Real-World Asset (RWA) Tokenization: Transforming Finance

Introduction

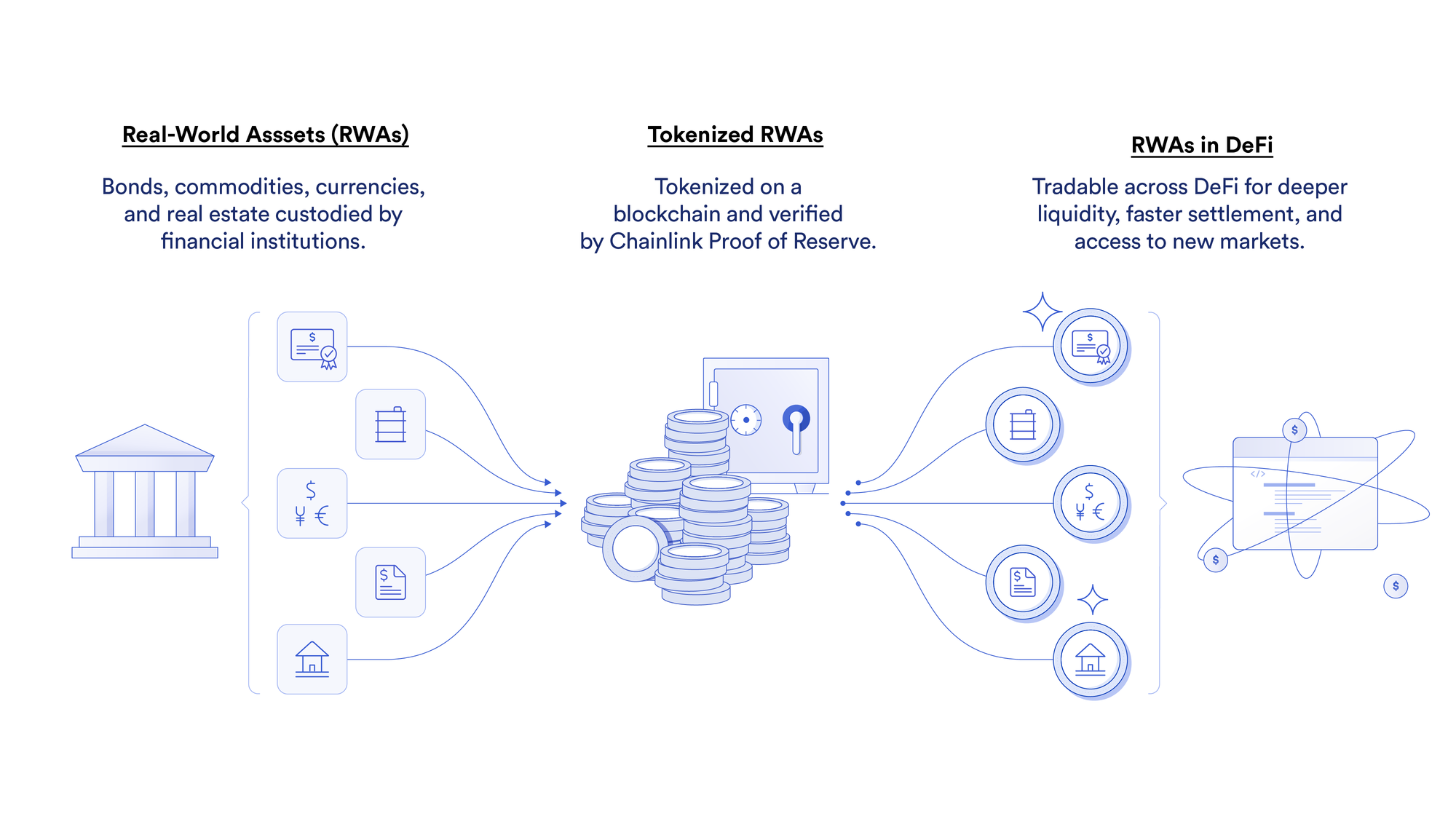

Real-World Asset (RWA) tokenization is revolutionizing the financial landscape by bridging traditional assets with blockchain technology. By converting physical and financial assets—such as real estate, commodities, bonds, and art—into digital tokens on a blockchain, tokenization enhances liquidity, accessibility, and transparency. The tokenized RWA market, excluding stablecoins, grew to $15.2 billion by December 2024, with projections estimating a market size of $10–16 trillion by 2030 Chainlink, 2025. This article explores the mechanics, benefits, challenges, and future of RWA tokenization, supported by recent developments and expert insights.

What is RWA Tokenization?

RWA tokenization involves representing ownership rights of tangible or intangible assets as digital tokens on a blockchain. These assets include:

- Tangible Assets: Real estate, commodities (e.g., gold, oil), vehicles, and machinery.

- Intangible Assets: Bonds, equities, intellectual property, royalties, and carbon credits.

Tokens are typically created using standards like Ethereum’s ERC-20 (for fungible tokens) or ERC-721 (for non-fungible tokens, NFTs). For instance, a real estate property can be tokenized into 100,000 tokens, each representing a fractional ownership share, enabling investors to buy portions of the asset. This process leverages blockchain’s immutability, transparency, and security to streamline asset management and trading.

How Tokenization Works

The tokenization process involves several steps:

- Asset Selection and Valuation: Identify the asset (e.g., a commercial building) and appraise its fair market value through professional valuation.

- Legal and Regulatory Compliance: Ensure the asset’s ownership is verified and complies with local regulations, such as SEC registration for securities in the U.S. or MiCA in the EU.

- Asset Structuring: Define ownership rights, revenue-sharing terms, and token specifications (e.g., fungible or non-fungible).

- Blockchain Selection: Choose a suitable blockchain, such as Ethereum for its robust smart contract functionality or XRP Ledger for fast, low-cost transactions.

