RWA Tokenization on Ethereum: The State of a Trillion-Dollar Revolution

Introduction

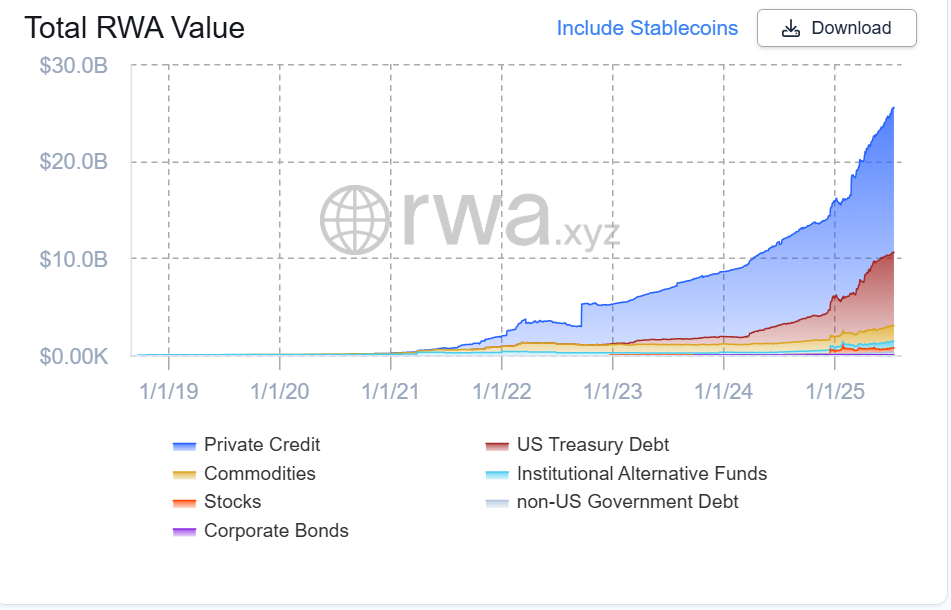

The tokenization of Real-World Assets (RWAs) marks a transformative intersection between traditional finance (TradFi) and decentralized finance (DeFi), unlocking trillions in value by bringing off-chain assets onto transparent, programmable blockchain infrastructure. As of mid-2025, the tokenized RWA market (excluding stablecoins) exceeds $24 billion an 80% increase from 2024 driven by institutional interest from players like BlackRock and crypto-native demand for stable, yield-bearing assets.

Ethereum has emerged as the dominant platform for RWAs, often described as the “institutional gravity well” due to its security, deep liquidity, and standardized token protocols (e.g., ERC-20, ERC-721). This article explores Ethereum’s critical role in enabling the RWA ecosystem, covering key asset classes including private credit ($14B), tokenized U.S. Treasuries ($6.6B), commodities, real estate, equities, collectibles, and newer frontiers like carbon credits, insurance, and intellectual property.

We examine the mechanics, platforms, risks, and enabling infrastructure that make tokenization viable, and how it transforms static real-world assets into programmable, composable building blocks for DeFi. As regulatory frameworks evolve, the future of RWAs rests on reconciling DeFi’s permissionless nature with real-world compliance on a path that could expand the market to $16 trillion by 2030 (Bold prediction, yeah😉)

Table 1: RWA Market Overview on Ethereum (H1 2025)

Asset Class | Market Size ($B) | Key Players | Growth Rate (YoY) |

|---|---|---|---|

Private Credit | 14.0 | Centrifuge, Maple Finance | 100% |

U.S. Treasuries | 6.6 | BlackRock (BUIDL), Superstate | 600% |

Commodities (Gold) | 1.3–1.6 | PAXG, XAUT | 50% |

Real Estate | 0.5 | RealT | 200% |

Equities | 0.5 | Backed Finance | 150% |

Collectibles | <0.1 | Artory, Tokeny | 300% |

Table 1: Snapshot of RWA market on Ethereum, H1 2025 (RWA.xyz).

