The 2025 Boom in Real-World Asset (RWA) Tokenization

Real-world asset tokenization involves converting shares of property, bonds, commodities, and other physical or financial assets into blockchain-based tokens. These tokens can be bought, sold, or used as collateral on the on-chain. By tokenizing assets, expensive investments become fractionally accessible: anyone can own a “slice” of a skyscraper or a corporate bond for as little as a few dollars. Industry leaders note that this is no longer science fiction – as BlackRock CEO Larry Fink remarked, “every asset can be tokenized” (his firm even launched a tokenized U.S. Treasury fund). The market evidence is mounting: by late 2024, the on-chain RWA market (excluding stablecoins) was already around $15.2 billion, and forecasts for 2025 are even larger. One analysis predicts RWA volumes could roughly double in 2025 (roughly $15–50 billion by year-end) as more institutions adopt blockchain methods. See https://www.investax.io/blog/2024-real-world-asset-tokenization-market-recap#:~:text=The%20tokenized%20RWA%20market%20,26%20billion This rapid growth reflects converging trends: better technology, clearer regulations, and rising demand for programmable, 24/7 liquidity in traditionally illiquid markets. See https://university.mitosis.org/tokenization-of-real-world-assets-rwa-how-blockchain-is-opening-the-doors-to-traditional-finance/#:~:text=Imagine%20owning%20a%20slice%20of,to%20anyone%20through%20blockchain%20technology

Why RWA Tokenization Matters

Tokenizing real-world assets addresses key inefficiencies in finance. Most importantly, it unlocks liquidity and access for everyday investors. For example, instead of needing millions to buy a rental property, one can buy tokens representing its cash flow. This means fractional ownership – the ability to invest with as little as $10 and still own part of a real estate or private equity asset. RWA tokens also carry earnings and yields: token holders can receive rent, interest, or dividends proportional to their stake. Because transactions are on a blockchain, they offer unprecedented transparency and security, with immutable records of ownership and transfers. Crucially, tokenized assets can flow into DeFi: investors can pledge RWA tokens as collateral for loans, trade them on decentralized markets, or include them in yield strategies. In short, tokenization brings broad accessibility, passive income, and real-time markets to assets once reserved for institutions. See https://university.mitosis.org/tokenization-of-real-world-assets-rwa-how-blockchain-is-opening-the-doors-to-traditional-finance/#:~:text=Why%20does%20this%20matter%3F

Key benefits of RWA tokenization include:

- Accessibility: Small investors can now own fractions of large assets (real estate, bonds, art, etc.) via tokens.

- Passive income: RWA tokens often distribute yields (rent, interest, dividends) directly to holders.

- Transparency & Liquidity: On-chain records make ownership auditable, and secondary markets can form to trade previously illiquid assets.

- DeFi Integration: Once on-chain, these assets can be used in lending pools, automated market makers, or other DeFi protocols (for example, tokenized treasury bills have been used as collateral in DeFi loans). See https://www.zoniqx.com/resources/tokenized-rwas-set-to-double-in-2025#:~:text=Integration%20with%20Decentralized%20Finance%20,

As one Mitosis University analysis explains, tokenization is “finally seeing the first real steps toward integrating DeFi with the real economy,” See university.mitosis.org. In 2024, a variety of tokenized funds and securities were launched (including U.S. bond ETFs, private credit funds, real estate trusts, and commodities), demonstrating that the technology works and can attract professional investors. See mirror.xyz

Leading RWA Platforms and Protocols

Several specialized platforms are spearheading the RWA tokenization wave. Each takes a different approach in terms of technology, partnerships, and regulatory strategy.

Zoniqx (AI-Powered Tokenization Platform)

Zoniqx is a Silicon Valley-based fintech infrastructure provider designed specifically for compliant RWA issuance. See zoniqx. Its platform uses an AI-powered, multi-chain architecture to handle all stages of the Tokenized Asset Lifecycle Management (TALM). In practice, this means Zoniqx offers “Tokenization Platform as a Service” (TPaaS) and custom token standards (like its ERC-7518 “DyCIST” protocol) to embed compliance (KYC/AML, jurisdictional rules, etc.) directly into tokens. The goal is to make on-chain assets secure and regulation-ready from day one. Zoniqx emphasizes interoperability: its tools and APIs let banks and asset managers tokenize assets on public or private chains while still satisfying rules in places like the EU or Dubai. See zoniqx

Because Zoniqx is fully API-driven, it can integrate with existing systems. For example, at the Token2049 conference in Dubai 2025, Zoniqx hosted banking and VARA-regulated property tokenization showcases. The company’s compliant token standard (DyCIST) and AI compliance checks mean that tokens can be automatically labeled and restricted according to local regulations. Seethecoinrepublic. Zoniqx also publishes market insights (e.g. on institutional interest by BlackRock, JPMorgan, UBS) and touts an AI-based aggregator (RWA Connect) to link tokenized assets to qualified investors and DeFi pools. In summary, Zoniqx is building a regulatory-first, multi-chain rail for securities tokens that appeals to global banks and funds.

