The Cross-Chain Liquidity Gap

New Layer 1 (L1) blockchains face the same problem:

- Fragmented liquidity pools

- Inefficient capital allocation

- High dependency on external incentives

Building real adoption requires deep, sustainable liquidity — but bootstrapping it from scratch is slow and expensive.

Mitosis solves this with Liquidity as a Service (LaaS) — a framework that allows any L1 to tap into unified, ecosystem-owned liquidity without sacrificing decentralization.

How Mitosis Provides Liquidity as a Service

Mitosis acts as a liquidity backbone for partner chains:

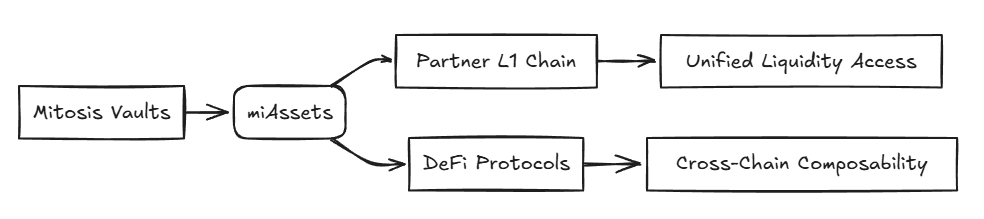

1. Unified Vault Infrastructure

Assets deposited into Mitosis vaults form a mobile liquidity layer, deployable across integrated chains.

2. miAsset Standardization

Assets like miETH or miUSDC can flow freely between ecosystems, unlocking DeFi utility without liquidity fragmentation.

3. Composable, Cross-Chain DeFi

Partner chains gain access to deep liquidity, without isolated pools or reliance on mercenary capital.

4. Protocol-Owned Liquidity (EOL) Built-In

Liquidity provided is sticky — anchored to protocol growth, not temporary incentives.

Liquidity as a Service in Action

Why It Matters for L1 Chains

LaaS with Mitosis enables:

- Immediate liquidity access for new ecosystems

- Reduced costs for attracting users and developers

- Native support for cross-chain DeFi applications

- Strengthened token utility through miAsset integration

Instead of competing for fragmented liquidity, L1s integrate with Mitosis to amplify their capital efficiency and accelerate ecosystem growth.

Case Example: Expanding an Emerging L1

An emerging chain partners with Mitosis:

- Mitosis vaults are seeded with assets (ETH, USDC, etc.)

- miAssets are deployed on the new chain

- Developers build DeFi apps leveraging mobile liquidity

- Users access yield opportunities without bridging friction

Result: Faster adoption, reduced fragmentation, and sustainable liquidity flows.

Comments ()