The Next Evolution in DeFi: Straddle Vault by Theo & Mitosis

A new yield strategy has been introduced, market-neutral, accessible, and efficient. But what exactly is behind it? This is a structured breakdown of the Straddle Supply Opportunity Vault and its implications for DeFi liquidity.

The Concept: Market-Neutral Yield for Everyone

Theo, in collaboration with Mitosis, presents a delta-neutral yield strategy designed for ETH holders. The goal is to generate high yield without directional risk, leveraging the efficiency of modern DeFi tools.

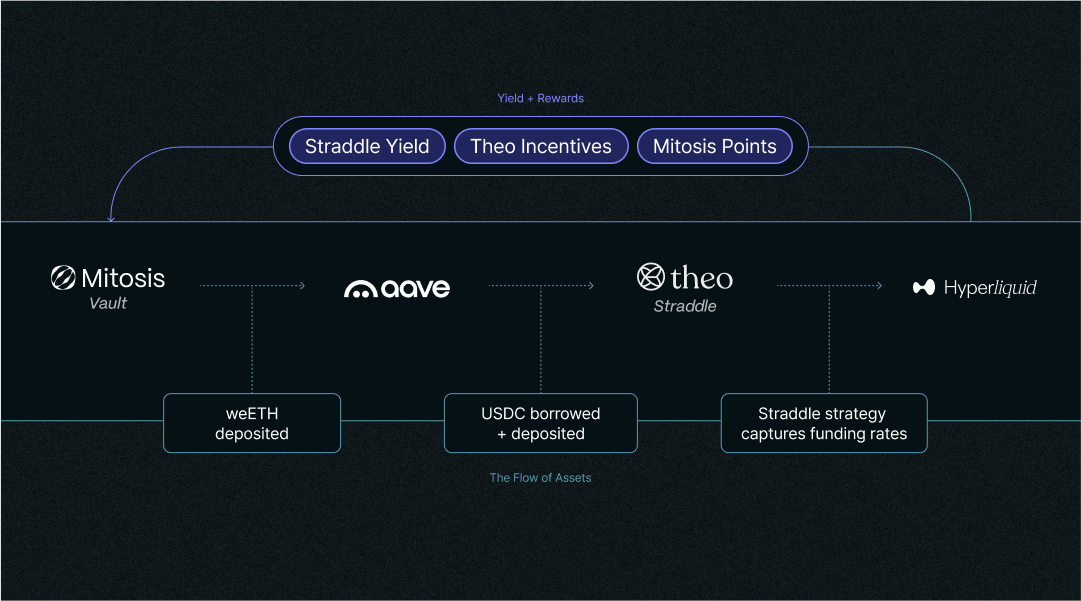

How It Works

- Deposit: Users supply wrapped ETH (weETH) into the vault.

- Lending & Borrowing: The ETH is supplied to Aave, and USDC is borrowed against it.

- Hedging: The borrowed USDC is bridged to Hyperliquid, where an ETH short position is opened.

- Delta-Neutral Strategy: The strategy earns yield from the ETH funding rate while remaining hedged against price fluctuations.

This approach represents an evolution in cross-chain yield strategies, ensuring stable returns across multiple ecosystems.

Composable Liquidity & Capital Efficiency

One of the biggest innovations in the vault structure is liquidity composability. Instead of locking funds in a single protocol, users receive maAssets, tokenized claims that represent their position in the vault.

Benefits of This Model

- Liquidity remains usable across DeFi applications.

- Users can earn cross-chain yield while maintaining exposure to their ETH.

- Unlike traditional DeFi lending models, the Matrix Vaults structure enables more capital-efficient lending and yield farming.

By applying programmable liquidity, Theo ensures that user funds are always optimally allocated.

Flexible Withdrawals Without Lockups

Traditional DeFi staking and lending models often rely on rigid lockups, limiting liquidity and discouraging participation. Theo’s vault offers a more flexible alternative.

Key Features

- The vault operates in five-day rounds.

- Users can request withdrawals at any time, processed at the end of the round.

- Early exits come with a minor yield penalty to balance liquidity stability.

This system ensures ecosystem-owned liquidity (EOL) rather than relying on mercenary capital.

Beyond Yield: The Role of Mitosis and Future Innovations

Theo is leveraging Mitosis’s Matrix Vaults and cross-chain liquidity provision to create a more scalable and modular DeFi framework.

Mitosis’s Impact

- Liquid restaking integration: Enhancing ETH-based yield strategies.

- Cross-chain liquidity optimization: Enabling seamless DeFi lending across different networks.

- Modular blockchain infrastructure: Supporting scalable DeFi applications.

As DeFi evolves, concepts like Actively Validated Services (AVS) and Chain Abstraction will further enhance yield efficiency and capital mobility.

The Role of Mitosis University: Learn & Build in DeFi

For those looking to deepen their knowledge, Mitosis University provides a community-driven educational platform covering everything from Automated Market Makers (AMM) to Bitcoin Staking and DeFi Lending.

By understanding foundational concepts such as Fair Market Liquidity and Cross-Chain Yield, users can actively participate in the next wave of DeFi innovation.

Looking Ahead: A More Sustainable DeFi Future

The flexibility and composability of Theo’s vault point toward a more mature DeFi ecosystem where:

- User autonomy and protocol sustainability go hand in hand.

- Matrix Vaults provide deeper liquidity management.

- Cross-chain and modular blockchain integrations unlock new opportunities.

With Theo and Mitosis laying the foundation, future DeFi projects can build upon this model to develop more advanced yet accessible solutions.

Could this become the new standard for capital-efficient DeFi liquidity?

For a deeper dive, check out the full announcement: Mitosis Blog

I hope you guys enjoyed this thread about Mitosis. If you have any feedback feel free to hit me a dm on https://x.com/FarmingLegendX

Bibliography

- Figure 1: Image source https://blog.mitosis.org – All rights reserved to the original creator.

- Figure 2: Image source https://blog.mitosis.org – All rights reserved to the original creator.

- Figure 3: My Own Creation.

- Figure 4: Image source https://x.com/MitosisOrg – All rights reserved to the original creator.

- Mitosis Blog: https://blog.mitosis.org – Full announcement and detailed breakdown of the announcement.

- Theo Network: https://theo.xyz/ – Information on the Theo Network.

- Mitosis Litepaper: https://docs.mitosis.org/assets/files/mitosis-litepaper.pdf – In-depth explanation of Mitosis’s programmable liquidity.

- EIP-4626: Tokenized Vault Standard: https://eips.ethereum.org/EIPS/eip-4626 – Standardized framework for vault-based DeFi strategies.

- Mitosis University: https://mitosis.org/university – Educational resources for DeFi concepts.

Comments ()