Revolutionizing Liquidity and Governance: Mitosis’s Role in the Future of Decentralized Finance

In the fast space of decentralized finance (DeFi), one of the biggest hurdles we face is the issue of fragmented liquidity and inefficient capital flows. Enter Mitosis—a blockchain-based protocol that’s here to tackle these challenges head-on. It’s not just another tool for programmable liquidity; it’s truly a game-changer in how DeFi protocols manage assets, liquidity, and governance. In this article, we’ll explore the standout features of Mitosis and see how they address critical issues in the DeFi space, from liquidity fragmentation to the centralization of governance. See https://docs.mitosis.org/docs/learn/what-is-mitosis

1. Programmable Liquidity: A DeFi Revolution

Mitosis’s programmable liquidity really sets it apart from a lot of the existing options in the DeFi space. Unlike traditional liquidity pools where providers often find themselves locking up their assets with minimal flexibility, Mitosis introduces a more dynamic approach. It allows liquidity providers to craft personalized liquidity profiles using miAssets. These programmable tokens are directly tied to liquidity provisions, which means they can be traded, transferred, or utilized in various DeFi applications across different chains.

In a nutshell, Mitosis is changing the game when it comes to managing liquidity, making it more adaptable and efficient. The liquidity turns into a flexible asset that can be moved or used across blockchains without losing its value or integrity. One of the standout advantages of this method is its cross-chain compatibility. For instance, liquidity from Ethereum can be effortlessly transferred to Polkadot or Binance Smart Chain without the hassle of expensive and time-consuming bridges. This helps to eliminate bottlenecks and reduce liquidity fragmentation, ultimately boosting the overall efficiency of the DeFi ecosystem.

As Mitosis continues to evolve, it has the potential to become the go-to protocol for liquidity management across various ecosystems, enhancing both accessibility and efficiency for DeFi applications. Could Mitosis’s innovative approach to liquidity set a new benchmark for all DeFi platforms? For more details, be sure to check out the Mitosis Litepaper. See https://blog.mitosis.org/

2. Matrix Vaults: Tailored Liquidity Solutions

Let’s talk about Matrix Vaults, a standout feature of Mitosis that’s shaking things up in the DeFi space. These vaults give liquidity providers the chance to dive right into DeFi protocols and set their own terms for liquidity—think lock-up periods, risk levels, and reward setups. Unlike traditional liquidity pools, where your assets can be tossed around by market swings, Matrix Vaults provide a more customized, secure, and reliable way to earn yields.

But that’s not all! Matrix Vaults also lets liquidity providers have a voice in governance decisions for the protocols they back. By holding governance tokens tied to their liquidity contributions, participants in Mitosis’s Matrix Vaults can influence everything from protocol development to how yields are distributed. This decentralized governance approach puts power in the hands of users, ensuring that liquidity is spread out among a diverse group of stakeholders instead of being hoarded by a few big players. It’s a fresh perspective on liquidity provision in DeFi, making it more democratic and community-focused. See https://university.mitosis.org/page/2/

How Matrix Vaults Work

Matrix Vaults function in two main phases: before and after the Mitosis Mainnet launch.

Before Mitosis Mainnet

- Matrix Vaults are set up on each supported network, like Ethereum, Arbitrum, Linea, and others.

- Users can deposit their assets into these Matrix Vaults according to their chosen network.

- In exchange, they receive maAssets, which serve as receipt tokens for their deposits.

- These maAssets are designed to generate a variety of rewards for users.

After Mitosis Mainnet

Once the Mitosis Mainnet is live, Matrix Vaults shift to the Mitosis L1 chain, enabling native asset deposits.

- Users can deposit assets into Mitosis Vaults across different networks (for instance, putting weETH from Arbitrum into the Mitosis Vault on Arbitrum).

- In return, they get Vanilla Assets on the Mitosis L1 mainnet.

- These Vanilla Assets can then be deposited into Matrix Vaults on Mitosis L1.

- Users will receive maAssets on the Mitosis L1 mainnet, which represents their deposits.

- These maAssets keep generating a range of DeFi rewards.

This organized approach allows Matrix Vaults to function as efficient liquidity pipelines, ensuring that liquidity flows smoothly across DeFi ecosystems while offering excellent yield opportunities. See https://docs.mitosis.org/docs/learn/matrix/intro

So, does this new approach hint at a move towards more sustainable liquidity pools in DeFi? Could it open doors for longer-term capital commitments across various platforms?

3. Ecosystem-Owned Liquidity (EOL): A Community-Focused Model

Mitosis is shaking things up with its Ecosystem-Owned Liquidity (EOL) Vault concept, which takes a fresh look at how liquidity works in DeFi. Instead of letting centralized entities or big institutional investors call the shots, Mitosis empowers the community to own and manage liquidity pools. This groundbreaking approach not only promotes fairness but also reduces the chances of manipulation by those large stakeholders who often sway the market with their hefty investments.

