The Liquidity Wars

I recently came across Traffic Machine's (TM) introductory article explaining liquidity provision, and I thought it would be an excellent opportunity to explore a common challenge that all DeFi protocols face - the competition for liquidity, often referred to as The Liquidity Wars.

Anyone who has been in the DeFi space over the past few cycles has likely encountered the term "Liquidity Wars." In this article, I'll analyze two famous cases - The Curve Wars and Sushiswap's Vampire Attack.

The evolution of DeFi has given rise to fascinating competitive dynamics, particularly in how protocols compete for liquidity. This analysis explores two pivotal cases that have shaped the DeFi landscape. Let's first dive into The Curve Wars.

The Curve Wars: Battle for Power and Liquidity

It’s a term well-known to many who have been around in DeFi space, one that is used to describe the competition for liquidity in the Curve Finance ecosystem. It represents a power struggle within the decentralized finance ecosystem, centered around Curve Finance - a prominent decentralized exchange that specializes in efficient trading of stable coins and volatile assets.

How does Curve work & What is The Curve Wars?

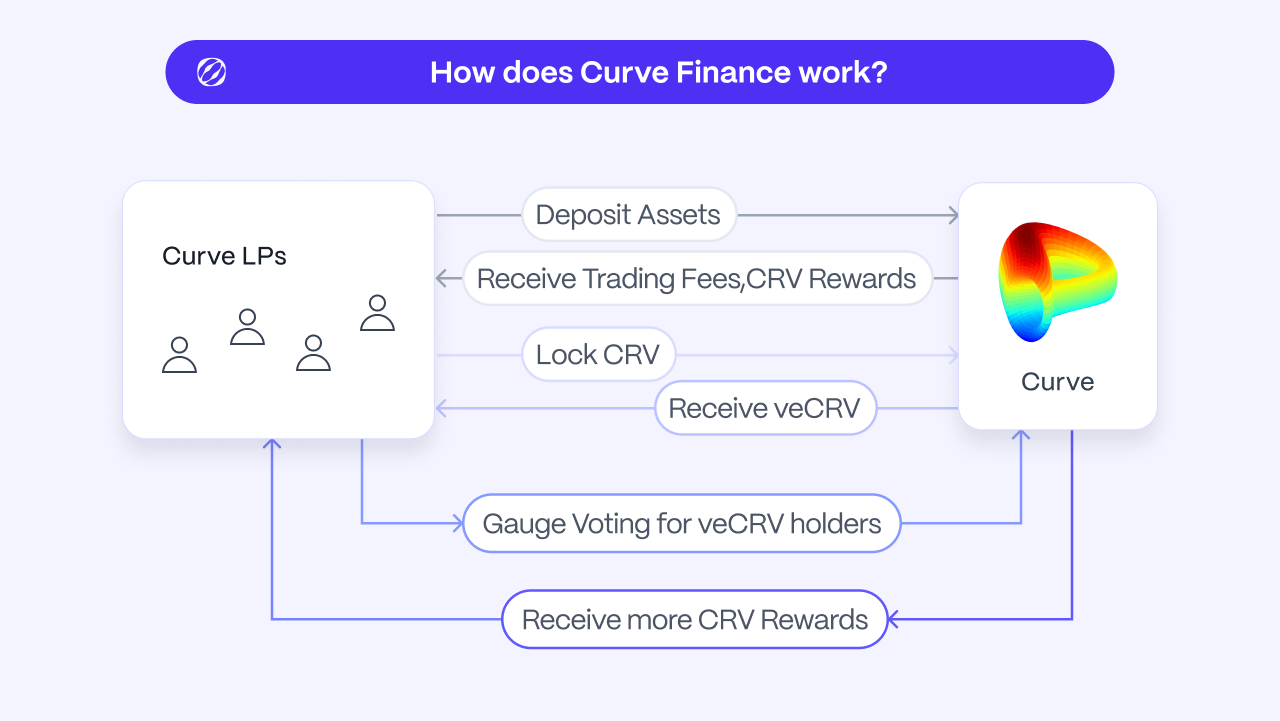

To understand this liquidity war, it's crucial to examine how Curve strategically attracted Liquidity Providers (LPs).

For the Skimmers

The Curve Wars phenomenon was essentially a battle for influence over Curve Finance's CRV token emissions. Curve distributes CRV tokens to its liquidity providers, but here's the key - CRV holders who lock their tokens (veCRV) can vote on where these rewards go. This created a meta-game where protocols like Convex, Yearn, and others competed to accumulate veCRV to direct liquidity to their preferred pools. Think of it like protocols playing 4D chess - they weren't just competing for direct liquidity, but for governance power over future liquidity distribution.

For the Detail-Oriented

About Curve

- When LPs lock their CRV on Curve, they receive veCRV (vote-escrowed CRV) in proportion to their lock-up period[1]. These veCRV holders may participate in Gauge Voting - basically voting on how many CRV tokens should be distributed across different pools. This is particularly important for stablecoins, as the depth of its liquidity would determine its price “stability”.

- While veCRV significantly amplifies rewards, the requirements to gain the maximum boost —a four-year lock-up period and substantial CRV holdings—proved prohibitive for individual participants.

This is where Convex Finance solves the painpoint and thus plays a key role in The Curve Wars.

The Curve Wars

- On Convex, CRV holders can stake their CRV and receive liquid version of veCRV, called cvxCRV, while Convex accumulates veCRV[2].

- CRV stakers are then able to utilize the liquid trait of cvxCRV by staking it on Convex and receive additional rewards which are generated from veCRV rewards that Convex earns. Additionally, they earn CVX (Convex native tokens). The cvxCRV that CRV stakers received in this process can also be sold for CRV or some other tokens, which resolves the painpoint of having to go through 4years lock-up period for maximum benefits[2].

