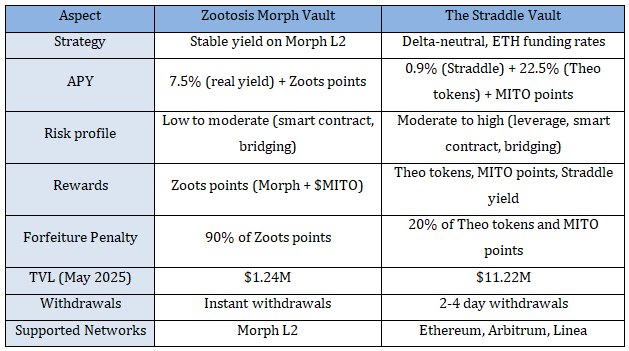

The Matrix: Zootosis Morph Vault vs. Theo Straddle Vault – A Comparative Analysis for Depositing 1 ETH

Mitosis introduces a paradigm shift in decentralized finance through its Ecosystem-Owned Liquidity (EOL) model, addressing liquidity fragmentation across modular blockchains like Ethereum, Arbitrum, and Linea. Mitosis’s Matrix Vaults offer curated, high-yield liquidity opportunities via tokenized assets (miAssets and maAssets). This article compares two key Matrix Vault campaigns—the Zootosis Morph Vault and the Theo Straddle Vault—focusing on their mechanics, risk-reward profiles, and outcomes for a 1 ETH deposit.

Mitosis and Matrix Vaults: A Primer

Mitosis tackles liquidity fragmentation, where assets are siloed across chains (e.g., Ethereum, Solana) or protocols (e.g., Uniswap, Aave), limiting capital efficiency. By minting miAssets (single-asset tokens) and maAssets (multi-asset tokens) at a 1:1 ratio upon deposit, Mitosis enables programmable liquidity that can be deployed across DeFi ecosystems. Matrix Vaults are time-bound campaigns that combine real yield (from protocol fees) with token rewards, offering flexibility with early withdrawal options (albeit with penalties). Unlike traditional liquidity pools with rigid lockups, Matrix Vaults incentivize long-term participation through reward redistribution, filtering out mercenary capital. The Zootosis Morph Vault emphasizes stable, community-driven yields on the Morph Layer 2 (L2) network, while the Theo Straddle Vault pursues a delta-neutral strategy for higher, hedged returns. Below, we dissect their differences, using a 1 ETH deposit example, and explain key financial concepts for broader accessibility.

Zootosis Morph Vault: Stable, Community-Driven Yields

Overview

The Zootosis Morph Vault, launched in collaboration with Morph L2 (a hybrid optimistic/zk-rollup solution), targets conservative investors seeking predictable returns. Deployed on the Morph network, it supports assets like WETH, USDT, USDC, and WBTC, with a TVL of approximately $1.24 million as of May 2025, reflecting early but growing adoption.

Mechanics

Deposit Process: Users deposit WETH (or ETH, converted to WETH) via app.mitosis.org/matrix/portfolio on the Morph network. A 1 ETH deposit yields 1 maWETH, a multi-asset token representing the position.

Yield Structure: Generates real yield from protocol fees (e.g., lending on integrated protocols) with an estimated Annual Percentage Yield (APY) of 7.5%, based on Morph’s ecosystem performance. Additional rewards include Zoots points, redeemable for Morph and estimated Mitosis ($MITO) tokens post-mainnet.

Reward Allocation: Zoots points accrue daily based on maWETH holdings. Early withdrawals forfeit up to 90% of Zoots, redistributed to remaining participants, encouraging long-term commitment.

Risk Profile: Low to moderate. Risks include smart contract vulnerabilities (mitigated by Morph’s audited contracts) and cross-chain bridging via LayerZero. No leverage is used, minimizing market exposure.

Duration and withdrawals: Runs for 270 days, with no mandatory lockups. Withdrawals are processed instantly, subject to forfeiture penalties.

Example: Depositing 1 ETH

- Initial Deposit: 1 ETH ($2,500, per CoinGecko’s ETH price on May 20, 2025).

- Tokenization: Receive 1 maWETH on Morph.

- Yield: At 7.5% APY, the 30-day yield is (7.5% / 12) × $2,500 = $15.63 (0.00625 ETH).

- Rewards: Approximately 300 Zoots points over 30 days (dashboard estimate), with a 1.1x multiplier on Morph. Assuming $MITO and Morph tokens at $0.10 each (speculative, community-derived), rewards are worth $30.

- Withdrawal: Early withdrawal forfeits 90% of Zoots (270 points), returning 1 ETH minus gas fees (~$0.50–$1 on Morph L2).

- Total Value: $15.63 (yield) + $30 (Zoots, if held) = $45.63.

Financial Implications

The Zootosis Morph Vault emphasizes capital preservation and real yield—returns from organic protocol activity (e.g., lending fees) rather than inflationary tokens. Its low-leverage approach reduces market risk, ideal for retail investors. The 90% forfeiture penalty ensures liquidity retention, aligning with Mitosis’s sustainable ecosystem goals.

