Technical Spotlight: Solana Network Scaling Extensions

Introduction

Solana’s recent unveiling of Network Extensions (NE) signals a pivotal leap in blockchain scalability. Unlike conventional Layer‑2 rollup solutions, NEs preserve Solana’s monolithic architecture while offering developers customizable execution environments—without fragmenting liquidity or composability. This article explores how this innovation could reshape Solana’s competitiveness, accelerate DeFi and NFT development, and open new frontiers across sectors like gaming, IoT, and real‑world assets.

1. What Are Network Extensions? A New Approach to Scaling

1.1 Defining Network Extensions

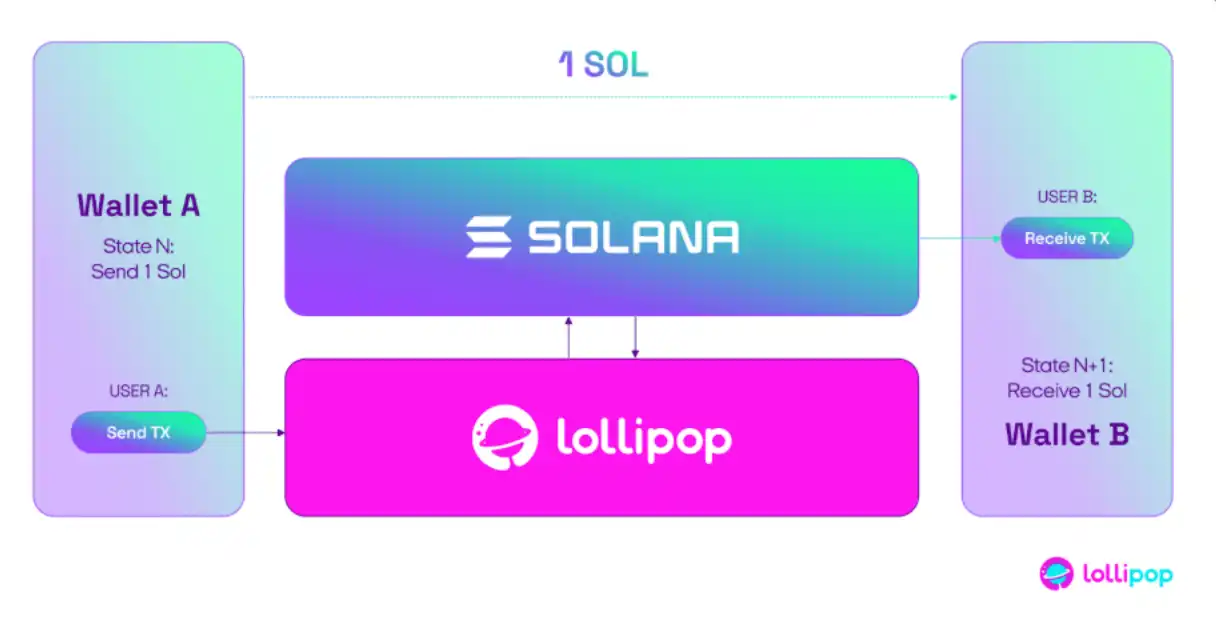

NEs are specialized execution environments layered atop Solana’s Layer‑1. Developers can tailor consensus mechanisms, transaction validation, and data storage to suit specific use cases—all while routing transactions through the same set of validator nodes. This ensures unified security and liquidity across the ecosystemmedium.com+13cryptoslate.com+13gate.com+13.

1.2 Customization Without Fragmentation

While Ethereum’s Layer‑2s increase throughput, they often result in liquidity siloing and token fragmentation. Solana’s NE model avoids this by maintaining a single, unified state and token pool, akin to “appchains” that don’t break composability cryptoslate.com.

1.3 Technical Innovations: ZK Compression & Data Lanes

NEs leverage domain-specific modules like ZK Compression (via Helius and Light Protocol) and specialized data lanes reminiscent of Ethereum’s blobspace. ZK Compression minimizes stored state on mainnet through zk‑proofs, boosting throughput without sacrificing verifiability zeeve.io+2cryptoslate.com+2ainvest.com+2.

2. Why Solana Needs This: Avoiding Ethereum’s Fragmentation Trap

2.1 Ethereum's Rollup Dilemma

Ethereum’s rise of rollups—Optimistic and zk‑based—addresses scalability but causes a “vampire draining” effect: as users and liquidity migrate offline, Ethereum L1 fee revenue and composability sufferx.com+5gate.com+5cryptoslate.com+5.