- Smart Contract Development: Create smart contracts to govern token issuance, transfers, and compliance, automating processes like dividend payments.

- Token Issuance and Distribution: Issue tokens via a Security Token Offering (STO), private sale, or public offering, then list them on exchanges for trading.

Benefits of RWA Tokenization

Tokenization offers transformative advantages over traditional asset management:

1. Enhanced Liquidity

Traditionally illiquid assets, like real estate or fine art, become tradable through fractional ownership. For example, Lofty’s platform allows investors to buy tokens representing shares in rental properties, enabling cash-out in seconds without intermediaries Nasdaq, 2024. This democratizes access to high-value markets.

2. Increased Accessibility

Fractionalization lowers the entry barrier for investors. Instead of needing millions to buy a Warhol painting, investors can purchase tokenized shares for as little as $200, as seen with Freeport’s tokenized art offerings Sygnum Bank, 2024.

3. Transparency and Security

Blockchain’s immutable ledger ensures transparent ownership records, reducing fraud risks. Chainlink’s Proof of Reserve provides real-time verification of off-chain reserves backing tokenized assets, enhancing trust Chainlink, 2025.

4. Reduced Transaction Costs

By eliminating middlemen like brokers and clearinghouses, tokenization lowers fees. XRP Ledger, for instance, offers transaction finality in 3–5 seconds at fractions of a cent, ideal for high-volume trading InvestaX, 2025.

5. Global Reach

Tokenized assets can be traded 24/7 across borders, attracting a global investor base. Platforms like InvestaX have facilitated RWA investments for users in over 177 countries InvestaX, 2025.

Key Use Cases

RWA tokenization is reshaping multiple industries:

1. Real Estate

Tokenized real estate enables fractional ownership, making property investment accessible. Propy integrates with real estate professionals to ensure compliance, while Blocksquare’s SPRING protocol digitizes property values into up to 100,000 tokens Tangem Blog, 2025. In 2024, tokenized real estate on Ethereum alone reached $6.5 billion.

