Stronger Together: How NFT Alliances Could Propel the Digital Asset Revolution

The cryptocurrency market in 2025 is experiencing a renaissance, fueled by unprecedented institutional adoption and a supportive U.S. administration.

As Bitcoin and Ethereum continue to dominate headlines with record highs, altcoins, memecoins, and non-fungible tokens (NFTs) are poised for explosive growth. Yet, despite these tailwinds, the NFT sector grapples with persistent challenges that hinder its full potential.

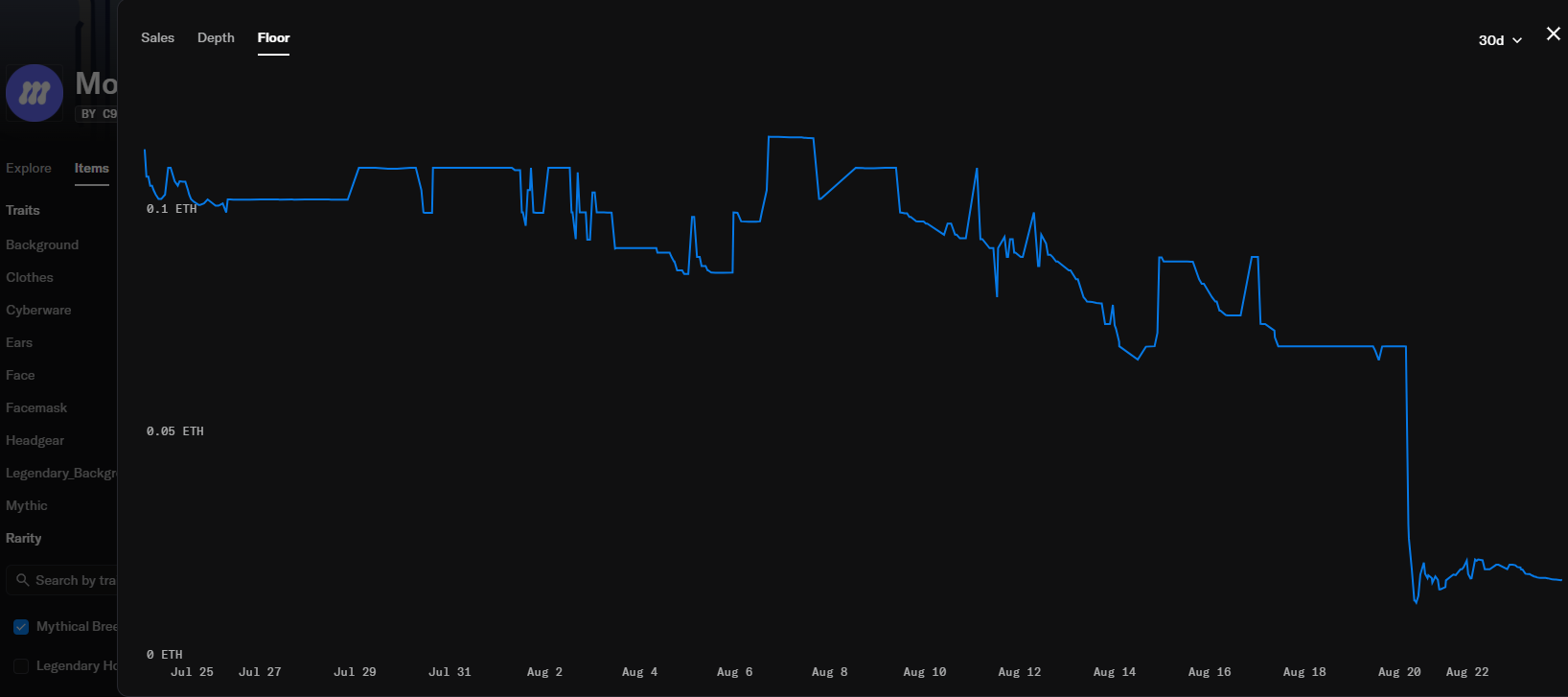

The sharp decline in the floor price of Morses, the NFT collection of the Mitosis project, after the airdrop checker went live, serves as a clear example of this.

This article explores the current crypto landscape, dissects the NFT market's limitations, and proposes a groundbreaking solution: strategic alliances between NFT collections, modeled on airline partnerships like Star Alliance, Oneworld, and SkyTeam.

By fostering collaboration, these alliances could address core issues, unlocking sustainable value for collections, holders, and the industry at large.

Part 1 - Review of the Current Situation: Potential Opportunities and Persistent Challenges.

The cryptocurrency ecosystem is entering what many experts call a "golden age," driven by institutional inflows, technological advancements, and regulatory clarity. Institutional adoption has surged, with major players like BlackRock and Fidelity expanding their offerings beyond Bitcoin ETFs to include Ethereum, altcoin-based products, and even NFTs with Pudgy Penguins.

