Rails vs. Riders: How Infrastructure Powers Value in Stocks and Crypto — But Captures It Differently

Abstract

The "Rails vs. Riders" framework shows how value is captured in traditional equity markets and the cryptocurrency ecosystem. Infrastructure ("Rails")—from semiconductors to Layer 1 blockchains—enables consumer-facing applications ("Riders") like retail platforms and decentralized finance (DeFi). In equities, infrastructure’s stable cash flows and high barriers to entry ensure durable market dominance, as seen in companies like Microsoft and Nvidia. In crypto, a narrative premium (inflated value from hype and community belief) often elevates speculative assets like memecoins, overshadowing critical protocols like Chainlink. As crypto matures, value will converge toward utility, rewarding foundational infrastructure. This article dissects these ecosystems, offering strategies for investors and builders to navigate the digital economy’s evolution.

Introduction: The Anatomy of an Ecosystem

Imagine a railroad connecting a frontier town: the tracks (infrastructure) enable commerce, but the goods and passengers (applications) capture attention. In economic ecosystems, this tension between foundational "Rails" and consumer-facing "Riders" shapes value allocation. Why does Microsoft, a titan of enterprise software and cloud infrastructure, command a $3 trillion market cap, while Chainlink, a vital oracle(and more) for crypto’s DeFi ecosystem, often trails memecoins like Shiba Inu? This question reveals a fundamental dynamic: infrastructure powers economies, but markets reward it differently in mature equities versus nascent crypto.

The "Rails vs. Riders" framework compares the U.S. equity markets deeply integrated into global commerce with the crypto economy, a digital frontier akin to the early internet. By analyzing infrastructure and application taxonomies, quantitative market structures, and unique value accrual mechanisms, this article uncovers opportunities for investors and builders. As crypto evolves, its value loop (the symbiotic relationship between rails and riders) will mirror equities, rewarding the silent scaffolding of the decentralized internet.

Defining the Rails: A Taxonomy of Infrastructure

Infrastructure, the backbone of any economy, requires significant capital and offers high barriers to entry. Its forms differ between Web2 (equities) and Web3 (crypto).

Traditional Markets (Web2): The Physical and Digital Backbone

Web2 infrastructure supports global commerce through tangible and digital assets, tied to real-world processes (Hamilton Lane).

- Tangible Infrastructure: (examples)

- Logistics & Transportation: CSX Corporation (rail) and Old Dominion Freight Line (freight) form commerce’s circulatory system. Caterpillar’s machinery powers industrial projects (Moneywise).

- Energy & Utilities: Constellation Energy (power generation) and Linde plc (industrial gases) provide essential inputs. American Electric Power ensures reliable grids (Slickcharts).

- Telecommunications: American Tower (cell towers) and T-Mobile US (networks) enable connectivity, critical for digital economies (Nasdaq).

- Digital Infrastructure:

- Semiconductors: Nvidia, Broadcom, Intel, AMD, and TSMC produce chips for computing and AI. ASML’s equipment is vital for fabrication (Slickcharts).

- Cloud Computing & Data Centers: Amazon Web Services (AWS) and Microsoft Azure offer scalable computing, replacing on-premise servers (AWS).

- Enterprise Software & IT Services: Microsoft Windows, Oracle databases, and Cisco networking equipment supports corporate IT.

- Payment Networks: Visa, Mastercard, and PayPal facilitate global transactions.

Web2 infrastructure’s tangible nature anchors its valuation in cash flows and assets, making it intuitive for investors.

Crypto Markets (Web3): The Decentralized Stack

Web3 infrastructure operates in a digital, decentralized environment, forming a layered stack of open-source protocols. Its abstract services—composability (protocols interoperating like "money legos") and decentralized consensus (trustless agreement via algorithms)—require technical understanding, impacting valuation (Zeebu).

- Layer 0 (Interoperability): Cosmos (ATOM), Layerzero, Hyperlane, LiFi , Caldera (Meta layer), Skate (Stateless IS) , Polkadot (DOT) e.t.c connects blockchains, enabling asset and data transfer.

