The DNA That Could Fix Broken Blockchain Incentives Forever

The Web3 Incentive Crisis No One Wants to Admit

Blockchains are brilliant in theory—but in practice? Many collapse under their weight.

They launch with fanfare, balloon with liquidity, and then… stall. What happens?

Behind the scenes, there’s a silent killer: misaligned incentives.

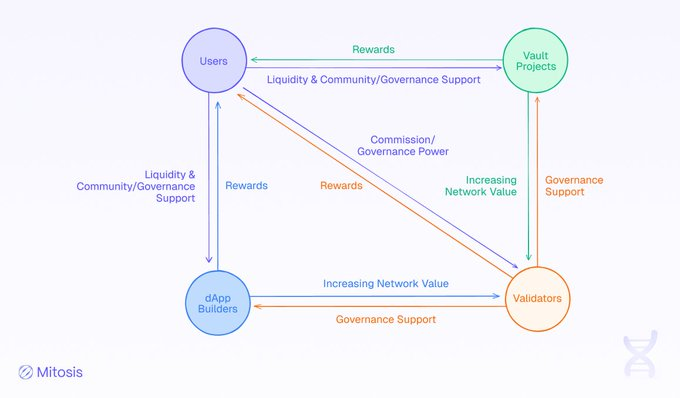

In most ecosystems, users jump from protocol to protocol, chasing yields. Validators secure the network but don’t care about what’s built on it. Developers ship dApps into the void, isolated and underfunded. Liquidity providers chase profits with no say in direction.

It’s a fragmented mess where everyone acts alone because no system rewards working together.

Mitosis: A Chain Where Incentives Evolve with the Ecosystem

Mitosis isn’t just launching a chain—it’s launching a new kind of coordination mechanism: the DNA Program (Dynamic Network Alignment).

Think of it as evolutionary tokenomics.

Instead of relying on rigid formulas or top-down foundation control, DNA rewards the behaviors that make ecosystems thrive. It creates an adaptive feedback loop where every participant’s success is tied to everyone else’s.

“This isn’t just staking and voting—it’s programmable alignment at scale.”

Let’s break it down.

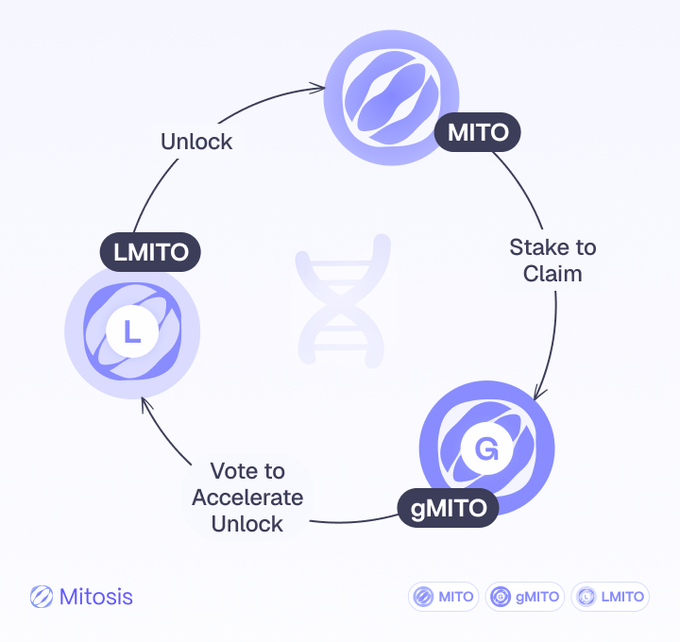

The Backbone: A Three-Token Incentive Engine

At the core of DNA is a unique triple-token structure:

MITO – The Utility Workhorse

- Gas for transactions, stakable, tradable.

- The more MITO is used, the more valuable it becomes.

gMITO – The Governance Gatekeeper

- Earned by staking MITO.

- Non-transferable = no vote buying or flash loan exploits.

- Used for ecosystem votes, vault parameters, and incentive direction.

Locked MITO (LMITO) – The Patience Multiplier

- Unlocks slowly over time—unless you participate.

- Vote more, earn faster.

- Can’t be sold or transferred until unlocked = built-in loyalty filter.

This token trinity creates natural tension.

👉 Use now (MITO)

👉 Shape the future (gMITO)

👉 Earn big over time (LMITO)

It’s a system designed to reward the long game—and punish short-term extraction.