Forecasts predict a bull run in 2025/2026, propelled by AI integration, real-world asset (RWA) tokenization, and decentralized physical infrastructure networks (DePIN).

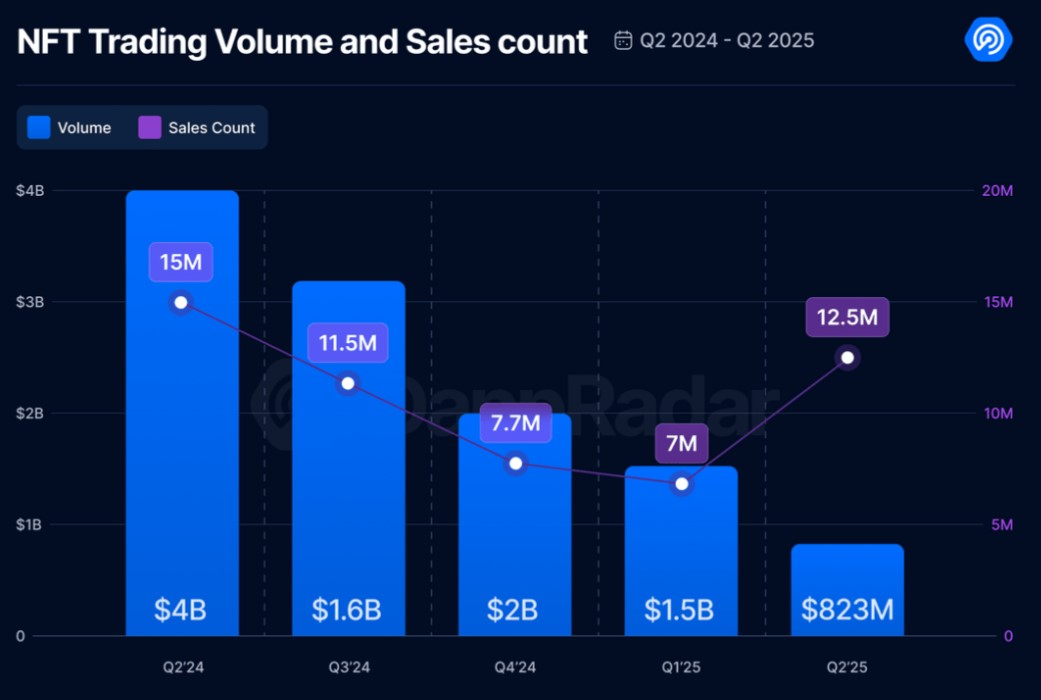

Overall Evolution of NFT Market Volumes (2024-2025)

Meanwhile, the NFT market that peaked in 2021-2022 with PFP and art hype but crashed hard during the 2022-2023 "crypto winter" is doing better but still doesn't look ready to bet back to ATH...

In 2025, volumes still declined year-over-year due to crypto volatility and less speculation, though efficient chains like Polygon and Solana showed growth.

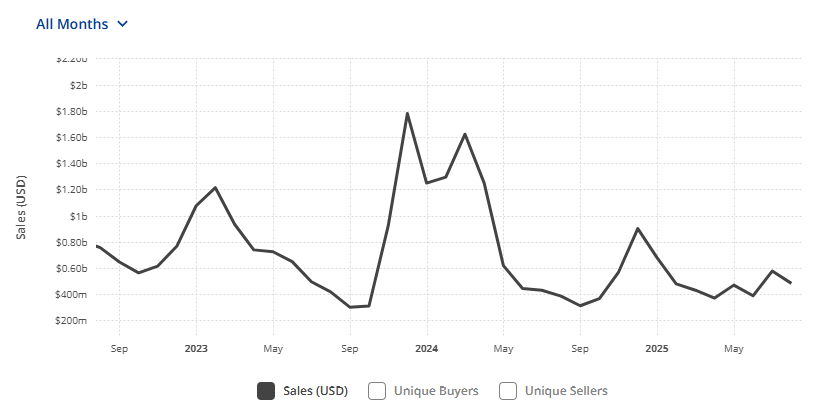

Total global sales in H1 2025 were $2.32 billion, down 4.61% from H2 2024’s $3.6 billion, with sales counts rising 78% to ~19.5 million transactions, reflecting more low-value activity. Trading volumes dropped 45% in Q2 2025 to $823 million from Q1’s $1.5 billion, per DappRadar.

Key Trends for Next Months

- Utility Shift: Lower volumes due to fewer high-profile drops and near-zero royalties, but engagement rose (e.g., 20% more active wallets in Q2 to 4.2 million). Gaming and RWAs now drive 60% of activity (up from 40% in 2024).

