The partnership of Mitosis and Theo: A new liquidity standard for DeFi

Introduction

In the world of decentralized finance (DeFi), liquidity is a key factor determining the efficiency of protocols and user opportunities. One of the most significant developments in this field is the partnership between Mitosis and Theo, which promises to revolutionize liquidity management and yield generation. This partnership not only addresses existing DeFi challenges but also sets new standards for more flexible and secure financial strategies.

This collaboration creates new opportunities for investors by providing access to efficient capital management strategies without requiring significant initial investments or complex manual operations. It also helps reduce risks and enhance yield stability for users—an essential aspect in the volatile crypto environment. In this article, we will explore the key aspects of this partnership, its impact on the DeFi market, the technical elements of the solutions being implemented, potential risks, and prospects for future development.

Why is Liquidity a Challenge in DeFi?

Liquidity remains one of the biggest challenges in decentralized finance. DeFi users often struggle with placing their assets in protocols due to capital inefficiency, high risks, unstable yields, and the fragmentation of liquidity across multiple networks and protocols.

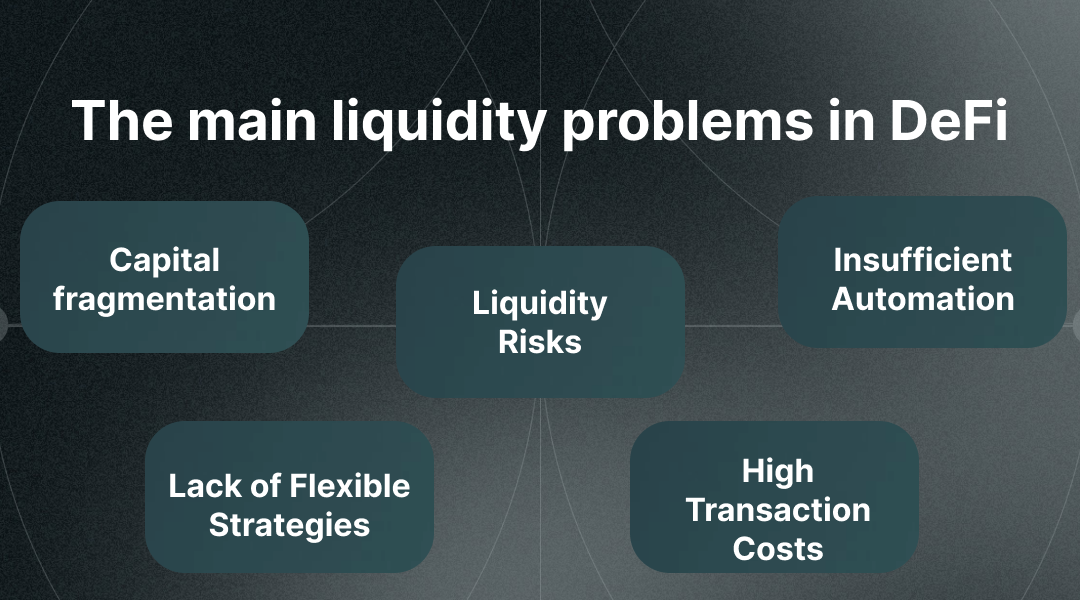

Key Liquidity Issues in DeFi:

- Capital Fragmentation: Assets are often distributed across various protocols, making efficient utilization difficult and centralized management impossible.

- Lack of Flexible Strategies: Most available tools require long-term capital lock-up, limiting flexibility and reducing responsiveness to market changes.

- Liquidity Risks: In times of high volatility or market instability, users may lose access to their funds or suffer significant losses due to low liquidity.

- High Transaction Costs: Many DeFi strategies involve moving assets across networks and protocols, leading to high fees.

- Insufficient Automation: Some solutions require constant user management, increasing the likelihood of errors and losses.

Mitosis and Theo aim to solve these issues by introducing new liquidity management approaches, such as Matrix Vault, which ensures flexibility, security, and efficiency across all stages of DeFi protocol interactions.

What is Straddle Matrix Vault?

Straddle Matrix Vault, launched by Theo with Mitosis’s support, is an innovative delta-neutral product that allows users to deposit weETH (Wrapped Ether) and earn stable yields. This product integrates multiple tools for automated risk and yield management.

Key Features of Straddle Matrix Vault:

- Multi-Network Support: Users can deposit weETH on Ethereum, Arbitrum, and Linea networks. This enables liquidity provisioning across multiple major blockchain ecosystems, significantly expanding DeFi accessibility.

- Delta-Neutral Strategy: Straddle Matrix Vault strategies automatically adjust asset balances to minimize market volatility impact, maintaining stable returns even during unstable periods.

- Automated Risk Management: Advanced algorithms continuously adapt liquidity management strategies to market conditions, reducing human error in asset management.

- Flexible Withdrawals: Users can request withdrawals at any time, with processing occurring every 48 hours. This allows users to maintain flexibility without locking capital for extended periods.