- Layer 1 (Consensus & Security): Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and BNB Chain (BNB) provide security and settlement (staking: locking tokens to secure a blockchain and earn rewards) (Solulab).

- Layer 2 (Scalability & Execution): Arbitrum and Optimism (rollups: Layer 2 solutions bundling transactions for scalability) enhance throughput.

- Middleware:

- Oracles: Chainlink (LINK) and Pyth Network feed real-world data to smart contracts, enabling DeFi.

- Data Availability (DA): Celestia (TIA) ensures rollup data verification.

- Decentralized Storage: Filecoin (FIL) and Arweave (AR) offer censorship-resistant storage (Alchemy).

- Restaking: EigenLayer allows staked ETH to secure other protocols, creating a security marketplace (Mitosis).

Defining the Riders: A Taxonomy of Applications

Riders leverage infrastructure to deliver consumer products and services, capturing attention and demand.

Traditional Markets (Web2): The Consumer-Facing Economy

- Durable Goods & Automotive: Apple (iPhones) and Tesla (EVs) produce high-value products.

- Retail & E-commerce: Amazon’s retail arm, Walmart, and Costco utilize logistics and payments. McDonald’s leverages supply chains.

- Media & Entertainment: Netflix and Disney rely on cloud and internet infrastructure.

- Consumer Services: Airbnb and Booking Holdings use digital and payment systems.

Crypto Markets (Web3): The On-Chain Experience Layer

- Decentralized Finance (DeFi): Uniswap (UNI), AAVE, and Compound (COMP) offer permissionless trading and lending. Maker (MKR) issues stablecoins.

- Digital Culture & NFTs: CryptoPunks, Bored Ape Yacht Club (BAYC), and Pudgy Penguins focus on digital art and identity.

- Social & Speculative Assets (Memecoins): Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) thrive on social consensus (shared belief driving value) (EBSCO).

- Gaming & Metaverse: The Sandbox (SAND) and Gala (GALA) integrate blockchain for player-owned assets.

Market Structure by the Numbers

Quantitative analysis reveals distinct value distributions, reflecting market priorities.(Slickcharts, Coinmarketcap).

