The Illusion of Infinite Wealth Through Gambling and Risk

Many believe that gambling, investing, and speculation are ways to get rich quickly.

Especially in the era of cryptocurrencies and hype-driven startups, this idea becomes particularly attractive.

However, behind the apparent simplicity lies a complex mathematical and psychological problem—the jackpot paradox and ergodicity—which explain why most participants ultimately lose everything, while only a few succeed.

Brief summary of Thiccy's thoughts: https://www.scimitar.capital/p/the-jackpot-age?hide_intro_popup=true

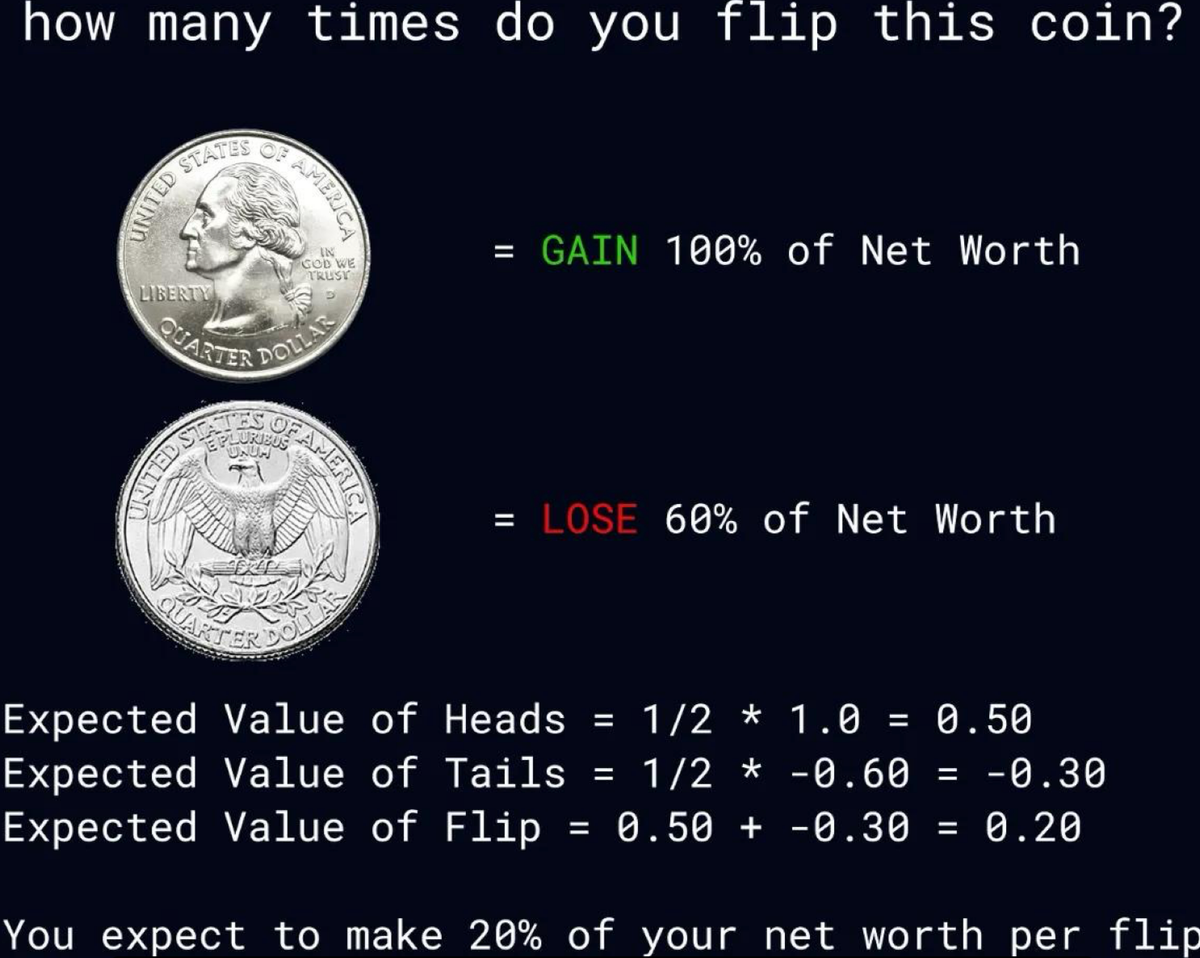

Chapter 1: The Coin Toss Experiment and the Illusion of Positive Expectation

Imagine a game: flipping a coin a thousand times. Each bet promises a +20% increase in capital if you win.

At first glance—this is a "money printer," where the expected return is positive. But looking deeper, it becomes clear that most players end up losing everything.

Why? Because the arithmetic mean of winnings does not reflect the actual trajectory of capital.

In the long run, money leaks away due to the multiplicative effect—even with a positive average gain, the geometric mean shows a negative result.

Chapter 2: The Jackpot Paradox and the Problem of Ergodicity

The key reason is the disconnect between the arithmetic mean and the geometric mean. The arithmetic mean shows the expected gain across all outcomes, while the geometric mean reflects what an "average" player experiences.

In reality, almost all trajectories lead to zero or bankruptcy; only rare lucky ones hit huge jackpots.

Ergodicity - https://en.wikipedia.org/wiki/Ergodicity

Chapter 3: Wealth Models and Risk Appetite in the Crypto Era

Modern traders and investors use different approaches to risk assessment:

Logarithmic approach (SBF): values each additional dollar less, reducing risk.

Linear approach (Suo Zhu): values each dollar equally.

Exponential approach (some crypto players): values each subsequent dollar more, increasing risk for a chance at jackpots.

These models reflect different strategies in conditions of high volatility and pursuit of extraordinary profits. Success stories like Musk or Bezos create myths about quick wealth through risk-taking, but behind them are millions of losers.

Chapter 4: Large Risks and the Culture of "Gradual" Successes

Modern entrepreneurial and investment culture promotes the idea that risk is a path to wealth.

Startups, venture capital, meme stocks—all demonstrate an exponential attitude toward wealth. People are willing to take enormous risks for a chance to become billionaires.

However, most fail; only a select few cross the success threshold. This culture creates an illusion of easy money, trapping more people into losing.

Chapter 5: How to Avoid the Jackpot Trap: A Strategy for Long-Term Success

Experience shows that to preserve capital and grow steadily, it’s crucial to create an edge rather than chase big bets or jackpots.

Avoid risking everything chasing short-term gains or taking excessive risks with low probabilities of success.

A logarithmic wealth strategy—optimizing median outcomes, reducing drawdowns, and gradually accumulating capital—is essential.

This approach helps avoid volatility traps and maintain long-term stability.

Chapter 6: Conclusion

Understanding the jackpot paradox and ergodicity issues is vital for all market participants—from traders to amateur investors.

Most lose because they chase rare big wins instead of focusing on sustainable growth through prudent risk management and strategic planning.

Ultimately, success is achieved not through gambling or greed but through discipline and creating advantages in the market.

Chapter 7: Useful Links

🌐 Website: https://mitosis.org

📖 Documentation: https://docs.mitosis.org

🐦 Twitter / X: https://twitter.com/MitosisOrg

💬 Discord: https://discord.gg/mitosis

Comments ()