So, what does this look like in action? Well, Mitosis users come together to oversee the liquidity within the system, creating a more decentralized and secure space for everyone involved. The liquidity is spread out more evenly, and the community gets to make decisions about how it’s allocated through governance mechanisms. This could be a game-changer for the sustainability of DeFi ecosystems, helping to lessen the impact of whales and centralized control.

The EOL model really sets itself apart from platforms like Aave and Compound, where a handful of big liquidity providers have a lot of influence over governance and liquidity distribution. By transferring liquidity ownership to the wider community, Mitosis might just pave the way for more inclusive and transparent DeFi platforms.

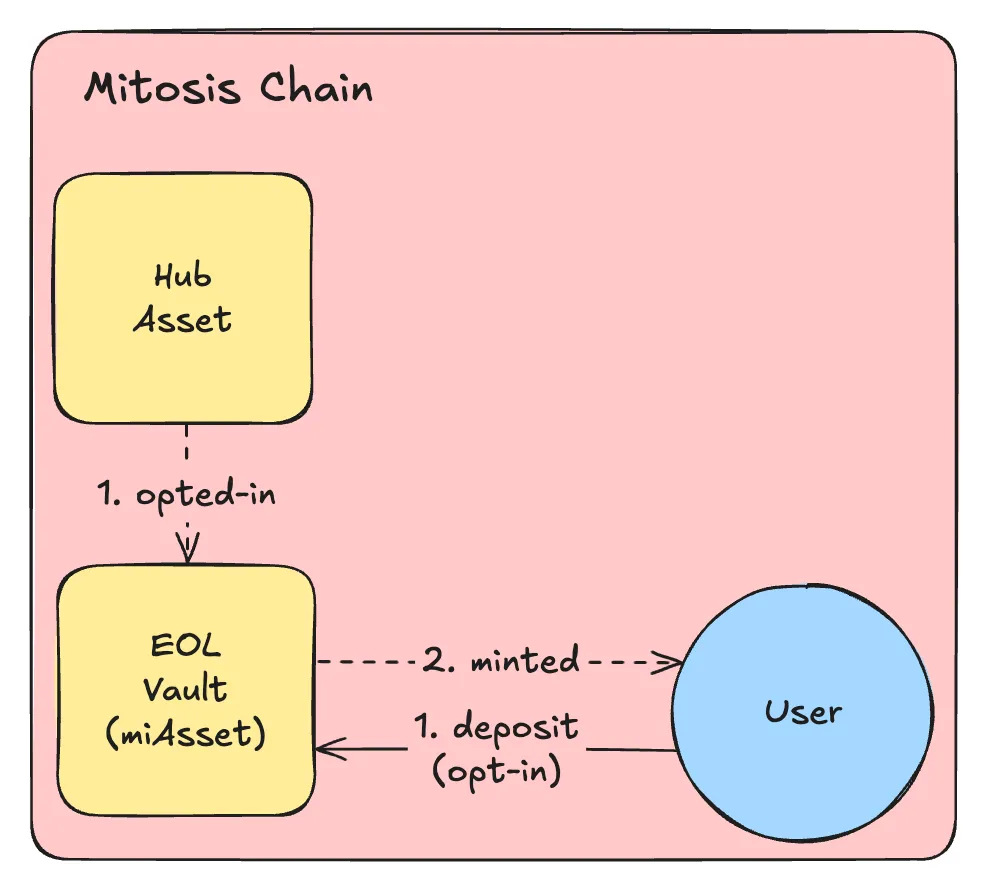

To deepen our understanding of the EOL Vault, refer to the diagram below with proper explanation.

If you're looking to get involved with the EOL Vault on the Mitosis Chain, here's how it works. By opting in, users can deposit their hub assets, which lets them take part in the EOL mechanism while still having access to yield-bearing assets.

When it comes to compliance, the EOL Vault follows the ERC20 standard and incorporates ERC4626 interfaces. This means it plays nicely with a variety of DeFi protocols and makes managing assets within the vault more efficient. Each miAsset, like miETH, is backed by its corresponding hub asset, such as ETH.

Now, if you decide to leave the EOL Vault, you can do so through an "opt-out" process, which allows you to get back your deposited hub assets. Just keep in mind that this isn't an instant process—there might be a bit of a wait depending on how the vault operates, yield settlements, or liquidity conditions.

Opt-in

The diagram above exemplifies the opt-in process for the EOL Vault on the Mitosis Chain and is designed to let users deposit ETH and earn a yield-bearing asset in return.

