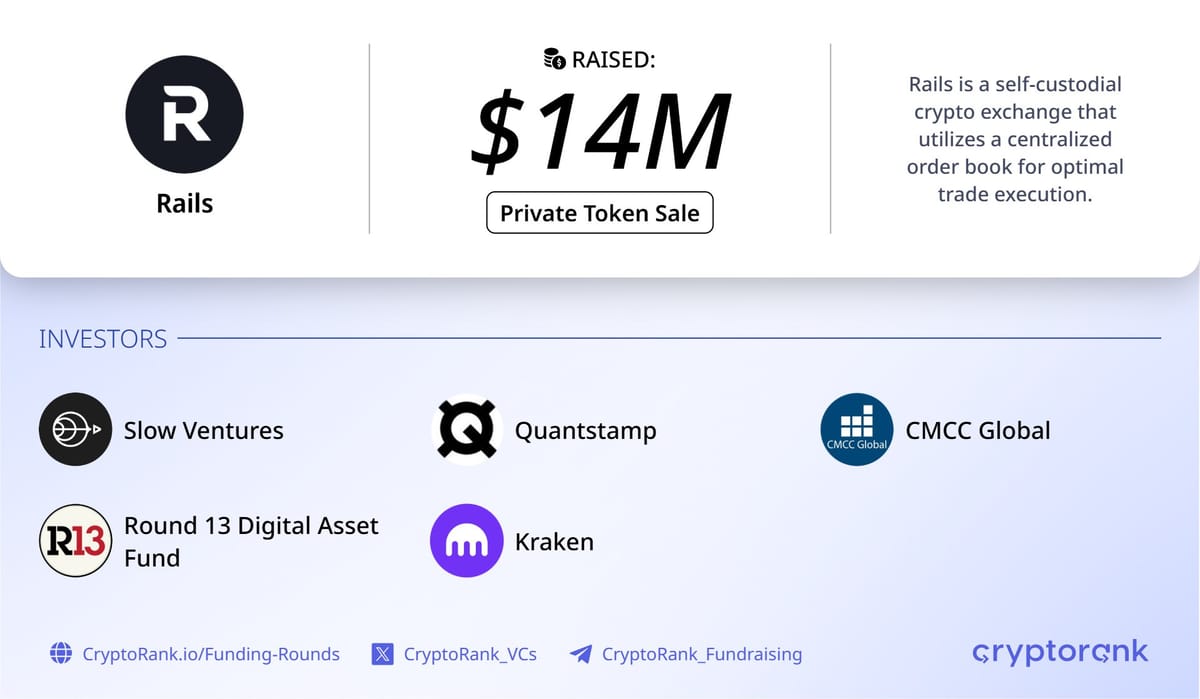

Rails’ $14M Token Raise: A Hybrid DEX for Speed and Security

Rails is a new crypto exchange startup aiming to bridge the gap between centralized exchanges (CEX) and decentralized exchanges (DEX). In early June 2025, Rails announced it raised $14 million in a token sale (plus a prior $6 million seed round in early 2024) to build its platform. This round was backed by notable investors: Kraken (a major crypto exchange), Slow Ventures, CMCC Global, Round13 Capital, and blockchain security firm Quantstamp, among others. In total, Rails now has about $20 million in funding.

The headline goal of Rails is a “hybrid crypto exchange”. Traditional on-chain DEXs let users hold their own keys (good for security) but often suffer from slower trade execution and higher costs. Centralized exchanges offer fast matching and deep liquidity, but users must deposit funds and trust the exchange to hold them. Rails’ model tries to capture the best of both worlds: user custody of assets with near-CEX trading speed and performance.

What is Rails? A New Kind of Crypto Exchange

The Hybrid DEX Model Explained

The Hybrid DEX Model Explained

Traditional decentralized exchanges (DEXs) allow users to keep control of their assets, but often trade execution is slow and can cost more in gas fees. Centralized exchanges (CEXs) like Binance and Coinbase are faster but require users to give up custody of their funds. Rails is building a platform that combines both approaches: fast, centralized order matching with on-chain settlement, so users never lose custody of their funds.

Rails uses a centralized matching engine to process trades at high speed. Orders are executed off-chain (like on a CEX), so you get the same kind of speed and low latency as traditional exchanges. But once a trade is completed, it settles on-chain, directly to and from the user’s own wallet.

This means your crypto stays in your control until the trade is finalized on the blockchain. To secure the process, Rails uses cryptographic techniques—zero-knowledge proofs and Merkle trees—to batch trades and post them to the blockchain for verification. The result is transparency: every trade is verifiable, and funds are always on-chain

The Ink Layer 2 Advantage

Rails will run on Kraken’s Ink Layer 2 network, an Ethereum-compatible scaling solution. Layer 2 networks help reduce transaction costs and boost throughput, making them ideal for high-speed trading. As the first exchange to launch on Ink, Rails is positioned to benefit from the infrastructure and ecosystem Kraken is building.

The Security–Speed Trade-Off in Crypto Trading

User Custody vs. Exchange Performance

Rails tackles a classic challenge in crypto: should users trade speed for security? With Rails’ hybrid model, you get both:

- High-Speed Trading: Trades are matched off-chain, delivering CEX-like performance, even for big orders or futures.

- On-Chain Custody: Your crypto never leaves your wallet until a trade is finalized. Even if Rails experienced a security issue, your funds aren’t exposed.

This approach addresses the concerns of both everyday users and institutional traders who want reliability and safety.

Security Through Transparency

Rails uses zero-knowledge proofs to batch trades and verify them without exposing sensitive user data. Every transaction is ultimately secured on-chain, and users can verify their balances anytime.

Investor Interest and the Road Ahead

Why Major Investors Back Rails

Kraken’s investment isn’t just financial—its Ink Layer 2 is the foundation of the Rails platform. Quantstamp, a leading smart contract auditor, likely helped validate Rails’ security model. The presence of well-known investors is a strong sign that Rails is seen as a credible player in the next generation of DeFi exchanges.

Growth Plans

Rails will use the funds to launch its exchange, meet compliance standards (such as KYC/AML), and expand the list of supported assets. Their goal is to attract both retail and institutional users by providing an experience that feels familiar to those coming from centralized platforms—while delivering the control and transparency of DeFi.

What This Means for Beginners

If you’re new to crypto, the idea is simple: Rails wants to let you trade quickly, like on a CEX, but never lose ownership of your crypto, like on a DEX. This addresses a major complaint in crypto: “Why can’t I have the speed of Binance with the safety of self-custody?” Rails’ hybrid DEX aims to bridge that gap.

Conclusion: The Future of Trading?

Rails is betting that users and institutions will demand exchanges that don’t force them to choose between speed and security. Its $14 million raise, strong backing, and hybrid model suggest that the next wave of DeFi platforms will look a lot more like Rails offering the best of both worlds.

Comments ()