The Innovation of Programmable Liquidity at MitosisOrg: Redefining DeFi

DeFi (Decentralized Finance) is reshaping money by letting people trade, lend, and earn without needing a bank. All you need is the internet. This sounds amazing right? but many DeFi systems still have their limits. Your money often ends up stuck in one place, unable to do more or connect with other tools and platforms. That’s where MitosisOrg steps in. They’re introducing programmable liquidity a fresh way of thinking about how your money works in DeFi. Instead of being locked or idle, your funds become more active, flexible, and useful. Think of it like turning your liquidity into a smart assistant, one that moves where it’s needed, works with other apps, and adapts to help you get more out of your money. This breakthrough can make DeFi simpler, faster, and way more powerful not just for experts, but for everyday users too.

In this article, we’ll break down what programmable liquidity means, how MitosisOrg makes it work, and why it could be a huge step forward for the future of finance.

What is Programmable Liquidity? Programmable Liquidity is a smarter, more flexible approach introduced by MitosisOrg. Instead of locking your crypto away, Mitosis gives you special tokens (called miAssets and maAssets) when you deposit funds into their vaults. These tokens still earn rewards, but they’re also usable in other DeFi platforms, tradable, and can even move across different blockchains. Imagine turning your crypto into a multitool instead of a one-trick pony. Your money doesn’t just sit still it works for you in more ways, giving you freedom, flexibility, and more opportunities to grow your earnings.

How to Make Liquidity Work Smarter with MitosisOrg MitosisOrg is reshaping how we use crypto in DeFi by making liquidity more useful, more flexible, and more rewarding. Here’s how they do it: 1. Smart Tokens for Your Deposits (miAssets & maAssets) When you put your crypto into Mitosis, you don’t just lock it up and wait. Instead, you get back special tokens, miAssets if you deposit a single coin like ETH, or maAssets if you deposit a pair like ETH and USDC. These aren’t just digital “claim tickets” they actually do things like:

- They earn you passive income

- Just by holding these tokens, you collect rewards from Mitosis’s strategies like fees from trades, interest from lending, or returns from staking. Your tokens grow in value over time.

- You can trade them anytime. Unlike many LP tokens that are hard to move or only work within one platform, these are ERC-20 tokens. That means you can swap, sell, or transfer them freely if you want to change your plans.

- They play well with others. You are not stuck in Mitosis. You can take your miETH (for example) and use it as collateral in apps like Aave to borrow other assets and still earn yield from Mitosis at the same time.

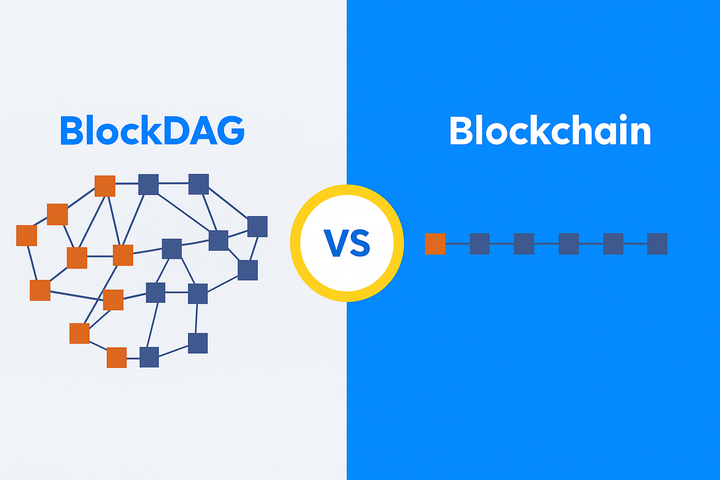

- Seamless Crypto Liquidity Across Blockchains – No Bridges Needed One of the biggest headaches in DeFi is trying to use your assets across different blockchains. Let’s say you’ve got USDC on Ethereum, but you want to use it on Solana normally, you will need to go through a bridge. And honestly, bridges can be a pain: they are slow, costly, and sometimes risky. That is where MitosisOrg steps in with a smarter solution: cross-chain vaults. These vaults let you use your crypto on different blockchains without actually moving it the hard way. Here is work it works: You deposit your crypto (like USDC) into a Mitosis vault on one chain, such as Ethereum. In return, you get a “mirror” version of it called something like miUSDC. Now, you can take that miUSDC and use it on other blockchains like Polygon or Solana. No bridging, no stress. And the interesting part is, you still earn rewards from your original deposit while using the mirrored token elsewhere. Mitosis makes DeFi feel more like one connected system instead of a bunch of separate blockchains. It’s faster, cheaper, and just makes life easier for anyone trying to do more with their crypto.

