Stablecoin Adoption Surge

The global financial landscape is undergoing a transformative shift, with stablecoins emerging as a cornerstone of the digital economy. Stablecoins, cryptocurrencies pegged to stable assets like fiat currencies or commodities, have seen a remarkable surge in adoption over the past few years. This article explores the drivers behind this surge, the implications for financial systems, and the challenges and opportunities that lie ahead.

What Are Stablecoins?

Stablecoins are digital currencies designed to maintain a stable value, typically by pegging their worth to assets like the U.S. dollar, euro, or gold. Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, stablecoins offer price stability, making them ideal for transactions, remittances, and as a store of value in the crypto ecosystem. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Binance USD (BUSD), with many others gaining traction.

Stablecoins achieve stability through various mechanisms:

- Fiat-backed stablecoins: These are collateralized by reserves of fiat currency, held in bank accounts or equivalent assets.

- Crypto-backed stablecoins: These are backed by other cryptocurrencies, often over-collateralized to account for volatility.

- Algorithmic stablecoins: These use smart contracts to adjust supply and demand dynamically to maintain a stable peg.

Drivers of the Stablecoin Adoption Surge

The rapid rise in stablecoin adoption can be attributed to several key factors:

1. Bridging Traditional and Crypto Finance

Stablecoins serve as a bridge between traditional financial systems and decentralized finance (DeFi). They allow users to interact with blockchain-based applications without the volatility risks associated with other cryptocurrencies. For instance, DeFi platforms rely heavily on stablecoins for lending, borrowing, and yield farming, enabling users to earn interest or secure loans without exposure to wild price swings.

2. Global Remittances and Cross-Border Payments

Stablecoins have revolutionized cross-border payments, offering a faster and cheaper alternative to traditional banking systems. For example, sending money internationally through banks or services like Western Union can incur high fees and take days to process. Stablecoins, on the other hand, enable near-instantaneous transfers with minimal transaction costs, making them particularly attractive in regions with underdeveloped banking infrastructure, such as parts of Africa, Latin America, and Southeast Asia.

3. DeFi Ecosystem Growth

The explosive growth of DeFi has been a significant catalyst for stablecoin adoption. DeFi protocols, which facilitate decentralized lending, trading, and asset management, often require stablecoins as a medium of exchange or collateral. According to recent data, the total value locked (TVL) in DeFi protocols has surpassed $100 billion, with stablecoins like USDC and DAI playing a pivotal role in these ecosystems.

4. Institutional Adoption

Major financial institutions and corporations are increasingly integrating stablecoins into their operations. Companies like Visa and PayPal have announced support for stablecoin transactions, signaling growing confidence in their utility. Additionally, central banks and governments are exploring stablecoins as a foundation for central bank digital currencies (CBDCs), further legitimizing their role in the financial system.

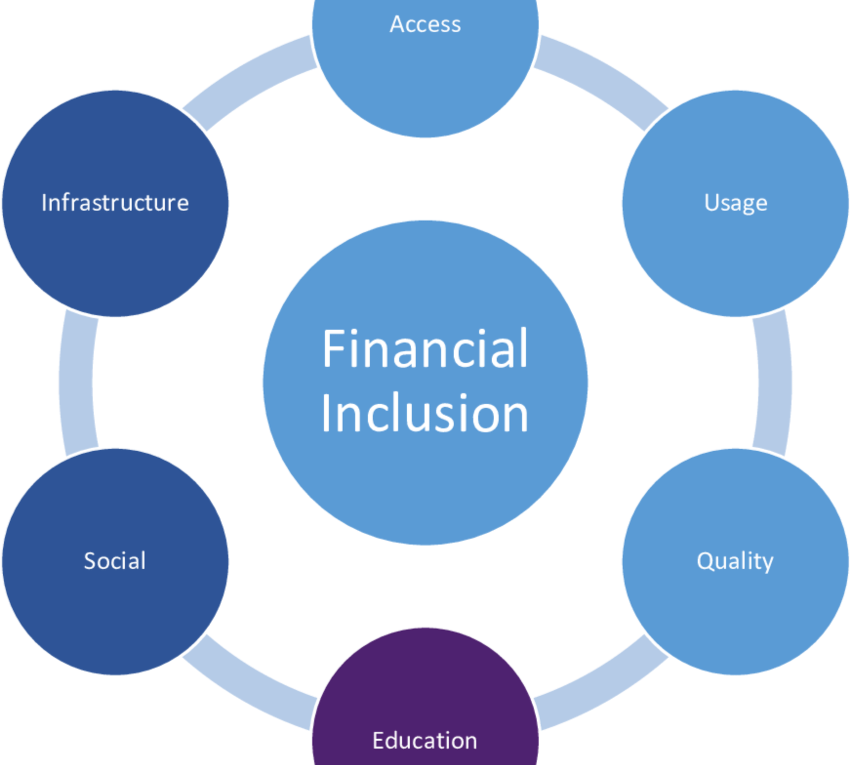

5. Financial Inclusion

In regions with unstable currencies or limited access to banking, stablecoins provide a viable alternative for individuals and businesses. For example, in countries like Venezuela and Zimbabwe, where hyperinflation has eroded trust in local currencies, stablecoins offer a stable store of value and a means to participate in the global economy.

