The Liquid Multiverse: How Mitosis is Building Parallel Liquidity Realities

Introduction

In the fragmented world of decentralized finance, Mitosis introduces a radical new design: the liquid multiverse. Unlike siloed chains competing for TVL, Mitosis envisions a reality where liquidity can exist and operate across multiple ecosystems simultaneously. This isn’t a bridge, and it’s not just an abstraction layer — it’s a foundational shift in how we think about cross-chain capital.

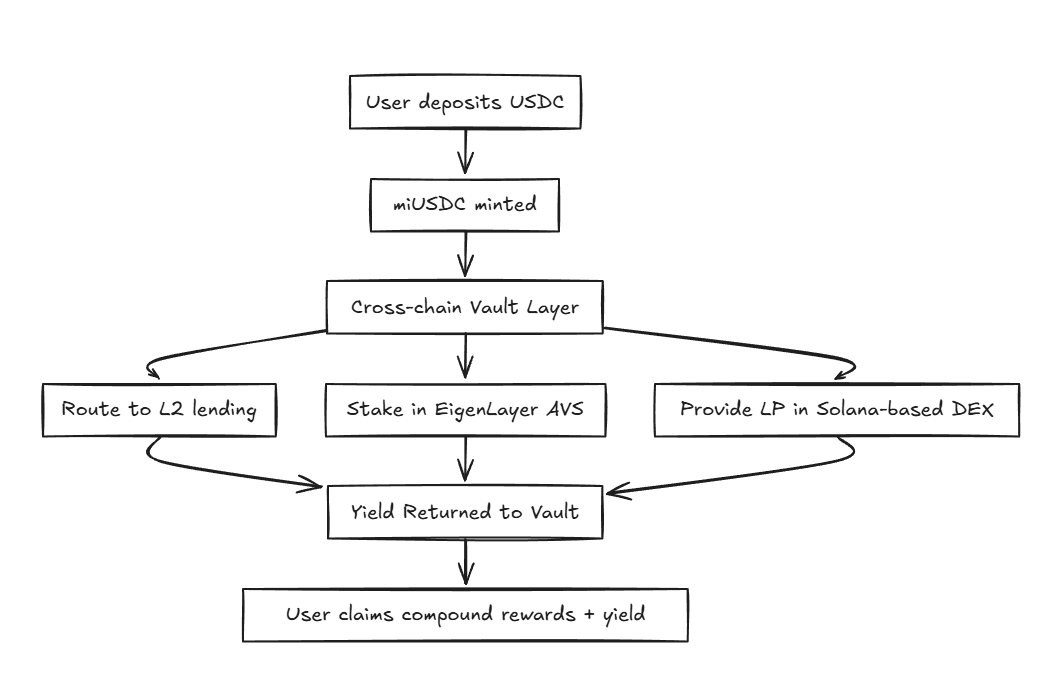

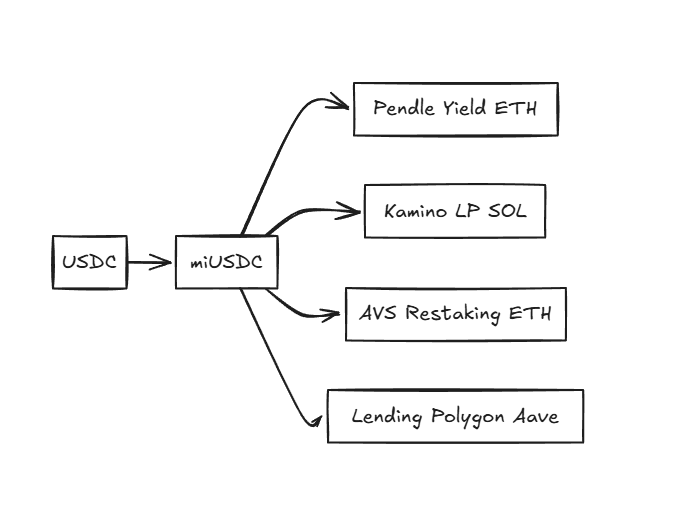

With primitives like miAssets, intent-based execution, and cross-chain vaults, Mitosis enables a world where a single user deposit is fragmented into high-performing, chain-native strategies. Let’s dive into how Mitosis is enabling this parallel capital deployment system.

Multiversal Liquidity: Beyond Interoperability

Most cross-chain solutions try to emulate interoperability with wrapped tokens and bridges. These are prone to hacks, fragmentation, and governance issues.

Mitosis doesn’t bridge assets; it creates a cross-chain liquidity base layer with:

- miAssets: Tokenized liquidity that natively moves between chains without wrapping.

- Intents: Users don’t execute transactions; they declare goals. Solvers fulfill them optimally.

- Vaults: A unified pool from which yield strategies are executed across chains.

Intent-Based Multichain Liquidity Execution

Composability Without Borders

Because intents and vaults are composable, a single asset can participate in:

- A Pendle fixed yield vault on Ethereum

- Solana-based memecoin LP pool

- EigenLayer staking

- All triggered by one signed intent

This is possible because of Mitosis’ architectural inversion: composability is no longer local to one chain, it’s global.

Parallel Strategy Graph for a Single Asset

Why It Matters

- Capital Efficiency: No need to rebalance across chains manually

- Solver Optimization: Bots compete to fulfill intents at the best rate

- Liquidity Stickiness: Protocols like Kamino or Pendle receive routed liquidity from a global pool

Comments ()