Ondo Finance (Treasury and Yield Products)

Ondo Finance bills itself as a “decentralized investment bank” for tokenized assets. It has focused especially on short-duration U.S. government debt and cash-equivalent instruments. Ondo’s flagship product is OUSG, a tokenized Short-Term U.S. Government Treasuries Fund that holds assets like BlackRock’s institutional Treasury ETF. By putting this fund on-chain, Ondo lets investors mint or redeem shares 24/7 – a dramatic change from traditional markets. For example, Ondo expanded OUSG onto the enterprise XRP Ledger (Ripple’s network) and tied it to the RLUSD stablecoin, enabling “qualified investors to mint and redeem tokens around the clock” with near-instant settlement. See coindesk.com. Similarly, Ondo joined Mastercard’s Multi-Token Network (MTN) so that businesses can convert cash into OUSG tokens in real time without manual settlement windows. See businesswire.com.

Because Ondo deals in high-grade debt, it works closely with regulators. In April 2025, the Ondo team (along with legal counsel) met with the SEC’s Crypto Task Force to discuss how to compliantly issue on-chain securities like tokenized U.S. equity and bond funds. See cryptoslate.com. The focus was on registration rules, broker-dealer requirements, and investor protections. Ondo has also secured partnerships with stablecoin issuers and DAO treasuries to provide liquidity (“liquidity-as-a-service”) and facilitate token trading. In short, Ondo’s model is to create institution-grade yield products on-chain (backed by real bonds) and bridge them into the existing financial infrastructure, making it easy for hedge funds, family offices, and even companies to park idle cash in tokenized Treasuries with daily yield. See https://tangem.com/en/blog/post/real-world-assets-rwa/#:~:text=Ondo%20Finance%20is%20a%20decentralized,token%20trading%20on%20decentralized%20exchanges

Centrifuge (Open DeFi Infrastructure)

Centrifuge is an open-source blockchain protocol for RWA tokenization and financing. Founded in 2017, it has built a broad ecosystem for any issuer of tokenized assets. Centrifuge’s latest architecture (Centrifuge V3) is EVM-compatible and modular, offering composable smart contracts (vaults, funds, ETFs, credit structures, stablecoins, etc.) to launch financial products on-chain. See centrifuge. A key innovation is the RWA Launchpad, which provides pre-built contract extensions (for features like tokenized bonds, lockups, ETFs, and a “Freely Transferable” token wrapper) so that asset managers need not code from scratch. For example, a tokenized fund on Centrifuge can opt into the Freely Transferable extension to ensure its tokens trade easily across DeFi platforms, unlocking liquidity. See centrifuge.mirror.xyz.

Centrifuge has demonstrated its institutional bona fides through high-profile use cases. In March 2025, it announced that Centrifuge-based infrastructure powered the winning bid in the MakerDAO (Sky) treasury RFP: a $200 million tokenized U.S. Treasury fund co-managed by Janus Henderson and Anemoy. Seecentrifuge.mirror. This fund (JRTSY) received top credit ratings from S&P and Moody’s, a strong signal of regulatory approval. Centrifuge CEO Anil Sood noted that being selected validates Centrifuge’s “comprehensive tokenization infrastructure” for any issuer or asset. Centrifuge also partners with regulated exchanges (e.g, Archax) and auditors to bridge DeFi with tradfi expectations. In essence, Centrifuge offers a middle path: it is a DeFi-native protocol (on-chain, decentralized) that nonetheless supports the standards and due diligence demanded by institutional investors. See centrifuge.

Comparing the Platforms

Although all three platforms share the goal of bringing real assets on-chain, they differ in focus and method:

- Asset Focus: Ondo concentrates on ultra-safe instruments (e.g, U.S. Treasuries and money-market funds), appealing to risk-averse investors. Centrifuge’s Launchpad covers a wide range (private credit funds, bonds, ETFs, etc.) with a flexible modular framework. See centrifuge. Zoniqx aims to serve any RWA issuer (real estate, private equity, intellectual property, etc.) with its end-to-end issuance suite.