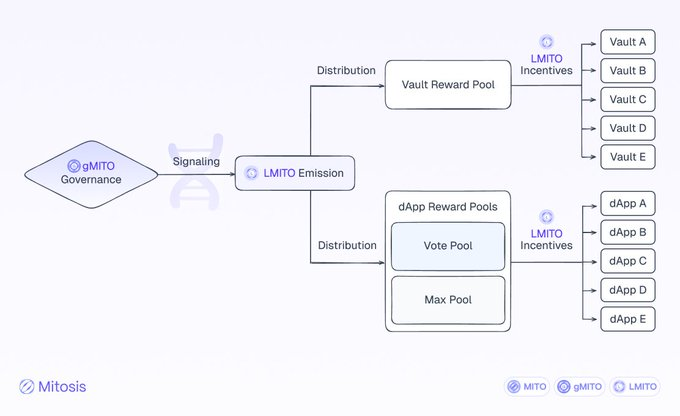

How Rewards Flow (Hint: It’s Not Random)

DNA isn’t spraying tokens blindly—it’s precision-engineered for impact.

Vault Rewards

Liquidity vaults are how capital enters the system, so they get first dibs. But not all vaults are equal.

gMITO holders vote on which ones get what. That means:

- High-performing vaults earn more rewards.

- Liquidity flows to where it creates value.

- Governance participation directly influences yield.

“You don’t just farm rewards—you shape the future of liquidity.”

🛠 dApp Rewards: Two Streams, One Goal

- The Max Pool (Autopilot Rewards)

- If your dApp uses MITO, it gets rewards. Period.

- The more integration, the more you earn. No politics—just math.

- The Vote Pool (Governance Boosters)

- Promising new dApps can be voted into early support.

- Adds a human layer to reward innovation before the metrics catch up.

This hybrid approach blends fairness with flexibility, something no other chain nails.

What’s In It For YOU?

For DeFi Users: Loyalty Pays

- Double dip: vault yields + LMITO rewards

- Governance boosts = faster unlocks

- Influence grows over time

- Diversified returns from an entire DeFi ecosystem

🛡 For Validators: From Miners to Architects

- Earn gMITO commissions, not just block rewards

- Shape network evolution through votes

- Incentives tied to ecosystem health, not raw block production

🛠 For Developers: Real, Ongoing Funding

- Predictable rewards for MITO-integrated apps

- Early-stage boosts via community voting

- Whitelisting = visibility + trust

- Access to vault-backed liquidity pools

For Vault Projects: First-Class Citizens

- Priority access to incentives

- Governance-controlled fee structures

- Flywheel: more votes → more rewards → more liquidity

Governance That Doesn’t Suck

Let’s be honest: most DAO governance is a mess. Not here.

DNA’s governance system is:

- Time-weighted (long-term = more say)

- Non-transferable (no mercenary votes)

- Equal weight (1 gMITO = 1 vote, no elite overrides)

gMITO holders manage:

- Vault allocation ratios

- dApp reward splits

- Custom vault parameters

- Ecosystem fee flows (treasury vs rewards vs dev fund)

“In DNA, governance isn’t a checkbox—it’s an economic engine.”

Phased Rollout: Slow, Steady, Decentralised

- Phase 1: Foundation First

- MITO and staking go live

- Early gMITO accumulation

- Key parameters set by the core team

- Phase 2: Community Control

- LMITO emissions activate

- Governance takes over incentive control

- Vaults and dApps funded by the community’s vote

The shift is gradual, but deliberate. No rug pulls, no chaos.

Why DNA Works When Others Don’t

The DNA Program succeeds where most fail because it:

✅ Aligns incentives across all roles

✅ Prioritises participation over speculation

✅ Balances objectivity and governance

✅ Prevents abuse with non-transferable tokens

✅ Adapts to ecosystem needs in real-time

✅ Decentralises responsibly

This isn’t tokenomics. It’s token evolution.

“DNA turns blockchains from zero-sum into win-win.”

Final Thought: The Future Belongs to Aligned Ecosystems

The Mitosis DNA Program is more than a new incentive structure—it’s a philosophical shift.

One where:

- Users earn more by staying loyal

- Validators guide the network, not just secure it

- Developers get funding that lasts

- Projects thrive through real integration

- And governance becomes a value-creation machine

In a Web3 world full of short-term hype, DNA is building something rare: a foundation for long-term value.

This is what growing up looks like—for a chain.

Ready to participate?

Jump into the Mitosis Discord and explore how you can become part of the world’s first ecosystem where incentives grow with you.

more links for reference:

https://university.mitosis.org/mitosis-dna-program-a-revolutionary-approach-to-incentives-in-blockchain-ecosystems/

https://university.mitosis.org/mitosis/

https://university.mitosis.org/defi/

https://x.com/MitosisOrg/status/1908187889567203651?t=2-BkplxQNsaatzhDgo9ykQ&s=09

Comments ()