Scaling Roadmaps: From Token Generation to Mainnet Growth

Charting the post-TGE technical milestones, ecosystem partnerships and market performance of Sahara AI, Magic Newton & Humanity Protocol

Introduction

The buzz surrounding Token Generation Events (TGEs) is just the beginning of a project’s real challenge: turning that initial excitement into ongoing usage, network effects, and real-world applications. Just in the last month, thanks to Humanity Protocol’s launch on June 25th, Magic Newton’s TGE on the same day, and Sahara AI’s debut on June 26th, we’ve seen three unique visions enter the token arena. However, the market doesn’t take long to form its opinions.

In this article, we’ll first outline each team’s technical achievements and key partnerships after their TGEs. Then, we’ll dive into how their tokens have performed early on, looking at price movements, trading volumes, listing behaviors, and volatility, to see if their ambitious plans are hitting home with token holders and market makers. By comparing these three different strategies, AI infrastructure (Sahara AI), verifiable agent automation (Magic Newton), and decentralized identity (Humanity Protocol), we’ll shed light on how clear roadmaps and quick execution can determine the success or failure of emerging blockchain projects.

What you’ll learn:

- A detailed comparison of each project’s key milestones from testnet to mainnet

- How each team is forming strategic partnerships to boost adoption

- Quantitative insights into token performance during the critical first weeks after the TGE.

- Valuable takeaways on what early price trends might indicate for long-term growth

1. Sahara AI: Decentralized AI Stack

Roadmap Milestones

- Q4 2024: Testnet launch with data-labeling bounties, attracting over 200,000 contributors and 3 million+ human annotations.

- Q1 2025: Release of the Sahara AI Marketplace—pre-built Retrieval-Augmented Generation (RAG) pipelines for developers to integrate on-chain AI.

- Q2 2025: Debut of Sahara Studio, a comprehensive toolkit for model training, deployment and orchestration across multiple Layer-1 chains.

- Q3 2025: Mainnet “Sahara Chain” go-live on Ethereum and BNB Chain, fully operationalizing on-chain compute and data services. coinedition.comcoingecko.com

Ecosystem Partnerships

- Collaboration with Microsoft, Amazon and MIT for enterprise pilot programs and research initiatives coinedition.com.

- Secured backing from Sequoia, Pantera Capital and Binance Labs, providing both capital and exchange listing pathways 99bitcoins.com.

- Community incentives through Binance’s 3 million SAHARA trading challenge—designed to kick-start liquidity and on-chain volume binance.com.

