RWA + Mitosis: Powering Liquidity for the Real World Asset Revolution in Multichain DeFi

1. Introduction

A New Era in Finance: Tokenization of Real World Assets (RWA)

We are on the cusp of one of the most significant transformations in the financial world – the tokenization of Real World Assets (RWA). Imagine being able to trade fractional shares of real estate, art, private equity, bonds, or even intellectual property as easily as we trade cryptocurrencies today – 24/7, globally, with enhanced transparency and efficiency. This is the promise of RWA.

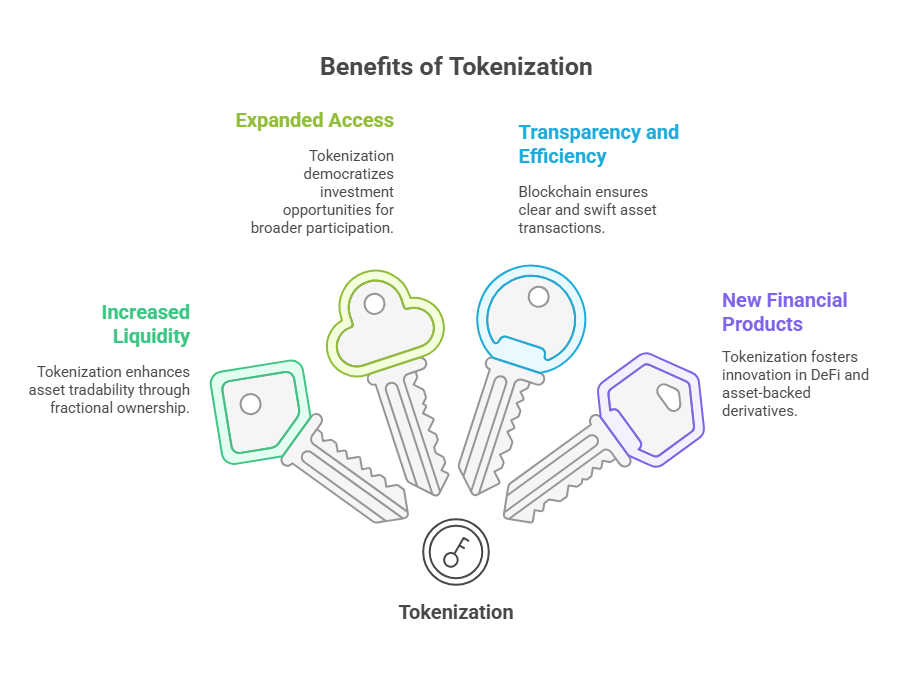

Tokenization is the process of converting rights to a real-world asset into a digital token on a blockchain. This trend is gaining momentum for several reasons:

- Increased Liquidity: Makes traditionally illiquid assets (e.g., real estate) more accessible for trading and investment through fractionalization.

- Expanded Access: Lowers the entry barrier for investors, allowing participation in markets previously accessible only to large institutional players.

- Transparency and Efficiency: Blockchain provides an immutable record of ownership and transactions, reducing intermediary costs and increasing settlement speed.

- New Financial Products: RWA pave the way for innovative DeFi protocols that use real-world assets as collateral, the basis for derivatives, etc.

It's no surprise that major financial institutions and forward-thinking Web3 projects are actively exploring and implementing RWA. The potential market size is estimated in the trillions of dollars.

Multichain Challenges for RWA: Fragmentation and Complexity

However, as RWA begin their journey into the digital world, they face the same problems inherent in the entire Web3 ecosystem, especially in a multichain context:

- RWA Liquidity Fragmentation: A tokenized real estate property might exist on Ethereum, a private equity fund on Polygon, and debt instruments on a specialized L1. This creates isolated liquidity pools for each RWA, hindering their efficient trading and price discovery.

- Complexity of Use in DeFi: How can an RWA token from one network be used as collateral in a lending protocol on another? How can its seamless participation in multichain DeFi strategies be ensured?

- Security of High-Value Asset Transfers: RWA often represent high-value assets. Their movement between networks must be maximally secure to avoid risks associated with traditional bridge vulnerabilities.

- Standardization and Interoperability: The lack of uniform standards for RWA tokens and their metadata across different blockchains complicates their integration and interaction.

These challenges can significantly slow down RWA adoption and limit their potential if effective infrastructure solutions are not found.

Mitosis: Providing Liquidity and Connectivity for RWA

This is precisely where Mitosis enters the scene. As a liquidity protocol initially designed to solve fragmentation problems and enable the secure movement of assets in a multichain environment, Mitosis can become a key infrastructure element for the RWA ecosystem to thrive.

Mitosis's ability to efficiently move value between different blockchains, provide liquidity through its Ecosystem-Owned Liquidity (EOL) model, and guarantee a high level of security via EigenLayer AVS integration makes it an ideal candidate for "greasing the wheels" of the RWA economy in Web3.

What Will You Learn From This Article?

In this article, we will explore in detail how Mitosis can contribute to the growth and integration of tokenized real-world assets in multichain DeFi:

- What specific RWA problems does Mitosis solve?