Key Statistics on Stablecoin Adoption

To illustrate the scale of the stablecoin surge:

- The total market capitalization of stablecoins exceeded $200 billion in 2024, up from just $20 billion in 2020.

- Tether (USDT) alone accounts for over 50% of the stablecoin market, with a circulating supply surpassing $100 billion.

- Stablecoin transaction volumes on major blockchains like Ethereum and Tron often rival or exceed those of traditional payment networks like Visa.

- Over 60% of DeFi transactions involve stablecoins, highlighting their dominance in decentralized finance.

Challenges Facing Stablecoin Adoption

Despite their promise, stablecoins face several challenges that could impact their long-term adoption:

1. Regulatory Uncertainty

Regulators worldwide are grappling with how to classify and oversee stablecoins. Concerns about money laundering, tax evasion, and systemic risks have prompted scrutiny from bodies like the U.S. Securities and Exchange Commission (SEC) and the Financial Stability Board (FSB). For instance, Tether has faced criticism over the transparency of its reserves, raising questions about the integrity of fiat-backed stablecoins.

2. Centralized Risks

Many stablecoins, particularly fiat-backed ones, rely on centralized entities to hold reserves and manage operations. This introduces risks such as mismanagement, fraud, or insolvency. The collapse of algorithmic stablecoin TerraUSD (UST) in 2022 serves as a cautionary tale, wiping out billions in value and shaking investor confidence.

3. Scalability and Infrastructure

While blockchain networks like Ethereum and Solana support stablecoin transactions, scalability issues and high gas fees during network congestion can hinder user experience. Layer-2 solutions and alternative blockchains are addressing these challenges, but widespread adoption requires further infrastructure improvements.

4. Competition from CBDCs

Central bank digital currencies (CBDCs) pose a potential threat to stablecoins. As governments develop their own digital currencies, they may impose restrictions on private stablecoins to protect monetary sovereignty. Countries like China and the European Union are already piloting CBDCs, which could compete with stablecoins in the future.

Opportunities for Stablecoin Growth

Despite these challenges, stablecoins present significant opportunities:

1. Mainstream Financial Integration

Stablecoins are increasingly being integrated into mainstream financial systems. For example, payment processors like Stripe and Square are exploring stablecoin-based solutions, which could drive broader acceptance among merchants and consumers.

2. Decentralized Finance Innovation

The DeFi sector continues to innovate, with stablecoins at the heart of new financial products. From decentralized stablecoin lending platforms to yield-generating stablecoin pools, the possibilities for creating value are vast.

3. Emerging Markets

Stablecoins have immense potential in emerging markets, where access to stable financial instruments is limited. By providing a reliable alternative to volatile local currencies, stablecoins can empower individuals and businesses to save, invest, and transact globally.

4. Tokenization of Assets

Stablecoins could play a pivotal role in the tokenization of real-world assets, such as real estate, commodities, or securities. By providing a stable medium of exchange, they enable seamless trading and settlement of tokenized assets on blockchain platforms.

The Future of Stablecoins

The surge in stablecoin adoption signals a paradigm shift in how we perceive and interact with money. As blockchain technology matures and regulatory frameworks evolve, stablecoins are poised to become a fundamental component of the global financial system. However, their success will depend on addressing regulatory concerns, ensuring transparency, and scaling infrastructure to meet growing demand.

For now, stablecoins are proving their worth as a versatile tool for financial innovation, inclusion, and efficiency. Whether facilitating cross-border remittances, powering DeFi protocols, or serving as a hedge against inflation, stablecoins are reshaping the future of finance one transaction at a time.

References

- CoinMarketCap. (2024). Stablecoin Market Capitalization.

- DeFi Pulse. (2024). Total Value Locked in DeFi.

- Financial Stability Board. (2023). Regulatory Issues of Stablecoins.

- Tether. (2024). Tether Transparency Report.

- Visa. (2021). Visa to Enable Stablecoin Payments.

- International Monetary Fund. (2023). Central Bank Digital Currencies and Stablecoins.

- Chainalysis. (2024). Stablecoin Transaction Volumes.

About Mitosis:

Mitosis APP

Blog

Docs

X

Discord

Comments ()