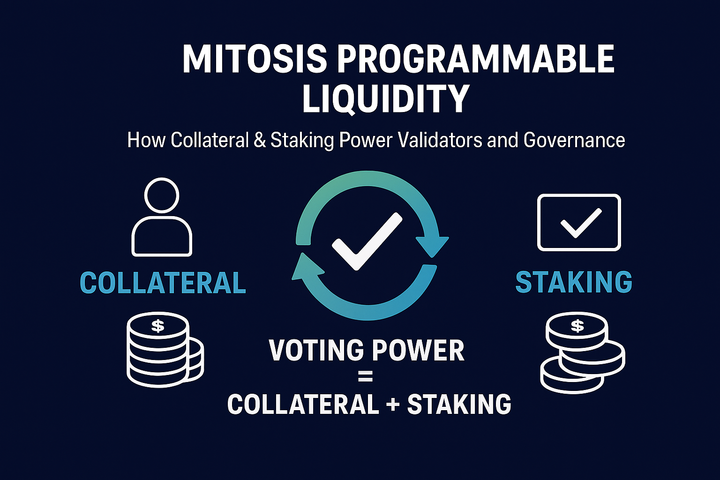

- Ecosystem-Owned Liquidity (EOL) One of the coolest things about MitosisOrg is Ecosystem-Owned Liquidity (EOL). It’s basically a way for everyday users not just whales or big investors to team up and access better earning opportunities together. In most of DeFi, the biggest profits usually go to people with the deepest pockets, while smaller users often get left behind. EOL flips that script by creating a shared liquidity pool that the whole community controls. Here is how it works: you add your crypto to a collective pool, and in return, you get governance tokens. These tokens give you a voice in deciding how the pool's funds are used whether it is lending, staking, or providing liquidity somewhere for rewards. Think of it like a decentralized, community-led fund. Everyone gets a say, and the profits are shared fairly. Mitosis built EOL to give power back to the people, making it easier for anyone to grow their assets, no matter their starting point.

- Matrix Vaults: Simple and Transparent Investment Opportunities MitosisOrg introduces Matrix Vaults, designed to make investing in programmable liquidity easy and rewarding. These vaults are pre-arranged investment pools with clear strategies and terms. Whether you're looking for safer, steady returns or aiming for higher, more aggressive gains, there's something for everyone. What makes Matrix Vaults special is their transparency and the way they encourage fair participation:

- Clear and Simple Terms: Each vault lays out exactly what to expect, how the strategy works, potential returns, risks, and how long your funds will be locked in. This helps you make smart, informed decisions about where to invest.

- Fair Reward System: To motivate long-term participation, rewards from early withdrawals are given to those who stay in the vault longer. This keeps the pools stable and discourages quick, speculative moves.

- Variety of Investment Strategies: Vaults offer different ways to get involved in DeFi, from providing liquidity to decentralized exchanges like Uniswap, to staking in networks like Lido or lending on platforms like Compound. By offering clear, well structured opportunities and rewarding committed investors, Matrix Vaults make it easier for anyone whether you are new to the game or more experienced to dive into programmable liquidity.

- MitosisOrg is built around the idea of maximizing how efficiently capital is used.

In traditional DeFi systems, liquidity providers (LPs) often have to choose between sticking to one protocol for rewards or moving their capital to another, which can result in missed opportunities. Mitosis removes this problem by ensuring that liquidity is always active and earning rewards. Here’s how Mitosis helps Liquidity Providers:

- Stack Rewards: LPs can earn rewards from multiple sources at once. For example, they can deposit ETH, get miETH in return, stake it in a governance protocol, use it as collateral for loans, and still earn rewards from the vault.

- No Idle Capital: With tokenized assets, liquidity is never "locked" into just one protocol. This means LPs can move their capital around and put it to work wherever it’s needed most.

- Maximized Earnings: Mitosis uses EOL and Matrix Vaults to direct liquidity towards the highest-return opportunities, so LPs don’t need to worry about complicated DeFi strategies. By using this approach, Mitosis offers a unique and powerful way for LPs to get the most out of their capital.

Why is Programmable Liquidity Important MitosisOrg’s programmable liquidity helps solve some key challenges in DeFi, offering benefits that make the whole system work better: 1. Helping Retail Users: Mitosis gives everyday users access to high-yield opportunities, like EOL and Matrix Vaults, helping them compete with big institutional investors. 2. Breaking Down Barriers: By offering cross-chain liquidity and tokenized assets, Mitosis connects different parts of DeFi, allowing capital to flow freely between them. 3. Making DeFi More Connected: Programmable tokens make it easier for different protocols to work together, encouraging innovation and teamwork across the DeFi space. 4. Creating Stable Markets: Reward systems that redistribute incentives help keep people invested for the long-term, reducing volatility in liquidity pools. 5. Boosting Efficiency: Liquidity providers (LPs) no longer have to choose between locking up their capital or chasing new opportunities, allowing them to fully take advantage of their assets.

Conclusion MitosisOrg’s programmable liquidity is a game-changer for DeFi. By turning liquidity positions into tokens, allowing cross-chain flexibility, and giving everyone access through Ecosystem-Owned Liquidity, Mitosis is making liquidity much more dynamic and easier to manage. This innovation helps liquidity providers (LPs) get more out of their capital, reduces fragmentation in the market, and creates a more connected and fair DeFi space. As DeFi keeps growing, MitosisOrg is leading the way, showing us a new and better way to manage liquidity. For LPs, developers, and communities, programmable liquidity is more.

Comments ()