- Additional Hedging Opportunities: Options strategies are utilized to minimize risks, ensuring more stable portfolio management during market fluctuations.

These features make Straddle Matrix Vault attractive to investors seeking stable returns with minimized risk—an essential factor for DeFi platforms looking to attract long-term participants.

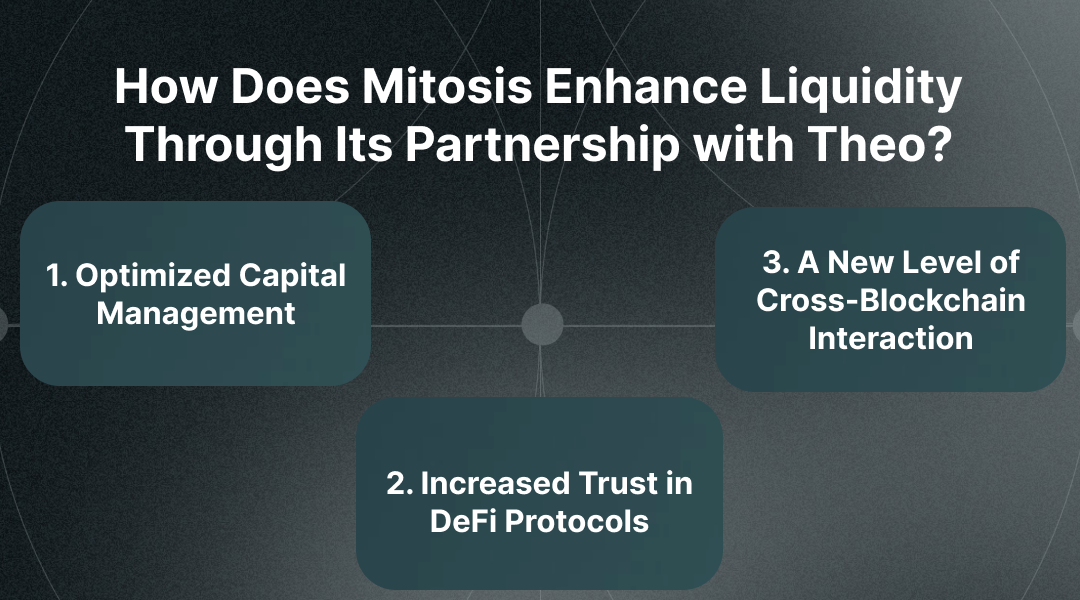

How Does Mitosis Enhance Liquidity Through Its Partnership with Theo?

- Optimized Capital Management

The Mitosis and Theo partnership enables users to access more efficient liquidity utilization strategies. Matrix Vault strategies allow capital to be deployed simultaneously across multiple protocols and directions, reducing costs and increasing profitability. - Increased Trust in DeFi Protocols

The integration of tools such as Straddle Matrix Vault helps enhance the stability of the DeFi ecosystem. Users can trust the reliability and predictability of their investments, attracting new market participants, including institutional investors who have traditionally avoided DeFi due to instability and high risk. - A New Level of Cross-Blockchain Interaction

One of the major advantages of this partnership is the ability to use maAssets across different ecosystems, effectively scaling liquidity between blockchains. This allows users to move assets across platforms without significant transaction cost losses, a key element in building more efficient and user-friendly DeFi networks.

Composability and Capital Efficiency

A major advantage of the partnership is the tokenization of assets. Users receive maAssets, which can be used in other DeFi protocols for additional returns. This significantly improves capital efficiency by enabling users to deploy their assets across multiple strategic directions simultaneously.

Additional Opportunities:

- maAssets can be used for liquidity provisioning on other DeFi platforms. Users can create new strategies utilizing their assets across various platforms.

- Integration with other strategic DeFi solutions. This allows the combination of different investment strategies, maximizing returns.

Future Prospects

The Mitosis and Theo partnership opens significant growth opportunities for the DeFi sector:

- Expansion of Matrix Vault Capitalization: The introduction of new assets and strategies will increase liquidity volumes and attract new investors.

- Support for Additional Assets: Future expansion to include different asset types will enhance liquidity accessibility.

- Integration with New Blockchain Networks: Expanding support for more networks will increase scalability and attract users from various ecosystems.

- Further Automation and Improvement of Liquidity Management Algorithms: Developing advanced algorithms will enhance liquidity management efficiency and reduce risks.

- Development of Tools for Greater Decentralization and Protocol Autonomy: This will reduce reliance on centralized structures, fostering more fair and independent financial systems.

Conclusion

The collaboration between Mitosis and Theo showcases how new technological solutions can transform the DeFi landscape. By implementing Straddle Matrix Vault, liquidity becomes more accessible, and yield opportunities become more equitable. This is not just a partnership between two companies but a fundamental step toward a new era of decentralized finance, where every user can maximize the potential of their assets.

If this trend continues, we will witness even more innovations that make DeFi more efficient, secure, and accessible to the wider public.

My Twitter account is https://x.com/Glodin9

Comments ()