The Matrix of Theo: Changing the Game in Decentralized Finance with MitosisOrg

Introduction

Decentralized finance, or DeFi, is a fast-growing area in the crypto world where people can lend, borrow, trade, and earn without needing a bank. It's all done using blockchain technology. One of the newest and most exciting projects in this space is called The Matrix of Theo, launched by a platform named MitosisOrg. This project is designed to make it easier and more rewarding for users to take part in the DeFi system by providing something called liquidity which basically means adding their crypto to pools that others can use for trading. MitosisOrg created this campaign to shake things up and solve some common problems in DeFi, like low rewards for users, bad trade prices, and systems that just don’t last. The Matrix of Theo is their big step toward building a more fair, rewarding, and long-lasting financial system on the blockchain.

In this article, let's delve into what it is, where it came from, how it works, and why it matters especially if you’re new to DeFi. How the Matrix of Theo Started The Matrix of Theo was launched in early 2025 by MitosisOrg. It was MitosisOrg’s first major move to attract people to their platform and get them to become liquidity providers people who help power the system by locking up their crypto so others can trade with it. The name “Matrix of Theo” has a deeper meaning. “Matrix” stands for a network or system of many connected parts, and “Theo” could mean knowledge or a higher purpose showing that this project is about building something powerful and meaningful for the DeFi space.

Why is this Campaign on MitosisOrg?

MitosisOrg started this campaign because they saw some big issues in DeFi. Many platforms weren’t using liquidity efficiently, trade prices were often unstable, and user rewards didn’t last long. On top of that, some users were losing money because of impermanent loss a tricky thing that happens when you provide liquidity and prices change a lot. The Matrix of Theo is MitosisOrg’s solution. It uses smart ideas from game theory (how people make decisions), economic models, and blockchain tech to build a system that makes it easier for people to join, earn, and stick around. It’s all about creating a healthy, long-term DeFi environment that works for everyone not just the early insiders. What Makes the Matrix of Theo Special: The Key Features Explained Simply

The Matrix of Theo isn’t just one idea, it is a full system made up of several smart features, all working together to make DeFi better. These features help people earn more, make smarter choices, and enjoy a smoother experience when using MitosisOrg. Let’s break down the main parts in simple terms:

- Smart Liquidity (a.k.a. Programmable Liquidity)

Usually, when you provide liquidity (meaning you lock your crypto into a trading pool), you don’t get much control. But in the Matrix of Theo, you can choose where your crypto goes and how it’s used. Here’s what that means: 1. You can pick specific trading pairs (like ETH/USDT) that you think will perform better. 2. You can adjust your contribution depending on market activity like when prices swing or volume goes up. 3. You earn based on how helpful and effective your liquidity is.

This makes it easier to avoid losses and earn better rewards. Basically, you're not just putting money in a pool and hoping, this is more like managing your own mini-investment plan.

- Reward Systems That Actually Work

To keep users active and motivated, the Matrix of Theo uses powerful incentive programs such as: 1. Token Rewards: When you add liquidity, you earn MitosisOrg’s own tokens. You can hold, trade, or use these tokens in the system. 2. Flexible Yield Farming: Rewards change based on the market so even during wild swings, you can still earn fair returns. 3. Invite and Earn: Bring in new users and earn bonus rewards when they join and provide liquidity.

These systems are built to benefit every users, traders, and the platform, so it becomes a win-win for the whole community.

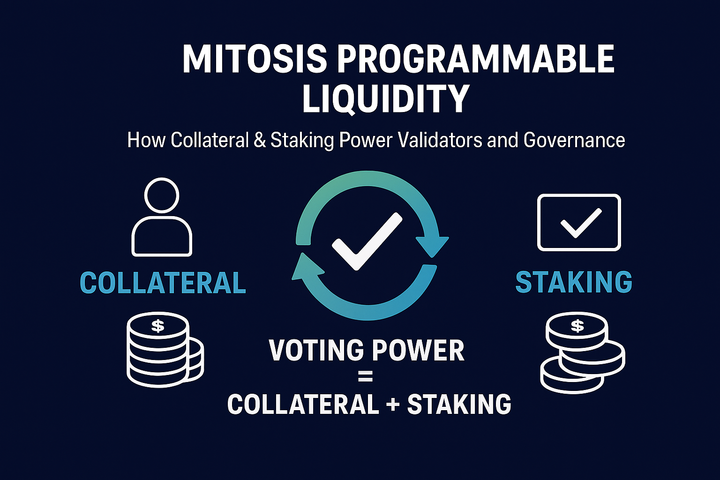

- Power to the People (Decentralized Governance)

Instead of a few people making all the decisions, MitosisOrg lets the community vote on important things. If you hold tokens, you can help decide in crucial decisions such as:

- How and when rewards are given.