2. Commodities

Tokenized commodities, like gold and oil, offer liquidity and accessibility. The tokenized gold market surpassed $1 billion in 2024, with platforms like Paxos issuing gold-backed tokens Sygnum Bank, 2024.

3. Art and Collectibles

Tokenizing artworks and collectibles democratizes the art market. Freeport’s fractionalized Warhol paintings and Energy Web’s tokenized renewable energy assets on Polkadot illustrate this trend, Nasdaq, 2024.

4. Financial Instruments

Tokenized U.S. Treasuries and private credit are booming, with yields attracting both retail and institutional investors. BlackRock’s BUIDL fund, launched in March 2024, sparked a surge in tokenized treasury adoption, with over 90% of RWA total value locked (TVL) in yield-bearing assets InvestaX, 2025.

5. Cross-Border Payments

Stablecoins, a subset of RWAs, facilitate efficient cross-border transactions. Ripple’s RLUSD aims to tokenize assets like real estate and commodities, enhancing payment networks Chainlink, 2025.

Challenges and Barriers

Despite its potential, RWA tokenization faces hurdles:

1. Regulatory Uncertainty

Legal frameworks for tokenized assets are evolving. The EU’s MiCA regulation provides clarity, but jurisdictions like the U.S. face ambiguity, complicating compliance. Tokens representing securities may require SEC registration, adding complexity, Sygnum Bank, 2024.

2. Legal Ownership vs. Token Ownership

There’s no universal legal recognition linking token ownership to real-world asset ownership. Enforcing ownership rights often requires lawsuits, undermining blockchain’s trustless nature Nasdaq, 2024.

3. Security Risks

Digital assets are vulnerable to hacking and fraud. Robust custody solutions and identity verification, like Chainlink’s DECO protocol, are critical to mitigate risks Chainlink, 2025.

4. Liquidity Paradox

While tokenization aims to enhance liquidity, low volatility in RWAs can deter crypto traders who thrive on price swings, potentially limiting trading activity InvestaX, 2025.

5. Interoperability

Tokenized assets on different blockchains need seamless transferability. Projects like Polkadot and LayerZero are addressing this through cross-chain solutions, but standardization remains a challenge, Tangem Blog, 2025.

Future Outlook

The RWA tokenization market is poised for exponential growth, with projections of $10 trillion by 2030 from Roland Berger and $16 trillion from Boston Consulting Group Sygnum Bank, 2024. Key trends shaping the future include:

- Interoperability Solutions: Polkadot, Cosmos, and LayerZero will enhance cross-chain asset transfers, creating a global tokenized market.

- Regulatory Clarity: The EU’s MiCA and UK’s regulatory frameworks will accelerate adoption, with other jurisdictions likely to follow.

- DeFi Integration: RWA-backed DeFi protocols, like Pendle’s tokenized yield trading, will offer new yield opportunities, bridging TradFi and DeFi.

- Sustainability: Tokenized carbon credits and renewable energy assets, as seen with Energy Web on Polkadot, align with ESG goals Tangem Blog, 2025.

Conclusion

RWA tokenization is a game-changer, merging the stability of traditional assets with blockchain’s efficiency. By unlocking liquidity, democratizing access, and streamlining transactions, it’s redefining finance. However, regulatory, legal, and technical challenges must be addressed to realize its full potential. With institutional backing, innovative platforms, and evolving regulations, RWA tokenization is set to transform global markets, offering unprecedented opportunities for investors and asset owners.

References

- Chainlink. (2025). Real-World Assets (RWAs) Explained.

- Nasdaq. (2024). How Is RWA Tokenization Disrupting Industries?

- Tangem Blog. (2025). Top 10 Real World Assets (RWA) Crypto in April 2025.

- Sygnum Bank. (2024). Is the tokenization of real-world assets going mainstream?

- InvestaX. (2025). 2024: The Year of Institutional Real World Asset Tokenization.

About Mitosis:

Mitosis APP

Blog

Docs

X

Discord

Comments ()