Part I: The Foundation of On-Chain Real-World Assets

The Tokenization Process

Tokenizing RWAs involves a hybrid process bridging off-chain legal structures with on-chain technology:

- Off-Chain Formalization & Legal Structuring: Assets undergo professional appraisal to establish fair market value, followed by the creation of a bankruptcy-remote Special Purpose Vehicle (SPV) or LLC to legally hold the asset and ensure token holders’ rights are enforceable (SP Global).

- Asset Management & Secondary Trading: Off-chain, custodians manage physical assets or legal documentation, while on-chain tokens (e.g., ERC-20) can be transferred or traded on secondary markets, enhancing liquidity for assets like real estate or art (SP Global).

The process highlights that tokenization is a legal and operational bridge, not merely technical. Platforms like Securitize, acting as regulated transfer agents, maintain official records alongside blockchain ledgers, ensuring legal soundness (SP Global).

Ethereum’s Dominance

Ethereum’s leadership in RWA tokenization stems from:

- Network Effects and Liquidity: Home to liquid stablecoins like USDC and USDT, Ethereum facilitates nearly all RWA transactions (Phemex).

- Security: As the largest proof-of-stake blockchain, it offers unmatched economic security for high-value transactions (Phemex).

- Standardization: ERC-20 and ERC-721 standards ensure composability, allowing RWAs to integrate seamlessly with DeFi protocols like Aave or MakerDAO (Phemex).

Part II: Core RWA Categories

Private Credit: The Yield Powerhouse

Market Overview & Size

Private credit, valued at over $14 billion, accounts for over half the RWA market, driven by demand for stable, real-world yields of 8–12% (RWA.xyz). It connects on-chain liquidity with off-chain borrowers, such as SMEs, real estate developers, or crypto market makers, offering returns uncorrelated with crypto volatility (SP Global).

Operational Mechanics

Protocols facilitate lending by:

- Conducting rigorous credit assessments using on-chain (e.g., transaction history) and off-chain (e.g., financial statements) data.

- Encoding loan terms (interest rate, maturity, repayment schedule) into smart contracts.

- Allowing lenders to deposit capital into pools, with some protocols (e.g., TrueFi) requiring stakers to provide first-loss capital buffers to mitigate default risks (Gate.com).

Key Platforms

- Centrifuge (CFG): Tokenized over $440 million in assets, including invoices, mortgages, and royalties, with integrations into MakerDAO and Aave (Gate.com).

- Maple Finance: Specializes in uncollateralized lending to crypto market makers and institutions, with billions in originations (SP Global).

- Goldfinch: Targets emerging market fintechs, offering hybrid fund access and direct lending (Gate.com).

- Institutional Funds: Apollo’s ACRED and Hamilton Lane’s SCOPE bring private credit to accredited investors via Ethereum, leveraging Securitize (SP Global).

Table 2: Comparative Analysis of Leading Ethereum Private Credit Protocols

Protocol | Core Mechanism | Typical Borrower | Collateral Type | TVL/Origination Volume | Key DeFi Integrations |

|---|---|---|---|---|---|

Centrifuge | Asset-backed Securitization | SMEs, Real Estate Developers, Fintechs | Tokenized Invoices, Mortgages, Royalties | $400M TVL | MakerDAO (Sky), Aave |

Maple Finance | Uncollateralized Pool Lending | Crypto Market Makers, Hedge Funds, Institutions | Undercollateralized / Reputation-based | Billions in Originations | N/A (Direct Lending) |

Goldfinch | Hybrid Fund Access & Direct Lending | Emerging Market Fintechs, TradFi Creditors | Varies | Not Specified | Not Specified |

Table 2: Comparing leading Ethereum private credit protocols

Strategic Implications

Private credit’s stable yields make it a “killer app” for DeFi, bridging crypto’s demand for yield with off-chain capital needs. Its hybrid model combining permissioned TradFi frameworks with DeFi infrastructure sets a precedent for institutional adoption, balancing regulatory compliance with blockchain efficiency (SP Global).

U.S. Treasuries and Money Market Funds

Market Overview & Size

Tokenized U.S. Treasuries and money market funds, valued at $6.6 billion, are the fastest-growing RWA category, expanding from $100 million in 2023 to over $1 billion by 2024 (RWA.xyz). Led by BlackRock’s BUIDL ($2.8 billion) and Superstate’s USTB ($739 million), these products offer low-risk, regulated yields for institutional and crypto-native investors like DAOs (Ledger Insights).