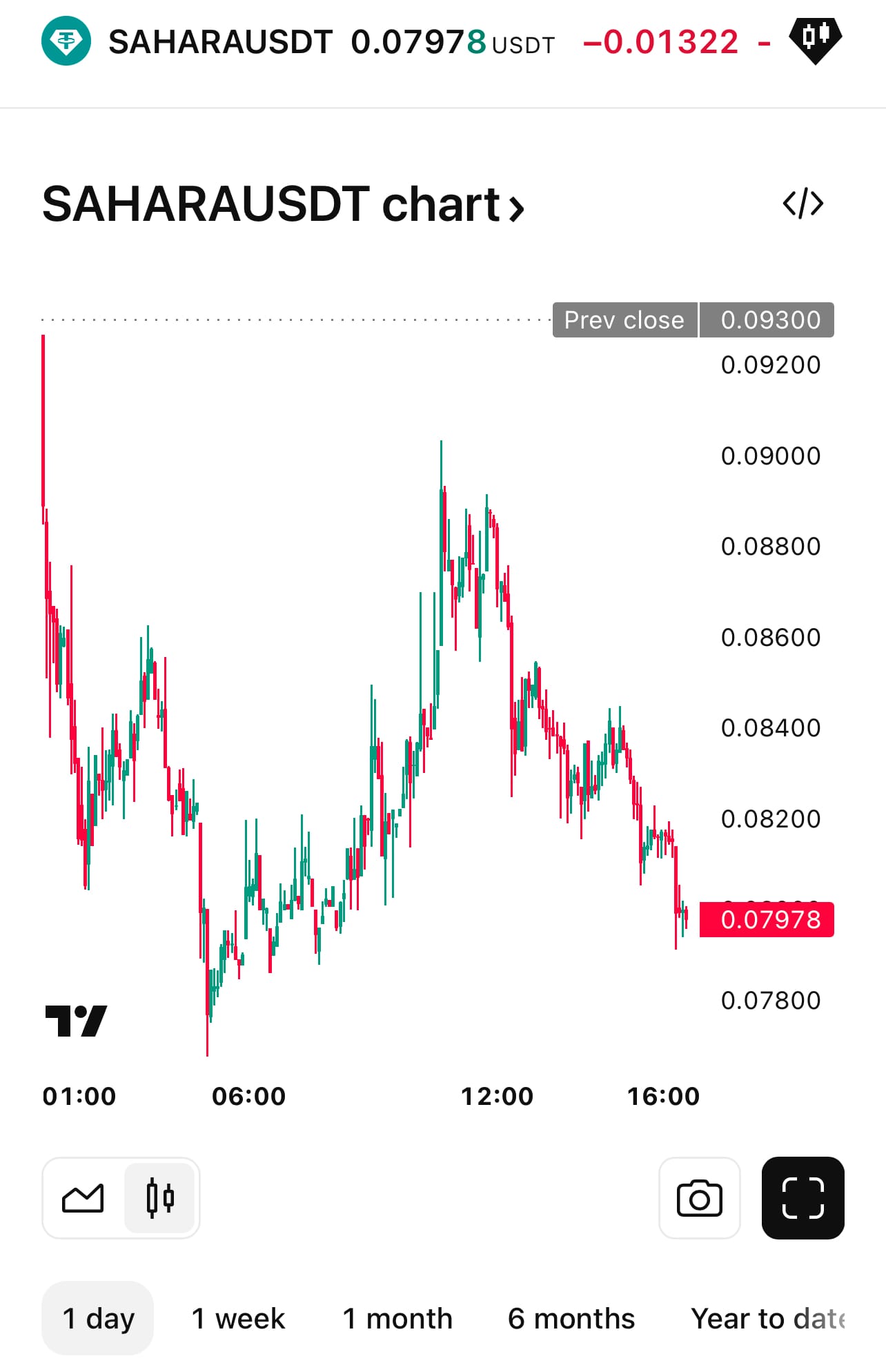

Post-TGE Price Performance

- Immediate reaction: Following its June 26th TGE and major exchange listings, SAHARA spiked to ~$0.14 before reversing sharply.

- Current price: ~$0.08306, marking a 32% decline from its intraday high on listing day ainvest.com.

- Market cap & volume: Circulating supply of 2 billion tokens yields a market cap ~BTC 1,575 (rank #307), with 24h trading volume near $630 K coingecko.com.

- Volatility & outlook: Bearish swings of 75% intra-day suggest over-enthusiastic initial bids, while modest 7-day returns (-0.00%) imply underperformance versus peers coingecko.com.

Visual Snapshot: Sahara AI Price

2. Magic Newton: Verifiable Agent Automation

Roadmap Milestones

- Pre-TGE: Deployment of TEE/ZKP-powered automation primitives—enabling smart contracts to spawn verifiable off-chain agents.

- Q1 2025: Integration of chain-unification smart-wallet on Base testnet, in partnership with Polygon Labs, streamlining cross-chain key management investing.com.

- Post-TGE (Q3 2025): Launch of the Newton Protocol mainnet featuring multichain keystore rollups, on-chain agent registry and marketplace.

- Future: Staking modules, on-chain governance and “agent-as-a-service” models to monetize automated strategies.

Ecosystem Partnerships

- Polygon Labs: Co-development of the Base Layer integration, providing initial testnet traction and shared developer tooling investing.com.

- Mitosis University: Planned hackathons and educational content to foster a developer ecosystem around on-chain automation.

- Venture Backing: ~$90 million from Placeholder, PayPal Ventures, DCG and prominent angel investors like Balaji Srinivasan investing.com.

Post-TGE Price Performance

- Listing surge: NEWT vaulted 30% above its listing price, touching an all-time high of $0.8337 within hours of launch.

- Rapid correction: Price then plunged 46% to ~$0.4515 as initial staking unlocks and airdrop distributions triggered selling pressure cryptorank.io.

- Stabilization: Over the past 24 hours, trading volume has softened by ~33.5%, with prices hovering around $0.38–0.47, forming a potential support base coingecko.comcryptorank.io.

- Current metrics: Market-wide risk-off sentiment may dampen immediate recovery, but roadmap catalysts (agent marketplace launch) loom ahead.

