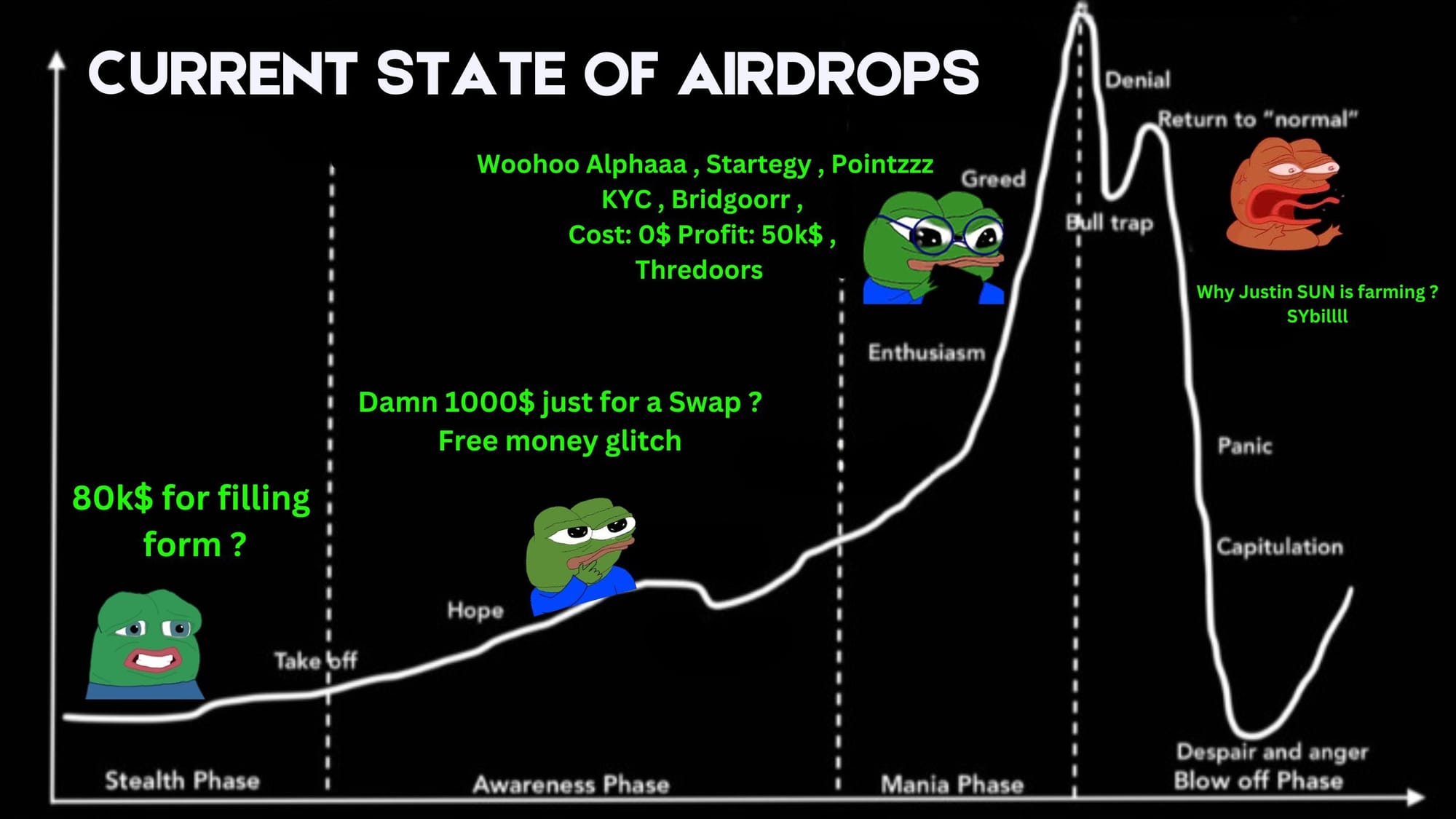

The Current State of Airdrops; a Death Spiral

What happened?

Airdrops, which were once a golden opportunity for users to earn free tokens for promoting or contributing to projects and for projects to build hype (market strategy to bootstrap adoption), have lost their shine over the years.

The Rise of Airdrops

Airdrops burst onto the crypto scene as a clever marketing masterstroke where projects would distribute free tokens to wallet addresses to create awareness, build hype, reward early adopters, and bootstrap their communities.

The idea was simple, give away tokens, spark interest, and encourage trading once the token hits exchanges. A standout example was Uniswap’s airdrop in 2020, where they distributed 15% of UNI token supply to early users, which was the first of many airdrops to come, setting a trend for others to follow.

At the time, this was a win-win to users who got free tokens (sometimes worth thousands of dollars), while projects gained traction they needed with minimal marketing costs. Airdrops were especially appealing because they played into the endowment effect: “people value things more when they own them”. By giving users a stake in the project (making them feel among by releasing a portion to them), projects encouraged loyalty and engagement. Early airdrops often targeted active community members, requiring small tasks like joining a Telegram group or retweeting a post. The rewards could be substantial, take Jito on Solana, which allocated 10% of its supply to an airdrop, with even the lowest tier receiving 4,941 JTO tokens, worth a tidy sum as at the time.