- Which trading pairs are supported.

- When should the system be upgraded or improved.

This helps keep the project on track with what users actually want, and makes the platform more flexible and fair.

- Everything Runs Automatically (Smart Contracts) The Matrix of Theo uses smart contracts basically automated code on the blockchain to handle things like:

- Giving out rewards.

- Managing liquidity.

- Letting users vote.

This means the system runs by itself, with less risk of errors or scams, and lower fees, so even small investors can take part without worrying about high costs.

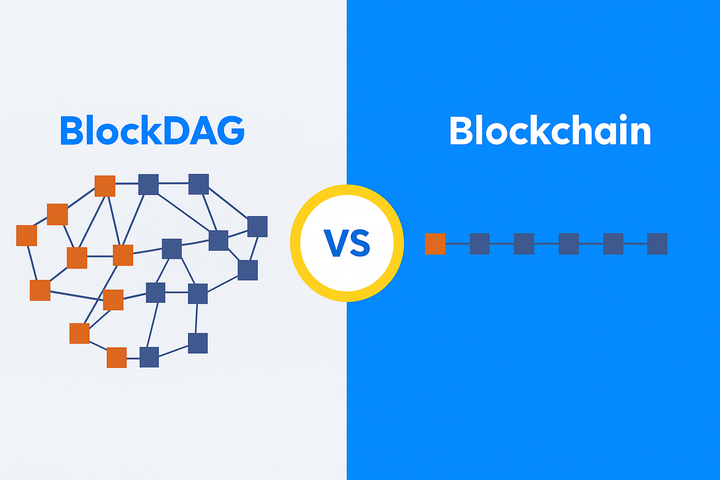

- Works Across Different Blockchains (Cross-Chain Interoperability)

Crypto is spread across many blockchains, and that can get confusing. The Matrix of Theo solves this by working across multiple networks like:

- Ethereum

- Binance Smart Chain

- Layer 2 networks like Arbitrum

So you can provide liquidity from wherever you hold your crypto. This opens the door to more users, more trades, and more rewards. How the Matrix of Theo Works: A Step-by-Step Guide to help You get Started The Matrix of Theo isn’t just a one-time setup, it is a living system that learns and adapts as more people join and the market changes.

Let me walk you through how it works in five simple steps:

- Starting the Liquidity Pools The first step is setting up liquidity pools, which are like shared funds where people deposit their crypto (like ETH, USDT, etc.) so others can trade easily. These pools focus on popular trading pairs that are in high demand or don’t have enough liquidity. Smart contracts (automated blockchain tools) manage the pools so everything runs smoothly and fairly. This helps every users get better prices when trading and that their funds are being put to good use.

- Using Data to Make Things Better MitosisOrg doesn’t just set and forget, it constantly watches how the pools are performing using data. It tracks things like:

- How deep the liquidity is (more depth = smoother trading).

- Slippage (how much a price changes during a trade).

- Impermanent loss (potential losses for LPs when prices shift a lot).

They use this info to:

- Adjust rewards when needed.

- Help LPs move their funds to better pools.

- Keep everything balanced and working well.

- Fair and Transparent Reward System People who provide liquidity earn rewards regularly. The amount you earn depends on:

- How much crypto you put in.

- How long you keep it in the pool.

- How helpful your contribution is (for example, if it made trading smoother for others).

Smart contracts handle all the math and payouts, so rewards are fair, automatic, and there’s no waiting or confusion.

- Listening to the Community

The Matrix of Theo is built for the people who use it, so MitosisOrg encourages feedback from the community.

Users can suggest ideas like new trading pairs or changes to rewards. Everyone who holds tokens can vote on these suggestions.

This means the system can grow and improve based on what users actually want, not just what the developers think.

5. Checking What’s Working (and What’s Not) Every so often, MitosisOrg reviews how the campaign is doing by looking at:

- Total value locked (TVL): how much crypto is in the pools.

- Trading volume: how much activity is happening.

- User retention: how many people are sticking around.

If something is working great, they double down on it. If something isn’t, they adjust or replace it. This constant improvement keeps the system strong and valuable over time.

In short, the Matrix of Theo is like a smart, flexible machine that grows and gets better with every user who joins and every trade that happens. Conclusion

The Matrix of Theo by MitosisOrg is a powerful new approach to making DeFi better and more rewarding for everyone. It brings together smart features like customizable liquidity, attractive rewards, and community voting to fix common problems in the DeFi world like losses from price changes or money sitting in the wrong places.

By using real-time data and listening to its users, the Matrix of Theo creates a system that constantly improves and grows. It’s designed to be fair, flexible, and focused on the people who use it.

Comments ()