SEC’s Regulatory “Reset” Lights Way Forward for NFTs, DeFi, and Web3

Introduction

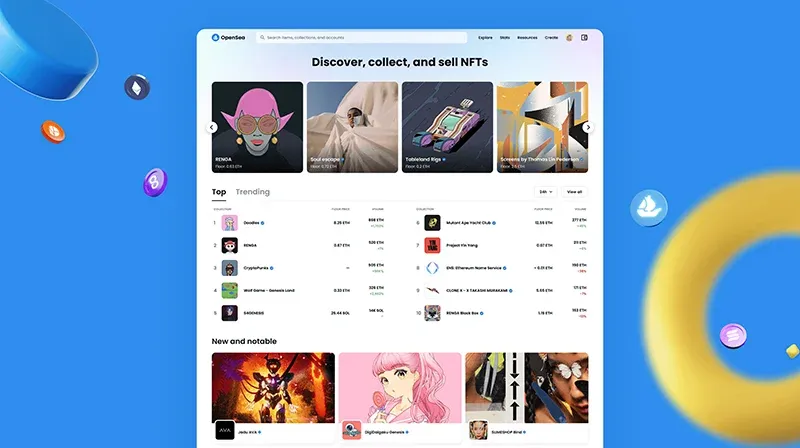

Just a few months back, the U.S. Securities and Exchange Commission (SEC) had the entire crypto community holding its breath. With high-profile enforcement actions, regulatory warning letters, and those dreaded “Wells notices,” it felt like a crackdown was imminent—especially after a nearly two-year investigation into OpenSea, the world’s largest NFT marketplace. But then, in a surprising twist, the SEC wrapped up its investigation into OpenSea on February 21, 2025, and kicked off its first-ever “Crypto Task Force” roundtable on March 21, signaling a new, more collaborative approach to digital-asset policy reuters.comreuters.com.

For NFT creators, decentralized finance (DeFi) innovators, and Web3 entrepreneurs, this “regulatory reset” isn’t just a headline—it’s a genuine chance to help shape the rules that will define the next chapter of the internet. This article dives into what the SEC’s shift means for marketplaces, DeFi protocols, and tokenized platforms, blending in real stories, practical tips, and a look at what lies ahead.

The Story Behind the Reset

From Enforcement to Engagement

From Enforcement to Engagement Back in August 2024, OpenSea’s CEO received a Wells notice—an unsettling sign of potential enforcement—over claims that some NFT listings on the platform might be considered unregistered securities. Collectors and artists braced themselves for the worst: fines, forced delistings, or a complete overhaul of how NFTs are traded. However, on February 21, 2025, SEC Chair Gary Gensler announced that the investigation was closed, with no enforcement action taken reuters.com. For many in the community, it felt like defusing a bomb.

Maya Lopez, a former OpenSea developer, recalls the tension: “We were updating smart contracts every day, worried we’d have to scrap everything,” she shares. When the news broke, the team erupted in cheers and quickly reached out to regulators, eager to share their insights on how NFT markets truly operate.

The Crypto Task Force Roundtable

Just a few weeks later, the SEC’s Crypto Task Force—set up by Commissioner Hester Peirce—held its very first roundtable in Washington, D.C. Legal experts, blockchain innovators, and seasoned industry players came together in a bright conference room at the SEC headquarters. The atmosphere was refreshingly different from the usual closed-door investigations: open, curious, and forward-thinking reuters.com.

Attendees shared what they had been eager to communicate to policymakers: NFTs aren’t a one-size-fits-all solution; DeFi protocols introduce unique governance structures; and tokenized assets need definitions that truly reflect the realities of the blockchain. By the end of the day, many participants felt that regulators were actually listening—not just issuing warnings.

What “Reset” Means for NFT Marketplaces

1. Clearer Definitions, Simpler Compliance

At its core, the SEC’s new approach acknowledges that labeling every NFT as a “security” doesn’t really add up. OpenSea has been advocating for regulators to officially recognize that most NFTs—like digital art drops, in-game items, and collectible moments—aren’t securities, as long as platforms steer clear of price-manipulation schemes and unregistered token offerings.

For marketplaces, this could mean:

- Tailored compliance: Instead of blanket KYC requirements, platforms might implement risk-based seller verification and smart-contract audits.

- Interoperability: Clear guidelines on how cross-chain NFTs and royalty splits are treated under securities laws.

- Lower friction: With fewer legal uncertainties, product launches could happen more quickly and with less engineering hassle.