2.2 Solana’s Monolithic Strength

Solana’s monolithic model already delivers high throughput (4,000–6,000 TPS). But real-world applications—from DeFi to gaming—require more specialized execution logic. NEs enable this focused scalability without sacrificing Solana’s unified ecosystem ainvest.com.

3. Crafting Competitive Edge: Solana vs. Ethereum and Other Layer‑1s

3.1 Thriving in the Rollup Arms Race

Solana sidesteps the competitive mess of fragmented rollups by integrating specialized environments directly into L1. This positions Solana as a more seamless, composable, and efficient platform compared to Ethereum, particularly for developers building performance‑oriented apps cryptoslate.com+1ainvest.com+1.

3.2 EVM Compatibility via Neon EVM

Neon EVM exemplifies NE in action—it allows Ethereum‑style smart contracts to run natively on Solana, letting developers repurpose existing Solidity code, use familiar wallets, and benefit from SOL fees while retaining broad Solana composability x.com+10neonevm.org+10medium.com+10.

4. Developer Outlook: Unleashing Innovation with NEs

4.1 DeFi: Tailored Environments for High‑Performance Finance

DeFi protocols can launch high-frequency exchanges, permissioned stablecoins with KYC, or confidential transaction pools—all within tailored NEs that preserve core liquidity and scalability linkedin.com.

- Termina & Nitro Labs deliver ZK‑enabled extensions that offload trade execution while anchoring settlement on Solana L1, cutting costs and boosting transaction speed solanacompass.com+1ainvest.com+1.

- Token Extensions add metadata, fee logic, gating, and privacy to SPL tokens—closing the gap with EVM’s ERC‑20 richness without leaving Solana gate.com.

4.2 NFTs & Gaming: Speed, UX, and Parallelism

Ephemeral rollups (ERs) enable low-latency, high-frequency game mechanics on-chain without congesting the base layer. Gaming projects can isolate game-state, settle instantly, and benefit from Solana’s rapid finality medium.com.

NFTs and NFT‑fi apps gain flexibility too: staging auctions, fractional ownership, embedded DeFi mechanics are more viable in domain‑specific execution lanes.

4.3 DePIN, Supply Chain & IoT: Scalable Data Onboarding

Extensions can handle IoT message ingestion, sensor network coordination, or supply chain state tracking without overwhelming the mainnet. DePIN systems benefit from parallel processing tailored for high-volume, real‑world data flows cryptoslate.com+1ainvest.com+1.

5. Challenges & Questions Ahead

5.1 Technical Complexity

Composable, domain-specific runtimes demand rigorous validation. Adapting the SVM to ZK‑proofs (e.g., ZK Compression) is non‑trivial and will require continued collaboration across ecosystem playerscryptoslate.com+2zeeve.io+2ainvest.com+2.

5.2 Semantic Debates

NEs draw criticism—some question whether they're simply Layer‑2s by another name. Advocates argue that maintaining merged liquidity, UX parity, and validator integration distinguishes true NEs kiln.fi+6medium.com+6gate.com+6.

5.3 Developer Adoption & Education

Complexity requires support. Projects like Termina are open‑sourcing tools, and community education is key to adoption. Developers need clear guidance on when, why, and how to deploy NEs solanacompass.com.

Conclusion: NEs May Redefine Solana’s Future

Solana’s Network Extensions represent more than scaling—they signal a paradigm shift. With domain‑specific execution lanes, unified liquidity, and validated performance upgrades, Solana becomes a flexible, composable, high-speed general-purpose layer.

For DeFi, gaming, NFTs, IoT, supply chains, and more, NEs unlock tailored environments previously only feasible in segmented chains or rollups. By ducking liquidity fragmentation and complexity, Solana arms itself to lead the next wave of blockchain innovation.

Key Takeaways

- NEs deliver scalable specialization without architecture fragmentation.

- Developers can implement fine-grained optimizations for high-performance apps.

- Solana strengthens its competitive posture against Ethereum and at-scale newcomers.

- True adoption depends on technical tooling, education, and community engagement.

Food for Thought & Next Steps

- Will we see high-frequency perpetual DEXs or private DeFi pools optimized via NEs?

- Can gaming ecosystems truly thrive with near-instant settlement using ERs?

- How will extending Solana capabilities with ZK‑proofs impact validator trust assumptions?

Internal Mitosis Links & Glossary References

- Bitcoin

- Blockchain

- Cryptocurrency

- Mitosis Core: https://university.mitosis.org/mitosis-core

- Governance: https://university.mitosis.org/governance

- Glossary: https://university.mitosis.org/glossary/

- Ecosystem Connections: https://university.mitosis.org/ecosystem-connections

Comments ()