Theo Straddle Vault: Delta-Neutral, High-Yield Strategy

Overview

Launched March 13, 2025, the Theo Straddle Vault, partnered with Theo Network, targets sophisticated investors with a delta-neutral strategy. With a TVL of $11.2 million, it leverages weETH on Ethereum, Arbitrum, and Linea to capture ETH funding rates on Hyperliquid.

Mechanics

Deposit Process: Users deposit weETH (or miweETH) via app.mitosis.org/matrix/portfolio. A 1 ETH deposit yields 1 maweETH (Theo). The vault borrows USDC on Aave, bridges to Hyperliquid, and shorts ETH to capture funding rates.

Yield Structure: Offers a base APY of 0.9% (Straddle yield) plus 22.5% APY in Theo tokens (updated from dashboard, reflecting token incentives). MITO Points (weETH) provide additional rewards.

Reward Allocation: Rewards include Theo tokens, MITO Points, and Straddle yield. Early withdrawals forfeit 20% of Theo tokens and MITO Points, processed every 2–4 days.

Risk Profile: Moderate to high. Risks include liquidation risk from leverage, smart contract vulnerabilities (Code4rena audit Q3 2024, Zellic audit pending), and cross-chain bridging. Collateral rebalancing mitigates price volatility.

Duration and Withdrawals: Unlimited, with 2–4 day withdrawal processing.

Example: Depositing 1 ETH

- Initial Deposit: 1 ETH ($2,500).

- Tokenization: Receive 1 maweETH (Theo).

- Yield: At 0.9% base APY, the 30-day yield is (0.9% / 12) × $2,500 = $1.88 (0.00075 ETH). Theo tokens at 22.5% APY yield (22.5% / 12) × $2,500 = $46.88 (0.01875 ETH equivalent, assuming Theo tokens track ETH).

- Rewards: 300 MITO Points (weETH) with a 1.2x boost on L2s (~$30, speculative at $0.10 per $MITO). Theo tokens add $31.25 (dashboard estimate, 0.0125 ETH equivalent).

- Withdrawal: Early withdrawal forfeits 20% of Theo tokens ($6.25) and MITO Points (60 points, $6). Returns 1 ETH after 2–4 days, minus gas fees (~$1–$2).

- Total Value: $1.88 (Straddle yield) + $46.88 (Theo tokens) + $30 (MITO Points) = $78.76.

Financial Implications

The Theo Straddle Vault targets alpha-seeking investors with a delta-neutral strategy, balancing long and short positions to minimize directional risk. Leverage introduces counterparty risk (reliance on Aave, Hyperliquid) and execution risk (cross-chain complexities). Higher yields reflect this risk premium, appealing to institutional-grade DeFi participants.

Comparative Analysis: Key Differences

Practical Example: 1 ETH Deposit Outcomes (30 Days)

Zootosis Morph Vault:

- Yield: $15.63 (0.00625 ETH at 7.5% APY)

- Rewards: 300 Zoots points (~$30, speculative)

- Total Value: $45.63

- Risk: Minimal market risk, smart contract risk

Theo Straddle Vault:

- Yield: $1.88 (0.00075 ETH) + $46.88 (Theo tokens at 22.5% APY)

- Rewards: 300 MITO Points ($30) + Theo tokens ($31.25)

- Total Value: $78.76

- Risk: Leverage, cross-chain, smart contract risks

Financial Concepts Explained

/ / Real Yield: Returns from protocol operations (e.g., lending fees), as in Zootosis, ensuring sustainability versus inflationary rewards.

/ / Delta-Neutral Strategy: Balances long and short positions to neutralize market exposure, reducing directional risk but increasing execution risk (Theo Straddle).

/ / Counterparty Risk: Dependence on third-party protocols (e.g., Aave, Hyperliquid) in Theo’s leveraged strategy.

/ / Smart Contract Risk: Potential code vulnerabilities, mitigated by audits (Code4rena for Theo, Morph’s hybrid L2 audits).

/ / TVL: Total assets staked, reflecting protocol scale. Zootosis’s $1.24 million TVL indicates early growth, while Theo’s $11.22 million shows broader adoption.

Conclusion:

Choosing the Right Vault for a 1 ETH deposit, the Zootosis Morph Vault offers a stable $45.63 return over 30 days, ideal for retail investors prioritizing low risk. The Theo Straddle Vault delivers a higher $78.76 return but with elevated risks, suiting sophisticated investors comfortable with leverage. Both leverage Mitosis’s miAsset/maAsset framework for capital efficiency. Investors should verify smart contract audits and monitor app.mitosis.org for updates, as $MITO and Theo token valuations are speculative pre-mainnet.

Disclaimer: DeFi investments carry risks, including loss of principal. Conduct thorough due diligence.

Sources:

- app.mitosis.org/matrix/portfolio

- Mitosis Official Documentation

- CoinGecko for ETH pricing

Comments ()