As Aria Patel, the founder of a specialized music-NFT marketplace, puts it: “For the first time, I feel confident I can create new features without waking up to a cease-and-desist letter.”

2. A Surge in Experimentation

Since the probe wrapped up, a bunch of new platforms have been quietly testing out some exciting NFT formats—think time-limited “drops,” on-chain governance tokens, and fractional ownership models. Data from LooksRare, a competitor to OpenSea, reveals a 25% increase in trading volume during March and April 2025, indicating that both builders and collectors are sensing a chance to innovate, according to reuters.com.

This revival isn’t just about art, either. Creators are racing to roll out new experiences in areas like domain-name NFTs, membership passes, and digital fashion, all under more favorable regulatory conditions.

Implications for DeFi & Tokenized Platforms

1. Beyond Enforcement: Toward Rulemaking

In the past, the SEC took a case-by-case approach—sending warning letters to lending protocols, imposing fines on staking services, or filing lawsuits against token issuers. The new strategy suggests a shift towards proactive rulemaking: establishing clear standards for token-sale disclosures, protocol audits, and governance structures before enforcement issues arise.

DeFi developers are already getting organized: industry groups like the Blockchain Association and the Chamber of Digital Commerce have put together whitepapers that outline best practices for smart-contract risk disclosures and consumer protection measures.

2. Balancing Innovation with Safeguards

Not everyone is on board with this shift. Commissioner Caroline Crenshaw has warned that flexibility shouldn’t come at the cost of investor protection. “We must avoid becoming the Wild West,” she stated during the roundtable discussion. Her comments highlight a key tension: how to encourage creativity while also preventing scams, hacks, or market manipulation.

Practical takeaways for DeFi teams:

- Layered risk controls: Automated “circuit breakers,” clear error-margin disclaimers, and third-party audits.

- Transparent governance: On-chain voting logs and community oversight to deter insider trading.

- Consumer education: In-protocol tutorials and plain-English disclosures linking back to authoritative sources (e.g., the SEC’s own investor-education pages).

A Human Perspective: Stories from the Frontlines

- Collector Claire Yang: Collector Claire Yang had a tough experience last year when she lost nearly $10,000 to a phishing scam on a small NFT platform, which made her think twice about minting new art. “The reset gave me hope,” she shares. “I’ve already loaded up my wallet to support my favorite artists again.”

- Developer Jamal Wright: His DeFi lending protocol paused a Developer Jamal Wright faced a similar challenge when his DeFi lending protocol had to pause a feature launch after the SEC hinted at potential enforcement actions. “We moved to the sidelines for months,” Jamal remembers. “Now, with clearer signals, we’re back to building—and hiring.

- Artist Isabella Cruz: Artist Isabella Cruz, a multimedia creator, had to put her plans for a tokenized membership club on hold due to legal uncertainties. “I felt like I was asking permission to do art,” she explains. “Now, I’m sketching out smart-contract ideas again.

Their experiences highlight the emotional stakes involved: behind every line of code or piece of digital art, there are real people yearning for certainty and the freedom to create.

Conclusion & Practical Takeaways

The SEC’s “reset” isn’t a free-for-all—fraud, market manipulation, and unregistered offerings are still very much on the agency’s radar. However, for builders, artists, and investors, this shift towards engagement, dialogue, and rulemaking represents a significant turning point.

Key actions to seize the moment:

- Engage with regulators: Submit comments, participate in public workshops, and share on-chain data to inform practical rules.

- Prioritize transparency: Adopt best-practice disclosures, integrate third-party audits, and educate your users.

- Collaborate with peers: Join consortia and industry groups to propose standardized frameworks for token-sales, governance, and consumer-protection.

Looking Ahead

- Will the SEC establish an “NFT safe harbor” to clearly separate art and collectibles from securities?

- How will Congress react—could bipartisan crypto legislation help align the SEC and CFTC jurisdictions?

- Can the Crypto Task Force turn roundtable discussions into lasting rules that survive beyond election cycles?

Web3’s pioneers now have a rare chance to step from behind the shadows of uncertainty into a well-lit future defined by clear, balanced rules. The question isn’t just “What will the SEC do?” but “What will you build with this new clarity?

Internal Mitosis Links & Glossary References

- Bitcoin

- Blockchain

- Cryptocurrency

- Mitosis Core: https://university.mitosis.org/mitosis-core

- Governance: https://university.mitosis.org/governance

- Glossary: https://university.mitosis.org/glossary/

- Ecosystem Connections: https://university.mitosis.org/ecosystem-connections

Comments ()