- Regulatory Strategy: Zoniqx embeds compliance by design (via its DyCIST token standard and regional partnerships with regulators like Dubai’s VARA). See thecoinrepublic. Ondo proactively engages regulators (SEC meetings, credit ratings, etc.) and even uses established payment rails (Mastercard MTN, Ripple’s network) so that token trading fits existing frameworks. See cryptoslate. Centrifuge, while originally DeFi-native, has pursued institutional trust by enabling credit ratings and working with regulated entities (e.g. having Moody’s rate its tokenized fund).

- Technology & Scalability: Zoniqx’s stack is multi-chain and AI-driven, with an emphasis on smooth integration (it provides SDKs and APIs for issuers). Ondo issues tokens on public blockchains (Ethereum, now also XRP Ledger) but uses fiat-backed stablecoins to bridge into banking rails. See coindesk.combusinesswire.com. Centrifuge V3 uses EVM-based smart vault standards (e.g. ERC-4626, ERC-7540) to ensure interoperability with the wider DeFi ecosystem. All are designed to scale to institutional volumes, but Zoniqx and Centrifuge focus on broad multi-chain support, whereas Ondo emphasizes connecting to high-throughput enterprise networks.

- Institutional Use Cases: Ondo’s products are explicitly targeted at funds, DAO treasuries, and businesses that want yield with safety (as seen by its partnerships with BlackRock’s cash fund and Mastercard). Centrifuge powers tokenized funds and credit facilities for asset managers (e.g, Anemoy’s Janus Henderson fund, BlockTower’s large credit fund). See centrifuge.mirror.xyzcentrifuge.mirror.xyz. Zoniqx, meanwhile, is building tools for banks and fintechs to issue their own tokens – essentially white-label infrastructure. In practice, a major bank could use Zoniqx to digitize its bond offerings, while DeFi-first asset managers use Centrifuge or Ondo to create tradable token funds.

Evolving Technology and Standards

The RWA boom is accelerating thanks to new tech and token standards. For example, ERC-3643 and Zoniqx’s ERC-7518 (“DyCIST”) provide templates for permissioned securities tokens. The Centrifuge protocol embraces modern vault standards (ERC-4626, ERC-7540) so tokens can plug into lending and liquidity protocols seamlessly. Oracles and data providers (Chainlink, Moody’s, Particula) are being integrated to feed real-world pricing and risk data on-chain. Moreover, advances in blockchain interoperability allow RWA tokens to move across networks: Ondo’s use of the XRP Ledger for US Treasuries and Microsoft’s push into multi-token networks are examples of this cross-chain expansion. Artificial intelligence is also starting to play a role – Zoniqx promotes AI for compliance automation and portfolio management, and other projects are exploring ML-driven credit scoring for on-chain assets. See https://centrifuge.mirror.xyz/Ujcfp4flrFUGxLUEXiDlwZH1ZCfLmh4HMdXI1CUP-XQ#:~:text=The%20Centrifuge%20RWA%20Launchpad%20applies,portfolio%20strategies%20via%20standard%20vault

