The Corporate Crusader: How MicroStrategy Bet Its Future on Bitcoin and Changed the Game

In a quiet corporate office in Tyson's Corner, Virginia, a war chest was being assembled—not for M&A or R&D, but for a revolution. It was 2020, and while the world reeled from the chaos of a pandemic, MicroStrategy’s CEO, Michael Saylor, sat with a conviction few dared voice aloud: the dollar was melting, and Bitcoin was the ark.

That single, defiant thesis would go on to reshape the DNA of MicroStrategy—and rattle the foundations of corporate finance.

From Business Intelligence to Bitcoin Maximalism

MicroStrategy wasn’t built to be a Bitcoin giant. For over two decades, it sold enterprise software—solid, respectable, unsexy. But Saylor wasn’t content with survival. As inflation loomed and the Federal Reserve printed trillions, he looked at MicroStrategy’s cash reserves and saw them quietly dying.

So, he made a move. Bold. Unprecedented. Reckless, some said.

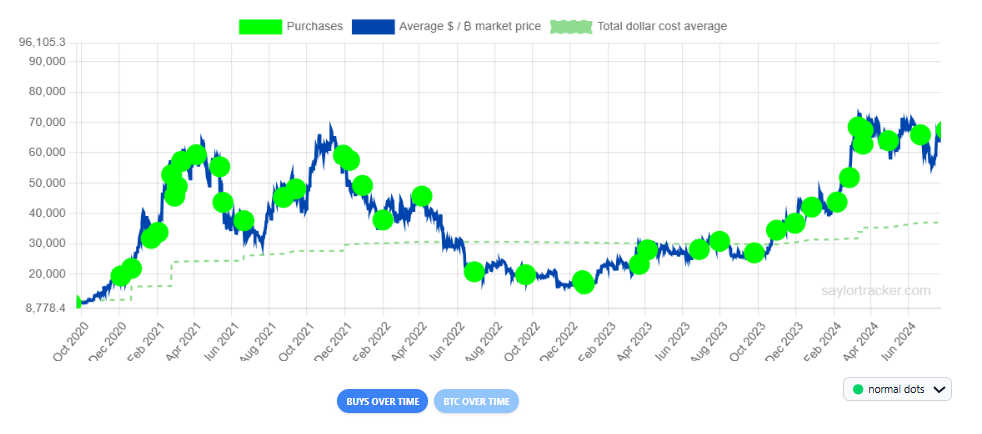

In August 2020, MicroStrategy became the first publicly traded company to convert a significant portion of its balance sheet into Bitcoin. But it wasn’t a one-off—this was just the beginning of a multi-year accumulation that now exceeds 553,000 BTC, worth more than $32.2 billion at today’s prices.

The world watched as Saylor, part oracle, part zealot, rewrote the rulebook on treasury management.

Leveraging the Future: Equity, Debt, and Conviction

This wasn’t just a company dollar-cost averaging into crypto. MicroStrategy weaponised capital markets, issuing convertible debt, selling equity via ATM offerings, and recycling all the firepower into Bitcoin.

They diluted. They borrowed. And they did it over and over again.

Where others saw risk, Saylor saw strategy. Each market dip? A buying opportunity. Each halving? A catalyst. He didn’t hedge; he doubled down. Again and again. Until MicroStrategy was less a tech company and more a high-leverage Bitcoin ETF in disguise.

Investors didn’t know what to make of it. Traditional analysts baulked. But crypto natives hailed Saylor as a prophet. His confidence fueled a new wave of institutional curiosity and changed the tone of boardroom conversations globally.

A New Proxy Emerges

MSTR, once just another mid-cap tech stock, became something else entirely—a proxy for Bitcoin in the U.S. equities market. When BTC ran, MSTR soared. When it dipped, MSTR tanked harder. Hedge funds, retail traders, and even ETFs began using MSTR as a tool—levered exposure to digital gold without touching a wallet or key.

MicroStrategy had become, unwittingly, Wall Street’s Trojan horse for Bitcoin.

But with that transformation came risk. The company’s health became tethered to crypto’s volatile tides. Critics warned of overexposure. Shareholders questioned the dilution. Still, Saylor smiled. He wasn’t playing the quarterly game. He was playing the century game.

The Sentiment Shockwave

Saylor’s crusade sent waves through the financial system:

- Institutional investors began whispering about BTC over Bloomberg terminals.

- CFOs in Fortune 500s debated whether their reserves should sleep in bonds or Bitcoin.

- Finfluencers started measuring “conviction” not by holdings, but by whether you were Saylor-level bold.

But not everyone was cheering. Traditional finance questioned the wisdom of anchoring a company to a speculative asset. Sceptics labelled it reckless, a ticking time bomb. What happens if Bitcoin crashes? What happens if the SEC cracks down?

Saylor, meanwhile, just kept buying.

Not Just a Bet—A Blueprint

Today, MicroStrategy stands at a strange crossroads. It's no longer just a software company. It's a beacon for Bitcoin maximalists, a real-time experiment in monetary transformation, and a corporate avatar for a decentralised vision.

In 2024, it even renamed itself: Strategy—a subtle nod to the singular mission that now defines it.

Whether you admire the audacity or fear the risk, one thing is clear: MicroStrategy’s Bitcoin play has permanently shifted the market narrative. It’s no longer a question of whether Bitcoin belongs in corporate treasuries. The question is—how many Saylor imitators are coming next?

MicroStrategy didn’t just put Bitcoin on its balance sheet—it put it on the map

INTERNAL LINKS:

MicroStrategy’s Bitcoin Strategy

The Bitcoin Treasury Pivot

Strategy’s Bitcoin acquisition strategy

Michael Saylor’s Strategy

Strategic Rationale

Comments ()