The M.O.R.S.E. Program: Pioneering Liquidity Incentives for a Thriving DeFi Future

Decentralized finance (DeFi) has revolutionized the global financial landscape, offering permissionless access to lending, borrowing, and trading. However, even the most well-designed DeFi protocols face a fundamental challenge—liquidity. DeFi markets become inefficient, volatile, and unattractive to institutional and retail participants without sufficient liquidity.

Mitosis, a next-generation liquidity infrastructure, recognizes this challenge and addresses it through its M.O.R.S.E. Program (Mitosis Operations and Rewards for Strategic Engagement), a meticulously designed incentive mechanism that stimulates early participation, fuels network effects, and lays the groundwork for a self-sustaining liquidity ecosystem.

In this article, readers will gain a comprehensive understanding of the fundamental liquidity challenges in DeFi and how Mitosis addresses them through its innovative M.O.R.S.E. Program. They will learn how strategic liquidity incentives attract capital, foster network effects, and create deep, sustainable markets.

A Strategic Approach to Liquidity Incentives

At its core, liquidity incentives serve as a catalyst to attract users and capital into a new financial ecosystem. Without an initial influx of liquidity, DeFi protocols struggle to provide seamless trade execution, lending opportunities, or stable asset valuation. The M.O.R.S.E. program strategically deploys liquidity incentives to overcome this barrier.

Mitosis allocates rewards to users who supply capital to its liquidity pools through this initiative, particularly within the Matrix Liquidity Framework. This framework enables DeFi protocols seeking liquidity to structure time-bound campaigns offering competitive yields. However, for newly launched protocols, high yields alone may not be enough to attract users. This is where the M.O.R.S.E. Program steps in, providing additional incentives in the form of $MITO tokens, thereby reducing the effective cost of liquidity acquisition for emerging DeFi projects while enhancing returns for liquidity providers.

By subsidizing early liquidity campaigns, the M.O.R.S.E. Program accelerates the formation of deep, liquid markets. It ensures that market participants are not simply parking their assets in Mitosis for the sake of speculation but are instead engaging in productive liquidity provision that benefits the entire ecosystem. This dynamic fosters a virtuous cycle, early liquidity attracts more traders, which in turn draws more liquidity providers, reinforcing network effects that sustain long-term market participation.

The $MITO Token: Bootstrapping Adoption and Utility

The effectiveness of any incentive program in DeFi depends not only on the rewards themselves but also on the utility and demand for the underlying incentive token. In the case of Mitosis, the $MITO token serves as the linchpin of its incentive strategy, offering more than just a temporary reward mechanism.

Firstly, $MITO functions as a governance token, allowing liquidity providers to shape the future of the ecosystem. Holders can vote on protocol upgrades, liquidity allocation strategies, and other critical governance parameters, ensuring that those who contribute to the system also have a stake in its evolution. This mechanism transforms passive liquidity providers into engaged ecosystem participants with a vested interest in Mitosis’ long-term success.

Secondly, $MITO introduces utility beyond governance, driving additional demand and value. Liquidity providers earning $MITO tokens are not merely accumulating speculative assets; they can stake or reinvest their tokens into various yield strategies within the Mitosis ecosystem, further enhancing their earning potential. This compounding effect incentivizes long-term holding and usage, stabilizing the token’s value while discouraging short-term farming behaviors that could otherwise disrupt liquidity markets.

Moreover, as Mitosis expands its cross-chain liquidity provisioning, $MITO will play a critical role in facilitating multi-chain liquidity flows, serving as an interoperable asset for transaction fees, collateralization, and liquidity provisioning. This dynamic positioning ensures that $MITO remains an integral component of the Mitosis infrastructure rather than merely an emission-based reward token destined for short-term speculation.

$MITO Token vs. $MORSE Token

There has been some confusion regarding the role of different tokens within the Mitosis ecosystem. It is crucial to distinguish between $MITO and $MORSE, as they serve distinct functions.

$MITO Token: The governance and reward token within the Mitosis ecosystem. It is used to incentivize liquidity provision, reward participation in the M.O.R.S.E. program, and facilitate decision-making in ecosystem governance.

$MORSE Token: A DN-404 standard token that serves as an engagement and community reward token within the Mitosis ecosystem. It is separate from the M.O.R.S.E. program but is integral to community interactions, NFT incentives, and other ecosystem activities.

This distinction ensures that liquidity incentives remain tied to $MITO, while $MORSE functions more broadly in the ecosystem’s engagement and NFT-based interactions.

From Incentives to Sustainable Liquidity

While liquidity incentives are effective in the early stages of a protocol’s lifecycle, they must eventually transition into a self-sustaining economic model. Over-reliance on external subsidies can lead to mercenary liquidity, where capital rapidly exits once incentives decline. Mitosis has anticipated this challenge and designed progressive mechanisms to gradually phase out artificial incentives while maintaining deep, resilient liquidity.