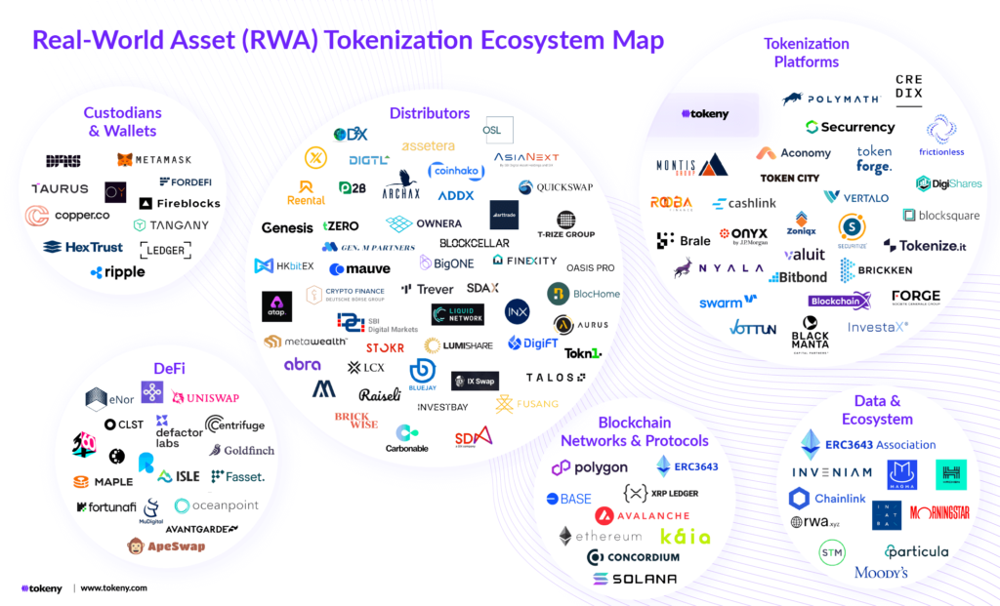

Despite the hype, challenges remain. Investors and issuers must navigate legal complexities (varying securities laws across jurisdictions) and ensure true asset backing (custody of the underlying collateral must be secure). Platforms are working on audit standards and insurance to address these risks. Key to success will be open standards: if tokenized assets on different platforms can interoperate easily, liquidity will grow. The Tokeny ecosystem map below (see Figure) illustrates the many categories – from tokenization services to DeFi protocols – that must come together for this market to thrive.

Mitosis and RWA Liquidity

A new entrant, Mitosis, offers innovative infrastructure that could significantly boost RWA token liquidity in DeFi. Mitosis treats liquidity itself as a programmable primitive. When users deposit assets into Mitosis vaults (across any supported chain), they receive on the Mitosis L1 “Vanilla Assets” representing their deposits. See docs.mitosis.org. These deposits can then be committed to yield-generating opportunities via two frameworks: Ecosystem-Owned Liquidity (EOL) or Matrix. In EOL, all pooled assets are managed collectively: participants vote on how to allocate the pool to various DeFi strategies, and each depositor receives a tradable miAsset token representing their share. Seedocs.mitosis.org. In Matrix, depositors join curated “liquidity campaigns” with fixed terms, earning higher rewards; they receive maAsset tokens as receipts for those specific vault allocations.

Importantly, these position tokens (miAssets and maAssets) are fully programmable. See docs.mitosis.org. They can be traded on secondary markets, used as collateral in other protocols, or decomposed into their underlying principal and yield components. For example, a tokenized real estate security deposited via Mitosis could yield an miAsset that itself might be used to collateralize a loan on another chain. This level of composability is unique: it turns a locked liquidity position into a liquid instrument. Mitosis’s settlement system also keeps everything synchronized across networks, ensuring fair accounting of yield and risk. See docs.mitosis.org.

How does this help RWAs? Imagine a small investor holding tokens of a corporate bond on Ethereum. They could deposit those tokens into a Mitosis vault and vote in EOL to have the pooled funds managed alongside others, gaining exposure to higher-yield credit deals that would otherwise be inaccessible to them. Alternatively, a tokenized asset issuer could launch a Matrix campaign (via Mitosis Matrix vaults) that offers guaranteed terms to depositor LPs. In both cases, the ecosystem-owned liquidity model democratises access to institutional-grade yields. See docs.mitosis.org. In short, Mitosis turns RWA positions into programmable building blocks, multiplying the ways they can be utilized in DeFi. (For more on Mitosis’s approach to collective liquidity, see the Mitosis docs on EOL and Matrix. docs.mitosis.orgdocs.mitosis.org.)

Conclusion

The 2025 RWA tokenization boom is fundamentally reshaping finance. By marrying digital assets with tradfi assets, markets become larger, faster, and more inclusive. For developers, this means rich opportunities to build new lending pools, AMMs, and derivatives based on real collateral. Investors gain access to professional-grade yields and portfolio diversification (for instance, combining stock index tokens with bond tokens, all on one blockchain portfolio). New standards and infrastructure (like Mitosis or the Centrifuge vaults) will continue to lower friction.

That said, clarity on regulations and robust custodial practices are critical. Participants must keep an eye on evolving laws (e.g. SEC guidance, EU MiCA, Singapore’s token frameworks) and ensure full transparency. As one Mitosis University overview notes, tokenizing assets “opens the doors to traditional finance” but requires careful bridges between the two worlds. See university.mitosis.org. Overall, however, the momentum is clear: the $15–17 trillion global asset market is inching on-chain. Platforms like Zoniqx, Ondo, Centrifuge (and infrastructure like Mitosis) are building the plumbing. By the end of 2025, real-world asset tokens could be as common in DeFi as stablecoins are today, fundamentally widening who can participate in asset ownership and yield generation.

🔗Links:

Comments ()