- How can the EOL model provide the necessary liquidity for trading and using RWA tokens?

- Why is Mitosis's security critically important for transferring high-value RWA?

- Potential use cases for Mitosis in the RWA ecosystem (cross-chain collateralization, RWA derivative markets, etc.).

Get ready to learn how Mitosis is helping to connect the world of real-world assets with the world of decentralized finance, creating new opportunities for investors and paving the way for a more efficient and accessible global financial system.

2. Mitosis as a Solution for Multichain RWA: Liquidity, Security, Accessibility

The tokenization of Real World Assets (RWA) holds immense potential, but its success in the multichain space directly depends on the availability of infrastructure capable of handling its unique challenges. Mitosis, thanks to its architecture and key features, offers solutions to these problems.

1. Overcoming RWA Liquidity Fragmentation with EOL

- The Problem: Tokenized RWA issued on different blockchains suffer from low liquidity. An investor holding tokenized real estate on network A might find it difficult to find a buyer or use that asset in a DeFi protocol on network B. This limits the utility of RWA.

- The Mitosis Solution (Ecosystem-Owned Liquidity - EOL):

- Creating Cross-Chain RWA Liquidity Pools: Mitosis, by managing its own liquidity (EOL), can create or support liquidity pools for popular RWA tokens between different networks. This means a user could swap their RWA token from network A for a stablecoin or another asset on network B via Mitosis, which would provide the liquidity for this operation.

- Stimulating Early Liquidity: For new, freshly tokenized RWA, Mitosis can use part of its EOL to "seed" initial liquidity, making these assets more attractive for trading and use from the outset.

- Reducing Reliance on Market Makers: Instead of relying solely on traditional market makers to provide RWA liquidity on every separate exchange or protocol, Mitosis can act as a decentralized liquidity provider accessible across different networks.

The Result: RWA become more liquid and interchangeable in the multichain space. Investors gain more opportunities to trade and utilize their tokenized real-world assets.

2. Ensuring Secure Transfer of High-Value RWA

- The Problem: Real-world assets often have high value. Tokenized commercial real estate or a bond portfolio can be worth millions of dollars. Moving such valuables across standard cross-chain bridges with their known vulnerabilities poses a huge risk.

- The Mitosis Solution (Security Based on EigenLayer AVS):

- Ethereum's Cryptoeconomic Security: Mitosis utilizes Actively Validated Services (AVS) from EigenLayer. This means the security of its cross-chain messages, and therefore asset transfers, is backed by the economic stake of Ethereum validators. The cost of attacking such a system is extremely high.

- Trust Minimization: Instead of trusting a small group of bridge operators, Mitosis's security is based on a decentralized set of AVS operators with strong economic incentives to act honestly.

- Protection Against Known Attack Vectors: As discussed in previous articles, Mitosis's architecture considers the lessons from past bridge hacks, aiming to prevent key compromises, logic errors, and other common vulnerabilities.

The Result: RWA owners and issuers gain a more reliable and secure way to move their high-value tokenized assets between different blockchains, which is critically important for trust and the development of the RWA market in DeFi.

3. Simplifying the Use of RWA in Cross-Chain DeFi

- The Problem: Even if an RWA token exists on multiple blockchains, using it in DeFi protocols on these different networks can be cumbersome. Users need to manually move the asset, pay fees, and deal with different interfaces.

- The Mitosis Solution (Seamless Transfers and Potential for Abstraction):

- Efficient Transfers: Mitosis enables fast and (potentially) inexpensive transfers of RWA tokens between networks. This allows users to quickly move their tokenized asset to where it can be used most profitably (e.g., as collateral for a loan at a lower interest rate or to participate in a yield program).

- Infrastructure for dApps: DeFi application developers can integrate Mitosis to allow their users to utilize RWA from other networks directly within their protocol. For example, a lending protocol on network A could accept RWA tokens located on network B as collateral, using Mitosis for their "virtual" movement or locking.

- Foundation for Intent Systems: As discussed earlier, Mitosis can serve as the foundation for intent-based systems that can automatically find the best ways to use RWA in multichain DeFi according to user requests (e.g., "find the best way to earn yield on my tokenized bonds").

The Result: RWA become more composable and useful within the entire DeFi ecosystem. The barrier to entry for using real-world assets in decentralized finance is lowered, opening up new investment and yield strategies.

Thus, Mitosis not only solves general cross-chain problems but also offers specific advantages for the burgeoning RWA market, facilitating its integration into the multichain future of Web3.

3. Future Scenarios and Conclusion: Mitosis as a Bridge Between Worlds

Potential Use Cases for Mitosis in the RWA Ecosystem

The integration of Mitosis with the world of tokenized real-world assets opens up numerous exciting use cases that could fundamentally change the landscape of both DeFi and traditional finance:

- Cross-Chain RWA Collateralization:

- Scenario: An investor owns tokenized real estate (an RWA token) on blockchain A but wants to take out a stablecoin loan on a lending platform operating on blockchain B, which offers more favorable terms.

