The Evolution of DAOs: Governance Models and Their Impact on Decision-Making

Introduction

Decentralized Autonomous Organizations (DAOs) represent a paradigm shift in how we conceptualize organizational governance. Enabled by blockchain technology, DAOs operate without centralized control, relying on smart contracts and token-based systems to facilitate decision-making and resource allocation. Since the inception of the first notable DAO, "The DAO," in 2016, these entities have evolved significantly, navigating technical, cultural, and regulatory challenges to redefine collective coordination. This article explores the evolution of DAOs, focusing on their governance models and their profound impact on decision-making processes. From early experiments to sophisticated frameworks, DAOs have reshaped trust, accountability, and participation in organizational structures, offering both opportunities and challenges for the future.

The Genesis of DAOs: A New Organizational Paradigm

The concept of a DAO emerged from the convergence of blockchain technology and the ethos of decentralization. Introduced in the mid-2010s, DAOs were envisioned as organizations where decisions are made through code and community consensus rather than hierarchical authority.

The DAO, launched on Ethereum in 2016, was a pioneering attempt to create a decentralized venture capital fund. Token holders could propose and vote on investment projects, with smart contracts executing decisions automatically. Despite raising over $150 million in Ether, The DAO's collapse due to a critical security flaw exposed the vulnerabilities of early DAO designs.

This initial failure underscored the need for robust governance mechanisms. The DAO's model relied heavily on simple majority voting, which, while democratic in theory, lacked safeguards against malicious actors or poorly vetted proposals. The hack, which resulted in the loss of $50 million in Ether, catalyzed a hard fork in Ethereum and sparked a broader conversation about DAO governance. Lessons from The DAO emphasized the importance of secure code, transparent processes, and mechanisms to balance efficiency with accountability.

Governance Models: From Simple Voting to Sophisticated Frameworks

As DAOs evolved, so did their governance models. Early DAOs operated on rudimentary token-weighted voting systems, where influence was proportional to token ownership. While straightforward, this approach often concentrated power among large token holders, or "whales," raising concerns about plutocracy. Over time, developers and communities experimented with diverse governance structures to address these limitations and enhance inclusivity, efficiency, and resilience. Below, we explore key governance models that have shaped the DAO landscape.

1. Token-Weighted Voting

Token-weighted voting remains the foundational governance model for many DAOs. In this system, each token represents a vote, and decisions are made based on the total weight of tokens cast. DAOs like MakerDAO, which governs the DAI stablecoin, initially relied on this model to approve protocol upgrades and parameter changes. While effective for aligning incentives with investment, token-weighted voting can marginalize smaller stakeholders and incentivize vote-buying or short-term speculation.

To mitigate these issues, some DAOs introduced caps on voting power or time-locked tokens to prevent sudden shifts in control. For example, Compound, a decentralized lending protocol, implemented quadratic voting, where the voting power of large token holders scales less linearly, reducing the dominance of whales and encouraging broader participation.

2. Delegated Governance

Recognizing the limitations of direct token voting, many DAOs adopted delegated governance models, inspired by traditional representative democracies. In this framework, token holders delegate their voting power to trusted representatives or "delegates" who vote on their behalf. This approach reduces voter fatigue and leverages expertise, as delegates are often chosen for their knowledge of the DAO's objectives or technical intricacies.

A prominent example is Uniswap, a decentralized exchange protocol, which employs delegated governance to streamline decision-making. Token holders can delegate votes to community members or entities who actively participate in governance discussions. While this model enhances efficiency, it risks creating new power imbalances if delegates become entrenched or unaccountable. To counter this, DAOs like Aave have introduced mechanisms for revoking delegation and incentivizing delegate accountability through reputation systems.

3. Quadratic Voting and Conviction Voting

Innovative voting mechanisms like quadratic voting and conviction voting have emerged to address the shortcomings of token-weighted systems. Quadratic voting, used by Gitcoin DAO, assigns voting power based on the square root of tokens committed, making it costlier for large holders to dominate decisions. This fosters inclusivity by amplifying the influence of smaller stakeholders without undermining the role of significant contributors.

Conviction voting, pioneered by 1Hive, introduces a time-based element to governance. Voters allocate tokens to proposals, and the "conviction" of a proposal grows over time based on sustained support. This model rewards long-term alignment with the DAO's goals and discourages short-term manipulation. By emphasizing commitment over raw token power, conviction voting creates a more dynamic and equitable decision-making process.