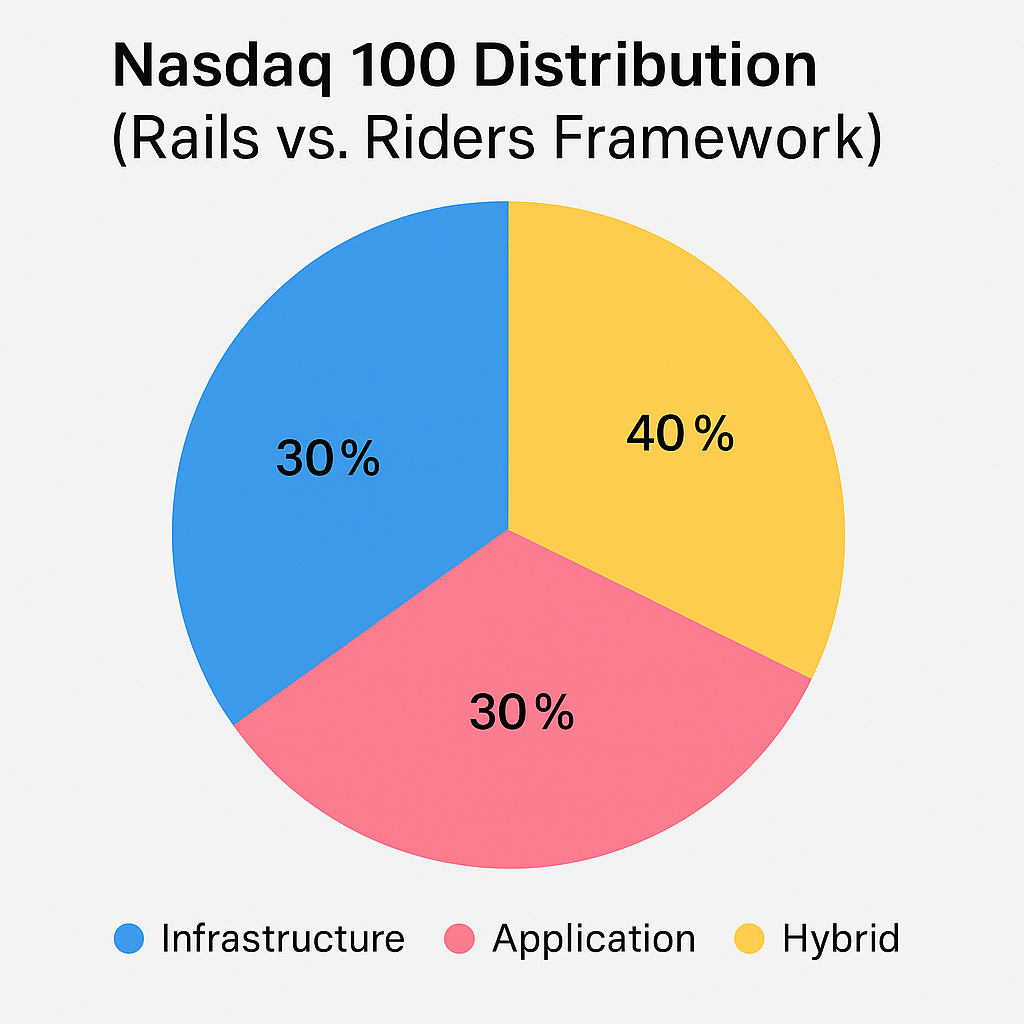

Nasdaq 100 Analysis

The Nasdaq 100 balances infrastructure, applications, and hybrids.

- Infrastructure (25–30%): Nvidia, Broadcom, Microsoft Azure, T-Mobile.

- Application/Consumer (25–30%): Tesla, Netflix, Costco, Starbucks.

- Hybrid/Platform (40–50%): Apple, Amazon, Alphabet, Meta.

Table 1: Nasdaq 100 Composition by Category

| Rank | Company (Symbol) | Market Cap (Approx. USD) | Primary Category | Sub-Category |

| 1 | Nvidia (NVDA) | $4.2 Trillion | Infrastructure | Semiconductors |

| 2 | Microsoft (MSFT) | $3.8 Trillion | Hybrid/Infra | Cloud, Enterprise Software |

| 3 | Apple Inc. (AAPL) | $3.2 Trillion | Hybrid/Consumer | Consumer Devices, Platform |

| 4 | Amazon (AMZN) | $2.4 Trillion | Hybrid | E-commerce, Cloud |

| 5 | Alphabet (GOOGL/GOOG) | $2.2 Trillion | Hybrid | Search, Cloud, Advertising |

| 6 | Meta Platforms (META) | $1.8 Trillion | Hybrid/Consumer | Social Media, Platform |

| 7 | Broadcom Inc. (AVGO) | $1.3 Trillion | Infrastructure | Semiconductors |

| 8 | Tesla, Inc. (TSLA) | $1.1 Trillion | Application/Consumer | Automotive |

| 9 | Netflix (NFLX) | $515 Billion | Application/Consumer | Media & Entertainment |

| 10 | Costco (COST) | $422 Billion | Application/Consumer | Retail |

Ranks and values are subject to market fluctuations.

Nasdaq 100 market cap distribution, showing a balance across categories

Top 100 Crypto Assets

Crypto markets favor speculative assets, with infrastructure undervalued.

- Infrastructure (25–30%): Bitcoin, Ethereum, Chainlink, Celestia.

- Application/Consumer (40–50%): Fartcoin, Shiba Inu, Uniswap.