- Chain Shifts: Ethereum leads at 45%, with Solana (25%) and Polygon (15%) gaining due to low fees. Bitcoin NFTs surged in Q1 but fell 50% in Q2.

- Rebound Signs: May 2025 hit $450M in sales, up 15% from April’s $373M, June saw a small consolidation to $390M but July increased to $575M

NFTs are starting to gain a lot of attention recently.

— wataminoodles (@wataminoodle) August 6, 2025

The amount of times 'NFTs' are being mentioned on CT has been increasing over the past year.

While trading volume remains inconsistent and overall in a downtrend since the 2021 bull run, certain months in 2025 have already… pic.twitter.com/7e8MoTGRbe

Persistent Challenges in the NFT Market: Shadows Amid the Bull Run

Overall, despite bullish crypto conditions, NFTs still face entrenched hurdles, here is a comprehensive list along with related surveys and reports:

- Low liquidity due to fragmented trading markets. (Fridgen, 2024)

- Rug pulls and scams, with losses running into millions. (Upadhyay, 2025)

- Declining interest in PFP (profile picture) NFTs versus utility-driven assets. (Vomberg, 2025)

- Volatility tied to broader crypto swings, deterring mainstream adoption. (Partheno, 2025)

- Accessibility and visibility, major marketplaces lack curation, causing NFT blue-chip collections to be buried among thousands of inactive projects and recently promoted scams. (Bhujel, 2022 - Forbes, 2022)

- Regulatory uncertainty, though improving in the U.S. (Whitehouse.gov, 2025)

- Market saturation, with thousands of competing projects. (Coinlaw, 2025)

- Royalties collapse, forcing projects to pivot to IP licensing or memecoin integrations. (Wang, 2024)

Part 2 - Potential Solution: NFT Alliances Modeled on Airline Partnerships

To overcome these barriers, NFT collections could form alliances—similar to airline consortia where partners share networks, lounges, and loyalty programs.

Selecting members:

Mitosis Morses could be a strong candidate to initiate these strategies. As a multichain DeFi protocol, Mitosis offers numerous opportunities to alliance members while also benefiting from perks provided by other collections.

Similar to airline alliances, NFT collections of all sizes should be welcomed, provided they meet safety and reliability requirements and contribute added value to the alliance, with at least some of the perks given to their holders.

Implementation Framework

- Governance & Formation:

Decentralized Autonomous Organizations (DAO) ensure fairness. Governance weight for each NFT collection should be adapted to the reputation, the market cap and the added value brought by each collection.

Academic studies highlight alliance benefits for resource pooling and risk-sharing. - Interoperability Protocols:

The holder identification mechanism (e.g., Matrica) should be efficient and reliable. For future initiatives, cross-chain bridges could enable asset sharing (see my previous article on NFT liquidity for DeFi on Mitosis). - Shared Rewards & Utilities:

Loyalty-style programs where staking/holding rewards can be redeemed, at least partially, in every NFT collection of the alliance. - Joint Initiatives: Co-branded tools, drops and events.

Addressing Challenges

- Liquidity: Shared audiences boost trading volumes.

- Trust: Entry criteria and audits reduce scams.

- Interest revival: Story-driven and GameFi-integrated NFTs.

- Accessibility: Shared tools simplify UX.

- Regulation & ethics: Shared good practices and rules can be enforced depending on DAO decisions.

- Saturation: Collaboration fosters differentiation and institutional appeal.

Benefits Across the Ecosystem

- Collections: Reach expansion, cost sharing, innovation.

- Holders: Perks and reduced volatility risks.

- Industry: Scam reduction, adoption growth, and standardization.

Part 3 - Conclusion

As the cryptocurrency market flourishes in 2025, propelled by institutional adoption and a supportive U.S. administration, NFTs stand at a pivotal moment. The proposed alliances, modeled on successful airline partnerships like Star Alliance and Oneworld, offer a transformative path forward. By uniting collections such as Mitosis Morses with others, these collaborations can enhance liquidity, rebuild trust, and revive interest through shared utilities and interoperable ecosystems.

Collections will gain expanded reach and innovation, holders will enjoy reduced risks and added perks, and the industry will benefit from increased adoption and reduced scams.

Moreover, such alliances would position NFT collections above individual blockchains, much like how strong airline alliances elevate the passenger experience and brand loyalty beyond the airplane manufacturers (e.g., Boeing or Airbus). In this model, NFTs transcend chain-specific limitations, becoming a superior layer of value through cross-ecosystem collaboration.

While challenges like IP conflicts and technical barriers remain, phased implementations and blockchain standards can pave the way for success. This strategic shift positions NFTs to harness the bullish crypto tide, creating a resilient, interconnected future.

As the digital landscape evolves, these alliances could redefine the NFT sector, turning potential into prosperity.

Comments ()