Telo Money: Borrow Against Your Vault, Stay Fully Composed

Telo isn’t just another lending protocol. It’s decentralized liquidity with full composability, meaning it speaks the same language as Matrix, EOL, Spindle, and Chromo Exchange. It is often said that Mitosis is a capital OS, but Telo, Telo is the borrow/lend kernel.

What is Telo?

Telo is Mitosis’s native, community-driven money market. It’s designed from the ground up to work with vault tokens (maAssets/miAssets) as collateral, not random ERC-20 Tokens, allowing users to borrow against vault deposits without compromising them. It’s fully transparent, modular, and built for everyone by the Mitosis community.

Why It Matters

- Vault positions stay active: Lock your assets in Matrix or EOL → earn partner rewards, points, and airdrops

- Borrow against them: No need to exit vaults or pause momentum

- Use borrowed assets anywhere in the Mitosis ecosystem or beyond

That testnet flow worked cleanly, you get yield and utility at the same time.

A Real Scenario

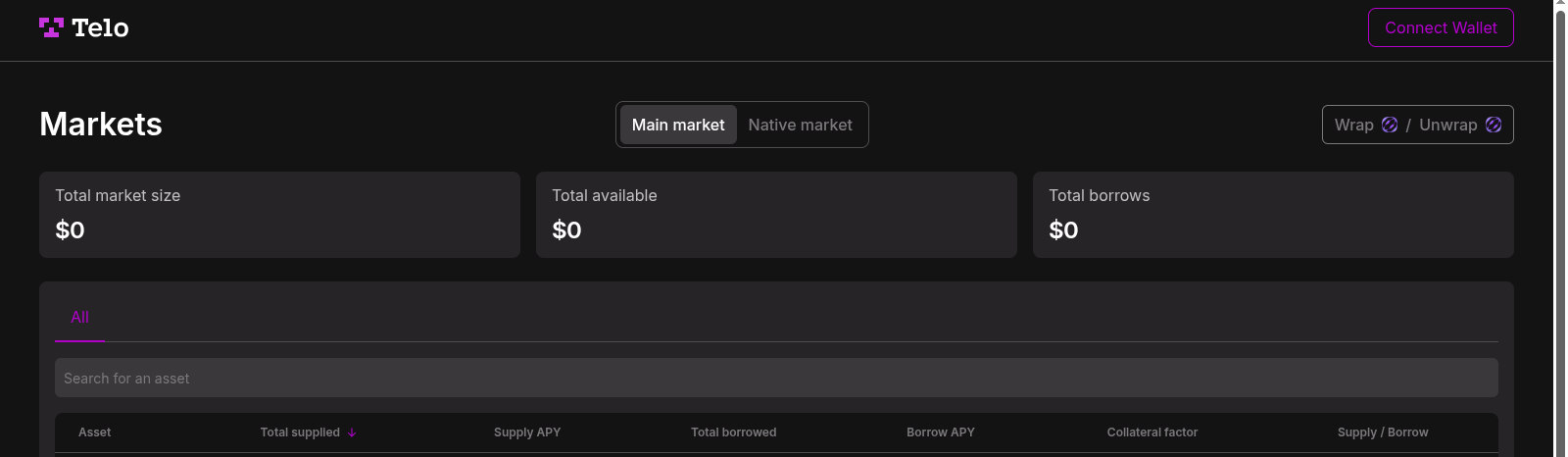

Based on Game of Mito Testnet, the current stage of mainnet preparation will be;

- You deposit ETH into a Matrix vault → receive maETH

- maETH is producing yield and stacking points

- You open Telo, deposit maETH → borrow stablecoins or alt assets

- Use borrowed funds for ops, reinvest, whatever, while maETH keeps earning

That’s dual-track DeFi: yield + liquidity, simultaneously.

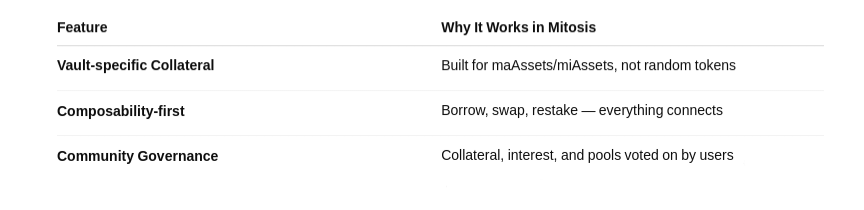

What Sets Telo Apart

TL;DR

Telo Money is the capital amplifier for Mitosis:

Supply vault assets

Borrow against yield

Strategize with composable positions

Maximize flow without leaving the ecosystem

Loop smarter. Lend natively. Borrow tactically.

Telo makes it one-click DeFi.

Comments ()