- Hybrid (20–25%): Ethereum, Solana.

| Rank | Token (Symbol) | Market Cap (Approx. USD) | Primary Category | Sub-Category |

|---|---|---|---|---|

| 1 | Bitcoin (BTC) | $2.35 Trillion | Infrastructure | Layer 1 / Store of Value |

| 2 | Ethereum (ETH) | $436 Billion | Infrastructure | Layer 1 / Smart Contract Platform |

| 3 | Tether (USDT) | $162 Billion | Infrastructure | Stablecoin / Financial Rail |

| 4 | BNB (BNB) | $108 Billion | Infrastructure | Layer 1 (Platform Token) |

| 5 | Solana (SOL) | $96 Billion | Infrastructure | Layer 1 |

| 6 | Dogecoin (DOGE) | $38 Billion | Application/Speculative | Memecoin |

| 7 | Chainlink (LINK) | $12.6 Billion | Infrastructure | Oracle |

| 8 | Shiba Inu (SHIB) | $8.9 Billion | Application/Speculative | Memecoin / Ecosystem |

| 9 | Uniswap (UNI) | $6.2 Billion | Application/DeFi | Decentralized Exchange |

| 10 | Pepe (PEPE) | $5.7 Billion | Application/Speculative | Memecoin |

The Disparity

The quantitative data reveals a fundamental difference in market structure. While both markets allocate a similar portion of capital to their core infrastructure, the crypto market directs a far greater share to its most visible and speculative consumer-facing layer.

This can be explained by the emergence of a powerful "narrative premium" in crypto. The permissionless nature of token creation, combined with 24/7 global markets and amplification through social media, allows assets with simple, potent, and viral narratives to attract capital at a speed and scale unparalleled in traditional finance. A compelling story can, for a time, substitute for fundamental utility. The market capitalizations of top memecoins, which often exceed those of critical infrastructure projects they depend on, are the clearest evidence of this phenomenon. In equities, while narratives play a role, valuations are more strongly anchored to established metrics like revenue, earnings, and cash flow, creating a more balanced distribution of value.

Equities: The Durable Moat

Web2 infrastructure builds value over decades through:

- Stable Cash Flows: Microsoft’s Azure and Office 365 generate predictable revenue via subscriptions (Investopedia).

- High Barriers to Entry: TSMC’s fabs and Amazon’s logistics require billions, deterring competitors (Hamilton Lane).

- Sticky Customers: Enterprises using AWS or Oracle face high switching costs (AWS).

Case Study: Nvidia’s Ascent

Nvidia’s GPUs, initially for gaming, became AI infrastructure. A $1,000 investment in its 1999 IPO would be worth ~$4.5M today, reflecting its role as indispensable rails.

Case Study: Oracle’s Enterprise Dominance

Oracle’s databases and cloud services power banks and governments, locking in clients. Its $350B market cap highlights sticky infrastructure’s value.

Crypto: The Narrative Premium

Crypto value is front-loaded, driven by:

- Permissionless Capital Formation: Tokens launch rapidly on decentralized exchanges, bypassing gatekeepers.

- Social Consensus: Memecoins like Dogecoin thrive on community belief, not utility (narrative premium: inflated value from hype) (EBSCO).

Case Study: Chainlink vs. Shiba Inu

- Chainlink (LINK): Oracles enable DeFi’s $100B+ ecosystem, yet LINK’s $10B market cap trails speculative assets.

- Shiba Inu (SHIB): Launched as a memecoin, SHIB’s value soared via the “Shib Army.” Its pivot to ShibaSwap and Shibarium reflects the “narrative-first, utility-later” pattern (Flabster).

Case Study: Cosmos’ Interoperability Vision

Cosmos (ATOM) creates an “internet of blockchains” via its Inter-Blockchain Communication (IBC) protocol. Its $1.8B market cap reflects bets on a multi-chain future, but it lags memecoins due to technical complexity, or probably something else?

The Disparity in Maturity

Equities serve diverse sectors like pharmaceuticals ($2.3T GDP contribution in 2022) and energy, ensuring stable demand (IFPMA, World Bank). Crypto’s recursive economy—Layer 2s serving dApps, oracles feeding DeFi—mirrors the early internet’s developer focus (e.g., email, FTP) before consumer giants like Amazon emerged.

