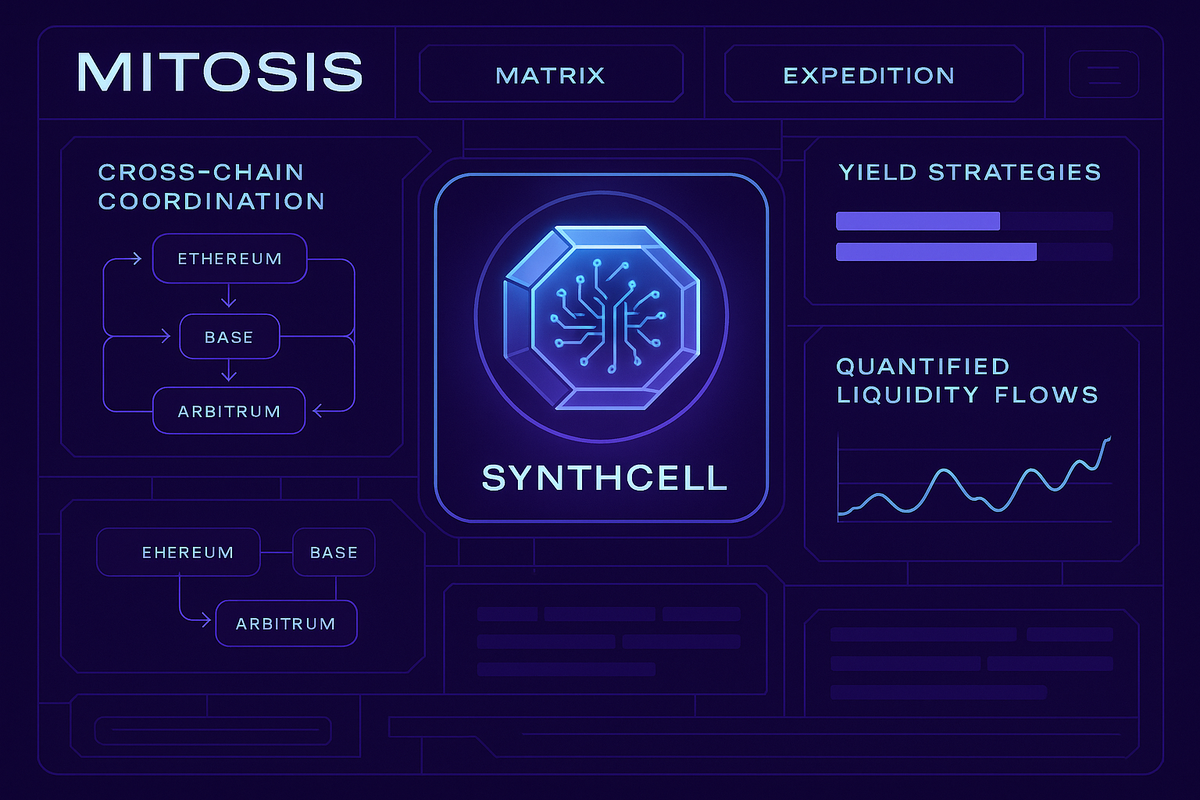

SynthCells: The Atomic Reactor of Mitosis

In Mitosis, cross chain liquidity isn't bridged It's minted. At the core of this magic lies the SynthCell: A modular, cross chain liquidity reactor that transforms passive assets into teleportable synthetic liquidity.

What is a SynthCell?

