The Next Evolution of DeFi Liquidity

Fragmentation has plagued the crypto ecosystem for years. Hundreds of chains. Thousands of protocols. Liquidity trapped in silos, fractured, inefficient.

Mitosis offers a systemic fix: building liquidity infrastructure at the modular base layer.

But it’s more than just another bridge or vault protocol. Mitosis positions itself as the Liquidity Operating System for modular chains — abstracting complexity and making liquidity programmable, mobile, and ecosystem-owned.

Fragmented Capital: The Root Problem

Legacy DeFi liquidity architecture is inefficient by design:

- Assets locked per chain

- Redundant capital requirements

- Manual bridging prone to risk

- Incentives driving mercenary liquidity

As modular blockchain architectures scale, this fragmentation becomes unacceptable. Liquidity must flow seamlessly — across L1s, rollups, and app-specific chains.

Mitosis: The Liquidity OS Stack

Mitosis addresses fragmentation through a layered liquidity stack:

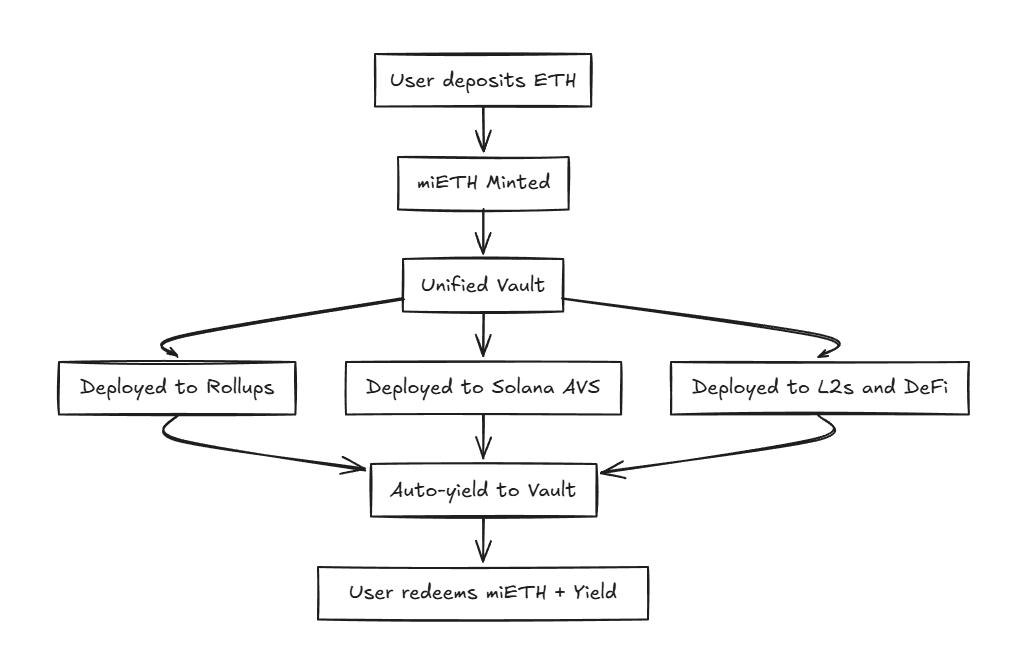

1. Cross-Chain Vault System

Unified vaults aggregate liquidity, making capital available across integrated ecosystems — Solana, Ethereum, Avalanche, Cosmos, and more.

2. miAssets

Standardized token representations (miETH, miUSDC, etc.) enable assets to move programmatically, while remaining composable across DeFi protocols.

3. Ecosystem Owned Liquidity (EOL)

Protocol-owned liquidity reduces reliance on yield mercenaries. Capital becomes a shared, productive resource for the entire ecosystem.

Mitosis Liquidity OS Architecture

Why This Matters

Mitosis isn't a patchwork solution. It's a chain-level redesign of liquidity flow:

- Capital efficiency maximized across chains

- Cross-chain DeFi becomes seamless

- TVL is no longer fragmented

- Protocols align incentives through EOL

For modular chains — the future of scalable Web3 — Mitosis provides native, unified liquidity as an operating system layer.

Comments ()