Deposit of Hub Asset (ETH)

First, a user puts 1 ETH into the EOL Vault. This ETH is then used within the EOL mechanism, which helps to generate returns or manage risk exposure

Minting of Yield-Bearing Asset (miETH)

Once the ETH is deposited, the user gets miETH back. But here’s the catch: miETH doesn’t represent a 1:1 value with ETH. Its worth changes based on how much yield is accumulated and any losses that might occur over time

Dynamic Adjustment of miETH

The amount of miETH a user receives is tied to how well the vault is performing. For example, if someone deposits 1 ETH, they might end up with just 0.9 miETH. This reflects the adjustments happening due to ongoing yield generation and risk management within the vault.

This system is designed to ensure that users in the EOL Vault can take advantage of yield opportunities while also being mindful of any risks that come with the underlying assets. See https://docs.mitosis.org/docs/developers/protocol/eol-vault

Opt-Out

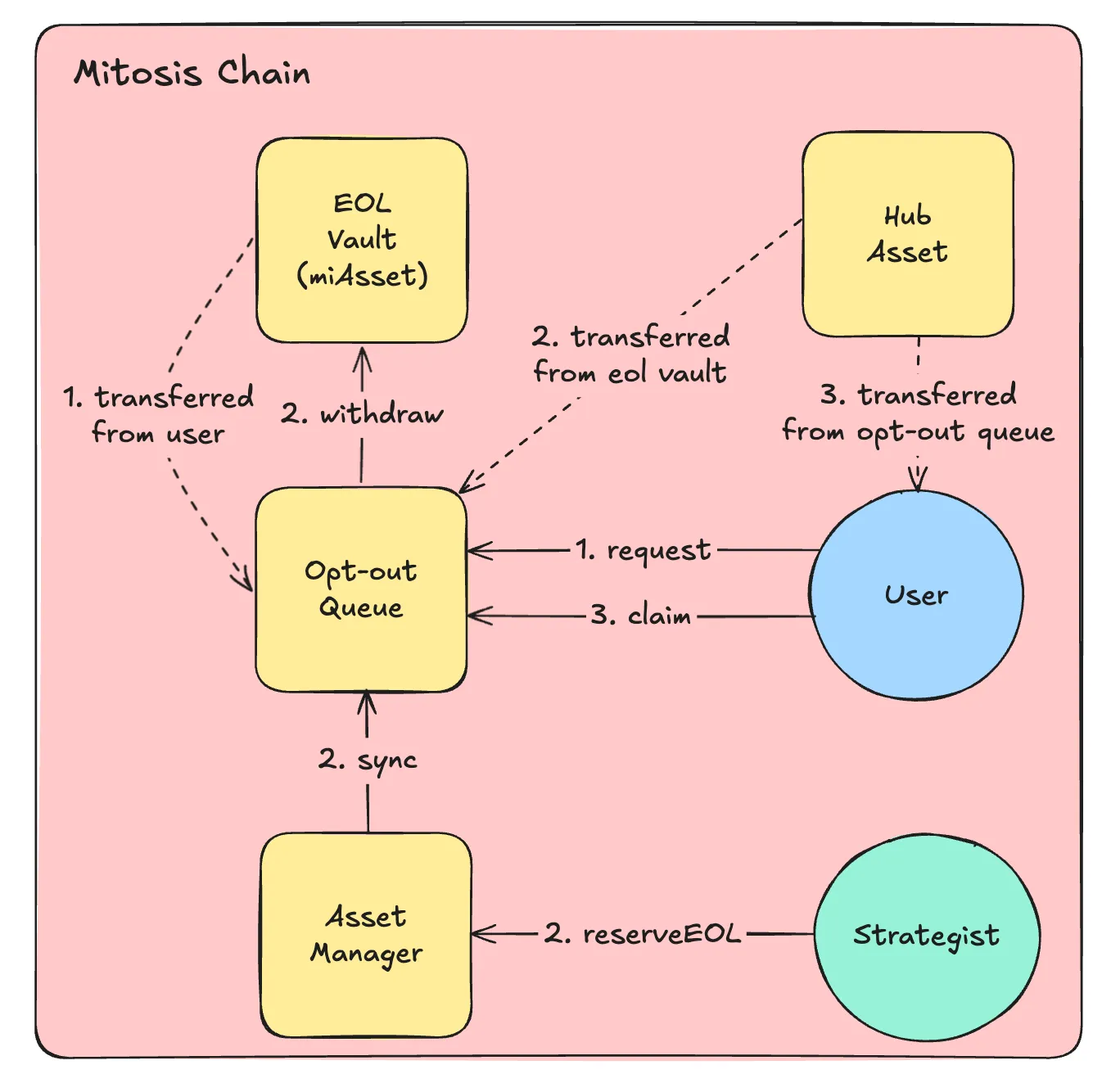

The Opt-Out Process: Withdrawing Assets from the EOL Vault

After taking part in Mitosis’ EOL Vault, users might want to reclaim their original hub assets through an opt-out process. But keep in mind, that this withdrawal isn’t instantaneous—it operates on a structured queue system that helps manage liquidity while keeping the vault’s operations running smoothly.