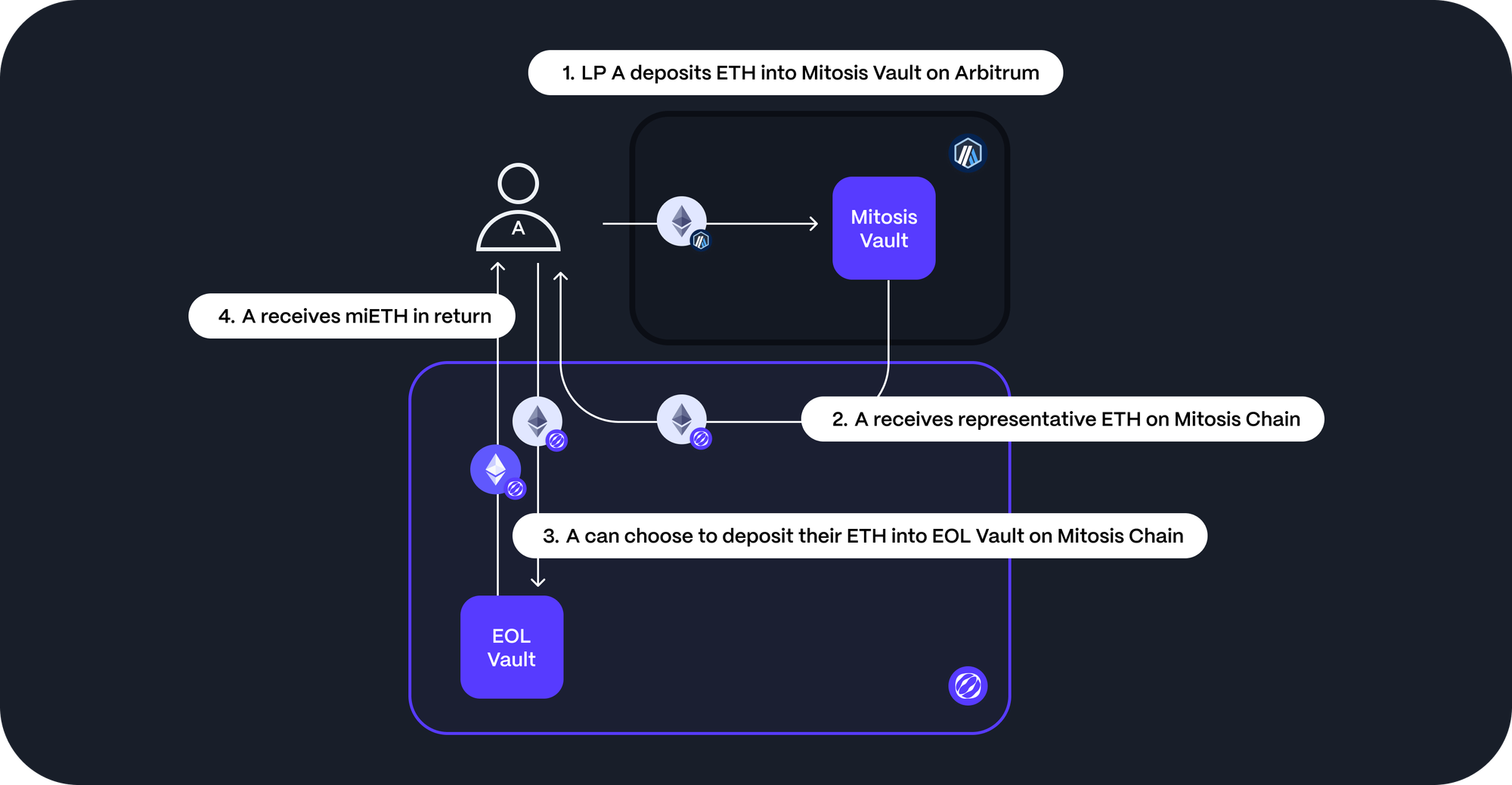

One of the primary strategies for achieving this transition is Ecosystem-owned liquidity (EOL). Unlike conventional DeFi models where liquidity is temporarily rented through incentives, Mitosis employs its Ecosystem-Owned Liquidity (EOL) framework, enabling the protocol to retain a portion of the liquidity it helps generate. Over time, as liquidity pools grow organically and EOL expands, the need for direct $MITO incentives will diminish.

Additionally, the Mitosis Chain fosters an ecosystem where liquidity provider positions become highly composable financial instruments. With the tokenization of liquidity positions through miAssets and maAssets, users are empowered to deploy their capital across various DeFi strategies without prematurely exiting the system. The ability to trade, collateralize, and leverage tokenized LP positions introduces additional revenue streams for liquidity providers, ensuring that their participation remains attractive even in the absence of direct incentives.

Furthermore, network effects generated by the M.O.R.S.E Program will ensure that as the Mitosis ecosystem matures, it becomes a preferred venue for liquidity provisioning. DeFi protocols seeking liquidity will recognize the robust, predictable capital base within Mitosis, leading to organic demand for liquidity provision. As a result, the protocol shifts from an externally subsidized liquidity model to one where yields are sustained by genuine economic activity rather than temporary token emissions.

Final Thoughts: A Blueprint for Sustainable DeFi Growth

The M.O.R.S.E. program exemplifies the strategic deployment of incentives, demonstrating how early rewards can seed liquidity, bootstrap network effects, and pave the way for a self-sustaining ecosystem. By subsidizing initial liquidity provision through $MITO incentives, Mitosis successfully attracts early adopters while ensuring long-term engagement through governance participation, liquidity composability, and protocol-owned liquidity structures.

This evolution from incentivized participation to organic liquidity growth is essential for any DeFi ecosystem aspiring for sustainability. Mitosis’s multi-pronged approach ensures that liquidity providers are not just transient yield farmers but integral stakeholders in a thriving financial network.

As the DeFi landscape continues to evolve, one key question remains: How can liquidity incentives be further refined to balance short-term participation with long-term stability? By addressing this challenge, protocols like Mitosis can lead the next wave of DeFi innovation, creating efficient, resilient, and user-centric liquidity markets that redefine the future of decentralized finance.

Comments ()