The Peak: Airdrop Mania in 2023–2024

By 2023, airdrops had become a crypto adoption standard. Projects like Arbitrum, Optimism, and zkSync used them to reward early adopters on Layer 2 solutions, and Solana becoming a hub for airdrop activity.

This hype reached fever pitch in late 2023 - early 2024 as Bitcoin hit all-time highs following the launch of spot Bitcoin ETFs. Arbitrum’s $ARB and Celestia’s $TIA, Dymension’s $DYM being notable successes. Users started flocking to “airdrop farm & sybil” interactions with protocols solely to qualify for potential token drops, even without official announcements.

During this peak, airdrops evolved into different types:

- Standard Airdrops: First-come, first-served token distributions.

- Bounty Airdrops: Tokens for tasks like social media engagement.

- Holder Airdrops: Rewards based on existing token holdings.

- Exclusive Airdrops: Targeting specific groups, like NFT holders.

- Retroactive Airdrops: Interacting with a protocol before token launch especially through testnets or providing liquidity

- Raffle Airdrops: Adding a luck-based element to distributions.

The promise of “free money” was irresistible, but beneath the surface, cracks were forming.

What Went Wrong

The Decline began just before mid-2024, the airdrop model started to falter. Several factors contributing to this slow decline:

1. Oversaturation and Diminishing Returns - As airdrops became ubiquitous, the competition skyrocketed. Where once only thousands of users competed for rewards, now millions were in the game, leading to smaller allocations per user (ever slicing the pie into tinier pieces). With time, this reflected a growing frustration, with users noting that “airdrop season is dead” and that only a few projects were delivering meaningful rewards. The sentiment was clear: the glory days of airdrops were fading.

2. Price Dumps and Poor Performance - A 2024 study by Keyrock revealed that 88% of tokens launched with airdrops that crashed within 15 days. The initial excitement often led to massive sell-offs as recipients started cashing out their free tokens, creating intense sell pressure. Projects like ZKsync and Blast saw sharp declines in transaction volume and total value locked (TVL) post-airdrop. For example, ZKsync’s transactions dropped to 320,000 from a high of 1.6 million, a fivefold decrease. High fully diluted valuations (FDVs) also worsened the issue as tokens with inflated FDVs lacked the liquidity to withstand the dumps, leading to rapid price declines.

3. Sybil Attacks and Multi-Accounting - Airdrop farming gave rise to Sybil attacks, users began creating multiple wallets to claim more tokens, draining airdrop pools and diluting rewards for genuine users. Projects like LayerZero and ZKsync started responding with “Sybil hunts,” identifying and banning related addresses. But these clampdowns sparked backlash,with community discontent growing, and the negative sentiment often dragged down token prices further. The fight against multi-accounting became a double-edged sword: it aimed to improve fairness but alienated parts of the community.

4. Shifting Incentives - From Community to Utility, early airdrops were about building communities, but by 2024, many projects started using them as a quick way to inflate user metrics like TVL. Some forcing users into lockups or endless farming seasons, leaving participants feeling exploited rather than rewarded. Users began lamenting how projects were “milking users in the name of free money.” The focus now shifting from fostering genuine engagement to maximizing short-term metrics, which eroded trust.

5. Regulatory and Security Concerns - As airdrops grew, so did scrutiny. In some jurisdictions, regulations around free token distributions tightened, leading to automatic decline of airdrops on certain devices or platforms to comply with local laws. Security risks also spiked, scammers exploited airdrops with phishing schemes, prompting wallets to implement stricter protocols that sometimes blocked legitimate distributions adding another layer of complexity for users trying to claim their tokens.

6. Evolving Expectations - As users began to expect airdrops from every new project, the reality didn’t match the hype. Many projects lacked real utility or governance value, leading to disappointment. Airdropped tokens often came with no clear purpose and the lack of “skin in the game” meant recipients were more likely to sell than engage.

The Current State of Airdrops

Fast forward, June 2025, the airdrop landscape has shifted dramatically. Platforms like Binance Alpha and KaitoAI are moving toward more exclusive, whale-targeted distributions. The era of broad, community-driven airdrops is waning. Projects are now experimenting with new models, like points-based systems to retain users post-airdrop. However, these often fail to sustain momentum. Transaction volume are halved after token launch despite continued points programs.

While some projects are pivoting to retroactive airdrops or NFT-based rewards, aiming to reward genuine early adopters rather than speculative farmers. Others are focusing on cross-distribution to target more engaged audiences.

What’s next for Airdrops?

Looking ahead, the airdrop model needs a revamp. Some OGs predict a “return to the beginning / fundamentals” where airdrops go back to their roots as genuine thank yous to users, free of exploitative tactics. Others see a shift toward more sophisticated incentive systems, perhaps integrating gamification or long-term loyalty rewards, but one thing is certain: the days of easy “free money” are over. Projects must prioritize virality and product quality over gimmicks. Users, also, need to adapt, now more than ever, doing due diligence, avoiding scams, and focusing on projects with real value.

Conclusion

As blockchain technology and regulations evolve, airdrops have become more streamlined, but for now, the slow decline of airdrops serves as a cautionary narrative, “In crypto, nothing stays golden forever”.

Airdrops started as a brilliant way to build communities and spread awareness, but oversaturation, price dumps, and shifting dynamics have dulled this appeal. This decline pointing out to a much needed call for innovation.

About Mitosis

X

Discord

Mitosis App

Mitosis Docs

Comments ()