4. Futarchy and Prediction Markets

Futarchy, a governance model proposed by economist Robin Hanson, leverages prediction markets to guide DAO decisions. In a futarchy-based DAO, participants bet on the outcomes of proposals using tokens, and decisions are made based on market predictions of success. This approach aims to harness collective intelligence to optimize outcomes. For instance, a DAO might propose a protocol upgrade and use prediction markets to assess its potential impact on token value or user adoption.

While futarchy remains experimental, DAOs like Gnosis have explored its applications. The model’s reliance on market signals can enhance decision-making efficiency but introduces complexities, such as market manipulation risks and the need for liquid prediction markets. As DAOs scale, futarchy could play a larger role in aligning incentives with long-term value creation.

5. Hybrid and Modular Governance

Modern DAOs increasingly adopt hybrid governance models, combining elements of token-weighted voting, delegation, and innovative mechanisms like quadratic or conviction voting. Aragon, a platform for creating DAOs, enables organizations to customize governance frameworks to suit their needs. For example, a DAO might use token-weighted voting for financial decisions, delegated governance for technical upgrades, and quadratic voting for community initiatives.

Modular governance frameworks allow DAOs to evolve dynamically. Snapshot, a popular off-chain voting tool, enables DAOs to test proposals without incurring gas fees, fostering experimentation with governance structures. These hybrid models balance efficiency, inclusivity, and adaptability, addressing the diverse needs of DAO stakeholders.

Impact on Decision-Making: Opportunities and Challenges

The evolution of DAO governance models has profoundly influenced decision-making processes, offering both transformative opportunities and persistent challenges. Below, we analyze the key impacts.

Opportunities

- Decentralized Decision-Making: DAOs eliminate reliance on centralized authorities, enabling global, permissionless participation. This democratizes decision-making, allowing diverse stakeholders to contribute to organizational goals. For example, Decentraland, a virtual reality platform, empowers its community to govern land allocation and content policies, fostering a sense of ownership.

- Transparency and Accountability: Blockchain-based governance ensures that decisions are recorded immutably, enhancing transparency. Smart contracts automate execution, reducing the risk of human error or manipulation. MakerDAO’s transparent voting process, for instance, allows stakeholders to track proposals and outcomes in real time.

- Inclusivity and Community Empowerment: Advanced governance models like quadratic and conviction voting promote inclusivity by amplifying the voices of smaller stakeholders. This fosters community-driven innovation, as seen in Gitcoin’s funding of open-source projects through quadratic voting.

- Efficiency and Automation: Smart contracts streamline decision-making by automating proposal execution. This reduces bureaucratic overhead and enables rapid iteration. For instance, Compound’s governance system allows token holders to propose and implement protocol changes within days, compared to months in traditional organizations.

Challenges

- Voter Apathy and Participation: Despite their democratic potential, DAOs often struggle with low voter turnout. Complex proposals and technical jargon can deter participation, particularly among non-technical token holders. DAOs like Yearn Finance have experimented with incentives, such as governance token rewards, to boost engagement, but apathy remains a hurdle.

- Power Imbalances: Token-weighted voting and delegated governance can concentrate power among large holders or influential delegates. This risks replicating the hierarchies DAOs aim to dismantle. Governance reforms, such as vote caps and reputation systems, are critical to mitigating these imbalances.

- Security and Exploits: The reliance on smart contracts introduces security risks. The DAO hack of 2016 and subsequent exploits highlight the need for rigorous code audits and fail-safes. Modern DAOs invest heavily in security, with platforms like OpenZeppelin providing audited smart contract templates.

- Regulatory Uncertainty: DAOs operate in a regulatory gray area, with jurisdictions struggling to classify them as legal entities. This creates risks for participants, particularly in jurisdictions with stringent securities laws. DAOs like The LAO, a venture-focused DAO, have navigated this by structuring as legal entities, but broader regulatory clarity is needed.

- Scalability and Coordination: As DAOs grow, coordinating large, diverse communities becomes challenging. Decision-making can slow as the number of proposals and stakeholders increases. Tools like Snapshot and Aragon aim to address this, but scaling governance without sacrificing decentralization remains an open question.

Case Studies: DAOs in Action

To illustrate the impact of governance models, we examine three prominent DAOs:

- MakerDAO: As one of the earliest and most successful DAOs, MakerDAO governs the DAI stablecoin through a token-weighted voting system. Its governance has evolved to include delegated voting and risk management frameworks, enabling it to maintain DAI’s peg to the U.S. dollar while adapting to market volatility.

