Silo Finance: Risk-Isolated Lending in DeFi

Silo Finance is a decentralized, non-custodial lending protocol in the DeFi ecosystem, operating primarily on Ethereum and Arbitrum, with expansions to networks like Sonic and Avalanche. It enables users to lend and borrow crypto assets through an innovative risk-isolated model, aiming to combine security, flexibility, and accessibility for a broad range of tokens.

What is Silo Finance?

Unlike traditional lending platforms such as Aave or Compound, which pool all assets into a shared liquidity pool, Silo Finance isolates each asset into its own dedicated market—called a “Silo”—paired with a bridge asset like ETH or USDC. This design prevents problems in one market from spilling over into others, greatly reducing systemic risk.

Key Features

1. Risk Isolation

Each Silo contains only two assets: a base asset (e.g., wstETH, USDC) and a bridge asset (e.g., ETH). If one token faces an exploit or price manipulation, only that Silo is affected, leaving the rest of the protocol untouched.

2. Permissionless Markets

Anyone can propose a new Silo for any ERC-20 token, provided there is a reliable price oracle. This openness allows niche and long-tail tokens to be supported, making the protocol more inclusive and adaptable.

3. Bridge Assets

Bridge assets connect Silos, enabling cross-market borrowing without shared liquidity risks. For example, a user could deposit USDC, borrow ETH, and then use that ETH to borrow another token in a different Silo.

4. Overcollateralized Lending

Borrowers must deposit collateral worth more than their loan amount, reducing the risk of bad debt.

5. Dynamic Interest Rates

Rates adjust automatically based on supply and demand in each Silo. High borrowing demand pushes rates up to encourage lending, while lower demand reduces rates.

6. Silo V2 Enhancements

The V2 upgrade introduced programmable lending markets, partial liquidations, and a Hooks System for better integrations. It also made the protocol fully permissionless for market creation.

7. Security Measures

Silo’s smart contracts are immutable and have undergone multiple audits. It relies on decentralized oracles like Uniswap V3 and Balancer V2 to maintain accurate pricing.

8. Governance

SiloDAO governs the protocol, with $SILO token holders voting on key proposals, market parameters, and treasury management.

How It Works

- Lending: Users deposit assets into a Silo to earn interest. Deposits can either be lent out or held as collateral only.

- Borrowing: Users deposit collateral in a Silo, borrow the bridge asset, and use it to access other Silos. Maintaining a safe collateral ratio is essential to avoid liquidation.

- Liquidation: If collateral falls below the set threshold, part or all of it can be liquidated to cover the loan. Silo V2 allows partial liquidations for efficiency.

The $XAI Stablecoin (Deprecated)

Previously, Silo used $XAI, an overcollateralized USD-pegged stablecoin, as a bridge asset alongside ETH. Due to low adoption, $XAI is being phased out.

Benefits

- Enhanced security through risk isolation.

- Broader asset support via permissionless markets.

- User control over specific risk exposure.

- Efficient cross-Silo borrowing without shared-pool vulnerabilities.

- One-click leveraged yield strategies for advanced users.

Risks and Challenges

- Liquidity Fragmentation: Isolated markets may have less liquidity than shared pools.

- Bridge Asset Dependency: Price volatility in ETH or other bridge assets can cause liquidations.

- Oracle Risks: Even decentralized price feeds can be manipulated.

- Gas Fees: Ethereum transactions can be costly, though Layer 2 solutions help.

- Regulatory Uncertainty: Evolving rules could affect operations.

- Smart Contract Risks: Despite audits, vulnerabilities are possible.

Recent Developments

- Auto-Leverage Tool: One-click looped yield strategies offering up to 78% APR on certain assets.

- Silo Sonic: New yield-bearing stablecoin, smsUSD, on Sonic with a native 24% APY and up to 7.7x leverage.

- Performance: $153,000 in monthly revenue and over 8 million $SILO distributed to Sonic users.

- Partnerships: Collaborations with GSR, Pendle, and FalconStable for improved liquidity and yield strategies.

