🧠 Real-Time Oracle Integration

How can Pyth Network Support Cross-Chain Risk Monitoring in Mitosis 🔐📡

As cross-chain protocols like Mitosis scale across ecosystems, so do their requirements for high-speed, accurate, and verifiable data feeds. The Pyth Network, known for its institutional-grade price feeds, plays a critical role in delivering this data directly to blockchains — without intermediaries.

Let’s explore how Pyth’s on-demand oracle infrastructure enhances Mitosis’s cross-chain liquidity framework by enabling risk-aware operations 🔍.

🌉 Mitosis: Secure Liquidity Across Chains

Mitosis is a modular protocol enabling secure, permissionless liquidity transfer between chains. It allows users to deposit native assets (e.g., USDC, ETH) into vaults across supported chains, issuing miAssets as canonical tokens usable throughout the network.

💡 Each vault requires accurate, real-time information to:

- Confirm asset values 🔢

- Ensure correct miAsset minting ✅

- Protect against depegs and cross-chain imbalances ⚖️

This is where Pyth comes in.

📡 What is Pyth Network?

Pyth Network is a pull-based oracle system designed to deliver real-time financial market data to smart contracts across over 50 blockchains. Unlike traditional push-based oracles, Pyth’s architecture emphasizes:

| Feature | Description |

|---|---|

| 🧩 First-party data | Sources data directly from exchanges and market makers |

| ⏱️ Real-time updates | Publishes new prices on demand — not on fixed intervals |

| 📏 Confidence intervals | Reports both price and its reliability level |

| 🌐 Multichain access | Integrates with major ecosystems like Ethereum, Solana, Cosmos |

📘 Learn more: Pyth Docs – How It Works

🧬 Mitosis + Pyth: Officially Aligned for Real-Time Accuracy

The Pyth oracle can enhance Mitosis’s on-chain logic by delivering verified market prices used to:

- Validate user deposits into vaults (e.g., USDC = $1)

- Mint miAssets (like miUSDC) based on current asset values

- Prevent incorrect pricing during high volatility

- Ensure parity across vaults on multiple chains

💡 This ensures price-aware liquidity management, verified across chains using Mitosis’s ZK-proof and messaging system.

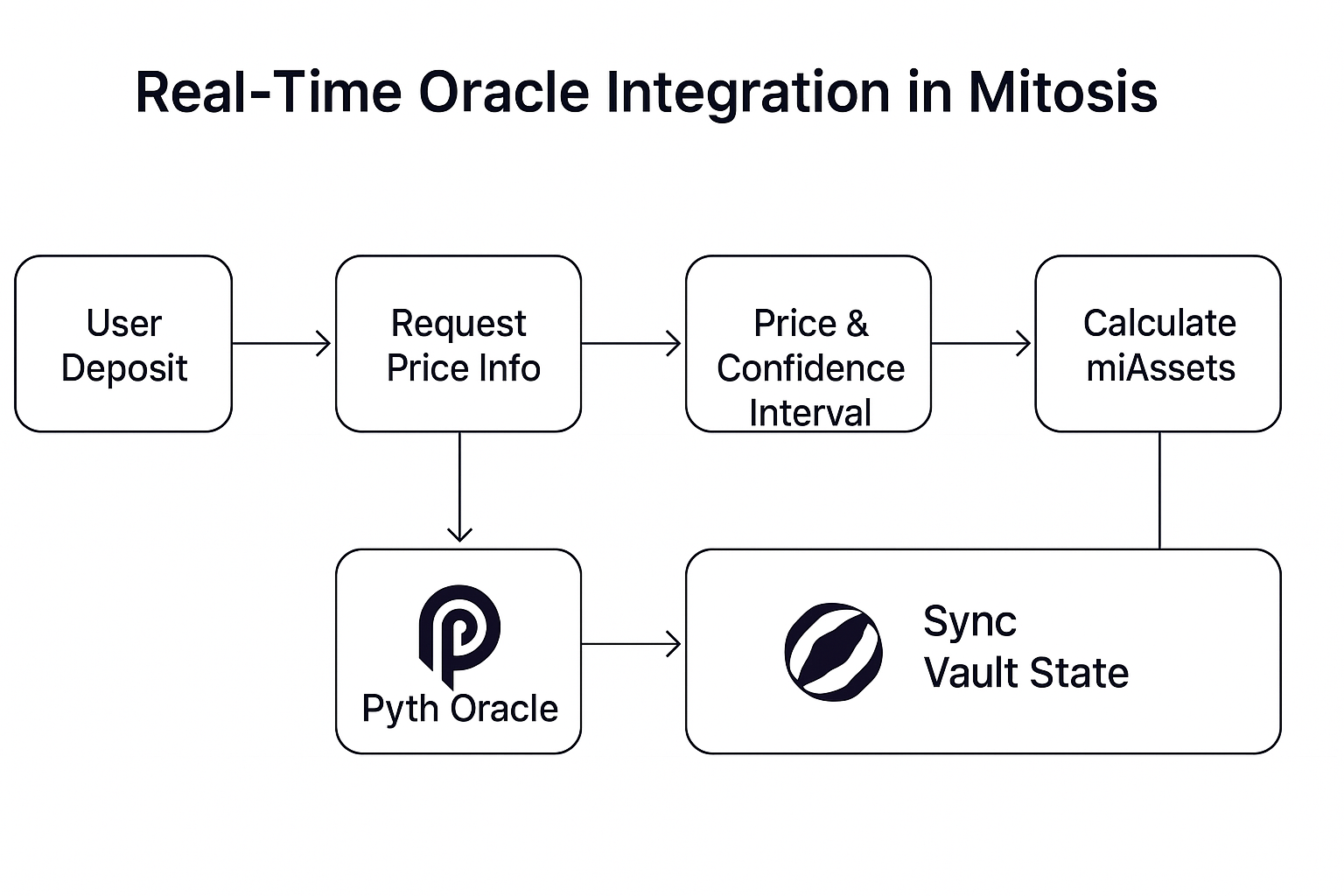

📊 Diagram: Real-Time Oracle Integration in Mitosis

Below is an infographic showing how Pyth Network contributes to vault-level integrity in Mitosis:

Explanation:

- 🌐 Mitosis Vaults exist on Mitosis mainnett

- 🔄 When a user deposits assets, Mitosis requests current price info from Pyth

- 🛰️ Pyth returns real-time price and a confidence interval

- ✅ Mitosis uses this data to calculate the correct amount of miAssets to mint

- 🔁 The vault state is recorded and synchronized across chains via ZK messages

🔗 Official Documentation

To dive deeper into the protocols:

🧠 Final Thoughts

The integration of Pyth Network can empower Mitosis with high-speed, first-party financial data, enabling more secure, real-time interactions between users and cross-chain vaults.

As DeFi scales into a multi-chain future, infrastructure like Pyth is not just useful — it’s essential. And for Mitosis, this means reliable, up-to-the-second data to back every miAsset it mints. 🚀

Comments ()