Operational Mechanics

- Tokenization: Licensed asset managers hold treasuries in custodial accounts, issuing ERC-20 tokens that represent fractional ownership, often requiring KYC/AML compliance and high minimum investments (e.g., $5 million for BUIDL) (Ledger Insights).

- Record-Keeping: On-chain ledgers mirror traditional book-entry records maintained by regulated transfer agents like Securitize, ensuring legal compliance (Ledger Insights).

Key Platforms

- BlackRock’s BUIDL: A market leader, accumulating $2.8 billion, validating Ethereum for institutional RWAs (Ledger Insights).

- Franklin Templeton’s OnChain U.S. Government Money Fund: Targets institutional investors with stable yields (Ledger Insights).

- Superstate, WisdomTree, Hashnote, OpenEden: Expand liquidity with products like USTB and TBILL vault (Ledger Insights).

Strategic Implications

Tokenized treasuries act as a “Trojan Horse,” pulling TradFi into DeFi by offering familiar, low-risk assets on efficient blockchain rails. They set a yield benchmark, pressuring DeFi protocols to innovate (e.g., Pendle’s yield-stripping protocols) to compete with stable, risk-free returns (Ledger Insights).

Stablecoins: The RWA Bedrock

Market Overview & Size

Stablecoins, with a combined market cap of $217 billion, are the most significant RWA category, serving as the digital economy’s unit of account and medium of exchange. Tether (USDT) and USD Coin (USDC) dominate, with Ethereum hosting the majority of their activity.

Operational Mechanics

- Minting and Redemption: Issuers mint tokens backed by fiat reserves, redeemable at a 1:1 ratio through direct redemption by authorized institutions (Circle).

- Peg Stability: Maintained via market arbitrage, where traders buy/sell tokens to correct price deviations (e.g., buying USDC at $0.99 and redeeming at $1.00) (Tether).

- Reserve Transparency: Proof of Reserve (PoR) oracles verify collateral, enhancing trust (Chainlink).

Key Platforms

- USDT and USDC: Used in nearly all RWA transactions, offering liquidity and stability.

- DAI (MakerDAO): A hybrid stablecoin backed by RWAs like treasuries and private credit, integrating deeply with the RWA ecosystem.

Strategic Implications

Stablecoins are the “bloodstream” of the RWA ecosystem, enabling purchases, lending, and disbursements. Yield-bearing stablecoins like Ondo Finance’s USDY or OpenEden’s USDO blur lines between medium of exchange and investment, challenging non-yield-bearing alternatives (Phemex).

Commodities: Digitizing Gold

Market Overview & Size

The tokenized commodity market, valued at $1.3–1.6 billion, is dominated by gold, with tokens like PAXG and Tether’s XAUT ($827 million) offering redeemability and fractional ownership (RWA.xyz).

Operational Mechanics

- Redeemability: Tokens represent legal rights to physical gold, redeemable from issuer vaults, subject to minimum amounts and fees (RWA.xyz).

- Fractionalization: Enables retail investors to own fractions of gold, reducing barriers to entry and eliminating storage costs (RWA.xyz).

Key Platforms

- PAXG: Represents one troy ounce of gold, widely used in DeFi (RWA.xyz).

- Tether Gold (XAUT): Backed by Swiss-vaulted gold, available as ERC-20 and TRC-20 tokens (Tether).

Strategic Implications

Tokenized gold keeps capital within the crypto ecosystem during market volatility, transforming an unproductive asset into a programmable DeFi instrument (e.g., collateral in lending protocols) (RWA.xyz).

Real Estate: Unlocking Illiquidity

Market Overview & Size

Tokenized real estate, though nascent, could reach $1.4 trillion by 2026 by fractionalizing ownership and enabling secondary market trading. Current market size is approximately $0.5 billion (Spydra).

Operational Mechanics

- Tokenization: Properties are held in SPVs, with ERC-20 tokens representing fractional shares that pay rental income in stablecoins (Spydra).