Competitor Comparison

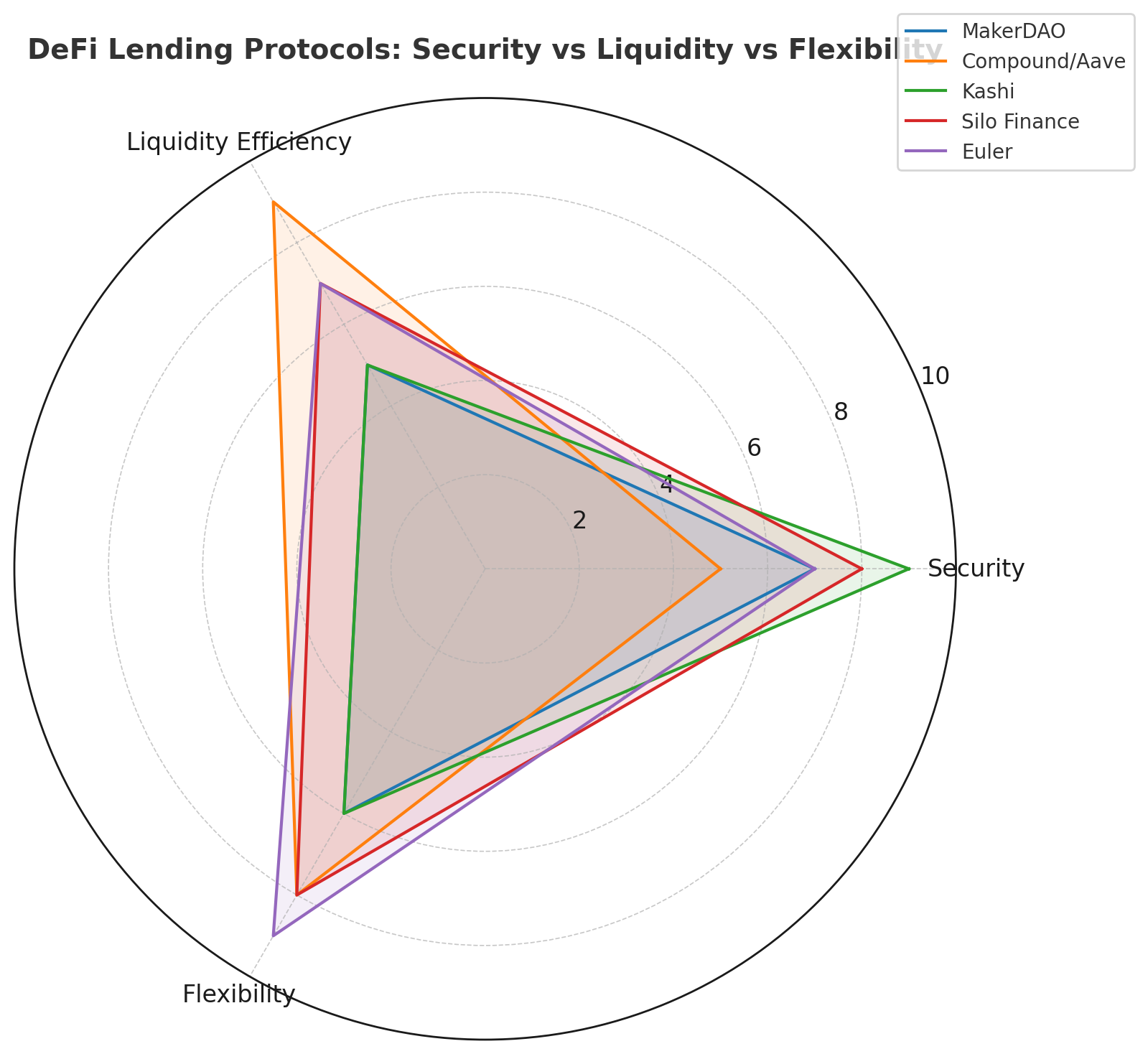

Below is a high-level look at how Silo stacks up against major DeFi lending protocols.

| Protocol | Model Type | Key Strengths | Trade-offs & Risks |

|---|---|---|---|

| MakerDAO | Vault (Collateral → Mint) | Decentralized minting | High governance complexity |

| Compound / Aave | Shared Pools | Capital efficient, high liquidity | Exposed to systemic risk in shared pool |

| Kashi | Isolated Pairs | Highly secure per pair | Split liquidity, lower utilization |

| Silo Finance | Isolated Silos w/ Bridge | Security + concentrated liquidity | Limited to tokens with bridge + oracle access |

| Euler | Modular Vaults, Tiered Risk | Flexible, customizable markets | Complex architecture, oracle-based risk |

Key Takeaways:

- Shared-pool models like Aave and Compound excel in efficiency but are vulnerable to systemic failures.

- Kashi maximizes security through isolation but suffers from liquidity fragmentation.

- Silo Finance blends both worlds by isolating risk while consolidating liquidity through a bridge asset.

- Euler offers deep customization for advanced users but has higher complexity.

Visual Overview

While each protocol brings unique strengths to the table, it’s easier to grasp their relative positions by looking at a visual comparison. The chart below maps Security, Liquidity Efficiency, and Flexibility for each protocol on a scale from 1 to 10.

From the visualization, we can see that:

- MakerDAO leads in security but lags in liquidity efficiency.

- Compound/Aave excel in liquidity but are more moderate on security.

- Kashi has high security but limited liquidity efficiency.

- Silo Finance balances all three attributes reasonably well.

- Euler stands out in flexibility while maintaining solid scores in other categories.

This snapshot makes it clear that while some protocols dominate in one metric, others aim for more balance. Such insights are key for determining which protocol might best suit a given DeFi strategy whether that’s stability, yield optimization, or versatility.

Getting Started

- Visit app.silo.finance.

- Connect a supported wallet.

- Choose a Silo, deposit to lend, or use collateral to borrow.

- Monitor your health factor to avoid liquidation.

Conclusion

Silo Finance stands out in DeFi lending by prioritizing risk isolation, permissionless market creation, and flexibility. It caters to both mainstream and niche tokens while offering advanced features like programmable markets and auto-leverage. Users must remain aware of liquidity, volatility, and technical risks, but for those seeking security and control in lending and borrowing, Silo offers a compelling option.

References

Comments ()