- In return, Convex benefits from the huge amount of voting rights that it gains from all the veCRV that it has accumulated - which it then utilizes to control where the liquidity should be directed to - which exposes CVX holders to a share on voting rights on how Convex uses its voting power on Curve. This is the part where bribing happens.

- For protocols looking to get more liquidity from Curve, they came to a realization that it is more cost-efficient to “bribe” these CVX holders rather than to purchase CVX tokens themselves - and for CVX holders, they simply earn more by delegating their voting rights to these protocols.

- To tackle this overbearing dominance of Convex, protocols started to “bribe” the LPs by sending them airdrops (free tokens) and incentivizing them to lock their CRV directly on Curve so that they can direct the votes towards these smaller protocols. This even led to development of “matchmaking” platforms such as Bribe.crv.finance[3] that enable these protocols to post bribe offers to holders and facilitate the allocation of voting rights.

SushiSwap’s Vampire Attack: Migration of liquidity

Uniswap, an established decentralized exchange for cryptocurrencies, has come a far way in building its competitiveness via trading capabilities and rewarding liquidity providers with transaction fees, but it lacked one crucial element: its own token. This gap created an opportunity that SushiSwap's anonymous founder, Chef Nomi, would soon exploit.

For the Skimmers

The SushiSwap vampire attack on Uniswap took a different approach. SushiSwap essentially copied Uniswap's code but added a native token (SUSHI) with generous rewards for liquidity providers who migrated their positions. It was a masterclass in game theory - they identified that Uniswap's lack of token-based incentives was a weakness and exploited it to drain over $1B in liquidity practically overnight.

For the Detail-Oriented

SushiSwap introduced an innovative liquidity mining program that would change DeFi's competitive dynamics. The protocol offered a compelling proposition to Uniswap's liquidity providers: deposit specifically your Uniswap LP tokens into SushiSwap and earn SUSHI tokens in addition to regular trading fees[4].

What made SushiSwap's strategy particularly ingenious was its two-phase approach. First, it attracted liquidity providers by offering generous SUSHI token rewards. Then, it planned to automatically migrate this liquidity from Uniswap to SushiSwap upon launch. This strategy, later termed a "Vampire Attack", proved remarkably successful, with SushiSwap attracting over $1 billion in liquidity within its first week. By the end of the migration, SushiSwap attracted approximately 55% of Uniswap’s liquidity[4].

Through the case study of The Curve Wars, it is evident that the battle for veCRV voting power demonstrates how liquidity has become not just a resource to be incentivized, but a strategic asset to be governed and fought over through sophisticated tokenomics mechanisms.

Impact on DeFi Ecosystem

Both cases demonstrate a fundamental truth about DeFi: liquidity isn't loyal. It follows incentives. Protocols learned they couldn't just build better technology - they needed to design sophisticated tokenomics or incentive structures to attract and retain liquidity, or more sustainable liquidity mining programs. Rather than renting liquidity at unsustainable rates, protocols began exploring ways to own their liquidity or create longer-term alignment with LPs.

How Mitosis Changes This

Building on this analysis of the Curve Wars and SushiSwap's vampire attack, Mitosis emerges as a potential solution to the inefficiencies and competitive dynamics of DeFi liquidity wars by transforming DeFi liquidity into programmable primitives. Mitosis introduces Ecosystem-Owned Liquidity (EOL) and Matrix - innovative Mitosis Liquidity Frameworks (MLFs) that make liquidity provision transparent and programmable.

Ecosystem-Owned Liquidity (EOL)

EOL transforms the traditional liquidity provision model by:

- Creating a collective bargaining system where smaller liquidity providers can access previously accessible for private deals with institutional LPs

- Implementing governance through miAssets, allowing liquidity providers to have a direct say in capital allocation

- Establishing sustainable, long-term liquidity relationships instead of temporary incentive-driven migrations

- Enabling protocols to acquire persistent liquidity without engaging in costly token emissions or incentive wars

Matrix

Matrix introduces a sophisticated approach to liquidity campaign management:

- Protocols can create customized liquidity campaigns with specific reward terms and durations

- Provides transparency of what LPs can expect from contributing to each campaign

- Liquidity providers receive maAssets as receipt tokens, representing their positions with built-in yield generation

Through tokenized liquidity positions (miAssets from EOL and maAssets from Matrix), protocols and LPs can create sophisticated financial products and strategies that were previously impossible in DeFi. This transforms liquidity from a battleground resource into programmable liquidity in a collaborative ecosystem where both protocols and liquidity providers can thrive.

The future of DeFi liquidity might not be defined by wars anymore, but by efficient, programmable markets - together with Mitosis. That's a future worth building.

Interested to dive deeper into what Mitosis has in its vision? Read our recently launched Litepaper here.

References

[1]“Curve DAO: Vote-Escrowed CRV — Curve 1.0.0 documentation,” curve.readthedocs.io. https://curve.readthedocs.io/dao-vecrv.html (accessed Dec. 18, 2024).

[2]“Understanding cvxCRV | ConvexFinance,” Convexfinance.com, Jul. 17, 2024. https://docs.convexfinance.com/convexfinance/general-information/why-convex/understanding-cvxcrv (accessed Dec. 18, 2024).

[3]LD Capital, “Inside the Curve Wars: DeFi Bribes,” *Hackernoon.com* , Feb. 25, 2022. https://hackernoon.com/inside-the-curve-wars-defi-bribes (accessed Dec. 18, 2024).

[4]“Sushiswap: A Uniswap Fork and DeFi Protocol | Gemini,” Gemini, 2023. https://www.gemini.com/cryptopedia/sushiswap-uniswap-vampire-attack (accessed Dec. 18, 2024).

Comments ()