Visual Snapshot: Magic Newton Price

3. Humanity Protocol: Proof of Humanity

Roadmap Milestones

- June 25, 2025 – TGE & Listing: $H token goes live on spot and perpetual markets, with ~10 billion max supply capped and seed funding of $30 million at a $1 billion valuation 99bitcoins.com.

- Q3 2025: Migration of Proof of Humanity (PoH) biometric system onto zkEVM L2 built with Polygon CDK, enabling scalable human identity verification.

- Late 2025: Launch of the “Humanity Foundation” governance DAO, seeded by industry veterans from Animoca Brands, Morgan Stanley and Polygon bitget.com.

Ecosystem Partnerships

- Open Campus: Integration of digital IDs into educational credentialing, unlocking verifiable diplomas and lifelong learning passports bitget.com.

- University Program: Collaborative research and hackathons with Cambridge, Yale and MIT to refine zk-biometric protocols and decentralized governance bitget.com.

- Corporate Alliances: Pilots with healthcare and voting platforms to test non-invasive palm vein scanning and liveness detection.

Post-TGE Price Performance

- Initial listing: $H surged briefly, hitting a June 25 ATH of $0.148, but collapsed by over 85% to trade near $0.0212 on June 27 — a dramatic sell-off as early token holders realized gains cryptorank.io.

- 24h volatility: +15.58% rebound in the past day indicates short-term bargain hunting, yet overall sentiment remains cautious given the sheer scale of the drawdown coinmarketcap.com.

- Volume & market cap: 24h volume around $57 million, circulating supply ~1.83 billion, market cap ~$40 million (rank #572) coinmarketcap.com.

- Looking ahead: Upcoming zkEVM testnet launches and governance activation could catalyze renewed interest—but execution risks are high.

Visual Snapshot: Humanity Protocol Price

Comparative Roadmap & Performance Summary

| Project | Key Roadmap Phases | Top Partnerships | TGE Date & Token Hits | Post-TGE Price Action |

|---|---|---|---|---|

| Sahara AI | Testnet → Marketplace → Studio → Mainnet Q3’25 | Microsoft, Amazon, MIT | Jun 26 2025; ATH ~$0.14 | –32% from ATH; stable ~$0.083; modest volume |

| Magic Newton | Primitives → Wallet → Mainnet & Marketplace | Polygon Labs, Mitosis University | Jun 25 2025; ATH $0.8337 | –46% correction; support ~$0.38–0.47; vol. down 33% |

| Humanity Protocol | TGE → zkEVM L2 → DAO & Governance | Open Campus, Cambridge, Yale | Jun 25 2025; ATH $0.148 | –85% plunge; partial +15% rebound; high vol. |

Conclusion & Key Takeaways

- Ambition vs. Execution Speed

- All three projects boast detailed, phase-based roadmaps. Yet, Sahara AI’s staggered rollout (testnet → studio → mainnet) appears more conservative and paced, while Magic Newton and Humanity Protocol front-load ambitious features close to their TGEs.

- Partnerships as Credibility Signals

- Sahara AI’s ties to tech giants and leading VCs helped secure broad exchange listings and initial demand. Magic Newton’s cross-chain wallet collaboration and heavyweight backers lend both technical and promotional heft. Humanity Protocol’s academic links underscore its credibility in governance—but haven’t prevented knee-jerk profit-taking.

- Volatility Reflects Narrative Strength

- Early price swings often mirror narrative clarity: Sahara AI’s moderate pullback suggests measured expectations; Magic Newton’s blow-off top underscores speculative fervor around automation; Humanity Protocol’s stark collapse reveals concerns over token unlock schedules and use-case maturity.

- Future Implications

- Sahara AI must translate its data contributor base into on-chain revenue to justify its valuation.

- Magic Newton needs smooth agent marketplace operations to regain trust and volume.

- Humanity Protocol must demonstrate real-world PoH deployments to rebuild confidence after a dramatic initial sell-off.

Internal Mitosis Links & Glossary References

- Bitcoin

- Blockchain

- Cryptocurrency

- Mitosis Core: https://university.mitosis.org/mitosis-core

- Governance: https://university.mitosis.org/governance

- Glossary: https://university.mitosis.org/glossary/

- Ecosystem Connections: https://university.mitosis.org/ecosystem-connections

Comments ()