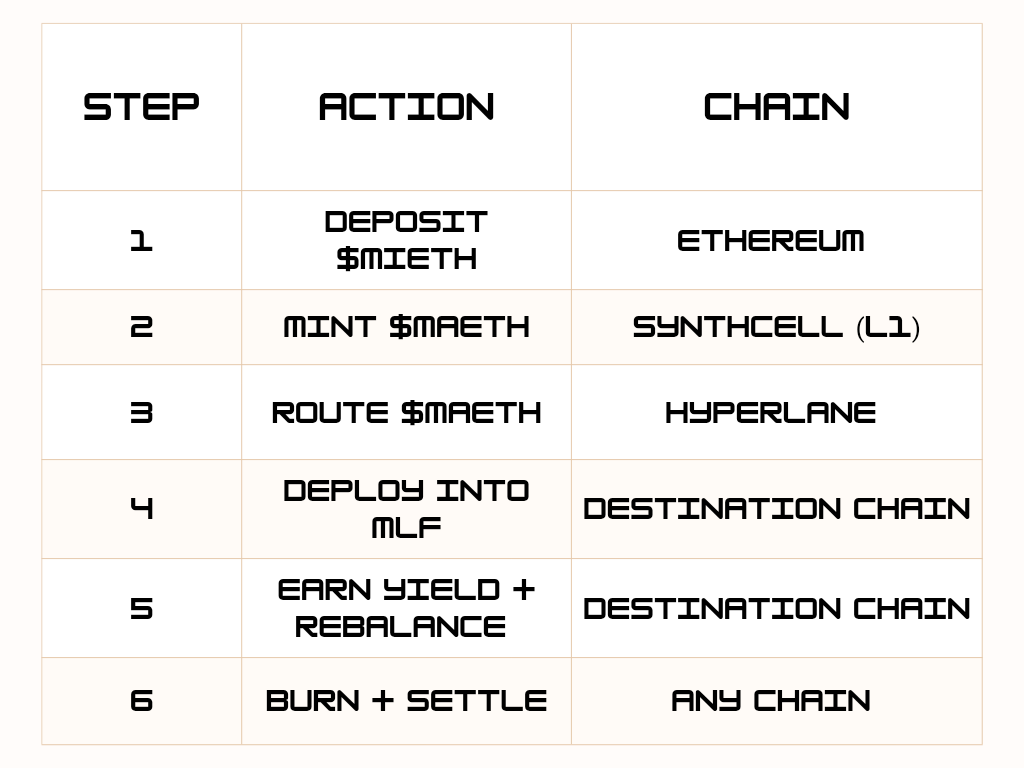

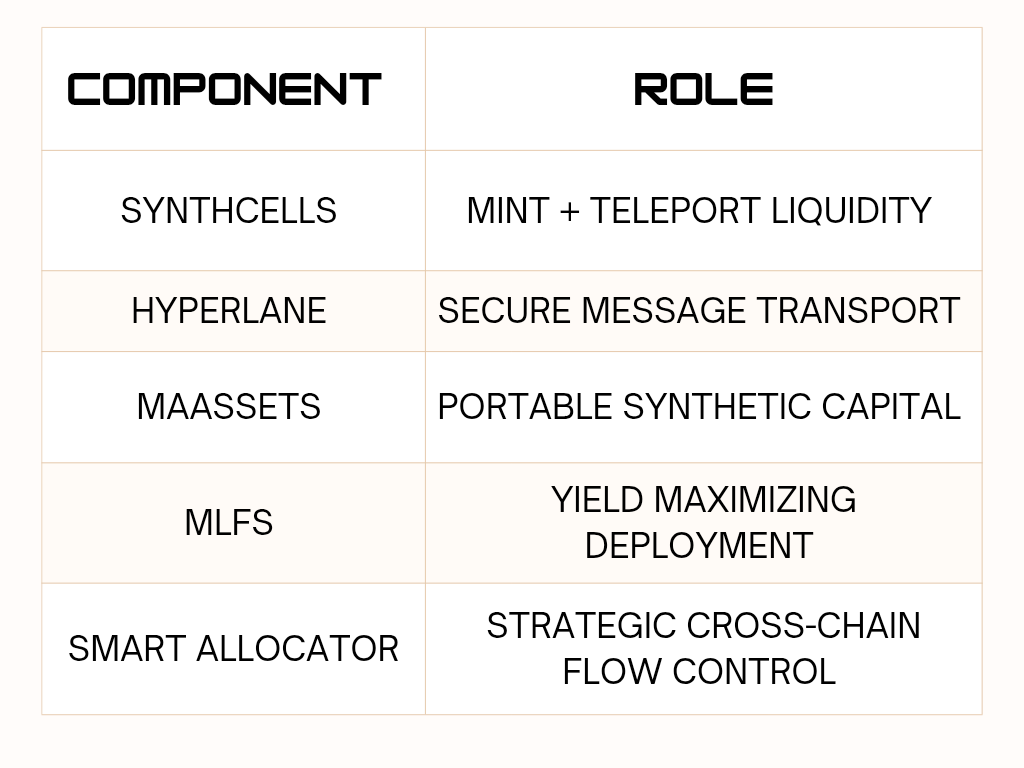

A SynthCell is a smart contract module that: 1. Accepts a real asset (e.g. $eETH, $rsETH) 2. Mints a maAsset (e.g. $maETH) against it 3. Routes the maAsset to a destination chain 4. Tracks cross chain debt via Hyperlane. It’s the Mitosis native way to synthesize, teleport, and deploy liquidity anywhere instantly and safely.

No lock and mint. No wrapped tokens. Just origination → execution → settlement.

The Lifecycle of an maAsset

Here’s how the process flows:

Unlike wrapped tokens, maAssets are natively recognized on their destination chains. They behave like local liquidity.

Why Hyperlane?

Mitosis uses Hyperlane for interchain messaging because it offers: • Modular security: Mitosis can run its own validator set. • Low latency messaging: near real time cross chain communication. • Composable hooks: SynthCells can automate post teleport actions. This gives Mitosis native control over liquidity routing no need to rely on generic bridges. Think of it as autonomous cross chain liquidity flow, not just sending tokens.

Smart Allocation Engine: Liquidity with a Brain

Once an maAsset arrives, it doesn't just sit idle. It’s deployed into the Matrix smart contract vaults that: • Optimize across multiple yield sources. • Autonomously rebalance positions. • Operate under cross chain governance rules This is where the magic happens: Mitosis doesn’t move liquidity it allocates it with precision.

SynthCells + MLFs = Modular Cross Chain Liquidity

Here’s the big picture:

Together, they form a modular, programmatic liquidity system. Each part can be upgraded, forked, governed, or extended.

Why It’s a Breakthrough

Traditional bridging is a hack. SynthCells are basics. They enable: • Composable interchain markets. • Programmable liquidity deployment • Cross chain yield generation without manual bridging. • Native liquidity for partner protocols (EOL)

This is how Mitosis turns passive assets into living capital.

Conclusion: The Liquidity Factory of the Modular Future

SynthCells are more than minting machines. They’re cross chain liquidity factories, programmable endpoints that make capital: Mobile, composable, autonomous, governable. In the end, the future of liquidity isn’t just cross chain. It’s cross intelligent. And SynthCells are the first step toward that future.

Never too late to join the Mitosis train as Luke stated on X, so join the Mitosis Discord and be very active on X so you don't get left out on this amazing journey. Gmito

Comments ()