- Liquidity: Secondary markets allow trading, transforming illiquid assets into tradable instruments (Spydra).

Key Platforms

- RealT: Tokenized over 200 U.S. residential properties, paying daily rental income in USDC (Spydra).

- Harbor, RedSwan: Focus on commercial real estate, expanding the market to institutional investors (Spydra).

Strategic Implications

Real estate tokenization democratizes access and enhances liquidity, creating a “liquid illiquid” asset class. Success requires vertically integrated platforms with expertise in property management and local regulations (Spydra).

Equities: Globalizing Ownership

Market Overview & Size

Tokenized equities, valued at $486 million, split into public stocks (24/7 trading, global access) and private equity (liquidity for illiquid assets) (RWA.xyz).

Operational Mechanics

- Public Stocks: Tokens like Backed Finance’s bCSPX (S&P 500 ETF) or bNVDA (NVIDIA stock) track prices via oracles, offering global access outside traditional market hours (Kraken).

- Private Equity: Security tokens manage cap tables, vesting schedules, and shareholder voting on-chain, enabling global Security Token Offerings (STOs) (Tokeny).

Key Platforms

- Backed Finance: Issues xStocks like bCSPX and bCOIN, tracking major equities (Kraken).

- Securitize, Polymath: Provide compliance frameworks for issuing security tokens (Tokeny).

Strategic Implications

Tokenization enhances accessibility for public stocks in underdeveloped markets and streamlines private equity management, reducing administrative overhead via smart contracts (Kraken).

Collectibles & Luxury Goods: The New Frontier

Market Overview & Size

This nascent market, valued at under $100 million, tokenizes high-value items like art, watches, and classic cars, using ERC-20 for fractional shares or ERC-721 for unique assets (RWA.xyz).

Operational Mechanics

- Fractionalization: Enables retail investment in multi-million-dollar assets (e.g., $1000 share of a $10 million artwork) (Tokeny).

- Provenance: Blockchain records ensure authenticity and ownership history, combating fraud (Tokeny).

Key Platforms

- Artory and Tokeny: Provide verified data and compliant ERC-3643 tokens for art, enabling fractional ownership (Tokeny).

- ChronoBase: Tracks luxury watch authenticity, ownership, and service history on Ethereum (Tokeny).

Strategic Implications

Tokenization democratizes access to alternative assets and enhances provenance, enabling new liquidity models like using art as DeFi collateral. The immutable digital passport reduces fraud risks (Tokeny).

Emerging Categories

Carbon Credits: Verifiable ESG Assets

- Concept: Tokenized carbon credits address inefficiencies in the voluntary carbon market by ensuring verifiability and preventing double-spending. Tokens are retired via burn addresses, creating auditable offset records (Carbon Credits).

- Mechanics: Credits from registries like Verra are tokenized (e.g., as BCT by Toucan Protocol) and traded on DEXs or retired for offsets (Carbon Credits).

- Key Players:

- Toucan Protocol: Pools credits into Base Carbon Tonne (BCT), creating a liquid, standardized market (Carbon Credits).

- KlimaDAO: Uses BCT-backed KLIMA tokens to drive demand for offsets, incentivizing projects like reforestation or renewable energy (Carbon Credits).

- Implications: Carbon credits enhance ESG investing on-chain, with smart contracts automating retirement and increasing transparency (Carbon Credits).

Insurance & Reinsurance: Parametric Policies

- Concept: Blockchain enables efficient, transparent insurance products, moving beyond intermediary-heavy traditional models (Beinsure).

- Mechanics: Parametric policies pay out based on predefined triggers (e.g., weather data for crop insurance), with smart contracts automating claims (Etherisc).

- Key Players:

- Implications: Tokenized insurance reduces costs and enhances accessibility, with parametric models offering instant payouts (Beinsure).

Intellectual Property: Monetizing Royalties

- Concept: Tokenizes future revenue streams from music, films, or patents, streamlining distribution and unlocking liquidity for creators (Tokeny).

- Mechanics: Smart contracts automate royalty payments based on usage data (e.g., streaming metrics), reducing unclaimed “black box” royalties (Tokeny).

