 demonstrates a commitment to expanding use cases, particularly in Web3 gaming. While the VIRTUAL token’s 52,000% surge in 2024 was followed by a 20% crash in January 2025, Virtuals’ long-term token-holding strategy and focus on utility suggest a vision beyond short-term profits. Users praise this approach, viewing Virtuals as a platform that aligns creator and investor interests for mutual benefit.

Also Read: Beyond Incentives: The Mitosis Architecture and Its Revolution in Liquidity

Conclusion

The stark differences between Pump.fun and Virtuals Protocol underscore a broader divide in DeFi’s future, casino chaos vs. community vision. Pump.fun may be exciting, fast, and undeniably viral, but it thrives on hype cycles that often leave users burned. Its fee model extracts more than it gives, its incentive structure rewards spectacle over substance, and its founders’ actions raise serious questions about long-term intentions. While it succeeds as a memecoin launchpad, it fails to build lasting trust or sustainable value. Virtuals Protocol, on the other hand, is building slowly but with purpose. By sharing the majority of trading fees with creators, it empowers those who contribute meaningfully to its ecosystem. Its emphasis on AI agents, real-world applications, and community-as-VC framing gives it a distinctly forward-looking ethos. Virtuals is not without volatility, but its structure rewards commitment and discourages quick flips. In the end, DeFi users must ask themselves: Do you want to gamble on fleeting pumps, or build with platforms designed for shared, long-term value? That answer may define who survives and thrives in the next evolution of crypto.

Comments ()