The AWS-in-2007 Analogy

In 2006, AWS was a nascent cost center, but its cloud infrastructure became indispensable. Crypto’s rails (Celestia, EigenLayer) are similar: undervalued today but critical for a modular blockchain future.

The Power of Platforms

Hybrid entities capture value across the stack.

Web2 Vertical Integration

- Amazon: AWS (rail) powers the internet; retail (rider) dominates e-commerce.

- Apple: iPhones (rider) and App Store (rail) extract 30% commissions (Wikipedia).

- Alphabet: Google Cloud (rail) supports search and YouTube (riders).

- Meta: Facebook and Instagram (riders) leverage ad platforms (rails).

Case Study: Alphabet’s Hybrid Model

Google Cloud powers enterprise IT, while search and YouTube dominate consumer attention. Its $2T market cap reflects data-driven synergy.

Web3 Composability

Web3’s composability enables protocols to stack like legos, creating hybrid platforms. (Medium)

- Ethereum (ETH): Hosts dApps while ETH pays gas, serves as collateral, and earns staking rewards.

- Solana (SOL): High-throughput rails support DeFi; SOL is used for fees and staking (B2BinPay).

- Base: Coinbase’s Layer 2 bridges Web2 users to Web3.

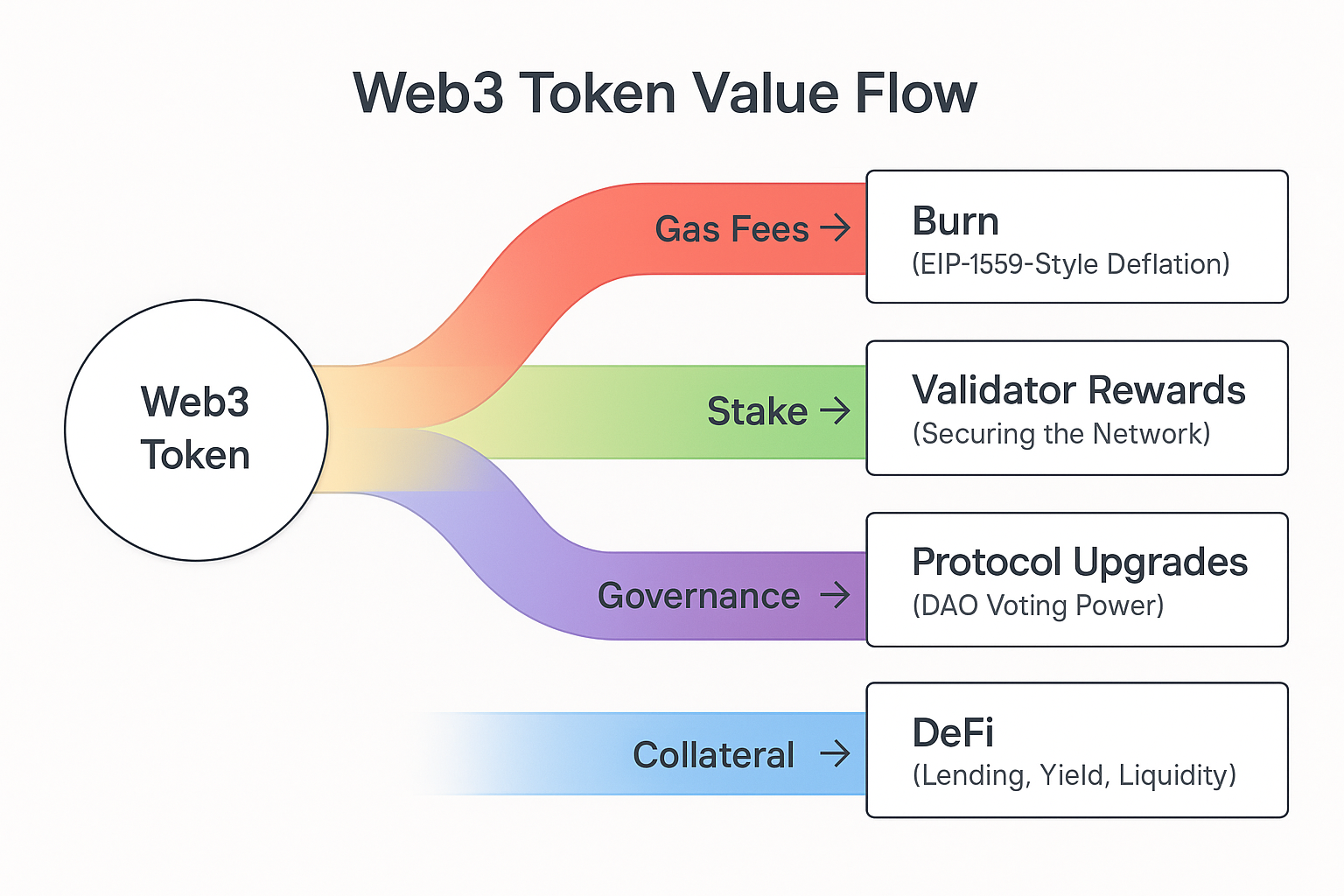

Web3’s Token-Driven Value

Unlike Web2’s equity model, Web3 protocols accrue value to tokens:

- Fee Burning: Ethereum’s EIP-1559 burns transaction fees, reducing ETH supply and creating deflationary pressure (Consensys).

- Staking: Holders lock tokens (e.g., ETH, SOL) to secure networks and earn rewards, making tokens productive assets (Solulab).

- Governance: Tokens like UNI (Uniswap) grant voting rights, aligning users with protocol success.

Conclusion: The Future of Scaffolding

The Rails vs. Riders loop drives innovation: robust rails enable riders, and successful riders increase demand for rails. In traditional equities, this feedback rewards dependable infrastructure—Microsoft’s cloud moat, for instance, commands enduring value. In crypto, speculative narratives often overshadow foundational tools; Chainlink's oracles, despite their essential role, trade below memecoins fueled by hype.