- Examples: Platforms like Royal tokenize music royalties, allowing fans to invest in artists’ future earnings (Tokeny).

- Implications: IP tokenization empowers creators and investors, with smart contracts ensuring transparent, data-driven payouts (Tokeny).

Part III: Enabling Infrastructure

Oracles (Chainlink)

- Proof of Reserve (PoR): Verifies off-chain collateral (e.g., stablecoin reserves, gold vaults) in real-time, enhancing trust (Chainlink).

- Cross-Chain Interoperability Protocol (CCIP): Enables RWA token transfers across blockchains and L2s, unifying liquidity (Chainlink).

- Functions: Automates processes like dividend payments or loan liquidations based on off-chain events (Chainlink).

Layer 2 Solutions

L2s like Polygon and Base enhance scalability and reduce costs while inheriting Ethereum’s security. Projects like Hamilton Lane’s tokenized fund (Polygon) and Nayms’ reinsurance marketplace (Base) leverage L2s for efficiency.

Compliance Frameworks

- Permissioned Tokens: ERC-3643 restricts transfers to KYC/AML-compliant investors, ensuring regulatory compliance (Tokeny).

- Platforms: Securitize and Tokeny provide end-to-end solutions for investor onboarding, KYC/AML, and token management (Tokeny).

Part V: Challenges and Risks

Regulatory Gauntlet

- Unclear Securities Status: Inconsistent regulations across jurisdictions (e.g., U.S., EU) create a “legal fog,” deterring institutional adoption. Mitigation includes structuring offerings under exemptions like Reg D or using regulated platforms like Securitize (SP Global).

- Cross-Border Conflicts: Varying AML/KYC rules limit global access. Geo-fencing and jurisdiction-specific compliance can address this (SP Global).

- Legal Enforceability: On-chain ownership does not guarantee off-chain legal recourse. Robust SPVs and trusted trustees are critical, though court disputes over tokenized assets remain untested (SP Global).

Technical Risks

- Smart Contract Vulnerabilities: Bugs can lead to irreversible losses. Multiple independent audits and formal verification mitigate risks (Debut Infotech).

- Oracle Reliability: Inaccurate data can disrupt pricing or payouts. Decentralized oracles like Chainlink, with circuit breakers and time-weighted average prices, reduce manipulation risks (Debut Infotech).

- Custodial Failure: Off-chain mismanagement (e.g., theft, damage) renders tokens worthless. Reputable, insured custodians and regular audits are essential (Debut Infotech).

Market Structure Challenges

- Illiquid Liquidity: Compliance restrictions limit trading, leading to wide bid-ask spreads. Secondary market development is needed (Debut Infotech).

- Liquidity Fragmentation: Cross-chain interoperability (e.g., Chainlink’s CCIP) is critical to unify siloed liquidity pools (Debut Infotech).

- Composability Dilemma: Balancing regulatory compliance with DeFi’s permissionless nature requires innovative token standards like ERC-3643 (Debut Infotech).

Table 3: Risk & Mitigation Matrix for RWA Adoption on Ethereum

Risk Category | Key Risks | Mitigation Strategies |

|---|---|---|

Regulatory | Unclear securities status | Engage legal experts, use Reg D exemptions, leverage Securitize |

Regulatory | Cross-border legal conflicts | Geo-fencing, focus on jurisdictions like Switzerland |

Regulatory | Off-chain enforcement failure | Robust SPVs, trusted trustees, clear legal recourse |

Technical | Smart contract exploit | Multiple audits, formal verification |

Technical | Oracle manipulation/failure | Decentralized oracles, circuit breakers, time-weighted prices |

Technical | Custodial failure/fraud | Reputable custodians, regular audits, PoR |

Market Structure | Illiquid markets | Develop secondary markets, reduce compliance barriers |

Market Structure | Liquidity fragmentation | Cross-chain protocols like CCIP |

Table 3: Key risks and mitigations for scaling RWA adoption on Ethereum.

Part VI: The Future of RWAs

The RWA market’s $24 billion valuation is a fraction of its projected $16 trillion potential by 2030 (RWA.xyz). The next phase will see RWAs evolve from 'just' digital replicas to programmable building blocks, integrating with DeFi to create a new financial paradigm. Key drivers include:

- Regulatory Clarity: Harmonized global standards will unlock institutional capital (SP Global).