- Uniswap: Uniswap’s delegated governance model balances efficiency and community input. By allowing token holders to delegate votes to active community members, Uniswap streamlines decision-making while fostering expertise-driven governance. Its recent fee switch proposal demonstrates the power of community-driven upgrades.

- Gitcoin: Gitcoin’s adoption of quadratic voting has revolutionized decentralized funding. By prioritizing broad community support over token wealth, Gitcoin has allocated millions to open-source projects, showcasing the potential of inclusive governance models.

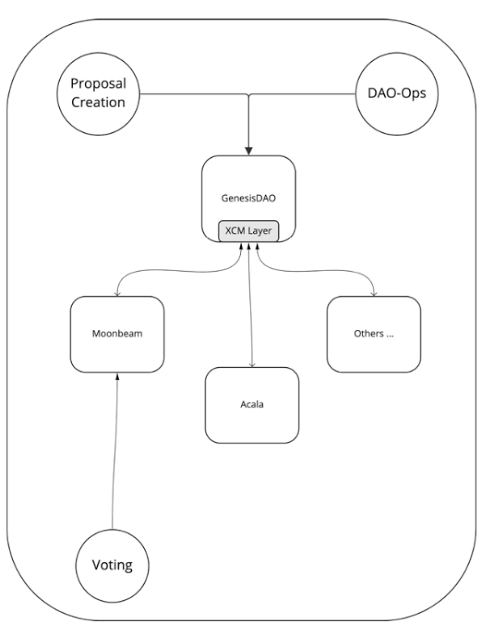

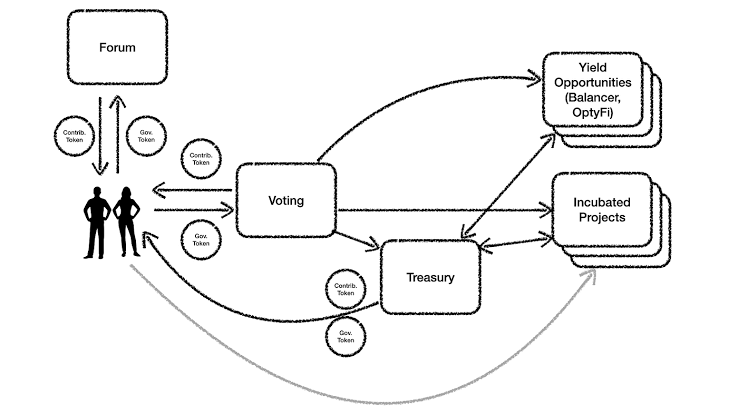

- Morse DAO : Mitosis organized the Morse DAO to revolutionize decision making for Mitosis (Morse holders), By allowing Morse Nft holders of holders with atleast 1 $MORSE token to make proposals and make decisions with a voting system which demonstrate community support.

The Future of DAO Governance

The evolution of DAOs is far from complete. Emerging trends suggest several directions for future governance models:

- AI-Augmented Governance: Integrating artificial intelligence with DAOs could enhance decision-making by analyzing proposals, predicting outcomes, and optimizing resource allocation. While still nascent, AI-driven tools could reduce voter fatigue and improve efficiency.

- Reputation-Based Systems: Reputation systems, which reward consistent and valuable contributions, could complement token-based voting. This would incentivize long-term commitment and reduce the influence of transient token holders.

- Interoperable Governance: As DAOs collaborate across ecosystems, interoperable governance frameworks could enable cross-DAO coordination. For example, DAOs could share voting mechanisms or align on shared goals, creating networked governance models.

- Regulatory Integration: As regulators clarify DAO frameworks, governance models may incorporate compliance mechanisms, such as KYC (Know Your Customer) for certain votes or legal wrappers to protect participants. This could broaden DAO adoption in traditional industries.

Conclusion

DAOs have transformed organizational governance by decentralizing decision-making and empowering communities. From the rudimentary token-weighted voting of The DAO to the sophisticated hybrid models of today, governance frameworks have evolved to balance inclusivity, efficiency, and security. While challenges like voter apathy, power imbalances, and regulatory uncertainty persist, the opportunities for transparent, community-driven decision-making are immense. As DAOs continue to innovate, their governance models will shape the future of organizations, offering a glimpse into a world where trust is coded, participation is global, and decisions are collective. The journey of DAOs is a testament to the power of decentralization, and their evolution will undoubtedly influence how we collaborate and govern in the decades to come.

Useful Links

Decentralized finance Glossary(Mitosis)

Comments ()