But as adoption deepens, utility begins to anchor value. Just as railroads reshaped 19th-century commerce, modern protocols like Ethereum, Celestia, and EigenCloud, Boundless protocol, Succinct, Caldera are laying digital tracks for a decentralized economy.

Investors should prioritize fundamentals: read whitepapers for technical depth, track GitHub for builder activity, and immerse in communities to measure traction. Builders, on the other hand, must choose between cathedral-like rails (e.g., EigenLayer) or nimble riders (e.g., Uniswap), weighing scale against agility.

Ultimately, the next trillion-dollar tokens will emerge not from noise but from the scaffolding---the quiet, essential infrastructure powering the decentralized internet

References

- App Store (Apple) - Wikipedia, https://en.wikipedia.org/wiki/App_Store_(Apple)

- Alchemy, list of 26 Decentralized Storage Tools - Alchemy, https://www.alchemy.com/dapps/best/decentralized-storage-tools

- AWS, https://aws.amazon.com/about-aws/our-origins/

- B2BinPay, https://b2binpay.com/en/news/solana-roadmap-key-upgrades

- Flabster, https://flabster.io/en/blog/what-is-shiba-inu-shib

- Hamilton Lane, https://www.hamiltonlane.com/en-us/education/private-markets-education/infrastructure-investing

- Investopedia, https://www.investopedia.com/how-microsoft-makes-money-4798809

- Medium, https://medium.com/liveplexmetaverseecosystem/composable-finance-building-blocks-for-the-next-wave-of-defi-2e0ba601e917

- Mitosis University, https://university.mitosis.org/understanding-eigenlayer-restaking-avs-and-its-role-in-blockchain-security/

- Moneywise, https://moneywise.com/investing/sp-500-companies

- Nasdaq, https://www.nasdaq.com/market-activity/stocks/screener

- Slickcharts, https://www.slickcharts.com/nasdaq100

- Solulab, https://www.solulab.com/top-layer-1-blockchains/

- Zeebu, https://www.zeebu.com/blog/understanding-blockchain-infrastructure

Comments ()