- Interoperability: Cross-chain solutions like Chainlink’s CCIP will unify markets (Chainlink).

- Composability: Protocols like Pendle, which separate yield from principal, exemplify the shift to programmable assets (Phemex).

Chart: Growth of the RWA Market on Ethereum

Stakeholder Guidance

- Issuers: Build robust SPVs, partner with trusted custodians, and ensure compliance with securities laws to attract institutional capital (SP Global).

- Investors: Conduct due diligence on assets, issuers, and tokenization stacks, prioritizing transparency and legal enforceability (SP Global).

- Infrastructure Providers: Develop tools like ERC-3643 or CCIP to solve the compliance-composability trilemma, enabling seamless DeFi integration (Tokeny).

Conclusion: A New Financial Paradigm

The tokenization of RWAs on Ethereum is redefining finance by merging real-world value with programmable logic. Stablecoins, private credit, and treasuries have laid the foundation, while emerging categories like carbon credits, insurance, and intellectual property expand the horizon. Overcoming regulatory, technical, and market challenges will unlock a trillion-dollar ecosystem, with Ethereum as the backbone of a composable, transparent financial future. Continued innovation in compliance, interoperability, and smart contract design is critical to sustaining this revolution. Stakeholders must act now to shape a financial system where assets are not just digitized but dynamically integrated into a global, programmable economy.

References

- Airvest. Real-world assets transition to integral DeFi components amid regulatory shifts. https://www.airvest.com/news/real-world-assets-transition-integral-defi-components-regulatory-shifts-2507/

- Beinsure. How tokenization is reshaping the insurance & financial industry. https://beinsure.com/tokenization-reshaping-insurance/

- Carbon Credits. Carbon crypto guide 2024: KlimaDAO, carbon NFTs, and carbon tokens. https://carboncredits.com/carbon-crypto-guide-2023-klimadao-carbon-nfts-and-carbon-tokens/

- Chainlink. Tokenized stocks & equities explained. https://chain.link/education-hub/tokenized-stocks-equities-explained/

- Circle. Transparency & stability. https://www.circle.com/transparency

- Debut Infotech. Top 6 challenges in RWA tokenization and how to overcome them. https://www.debutinfotech.com/blog/top-rwa-tokenization-challenges

- Etherisc. Make insurance fair and accessible. https://etherisc.com/

- Gate.com. What is TrueFi (TRU)? All you need to know about TRU. from https://www.gate.com/learn/articles/what-is-truefi/477

- Kraken. . Tokenized equities: Transforming liquidity and accessibility. https://www.kraken.com/learn/tokenized-equities/

- Ledger Insights. BlackRock tokenizes money market fund on Ethereum. Invests in Securitize. https://www.ledgerinsights.com/blackrock-tokenization-money-market-fund-invests-in-securitize/

- Phemex. How RWAs bring stability and diversity to DeFi. https://phemex.com/blogs/rwas-defi-stability-diversity-tokenization

- RWA.xyz. Analytics on tokenized real-world assets. https://app.rwa.xyz/

- SP Global. Tokenized private credit. https://www.spglobal.com/content/dam/spglobal/global-assets/en/special-reports/Corp_1022_TokenizedPrivateCredit.pdf

- Spydra. Top blockchains for RWA tokenization in real estate: A complete guide. https://www.spydra.app/blog/top-blockchains-for-rwa-tokenization-in-real-estate-a-complete-guide

- Tether. Transparency. https://tether.to/transparency/

- Tokeny. Real-world asset (RWA) tokenization ecosystem map. https://tokeny.com/real-world-asset-rwa-tokenization-ecosystem-map/

Similar Articles

- Strategic Shifts in Stablecoins & Digital Payments: A New Era for Global Finance

- Apollo's Credit Fund Tokenized on Solana DeFi: Real-World Asset Expansion

- RWA Tokenization Now Includes AI Royalties and Content Streams, What’s Next?

- DeFi as a Settlement Layer: How the Next Cycle Will Bypass CeFi Entirely

Comments ()