Initiating the Opt-Out Request

If a user wants to withdraw, they need to submit a request to the Opt-out Queue, indicating how much miETH they wish to redeem. Once that’s done, the equivalent amount of miETH is transferred from the user’s balance to the Opt-out Queue, marking their exit from the vault.

Liquidity Verification & Reservation

Not all assets in the vault can be withdrawn right away—many are actively used in EOL strategies. A strategist keeps an eye on the available liquidity and looks for any idle assets that aren’t currently allocated. If there are enough funds, the strategist reserves liquidity using reserveEOL(), ensuring that the necessary hub asset (ETH) is set aside for withdrawal.

The 7-Day Waiting Period

To keep things stable, users need to wait at least seven days before their opt-out request is finalized. This waiting period allows for liquidity adjustments, and yield distributions, and makes sure that everything is properly accounted for before any withdrawal takes place.

Claiming the Hub Asset (ETH)

Once the opt-out request is processed, meaning liquidity has been reserved and the waiting period is over, the user can claim their original hub asset. For instance, if a user initially deposited 1 ETH and held 0.9 miETH, they’ll now be able to withdraw 1 ETH from the opt-out queue. At this stage, their participation in the EOL Vault is completely wrapped up.

This organized withdrawal process ensures that the EOL Vault stays balanced, offering fair access to liquidity while maintaining efficiency for all users. It also highlights the importance of strategic asset management, allowing participants to exit with minimal impact on the system’s overall health. Could this innovative system be the key to achieving a truly decentralized financial ecosystem?

4.Cross-Chain Interoperability: Breaking Down Barriers

Cross-chain interoperability is a game-changer for Mitosis. In a space where various blockchains function independently, the ability to interact seamlessly between them is more important than ever. Mitosis tackles this challenge head-on by providing a cross-chain infrastructure that enables assets to flow smoothly across different blockchain networks, all while maintaining top-notch security and efficiency.

This capability is especially valuable because it removes the hassle of complicated and often sluggish bridges that can lead to delays or security risks. While projects like Thorchain and Cosmos have made strides in this area, they still face limitations due to technical hurdles and liquidity issues. Mitosis sets out to overcome these challenges by connecting multiple blockchain ecosystems and fostering genuine interoperability among them.

Cross-chain liquidity is vital for the growth of DeFi, ensuring that resources are available where they’re needed most. With its emphasis on smooth cross-chain transactions, Mitosis could emerge as a significant player in the interoperability landscape. Could this improved interoperability be the spark that ignites the next wave of decentralized applications? See https://university.mitosis.org/cross-chain-liquidity-management-how-mitosis-unifies-defi-liquidity/

5.Real-World Applications: Mitosis Beyond DeFi

While Mitosis is mainly recognized for its groundbreaking DeFi applications, its potential stretches far beyond that. With a strong emphasis on liquidity flexibility, governance, and cross-chain interoperability, Mitosis could find applications in various fields like supply chain management, decentralized identity systems, and data privacy.

Take Filecoin and Arweave, for example. They’ve developed decentralized data storage solutions, but they haven’t quite nailed liquidity management the way Mitosis has. Imagine if Mitosis could empower decentralized applications (dApps) in these areas to tap into a larger pool of liquidity, making them more accessible to a broader audience of users and developers.

Could Mitosis become a foundational layer for different industries, enabling decentralized applications and services beyond just DeFi?

In conclusion, Mitosis is pushing the envelope on what’s achievable in DeFi and beyond. Its combination of programmable liquidity, community-driven governance, and cross-chain interoperability sets it apart as a unique answer to many challenges currently facing decentralized finance. That said, its success hinges on how effectively it can weave these features into existing ecosystems and encourage widespread adoption. Will it genuinely revolutionize liquidity management in DeFi? And how will its governance model adapt as more stakeholders join the fold? As the DeFi space continues to evolve, Mitosis is key in shaping how liquidity is managed and governed across various chains.

Will Mitosis take the lead in cross-chain liquidity management, or will hurdles like adoption and scalability hold it back? How can other projects leverage Mitosis’s achievements to foster a truly decentralized financial ecosystem? I would appreciate your answers to the above questions in the comments.

Comments ()