- Role of Mitosis: Mitosis allows for the secure "movement" or value attestation of this RWA token for use as collateral on blockchain B. This could be implemented through wrapped versions of RWA tokens transferred via Mitosis, or through more complex cross-chain escrow mechanisms where Mitosis provides communication and verification.

- Benefit: Increases capital efficiency for RWA owners, expands the choice of lending platforms.

- Global RWA Derivative Markets:

- Scenario: Creation of derivative products (futures, options) based on RWA, such as real estate indexes, bond baskets, or even tokenized art. These derivatives could trade on DEXs across various networks.

- Role of Mitosis: Mitosis provides the necessary liquidity and arbitrage opportunities for these RWA derivatives between different networks, contributing to the formation of unified and efficient markets. It could also be used for settling these derivatives if the underlying RWA or payment asset is on a different network.

- Multichain RWA Funds:

- Scenario: Creation of decentralized investment funds that invest in a diversified portfolio of RWA located on different blockchains.

- Role of Mitosis: Simplifies asset management for such funds, fundraising from investors across different networks, and profit distribution. Mitosis can be used for portfolio rebalancing by moving RWA tokens or liquidity between networks.

- Improving Access to Yield from RWA:

- Scenario: Protocols generating yield from real-world assets (e.g., from renting out tokenized real estate or from coupon payments on tokenized bonds) might exist on one blockchain, while users wishing to access this yield are on another.

- Role of Mitosis: Allows users to easily invest in such yield-bearing RWA products by transferring their stablecoins or other assets via Mitosis to the target network, and just as easily withdraw their earned profits.

Mitosis: Building a Bridge Between TradFi and DeFi

The integration of RWA into DeFi is not just another trend; it's a potential merger of traditional finance (TradFi) with the world of decentralized finance. This unlocks access to trillions of dollars of capital locked in real-world assets for DeFi's innovation and efficiency. In turn, DeFi offers transparency, accessibility, and new financial instruments for RWA.

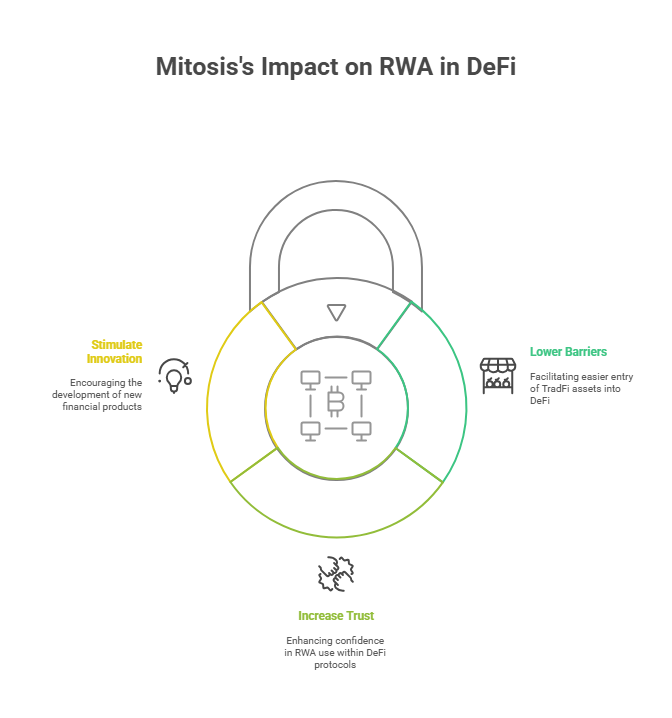

In this process, Mitosis acts as a critically important bridge – not only between blockchains but also between these two worlds. By providing secure and liquid infrastructure for the movement and use of RWA tokens, Mitosis helps to:

- Lower barriers for TradFi assets to enter DeFi.

- Increase trust in using RWA within decentralized protocols.

- Stimulate innovation in creating new financial products at the intersection of RWA and DeFi.

Conclusion: Mitosis and the Future of Real-World Asset-Backed Finance

The tokenization of real-world assets has the potential to become one of the main growth drivers for the entire Web3 ecosystem. However, realizing this potential requires reliable, secure, and efficient infrastructure capable of handling the challenges of a multichain environment.

Mitosis, with its unique Ecosystem-Owned Liquidity model, focus on security through EigenLayer AVS, and commitment to seamless cross-chain interaction, offers precisely such solutions. It can become the very "connective tissue" that provides the necessary liquidity, security, and accessibility for tokenized real-world assets in a world of multiple blockchains.

As the RWA market grows and matures, the role of protocols like Mitosis will only increase. They not only facilitate the technical aspects of asset movement but also lay the foundation for a new, more integrated, efficient, and accessible global financial system where the value of the real world and the innovation of the decentralized world work in synergy.

Learn more about Mitosis:

- Explore details on the official website: https://www.mitosis.org/

- Follow announcements on Twitter: https://twitter.com/MitosisOrg

- Participate in discussions on Discord: https://discord.com/invite/mitosis

- Read articles and updates on Medium: https://medium.com/mitosisorg

- Blog: https://blog.mitosis.org/

Comments ()